The market rallied further in the week gone by to cross yet another milestone backed by FII inflow and further easing of Covid restrictions. Auto, metals, IT stocks and index heavyweight Reliance Industries pushed the Sensex to surpass the 58,000-mark and the Nifty 17,300 levels.

On September 3, the Sensex climbed 277.41 points to 58,129.95, while the Nifty50 jumped 89.40 points to 17,323.60 and formed a bullish candle on the daily charts. The index gained more than 3.5 percent during the week and made a bullish candle on the weekly scale.

"Technically, the index has formed a strong bullish candle on weekly charts which is broadly positive. On daily and intraday charts, it also maintains a breakout continuation formation indicating further uptrend from current levels," said Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities.

While the short-term trend remains positive, some profit booking could be in the offing as traders are likely to book some profits near the 17,500 resistance level, he said.

"For the trend-following traders, 17,150 and 17,000 could be the important support level, while on the flip side, 17,500 and 17,700 could act as an important resistance level for the market," Chouhan said.

The broader markets also traded in the green. The BSE Midcap index closed 0.35 percent higher and the smallcap index ended with a gain of 0.41 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,243.83 followed by 17,164.07. If the index moves up, the key resistance levels to watch out for are 17,371.73 and 17,419.87.

Nifty Bank

The Nifty Bank fell 70.15 points to close at 36,761.15 on September 3. The important pivot level, which will act as crucial support for the index, is placed at 36,502.87, followed by 36,244.63. On the upside, key resistance levels are placed at 37,079.67 and 37,398.23 levels.

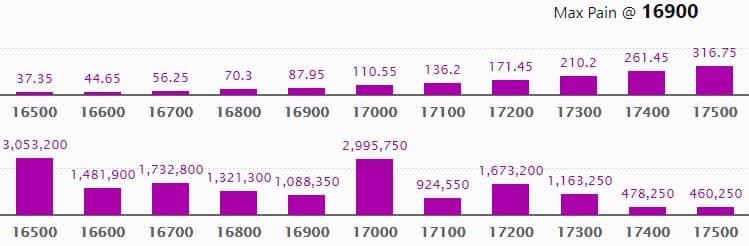

Call option data

Maximum Call open interest of 17.44 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the September series.

This is followed by 16,500 strike, which holds 14.85 lakh contracts, and 17,000 strike, which has accumulated 14.29 lakh contracts.

Call writing was seen at 17,300 strike, which added 2.18 lakh contracts, followed by 17800 strike, which added 1.51 lakh contracts, and 17,400 strike which added 1.38 lakh contracts.

Call unwinding was seen at 17,000 strike, which shed 1.51 lakh contracts, followed by 16,900 strike, which shed 70,050 contracts, and 16,800 strike which shed 56,300 contracts.

Put option data

Maximum Put open interest of 29.95 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the September series.

This is followed by 16,500 strike, which holds 30.53 lakh contracts, and 16,700 strike, which has accumulated 17.32 lakh contracts.

Put writing was seen at 17,300 strike, which added 8.6 lakh contracts, followed by 17,400 strike, which added 3.5 lakh contracts, and 17,000 strike that added 2.66 lakh contracts.

Put unwinding was seen at 16,900 strike, which shed 2.98 lakh contracts, followed by 16,800 strike which shed 2.2 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

57 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen:

23 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

43 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

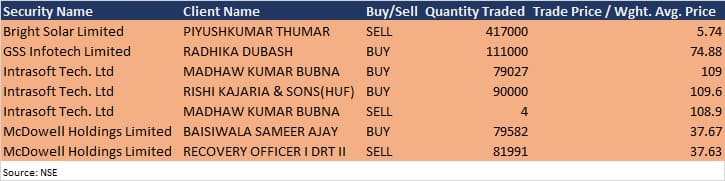

Bulk deals

McDowell Holdings: Recovery Officer I DRT (Debt Recovery Tribunal) II sold additional 81,991 shares in McDowell Holdings at Rs 37.63 per share, whereas Baisiwala Sameer Ajay bought 79,582 shares at Rs 37.67 a share on the NSE, the bulk deals data showed.

GSS Infotech: Radhika Dubash acquired additional 1.11 lakh shares at Rs 74.88 a share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Indian Energy Exchange: The company's officials will meet mutual funds and institutions in Ashwamedh-Elara India Dialogue 2021 on September 6.

Blue Star: The company's officials will meet T Rowe Price on September 6.

Max Healthcare Institute: The company's officials will meet Citigroup Global Markets on September 6.

Mahindra & Mahindra: The company's officials will meet several funds and investors in JP Morgan Virtual Investor Conference on September 6, Morgan Stanley Virtual ESG Conference on September 7, and Citi Virtual Investor Conference on September 9.

India Pesticides: The company's officials will meet Kotak Securities on September 6, Elara capital on September 8, and KR Choksey and Emkay Global on September 9.

CRISIL: The company's officials will meet YES Securities on September 6.

Anupam Rasayan India: The company's officials will meet investors in Ashwamedh-Elara India Dialogue 2021 on September 6.

Graphite India: The company's officials will meet Nippon Life Global Investors Singapore on September 6.

Gland Pharma: The company's officials will meet Kotak Mutual Fund on September 6, and Emkay Global Financial Services on September 7.

Nuvoco Vistas Corporation: The company's officials will meet investors and analysts on September 7.

Stocks in News

Engineers India: Chennai Petroleum Corporation entrusted the execution of EPCM-1 with MPMC & EPCM-3 services for 9 MMTPA Cauvery Basin Refinery (CBR) project at Nagapattinam, Tamil Nadu to Engineers India. The total awarded order value is Rs 1,039 crore, with a total project schedule of 42 months for mechanical completion.

HealthCare Global Enterprises: The company acquired oncology hospital labs and clinical trials business from Strand Lifesciences.

Reliance Industries: Subsidiary Reliance Strategic Business Ventures acquired 2,28,42,654 equity shares in Strand Life Sciences for Rs 393 crore.

ICICI Lombard: The company has received regulatory and other approvals from the Insurance Regulatory and Development Authority of India (IRDAI) for the demerger of the general insurance business of Bharti AXA General.

Fermenta Biotech: The company reported lower consolidated profit at Rs 11.31 crore in Q1FY22 against Rs 13.6 crore in Q1FY21, revenue rose to Rs 109.65 crore from Rs 94.44 crore YoY.

Bank of India: LIC acquired an additional 3.87 percent stake in the bank via QIP, raising shareholding to 7.05 percent from 3.17 percent.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 768.58 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 668.60 crore in the Indian equity market on September 3, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Indiabulls Housing Finance is under the F&O ban for September 6. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!