The selling pressure at higher levels wiped out market gains in late trade and the benchmark indices settled Friday's trade with moderate losses.

The BSE Sensex corrected 66.23 points to 52,586.84, while the Nifty50 fell 15.50 points to 15,763 and formed bearish candle which resembles Shooting Star kind of pattern on the daily charts. The index declined 0.6 percent during the week, witnessing Hammer kind of pattern formation on the weekly scale.

"The daily price action has formed a small bearish candle carrying either side shadows indicating volatility on either side. The short to medium term trend remains sideways within 15,900-15,500 levels," said Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

He further said any violation of an intraday support zone of 15,730 levels may cause profit booking towards 15,650-15,550 levels.

However, the next higher levels to be watched are around 15,880 levels, and any sustainable move above 15,880 levels may cause momentum towards 15,950-16,000 levels, he added.

The broader markets outperformed benchmark indices with the Nifty Midcap 100 index rising 1.1 percent and Smallcap 100 index gaining 0.44 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,717.6, followed by 15,672.2. If the index moves up, the key resistance levels to watch out for are 15,835.6 and 15,908.2.

Nifty Bank

The Nifty Bank declined 107.15 points to 34,584.35 on July 30. The important pivot level, which will act as crucial support for the index, is placed at 34,440.27, followed by 34,296.13. On the upside, key resistance levels are placed at 34,733.67 and 34,882.94 levels.

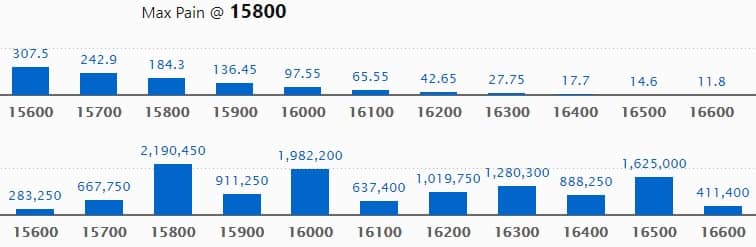

Call option data

Maximum Call open interest of 21.90 lakh contracts was seen at 15800 strike, which will act as a crucial resistance level in the August series.

This is followed by 16000 strike, which holds 19.82 lakh contracts, and 16500 strike, which has accumulated 16.25 lakh contracts.

Call writing was seen at 15800 strike, which added 4.92 lakh contracts, followed by 16200 strike, which added 1.81 lakh contracts and 16000 strike which added 1.56 lakh contracts.

Call unwinding was seen at 15700 strike, which shed 62,600 contracts, followed by 15600 strike which shed 38,450 contracts, and 15000 strike which shed 20,050 contracts.

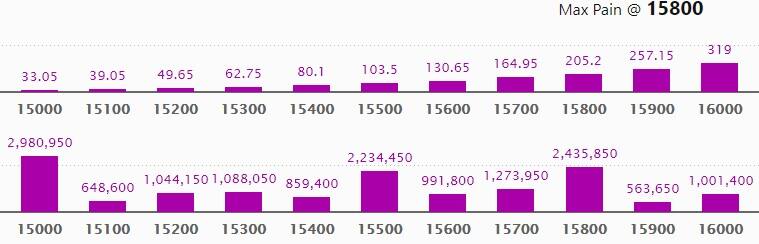

Put option data

Maximum Put open interest of 29.80 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the August series.

This is followed by 15800 strike, which holds 24.35 lakh contracts, and 15500 strike, which has accumulated 22.34 lakh contracts.

Put writing was seen at 15800 strike, which added 7.92 lakh contracts, followed by 15000 strike which added 3.18 lakh contracts, and 15300 strike which added 1.58 lakh contracts.

Put unwinding was seen at 15600 strike, which shed 46,650 contracts, followed by 15900 strike which shed 7,800 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

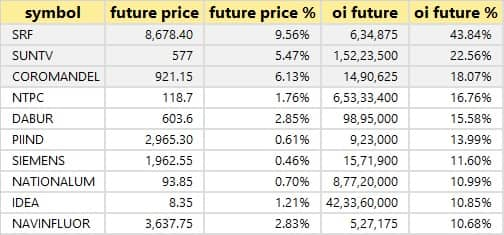

74 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

7 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 7 stocks in which long unwinding was seen.

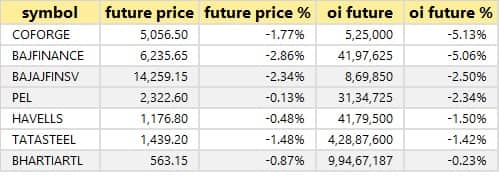

52 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

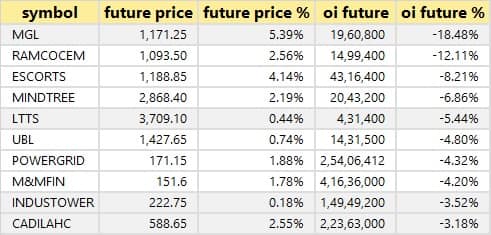

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

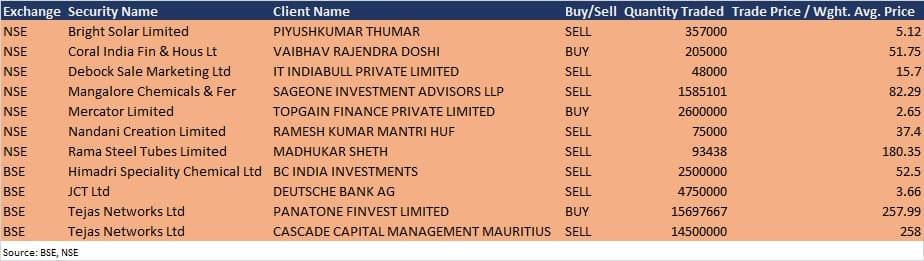

Bulk deals

Mangalore Chemicals: Sageone Investment Advisors LLP sold 15,85,101 equity shares in the company at Rs 82.29 per share on the NSE, the bulk deals data showed.

Himadri Speciality Chemical: BC India Investments sold additional 25 lakh equity shares in the company at Rs 52.5 per share on the NSE, the bulk deals data showed.

JCT Ltd: Deutsche Bank AG sold 47.50 lakh equity shares in the company at Rs 3.66 per share on the BSE, the bulk deals data showed.

Tejas Networks: Panatone Finvest acquired 1,56,97,667 equity shares in the company at Rs 257.99 per share, whereas Cascade Capital Management Mauritius sold 1.45 crore equity shares in the company at Rs 258 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on August 2, and Analysts/Investors Meeting

Results on August 2: HDFC, Punjab National Bank, Emami, Ajmera Realty & Infra, Balaji Amines, Carborundum Universal, Castrol India, CG Power and Industrial Solutions, Nahar Spinning Mills, Orient Cement, RBL Bank, Shree Renuka Sugars, and Varun Beverages will release quarterly earnings on August 2.

Tejas Networks: A Conference Call is scheduled on August 2 to understand recent strategic investments by Tata Sons.

Wipro: The company's official will meet analyst and institutional investors on August 2, in a non-deal roadshow.

HT Media: The company's official will meet analysts and investors on August 4 to discuss financial results.

Godrej Consumer Products: The company's official will meet investors and analysts on August 4, discuss its first quarter financial results.

Hindustan Media Ventures: The company's official will meet analysts and investors on August 4 to discuss financial results.

5paisa Capital: The company's official will meet Motilal Oswal on August 5.

Securekloud Technologies: The company's official will meet investors and analysts on August 6, to discuss financial results.

Hindalco Industries: The company's official will meet analysts and investors on August 6 to discuss financial results.

Phoenix Mills: The company's official will meet analysts and investors on August 7, to discuss the financial results.

Tata Consultancy Services: The company's official will meet analysts and investors on August 16, in the Edelweiss India CXO e-Conference 2021.

Stocks in News

Britannia Industries: The company reported lower profit at Rs 387 crore in Q1FY22 against Rs 542.7 crore in Q1FY21, revenue fell to Rs 3,403.5 crore from Rs 3,421 crore YoY.

Equitas Small Finance Bank: The company reported sharply lower profit at Rs 12 crore in Q1FY22 against Rs 58 crore in Q1FY21, net interest income increased to Rs 461 crore from Rs 404 crore YoY.

Cholamandalam Investment: Board approved raising up to Rs 28,000 crore via non-convertible debentures. The company reported lower standalone profit at Rs 326.80 crore in Q1FY22 against Rs 430.93 crore in Q1FY21, revenue from operations increased to Rs 2,466.89 crore from Rs 2,113.63 crore YoY.

Bandhan Bank: The bank reported sharply lower profit at Rs 373.1 crore in Q1FY22 against Rs 549.8 crore in Q1FY21, net interest income rose to Rs 2,114.1 crore from Rs 1,811.5 crore YoY.

UPL: The company reported higher profit at Rs 749 crore in Q1FY22 against Rs 653 crore in Q1FY21, revenue rose to Rs 8,515 crore from Rs 7,833 crore YoY.

Tata Motors: The company's sales in the domestic & international market for July 2021 stood at 54,119 vehicles, compared to 27,711 units during July 2020.

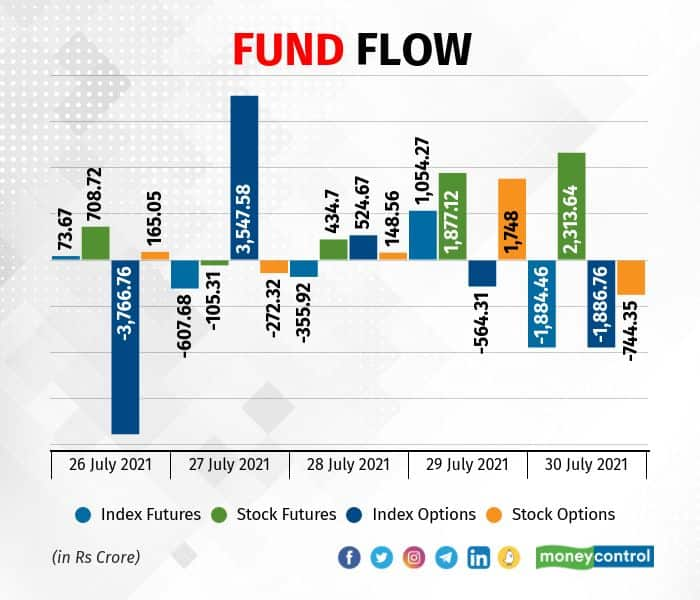

Fund flow

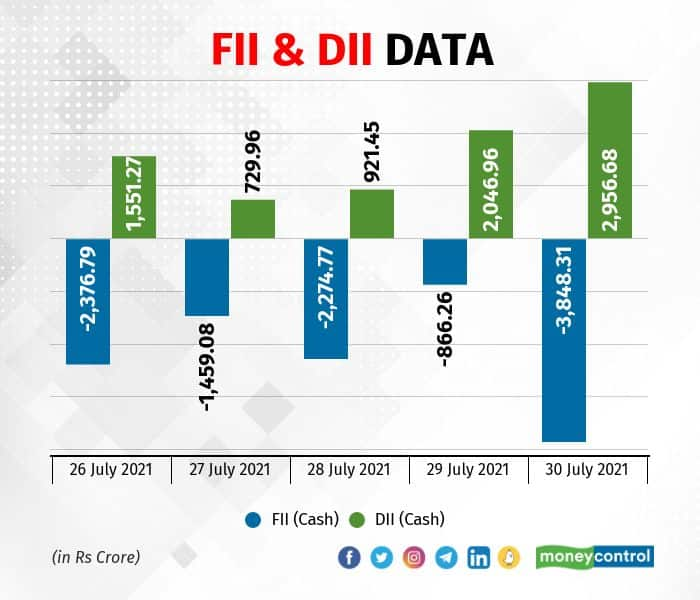

FII and DII data

Stocks under F&O ban on NSE

One stock - Sun TV Network - is under the F&O ban for August 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!