The market clawed back in the second half of the session to recover the losses and close flat on June 18, with by private banks & financials and index heavyweights lending support. It was also a short covering-led recovery.

The Sensex gained 21.12 points to close at 52,344.45, while the Nifty50 declined eight points to 15,683.40 and formed a Hammer pattern on the daily chart. The index was down 0.7 percent during the week, making a Spinning Top pattern on the weekly scale.

"A small negative candle was formed on the daily chart with long lower shadow. Technically, this action indicates a sharp upside recovery in the market. This candle pattern seems to be a Hammer or a Hanging Man type formation but they are wrongly placed to assert any predictive value. Hence, this upside recovery could be a positive signal for the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

The short-term trend of Nifty is very volatile. "The short-term downward correction seems to have completed and Friday's low of 15,450 could be an important support as of now. This swing low is expected to be a new higher bottom formation of larger degree post confirmation. Hence, the Nifty sustaining above 15,700 levels by next week is likely to open a way for another new all-time highs-above 15,901," he said.

The Nifty Midcap 100 and Smallcap 100 indices underperformed benchmark indices, falling 1.05 percent and 0.88 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in the story is the aggregate of three-month data and not of the current month alone.

Key support and resistance levels for the Nifty

According to pivot charts, key support for the Nifty are placed at 15,502.3, followed by 15,321.3. If the index moves up, the key resistance levels to watch out for are 15,812.9 and 15,942.5.

Nifty Bank

The Nifty Bank closed at 34,558, falling 47.40 points on June 18. The important pivot level, which will act as crucial support for the index, is 34,048.8 followed by 33,539.6. On the upside, key resistance levels are 34,927.3 and 35,296.6.

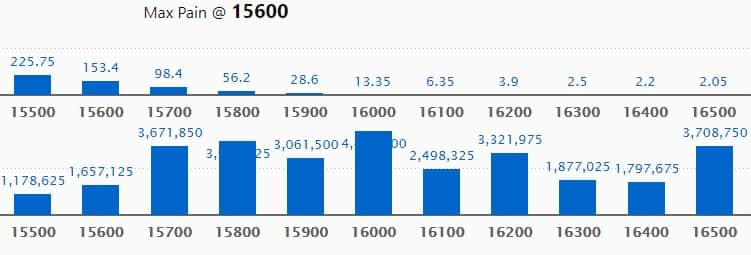

Call option data

Maximum Call open interest of 44.65 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the June series.

This is followed by 15800 strike, which holds 39.29 lakh contracts, and 16500 strike, which has accumulated 37.08 lakh contracts.

Call writing was seen at 16000 strike, which added 8.99 lakh contracts, followed by 16200 strike, which added 7.6 lakh contracts, and 15700 strike, which added 6.84 lakh contracts.

Call unwinding was seen at 15400 strike, which shed 72,000 contracts, followed by 15200 strike which shed 48,900 contracts.

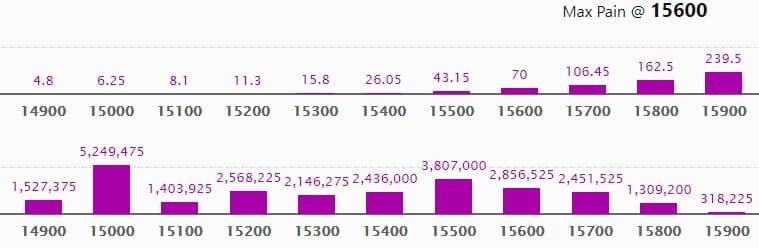

Put option data

Maximum Put open interest of 52.49 lakh contracts was seen at 15000 strike, which will act as a crucial support level in the June series.

This is followed by 15500 strike, which holds 38.07 lakh contracts, and 15600 strike, which has accumulated 28.56 lakh contracts.

Put writing was seen at 15000 strike, which added 15.09 lakh contracts, followed by 15200 strike that added 9.51 lakh contracts, and 15600 strike, which added 9.09 lakh contracts.

Put unwinding was seen at 16200 strike, which shed 1.49 lakh contracts followed by 16000 strike which shed 1.49 lakh contracts and 15800 strike, which shed 1.46 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

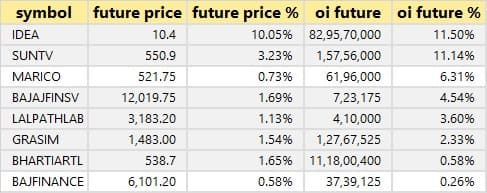

8 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the eight stocks in which a long build-up was seen:

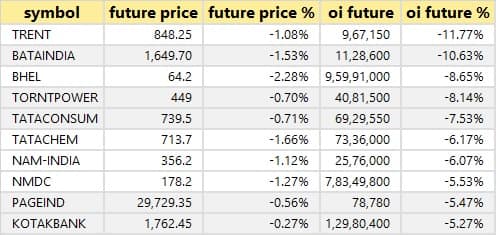

65 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

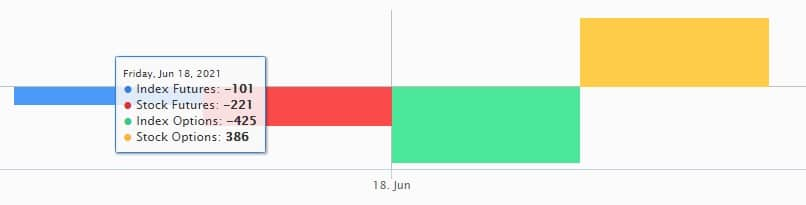

57 stocks saw short build-up

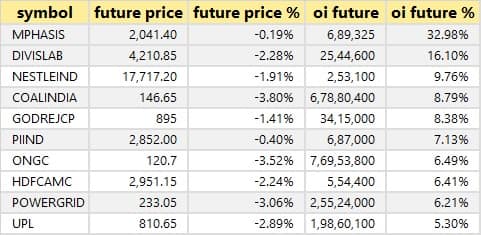

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

28 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen:

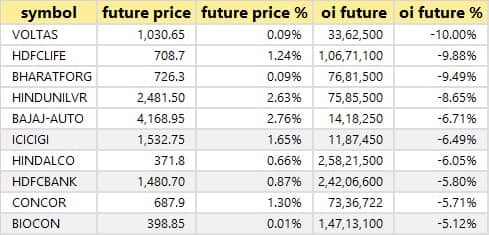

Bulk deals

SBI Cards and Payment Services: CA Rover Holdings, a subsidiary of Carlyle Group, sold 4.8 crore equity shares (5.1 percent of the total paid-up equity in SBI Card in a price range of Rs 1,002.01-1,003.27 per share. However, Morgan Stanley Asia (Singapore) Pte-ODI acquired 54,09,522 shares in SBI Card at Rs 1,002 apiece, the bulk deals data showed.

Capacite Infraprojects: Promoters Rahul Ramnath Katyal, Rohit Ramnath Katyal and Asutosh Trade Links sold 34,93,297 equity shares (or 5.1 percent of the total paid-up equity) in Capacite Infraprojects at Rs 202 a share. US-based hedge fund Think India Opportunities Master Fund LP was the buyer for all the above shares in Capacite at the same price, the bulk deals data showed.

HKG: TCG Funds-Fund 2 and TCG Funds-Fund 1 acquired 8.25 lakh equity shares (or 4.71 percent of the total paid-up equity) in business conglomerate HKG at a price of Rs 58 per share, bulk deal data showed.

Computer Age Management Services: The Vanguard Group Inc A/C Vanguard Emerging Markets Stock Index Fund A Series of Vanguard Internat bought 3,48,311 equity shares in Computer Age Management Services at Rs 2,781.82 apiece, the bulk deals data showed.

KNR Constructions: Promoters Kamidi Yashoda and Mereddy Rajesh Reddy together sold 40 lakh equity shares (or 1.4 percent of the total paid-up equity) in KNR Constructions at around Rs 223 a share. SBI Mutual Fund picked up a 1.69 percent stake (47,63,679 shares) in the company at the same price, the bulk deals data showed.

(For more bulk deals, click here)

Results on June 21, and analysts/investor meetings

Results on June 21: Oil India, Bharat Dynamics, Info Edge, Jaiprakash Associates, Aban Offshore, Deccan Polypacks, GPT Infraprojects, HBL Power Systems, Hindusthan National Glass, MM Forgings, Pokarna, Rico Auto Industries, Sumeet Industries, Talbros Engineering, TCNS Clothing, and VST Tillers Tractors will release quarterly earnings on June 21.

HeidelbergCement India: The company's officials will meet those of JM Financial on June 21.

Gati: The company's officials will meet ITI Mutual Fund, and Ambit Capital on June 22.

Radico Khaitan: The company's officials will meet Elo Pension Fund on June 21 and Principal AMC, and First State Investors on June 22.

Container Corporation of India: The company's officials will meet HSBC, Premji Investment and SBI Life Insurance Company on June 21.

Magma Fincorp: The company's officials will meet International Finance Corporation (IFC) on June 21.

Rallis India: The company's officials will meet analysts and investors during Trinity India Digital Conference on June 21.

Mahindra & Mahindra Financial Services: The company's officials will meet a group of investors at a BofA Indian Financial Tour: Investor Conference on June 21.

Tata Motors: The company's officials will meet Nomura on June 22.

Mahindra Logistics: The company's officials will meet Wellington Management on June 22 and Burman Family Holdings on June 24.

Stocks in news

NTPC: The company reported sharply higher consolidated profit at Rs 4,649.49 crore in Q4FY21 against Rs 1,629.86 crore in Q4FY20. Reveneue fell to Rs 30,102.6 crore from Rs 30,390.51 crore YoY.

BHEL: CRISIL downgraded company's long-term credit rating to AA-/Negative from AA/Negative, reflecting weakening of the business and financial risk profile of the company.

ICICI Bank: Global rating agency S&P has reaffirmed ICICI Bank's rating at BBB- and has changed the outlook from negative to stable. The stable outlook reflects S&P's expectation that bank's capitalisation will remain strong over the next 24 months, despite some deterioration in asset quality owing to COVID-19.

RattanIndia Power: The company reported consolidated profit at Rs 39.28 crore in Q4FY21 against loss of Rs 511.77 crore in Q4FY20, revenue rose to Rs 862.13 crore from Rs 294.33 crore YoY.

Centrum Capital: The Reserve Bank of India gave in-principle approval to Centrum Financial Services, the established and profitable NBFC arm of the Centrum Group, to establish a Small Finance Bank (SFB). Resilient Innovations Private Limited (BharatPe), one of India's fastest growing fintech companies, will be an equal partner.

Hinduja Global Solutions: The company reported sharply higher consolidated profit at Rs 130.31 crore in Q4FY21 against Rs 44.84 crore in Q4FY20. Revenue jumped to Rs 1,563.58 crore from Rs 1,285.7 crore YoY.

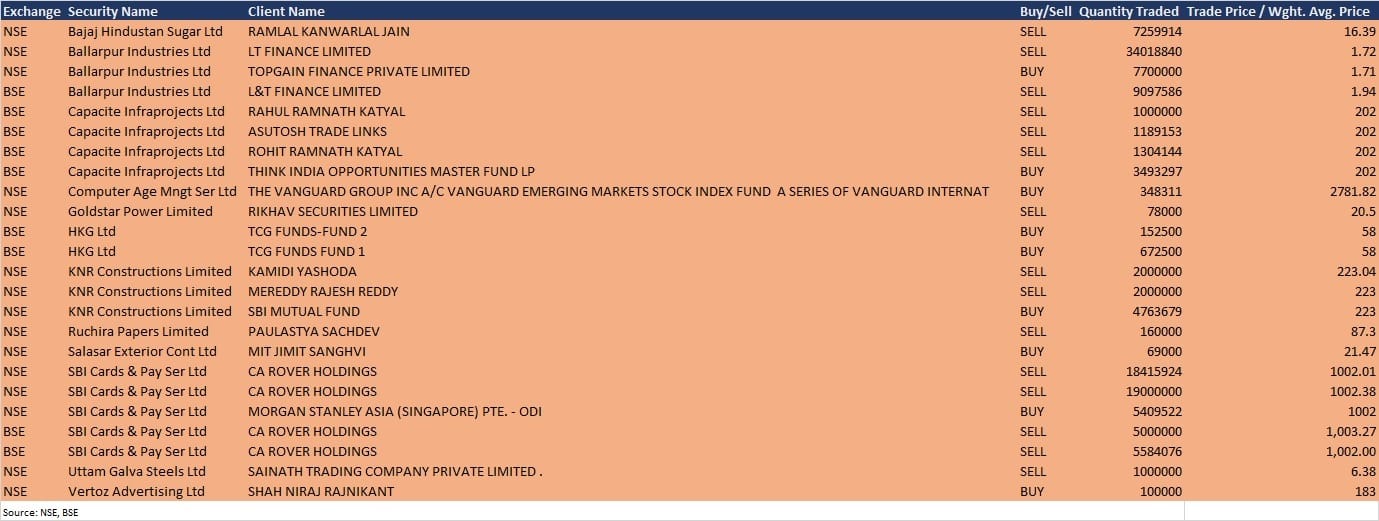

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 2,680.57 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 446.20 crore in the Indian equity market on June 18, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks—Adani Ports, BHEL, Punjab National Bank, and Sun TV Network— are under the F&O ban for June 21. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!