The market recouped all its previous two-day losses and marched further to close with nearly 2 percent gains on May 21, backed by all sectors. Banking & financials gained the most.

The BSE Sensex shot up 975.62 points or 1.97 percent to 50,540.48, while the Nifty50 climbed 269.30 points or 1.81 percent to 15,175.30 and formed a bullish candle on the daily charts as the closing was higher than opening levels. During the week, the index gained 3.4 percent and formed a bullish candle on the weekly scale.

"A long bull candle was formed, which indicated a sharp upside bounce from the lower support. This pattern seems to have confirmed a sustainable upside breakout of the hurdle and also an upper range (15,000-15,200) at 15,000 mark. As per this pattern, a potential upside pattern target of 15,800 could open up and this could be achieved over the next few weeks," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Intermittently, the higher highs and lows and minor downward corrections could be continued till the target is achieved. Immediate support is placed around 15,100-15,050," he said.

But, the broader markets underperformed frontliners on May 21, with the Nifty Midcap 100 index gaining 0.8 percent and Smallcap 100 index rising 0.56 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,044.07, followed by 14,912.83. If the index moves up, the key resistance levels to watch out for are 15,248.27 and 15,321.23.

Nifty Bank

The Nifty Bank outpaced benchmark indices, surging 1,272.35 points or 3.82 percent to 34,606.90 on May 21. The important pivot level, which will act as crucial support for the index, is placed at 33,879.67, followed by 33,152.44. On the upside, key resistance levels are placed at 35,014.27 and 35,421.63 levels.

Call option data

Maximum Call open interest of 44.03 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the May series.

This is followed by 16,000 strike, which holds 32.41 lakh contracts, and 15,700 strike, which has accumulated 29.03 lakh contracts.

Call writing was seen at 15,700 strike, which added 14.73 lakh contracts, followed by 15,500 strike which added 11.52 lakh contracts and 15,600 strike which added 8.09 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 14.55 lakh contracts, followed by 15,100 strike which shed 7.11 lakh contracts, and 14,900 strike which shed 4.79 lakh contracts.

Put option data

Maximum Put open interest of 45.88 lakh contracts was seen at 15,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 37.15 lakh contracts, and 14,800 strike, which has accumulated 30.07 lakh contracts.

Put writing was seen at 15,000 strike, which added 17.95 lakh contracts, followed by 15,100 strike which added 17.57 lakh contracts and 14,900 strike which added 11.06 lakh contracts.

Put unwinding was seen at 14,400 strike which shed 1.93 lakh contracts, followed by 16,000 strike, which shed 21,075 contracts.

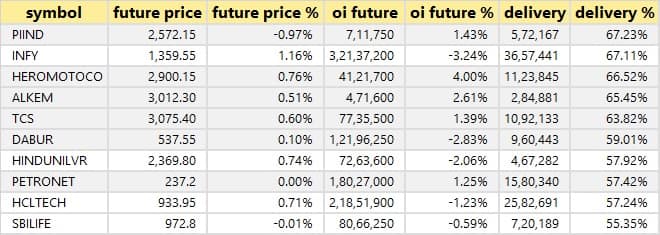

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

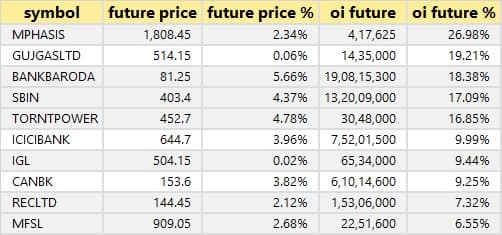

59 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

16 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

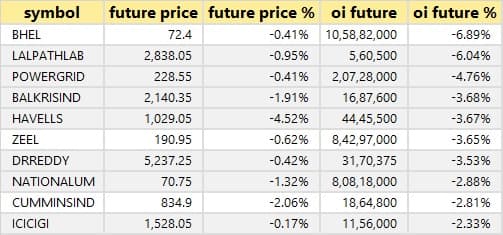

26 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

56 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

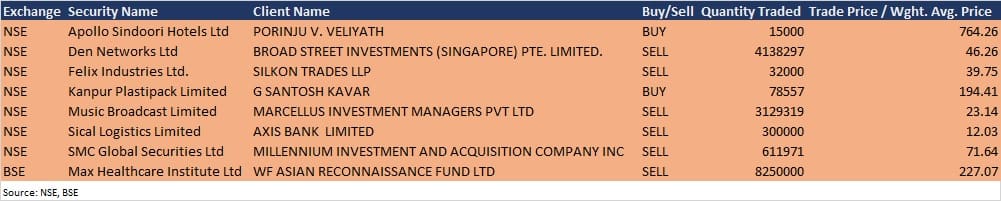

Bulk deals

Apollo Sindoori Hotels: Porinju V Veliyath acquired 15,000 equity shares in Apollo Sindoori at Rs 764.26 per share on the NSE, the bulk deals data showed.

Den Networks: Broad Street Investments (Singapore) Pte Limited sold another 41,38,297 equity shares in Den Networks at Rs 46.26 per share on the NSE, the bulk deals data showed.

Music Broadcast: Marcellus Investment Managers Pvt Ltd sold 31,29,319 equity shares in Music Broadcast at Rs 23.14 per share on the NSE, the bulk deals data showed.

Max Healthcare Institute: WF Asian Reconnaissance Fund sold 82.5 lakh equity shares in Max Healthcare at Rs 227.07 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Results on May 24

Grasim Industries, India Cements, JK Paper, Mahanagar Gas, ADF Foods, Balaji Amines, Barbeque-Nation Hospitality, Choksi Imaging, Dalmia Bharat Sugar and Industries, FGP, 3P Land Holdings, ADC India Communications, Hindustan Fluorocarbons, IG Petrochemicals, India Cements Capital, Jonjua Overseas, JSW Holdings, Kanpur Plastipack, Karda Constructions, Lakshmi Machine Works, Loyal Textile Mills, Nutricircle, Pharmaids Pharmaceuticals, Poly Medicure, Ramco Cements, Ramco Industries, Shanthi Gears, Shree Pushkar Chemicals & Fertilisers, Sparc Systems, Summit Securities, Tiaan Consumer, Tirupati Tyres, UTL Industries, and Wall Street Finance will release quarterly earnings scorecard on May 24.

Stocks in News

JSW Steel: The company reported sharply higher consolidated profit at Rs 4,191 crore in Q4FY21 against Rs 188 crore in Q4FY20, revenue jumped to Rs 26,934 crore from Rs 17,887 crore YoY.

Shree Cement: The company reported higher standalone profit at Rs 767.6 crore in Q4FY21 against Rs 588.1 crore in Q4FY20, revenue increased to Rs 3,930.8 crore from Rs 3,217.5 crore YoY.

United Spirits: The company reported sharply higher consolidated profit at Rs 203.3 crore in Q4FY21 against Rs 49.3 crore in Q4FY20, revenue rose to Rs 2,230.4 crore from Rs 1,990.5 crore YoY.

Bharat Parenterals: The company has received the license and authorization from Drugs Controller General of India (DCGI) and Central Drugs Standard Control Organisation (CDSCO), for the manufacturing and marketing of 'Favipiravir oral suspension 100mg/ml' which will be used for treatment of COVID-19 disease.

Akzo Nobel India: The company reported higher consolidated profit at Rs 74.25 crore in Q4FY21 against Rs 54.08 crore in Q4FY20, revenue jumped to Rs 781.35 crore from Rs 581.27 crore YoY.

Amber Enterprises India: The company reported higher consolidated profit at Rs 76.47 crore in Q4FY21 against Rs 62.82 crore in Q4FY20, revenue rose to Rs 1,598.4 crore from Rs 1,315.18 crore YoY.

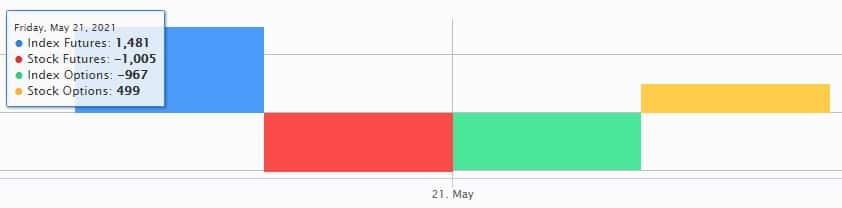

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 510.16 crore, while domestic institutional investors (DIIs) net acquired shares worth Rs 649.10 crore in the Indian equity market on May 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Five stocks - BHEL, Jindal Steel & Power, NALCO, Punjab National Bank, and SAIL - are under the F&O ban for May 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!