The market extended gains for the third consecutive session to gain more than half a percent on May 7, with all sectoral indices closing higher barring PSU Banks. Nifty Metal with a 4.73 percent rally gained the most.

The BSE Sensex climbed 256.71 points to 49,206.47, while the Nifty50 was up 98.40 points at 14,823.20 and formed a Doji kind of pattern on the daily charts.

"A small body of positive candle was formed on the daily chart with minor upper and lower shadow. Technically, this pattern could mean a Doji or a high wave-type candle pattern (not a classical one) after a reasonable upmove from the lows. Technically, this indicates caution for bulls at the highs and a negative close in the subsequent session could result in a minor reversal pattern. Hence, a sustainable move above this pattern at 14,863 levels could suggest a continuation of upside momentum in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

During the week, the index gained 1.3 percent and formed a reasonable bull candle on the weekly scale. "Nifty moved above the downside sloping weekly trend line resistance this time by closing above 14700 levels, after a failed attempt in the previous week. This is a positive indication," Shetti said.

Overall, he said the upmove with rangebound action of the last three sessions may not be a good sign for the strength of upside momentum and the upper area of 14,900-15,000 levels could act as a hurdle for the market.

"The short term uptrend status remains intact and one may expect further upside towards the hurdle by next week. A decisive move above 15,000 mark could only open sharp upside momentum. Otherwise, one may expect the next round of minor profit booking from the highs," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,771.47, followed by 14,719.73. If the index moves up, the key resistance levels to watch out for are 14,868.97 and 14,914.73.

Nifty Bank

The Nifty Bank index underperformed frontliners, rising 76.70 points to 32,904.50 on May 7. The important pivot level, which will act as crucial support for the index, is placed at 32,697.56, followed by 32,490.63. On the upside, key resistance levels are placed at 33,185.27 and 33,466.04 levels.

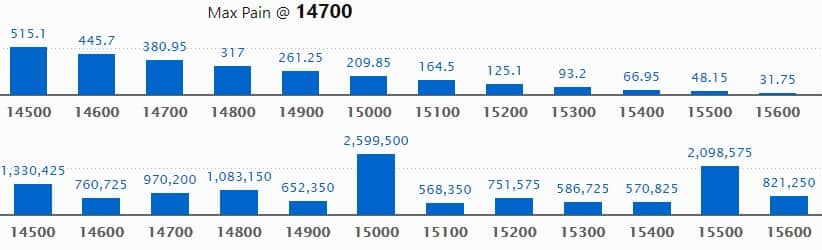

Call option data

Maximum Call open interest of 25.99 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 20.98 lakh contracts, and 14,500 strike, which has accumulated 13.30 lakh contracts.

Call writing was seen at 15,500 strike, which added 2.84 lakh contracts, followed by 14,900 strike which added 1.3 lakh contracts and 15,300 strike which added 1.07 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 86,550 contracts, followed by 14,600 strike which shed 68,550 contracts and 14,700 strike which shed 68,100 contracts.

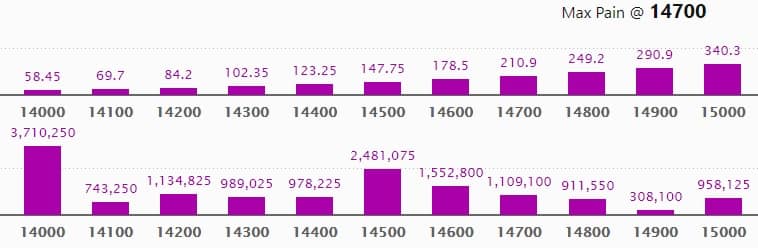

Put option data

Maximum Put open interest of 37.1 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 24.81 lakh contracts, and 14,600 strike, which has accumulated 15.52 lakh contracts.

Put writing was seen at 14,700 strike, which added 2.79 lakh contracts, followed by 14,000 strike which added 2.61 lakh contracts and 14,600 strike which added 1.55 lakh contracts.

Put unwinding was seen at 14,200 strike which shed 26,625 contracts, followed by 14,400 strike, which shed 900 contracts.

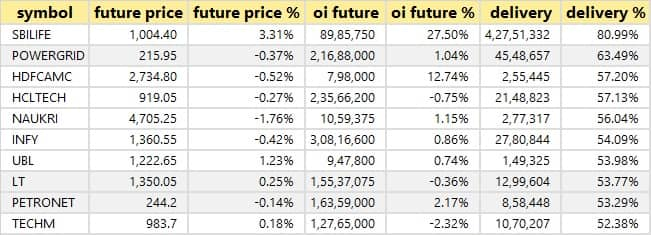

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

39 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

36 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

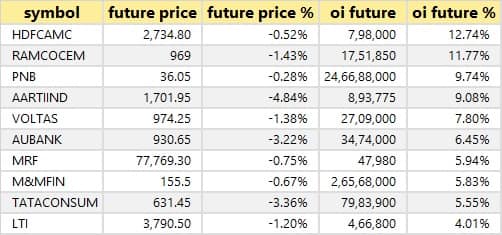

37 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

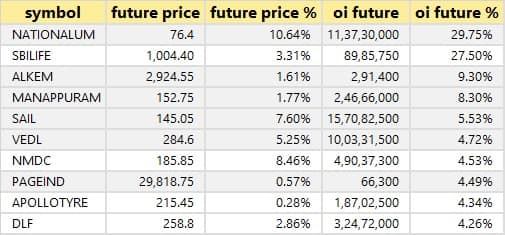

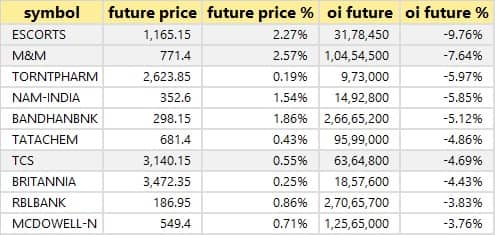

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

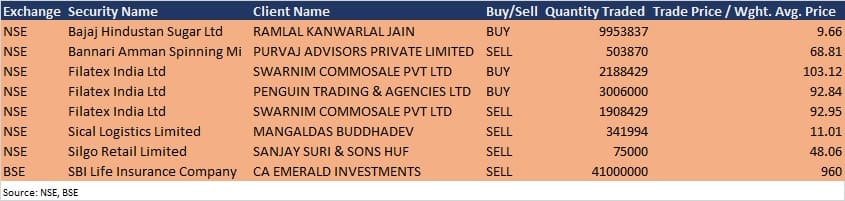

Bulk deals

(For more bulk deals, click here)

Results on May 10

Artemis Medicare Services, Chambal Fertilisers & Chemicals, Dai-Ichi Karkaria, DE Nora India, Escorts Finance, Ganges Securities, Gayatri Tissue & Papers, HFCL, HSIL, Inspirisys Solutions, Intellect Design Arena, JMC Projects (India), Nutricircle, Oriental Aromatics, Onesource Ideas Venture, Paushak, PPAP Automotive, Sangam Renewables, Satia Industries, Suryalakshmi Cotton Mills, TTI Enterprise, Venky's (India) and Zydus Wellness will release quarterly scorecard on May 10.

Stocks in News

DCB Bank: The bank reported higher profit at Rs 77.9 crore in Q4FY21 against Rs 68.8 crore in Q4FY20; net interest income fell to Rs 311.2 crore from Rs 323.7 crore YoY.

Avenue Supermarts: The company reported sharply higher consolidated profit at Rs 414.2 crore in Q4FY21 against Rs 271.5 crore in Q4FY20, revenue rose to Rs 7,411.7 crore from Rs 6,255.9 crore YoY.

Bandhan Bank: The bank reported sharply lower profit at Rs 103 crore in Q4FY21 against Rs 517.3 crore in Q4FY20; net interest income climbed to Rs 1,757 crore from Rs 1,680 crore YoY.

CSB Bank: The bank reported profit at Rs 42 crore in Q4FY21 against loss of Rs 59.7 crore in Q4FY20; net interest income jumped to Rs 275 crore from Rs 157.5 crore YoY.

IDFC First Bank: The bank reported sharply higher profit at Rs 127.81 crore in Q4FY21 against Rs 71.54 crore in Q4Y20; net interest income rose to Rs 1,960.26 crore from Rs 1,699.98 crore YoY.

Jubilant Pharmova: Subsidiary Jubilant Pharma received a favourable and unanimous judgment from the United States Court of Appeals summarily affirming Jubilant's earlier favourable rulings from the US Patent Office and the US International Trade Commission. These two rulings by the Appellate Court deny the appeals filed by Bracco Diagnostics, Inc.

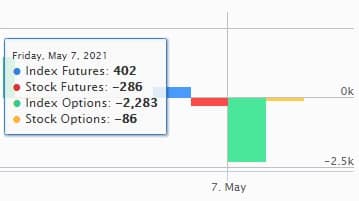

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,142.75 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,468.09 crore in the Indian equity market on May 7, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - BHEL, NALCO, Sun TV Network and Tata Chemicals - are under the F&O ban for May 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!