The market remained in the green throughout the session and closed at a record high on January 8 on the back of technology, auto, pharma and select banking & financials stocks.

The BSE Sensex surged 689.19 points, or 1.43 percent, to 48,782.51, while the Nifty50 climbed 209.90 points, or 1.48 percent, to 14,347.30 and formed a bullish candle on the daily as well as the weekly charts. It was up 2.35 percent during the week.

"A reasonable positive candle was formed with a gap-up opening (body gap, not a western gap) and this could signal an upside breakout of the two days sideways range movement at 14,250. This is a positive indication," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"On the weekly chart, the Nifty formed a long bull candle with minor lower shadow, which indicates the continuation of the sharp up trended movement as per the weekly timeframe chart. Some symmetrical chart pattern is unfolding in the Nifty weekly timeframe chart. Friday's upside breakout of small range and a formation of a symmetrical pattern on the daily/weekly chart could indicate that one more week of upmove in the market before showing any downward correction from the highs," he said.

The next upside targets to be watched is at 14,600 and immediate support is placed at 14,200 levels, he added.

The broader markets also ended higher but underperformed the benchmarks. The Nifty midcap index was up 1 percent and the smallcap gained 0.6 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are aggregate of three- month data and not the current month only.

Key support and resistance levels on Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,256.83, followed by 14,166.47. If the index moves up, the key resistance levels to watch out for are 14,402.43 and 14,457.67.

Nifty Bank

The Nifty Bank gained 128.20 points to close at 32,084.20 on January 8. The important pivot level, which will act as crucial support for the index, is placed at 31,958.7 followed by 31,833.2. On the upside, key resistance levels are placed at 32,253.9 and 32,423.6.

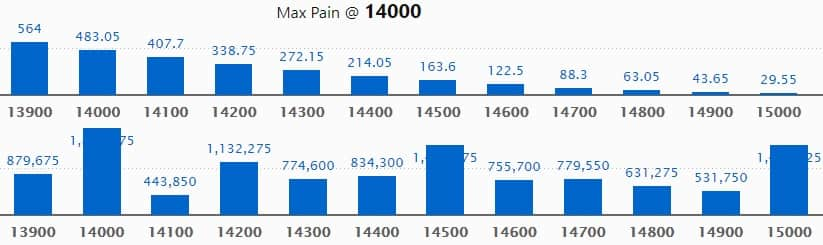

Call option data

Maximum Call open interest of 18.61 lakh contracts was seen at 14,000 strike, which will act as a crucial level in the January series.

This is followed by 15,000 strike, which holds 14.93 lakh contracts, and 14,500 strike, which has accumulated 14.86 lakh contracts.

Call writing was seen at 14,700 strike, which added 1.58 lakh contracts, followed by 14,400 strike, which added 1.54 lakh contracts and 15,000 strike that added 1.33 lakh contracts.

Call unwinding was seen at 14,500 strike, which shed 2.3 lakh contracts, followed by 14,100 strike that shed 71,175 contracts.

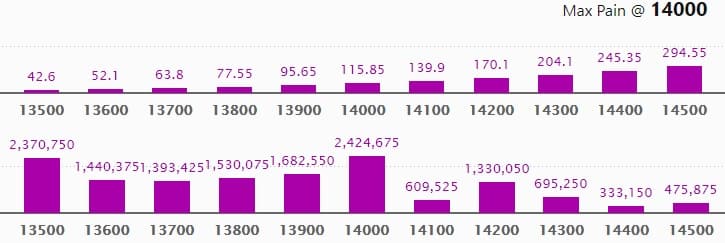

Put option data

Maximum Put open interest of 24.24 lakh contracts was seen at 14,000 strike, which will act as a crucial support in the January series.

This was followed by 13,500 strike, which holds 23.70 lakh contracts, and 13,900 strike that accumulated 16.82 lakh contracts.

Put writing was seen at 14,200 strike, which added 5.46 lakh contracts, followed by 14,300 strike that added 4.55 lakh contracts and 13,900 strike adding 3.35 lakh contracts.

Put unwinding was seen at 13,600 strike, which shed 65,700 contracts, followed by 13,700 strike, which shed 14,325 contracts.

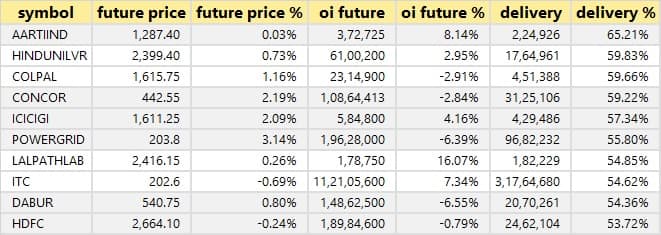

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

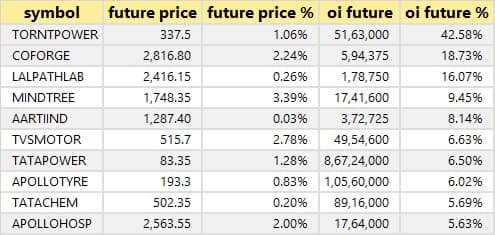

46 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

14 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

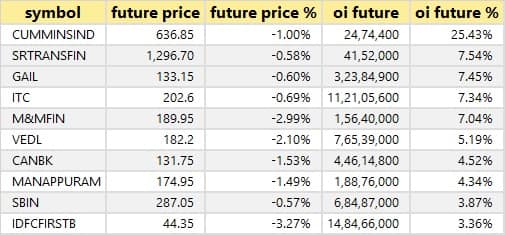

19 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

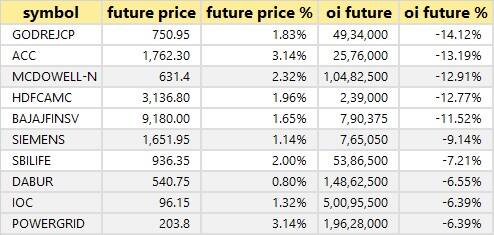

62 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

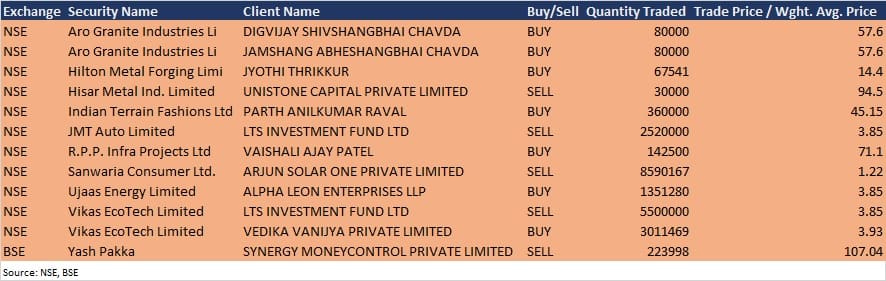

Bulk deals

(For more bulk deals, click here)

Bheema Cements, Dolat Investments, GNA Axles, Netlink Solutions, Nidhi Granites, Venmax Drugs and Pharmaceuticals and Zicom Electronic Security Systems will announce their quarterly earnings on January 11.

Stocks in the news

TCS: The IT major reported 7.2 percent rise in profit at Rs 8,701 crore against Rs 8,118 crore, revenue rose 4.7 percent to Rs 42,015 crore from Rs 40,135 crore QoQ.

Tata Steel: India business production in Q3 increased 0.2 percent QoQ and 2.9 percent YoY to 4.6 mt, but deliveries fell 7.7 percent QoQ and were down 3.9 percent YoY to 4.66 mt.

HDFC Bank: ICICI Prudential Life held 1.23 percent stake in the company in the September quarter but its name did not appear in the December quarter shareholding.

PVR: Foreign portfolio investors raised stake in the company to 38.5 percent in the December quarter from 34.6 percent in the previous quarter.

Mishra Dhatu Nigam: HDFC AMC increased stake in the company to 9.13 percent from 7.10 percent via open market transaction.

Prestige Estates Projects, DB Realty: DB Realty acquired a 49 percent equity stake and Prestige Estates Projects a 50 percent stake in Pandora Projects.

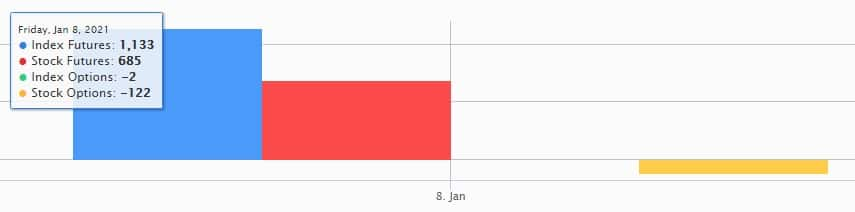

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 6,029.83 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,372.54 crore in the Indian equity market on January 8, as per the provisional data on the NSE.

Stocks under F&O ban on NSE

One stock—SAIL—is under the F&O ban for January 11. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!