The market recouped half of previous day's losses and closed with a 0.7 percent gains on November 20, aided by banking and financials, FMCG, and IT stocks.

The BSE Sensex climbed 282.29 points to 43,882.25, while the Nifty50 rose 87.30 points to 12,859 amid consolidation and formed a small bodied bullish candle which resembles Hammer kind of pattern on the daily charts.

"The Nifty on the daily chart sustained above the immediate short term support of 10-day EMA at 12,680 levels. This action could mean that the short term uptrend status remains intact after a small downward correction and Nifty is expected to bounce up towards new all-time highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

During the week, Nifty50 gained 0.6 percent, but saw bearish candle formation on the weekly scale as closing was lower than opening levels.

"Nifty on the weekly chart formed a small negative candle with minor lower shadow. This pattern signal a breather type formation at the new highs, after a sharp upmove of the previous couple of weeks. Hence, this could also mean a lack of selling enthusiasm in the market post sharp upmove/at all-time highs," Shetti said.

"One may expect Nifty to move towards the new all-time high of 12,963 levels by next week. A decisive/sustainable move above 13,000 levels could open next upside targets of 13,500-13,600 in the near term. Immediate supports are seen at 12,680-12,730 levels," he added.

The overall market breadth continued to be positive and broad market indices like Midcap and Smallcap segments have closed on a decent gains of around 0.86 percent and 1.15 percent, respectively on November 20.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 12,761.97, followed by 12,664.93. If the index moves up, the key resistance levels to watch out for are 12,924.27 and 12,989.53.

Nifty Bank

The Bank Nifty rebounded 332.95 points or 1.15 percent to close at 29,236 on November 20. The important pivot level, which will act as crucial support for the index, is placed at 28,742.37, followed by 28,248.73. On the upside, key resistance levels are placed at 29,568.17 and 29,900.33.

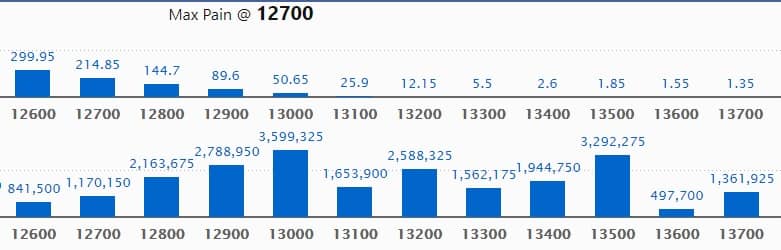

Call option data

Maximum Call open interest of 35.99 lakh contracts was seen at 13,000 strike, which will act as crucial resistance level in the November series.

This is followed by 13,500 strike, which holds 32.92 lakh contracts, and 12,900 strike, which has accumulated 27.88 lakh contracts.

Call writing was seen at 13,200 strike, which added 6.33 lakh contracts, followed by 12,800 strike which added 6.03 lakh contracts and 13,400 strike which added 3.9 lakh contracts.

Call unwinding was seen at 12,900 strike, which shed 2.3 lakh contracts, followed by 12,700 strike which shed 2.04 lakh contracts and 13,500 strike which shed 1.42 lakh contracts.

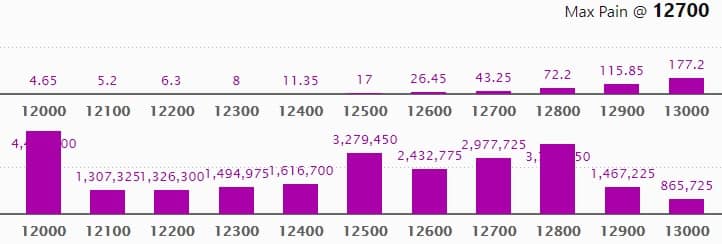

Put option data

Maximum Put open interest of 44.03 lakh contracts was seen at 12,000 strike, which will act as a crucial support in the November series.

This is followed by 12,800 strike, which holds 37.16 lakh contracts, and 12,500 strike, which has accumulated 32.79 lakh contracts.

Put writing was seen at 12,800 strike, which added 17.18 lakh contracts, followed by 12,000 strike, which added 7.03 lakh contracts and 12,500 strike which added 6.87 lakh contracts.

Put unwinding was seen at 13,100 strike, which shed 8,325 contracts, followed by 13,200 strike, which shed 6,600 contracts.

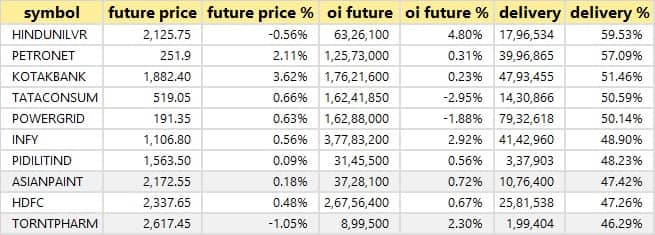

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

44 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

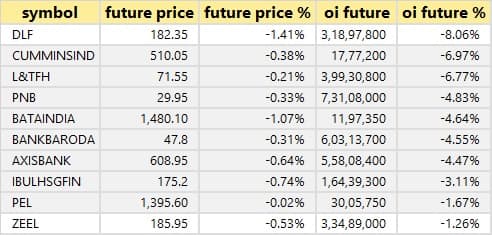

18 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

26 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

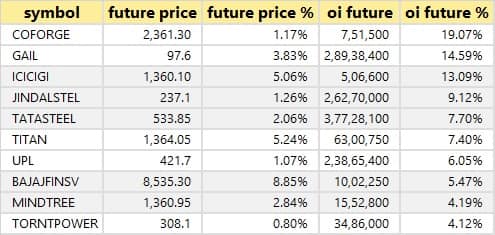

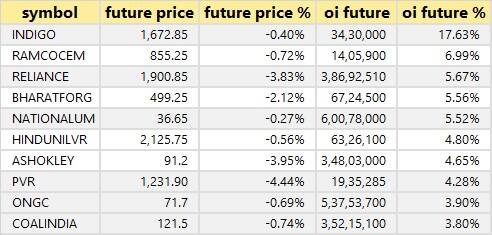

49 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

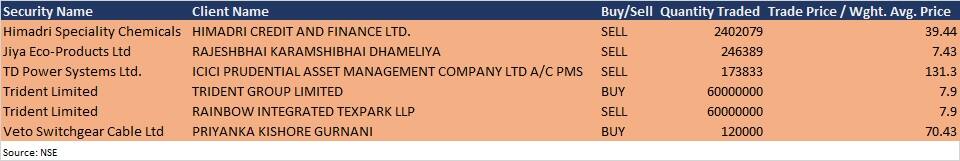

Bulk deals

(For more bulk deals, click here)

Analysts Meets/Board Meetings

Tata Steel: Company's officials will meet Jefferies India and Macquarie Capital Securities via conference call on November 24.

Asian Paints: Company's officials will participate in Edelweiss Virtual conference and will meet Soros Capital Management on November 24, will have conference call with Sands Capital Management on November 25 and with Invesco on November 26.

ABB Power Products and Systems India: One Conference Call with investors/analysts is being organised on November 23.

Mahindra & Mahindra: Company's officials will hold conference call with Invesco Asset Management on November 23 and Fidelity Management Research on November 24.

ITD Cementation: Company's officials will hold conference call with Franklin Templeton AMC (India) on November 23 and Sundaram Mutual Fund on November 24.

Mahindra Lifespace Developers: Company's officials will hold conference call with Marshmallow Capital and Manan Patel (Individual Investors) on November 23, Solidarity Advisors Pvt Ltd and IIFL Capital on November 25.

HFCL: Management of the company will be having a Con-call on November 23, with Carnelian Asset Management.

Cipla: Company's officials will attend Edelweiss India e-Conference 2020, Asia-Pacific on November 23.

Galaxy Surfactants: Company will hold meeting with investors on November 23 and November 24.

Stocks in the news

Reliance Industries: Competition Commission of India approved Future Retail & Reliance Retail deal.

HFCL: Promoter entity MN Ventures acquired additional 5 lakh equity shares in company via open market transaction.

IIFL Securities: Board approved buy-back of equity shares of the company; selling / disposing / leasing of asset(s) of the material subsidiary (ies); and resignation of Mohan Radhakrishnan as Executive Director & Chief Compliance Officer.

Sun Pharma: Promoter entity Shanghvi Finance Pvt Ltd pledged 41 lakh equity shares of the company.

Jump Networks: Company reported profit at Rs 6.1 crore in Q2FY21 compared to loss Rs 6.45 crore, revenue increased to Rs 34.3 crore from Rs 9.96 crore YoY.

Filatex India: Nouvelle Securities increased stake in the company to 5.17% from 4.97% earlier.

IRCTC: Government appointed Crawford Bayley & Co., as Legal Advisor for disinvestment of paid up equity capital of IRCTC through offer for sale.

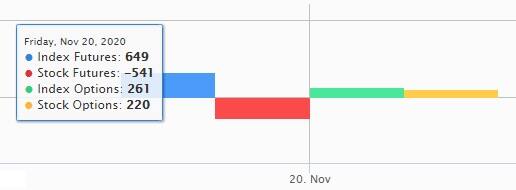

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 3,860.78 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,868.66 crore in the Indian equity market on November 20, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Ten stocks - Bank of Baroda, BHEL, Canara Bank, DLF, Indiabulls Housing Finance, Vodafone Idea, L&T Finance Holdings, NALCO, Punjab National Bank and RBL Bank - are under the F&O ban for November 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!