The market closed lower for a second consecutive session on October 30, the first day of the November series. Traders now keenly await direction from the US elections slated next week and clarity on the looming threat from the second wave of coronavirus cases across the US and Europe.

The BSE Sensex fell 135.78 points to close at 39,614.07, while the Nifty 50 shed 28.40 points to 11,642.40 and formed a small-bodied bearish candle which resembles a Doji kind of pattern on the daily charts.

"We observe back to back weakness in the last two sessions, post the formation of a long bear candle of October 28. After the downside range breakout recently, the Nifty struggled to sustain above the hurdle of the range breakout area at 11,750 levels, as per the concept of change in polarity. The formation of lower highs of a smaller swing on the daily chart could signal a possibility of further weakness below 11,600 levels again," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

Nifty declined 2.4 percent for the week, forming a long bear candle on the weekly chart and placing at the edge of moving below the significant trend line support at 11,600 levels, as per change in polarity.

"After the upside breakout of this trend line in the early part of October, the Nifty failed to show any meaningful follow-through an upmove later, as it moved in a broader sideways range with weak bias. Hence, this pattern could signal a chance of Nifty showing further weakness in the next week, before showing any meaningful upside bounce," Shetti said.

The broader markets closed mixed. The Nifty Midcap index was up half a percent while the Nifty Smallcap declined third of a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,535.6, followed by 11,428.8. If the index moves up, the key resistance levels to watch out for are 11,749.1 and 11,855.8.

Nifty Bank

The Bank Nifty dropped 191.10 points to close at 23,900.90 on October 30. The important pivot level, which will act as crucial support for the index, is placed at 23,583.3, followed by 23,265.7. On the upside, key resistance levels are placed at 24,247.9 and 24,594.9.

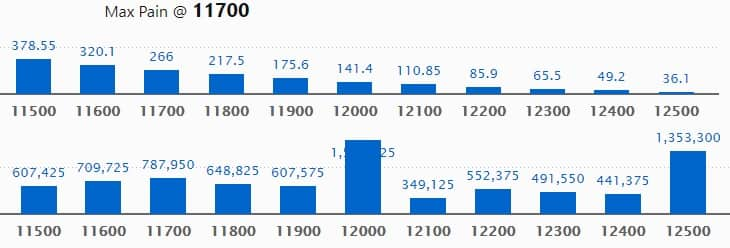

Call option data

Maximum Call open interest of 15.70 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the November series.

This is followed by 12,500 strike, which holds 13.53 lakh contracts, and 11,700 strike, which has accumulated 7.87 lakh contracts.

Call writing was seen at 11,600 strike, which added 2.44 lakh contracts, followed by 11,700 strike whihc added 1.34 lakh contracts and 12,400 strike which added 1.23 lakh contracts.

There was hardly any Call unwinding seen on October 30.

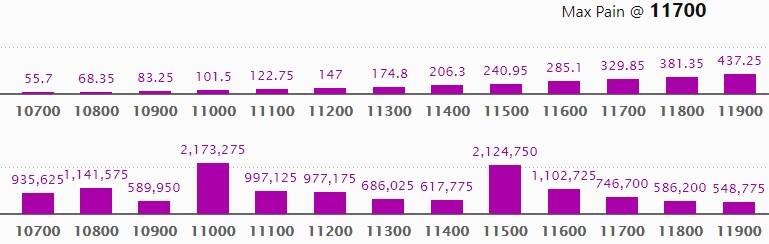

Put option data

Maximum Put open interest of 21.73 lakh contracts was seen at 11,000 strike, which will act as crucial support in the November series.

This is followed by 11,500 strike, which holds 21.24 lakh contracts, and 10,800 strike, which has accumulated 11.41 lakh contracts.

Put writing was seen at 11,200 strike, which added 1.7 lakh contracts, followed by 11,600 strike, which added 86,400 contracts and 11,300 strike which added 80,550 contracts.

Put unwinding was witnessed at 12,000 strike, which shed 33,750 contracts, followed by 11,900 strike which shed 33,600 contracts and 11,800 strike, which shed 25,200 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

48 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

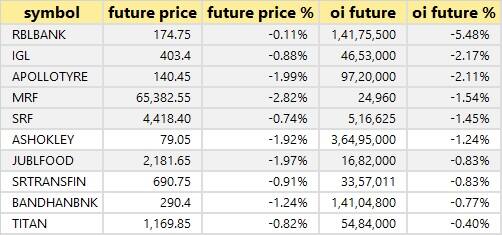

15 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

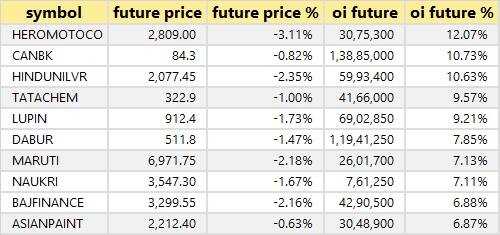

46 stocks saw short build-up

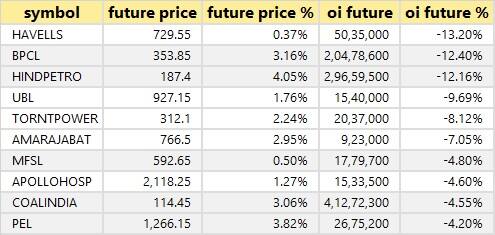

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

29 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are top 10 stocks in which short-covering was seen.

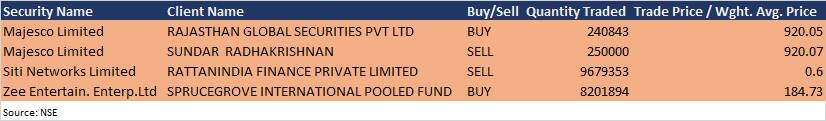

Bulk deals

(For more bulk deals, click here)

Results on November 2

HDFC, Cadila Healthcare, Punjab National Bank, NTPC, Bandhan Bank, AIA Engineering, Anant Raj, BF Utilities, Coromandel International, City Union Bank, Embassy Office Parks REIT, Escorts, Narayana Hrudayalaya, OnMobile Global, Pfizer, PNC Infratech, Shriram City Union Finance, TCI Express, Whirlpool of India, Wockhardt, Wonderla Holidays and Zee Entertainment Enterprises among 61 companies will declare their quarterly earnings on November 2.

Stocks in the news

Reliance Industries: Company reported consolidated profit at Rs 9,567 crore in Q2FY21, against adjusted profit at Rs 8,380 crore in the June quarter. Consolidated revenues jumped 27.2 percent sequentially to Rs 1,28,385 crore QoQ.

ICICI Bank: Bank reported sharply higher profit at Rs 4,251.3 crore in Q2FY21 against Rs 655 crore in same period last year. Net interest income rose to Rs 9,366.1 crore from Rs 8,057.4 crore, YoY.

Grasim Industries: Company has executed agreements with Lubrizol Manufacturing India Private for production of chlorinated polyvinyl chloride (CPVC) resin in India.

Just Dial: Company reported lower consolidated net profit at Rs 47.34 crore versus Rs 76.94 crore, revenue fell to Rs 167.53 crore versus Rs 242.57 crore YoY.

Aarti Industries: CRISIL upgraded the long-term rating to AA/stable from AA-/positive.

UPL: Company reported profit at Rs 537 crore in Q2FY21 against Rs 202 crore, revenue increased to Rs 8,939 crore from Rs 7,817 crore YoY.

DLF: Company reported consolidated net profit at Rs 232 crore versus Rs 446 crore, revenue declined to Rs 1,610 crore from Rs 1,716 crore YoY.

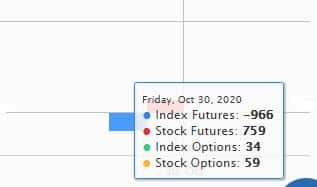

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 870.88 crore, whereas domestic institutional investors (DIIs) net bought shares worth Rs 631.11 crore in the Indian equity market on October 30, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Not a single stock is under the F&O ban for November 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!