The market closed at more than six-month high on August 28, the first day of September series, as bulls remained in strong position, backed by banking & financials and liquidity boost.

The BSE Sensex climbed 353.84 points to 39,467.31, while the Nifty50 rallied 88.30 points to 11,647.60, the highest level since February 26, 2020 and formed bullish candle on the daily as well as weekly charts. The index gained 2.43 percent for the week.

"Now, one needs to be cautious about 11,500 holding in the next week to consider this as a sustainable upside breakout. A sustainable movement for the next week is likely to pull Nifty towards the next upside levels of 12,000 and higher for the coming week. Formation of any significant reversal pattern at the highs is expected to trigger profit booking from the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

Siddhartha Khemka, Head - Retail Research at Motilal Oswal Financial Services also feels going ahead, the market may move upwards in the near term with more of sector/stock specific actions, but intermittent profit booking should not be ruled out.

"Gradual cooling in volatility on week-on-week basis also suggests bullish stance and buy on decline strategy could continue in the market," he said.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,596, followed by 11,544.4. If the index moves up, the key resistance levels to watch out for are 11,692.6 and 11,737.6.

Nifty Bank

The Bank Nifty smartly outperformed the Nifty50, rising 923.45 points or 3.91 percent to 24,523.80 majorly driven by PSU banks. The important pivot level, which will act as crucial support for the index, is placed at 23,878.06, followed by 23,232.33. On the upside, key resistance levels are placed at 24,890.66 and 25,257.53.

Call option data

Maximum Call open interest of 21.97 lakh contracts was seen at 12,000 strike, which will act as crucial resistance in the September series.

This is followed by 11,500 strike, which holds 16.23 lakh contracts, and 11,800 strike, which has accumulated 11.83 lakh contracts.

Call writing was seen at 12,000 strike, which added 3.1 lakh contracts, followed by 12,200, which added 1.66 lakh contracts, and 11,900 strike, which added 1.56 lakh contracts.

Call unwinding was seen at 11,500 strike, which shed 87,525 contracts, followed by 11,300 strike, which shed 27,000 contracts.

Put option data

Maximum Put open interest of 27.17 lakh contracts was seen at 11,000 strike, which will act as crucial support in the September series.

This is followed by 11,500 strike, which holds 21.54 lakh contracts, and 11,300 strike, which has accumulated 16.20 lakh contracts.

Put writing was seen at 11,600 strike, which added 3.26 lakh contracts, followed by 11,300 strike, which added 2.03 lakh contracts, and 11,700 strike, which added 1.62 lakh contracts.

Put unwinding was witnessed at 11,000, which shed 46,425 contracts.

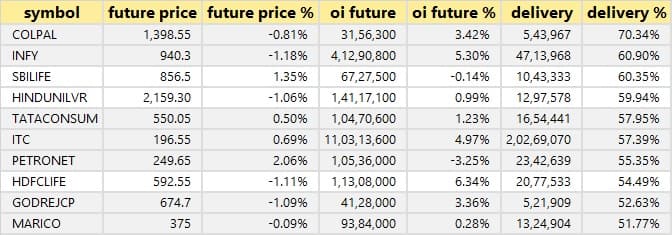

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

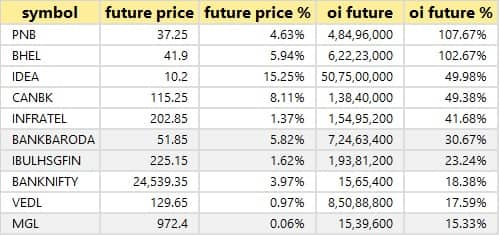

61 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

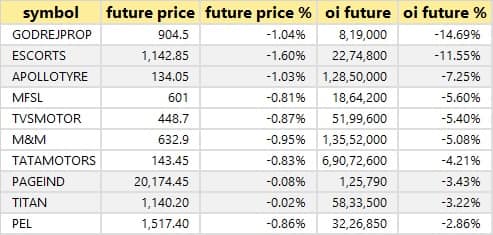

16 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

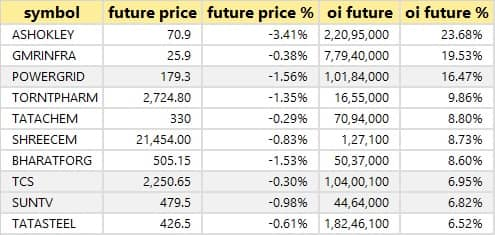

40 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

19 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

ICICI Securities: ICICI Bank LTD. (Investment) sold 64,42,000 shares in subsidiary company at Rs 480.95 per share on the NSE.

Indian Energy Exchange: PPFAS Mutual Fund A/C PPFAS Long Term Value Fund acquired 24,37,780 shares in company at Rs 190 per share. However, Rural Electrification Corporation sold 26,01,205 shares in company at Rs 190.12 per share on the NSE.

Aarey Drugs & Pharmaceuticals: Vikas Ecotech bought 2.5 lakh shares in company at Rs 38.04 per share on the BSE.

Sheela Foam: DSP Mutual Fund acquired 5.9 lakh shares in company at Rs 1,365 per share. However, Tushaar Gautam sold 10 lakh shares in company at the same price on the BSE.

Patel Integrated Logistics: Central Bank of India sold 7,85,500 shares of the company at Rs 31.08 per share on the NSE.

(For more bulk deals, click here)

8K Miles Software Services, Arvind, Bharat Dynamics, BF Utilities, BPL, Dredging Corporation of India, GMDC, Indosolar, JK Cement, Morepen Laboratories, Mukand, NHPC, Prakash Industries, Pricol, Prozone Intu Properties, Shree Renuka Sugars, Sadbhav Infrastructure Project, Spandana Sphoorty Financial, Speciality Restaurants, Tera Software, Technocraft Industries etc will announce their quarterly earnings on August 31.

Stocks in the news

Reliance Industries: Reliance Retail to acquire retail & wholesale and the logistics & warehousing business of the Future Group for Rs 24,713 crore.

RBL Bank: Vishwavir Ahuja, Managing Director & CEO of the bank, sold 18,92,900 shares of RBL Bank on 27th & 28th of August, 2020, for approximately Rs 38.52 crore.

Paramount Communications: The company's consolidated revenue for Q1FY21 stood at Rs 85.83 crore against Rs 152.65 crore YoY. Net loss at Rs 1.6 crore against profit of Rs 6.62 crore YoY.

ICICI Prudential Life Insurance: Raghunath Hariharan tendered his resignation as a Director of the company on August 28. The company appointed Wilfred John Blackburn as a non-executive (Additional) Director.

Ramkrishna Forgings: Board in a meeting on September 2 will consider raising up to Rs 150 crore.

RITES: The company announced final dividend of Rs 6 per share in addition to already paid interim dividend of Rs 10 per share.

J&K Bank: The board of directors approved raising up to Rs 4,500 crore capital.

IRB Infrastructure Developers: CRISIL cut company's long term rating to A from A+.

ITC: Board of directors will meet on September 4 to consider amalgamating 3 subsidiaries (Sunrise Foods, Hobbits International Foods and Sunrise Sheetgrah) with itself.

Indiabulls Ventures: Company will raise Rs 588 crore via preferential issue.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,004.11 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 543.56 crore in the Indian equity market on August 28, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Two stocks -- Bank of Baroda and Vodafone Idea -- are under the F&O ban for August 31. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: "Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd which publishes Moneycontrol."

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!