The market regained momentum and closed half a percent higher on August 21 driven by banking and financial stocks and positive Asian cues, while for the week, it registered around 1.5 percent rally after fourth of a percent fall in previous week.

On August 21, Sensex gained 214.33 points, or 0.56 percent, to close at 38,434.72, while Nifty50 climbed 59.40 points to 11,371.60 but formed bearish candle on the daily charts as its closing value was lower than opening levels.

"The opening downside gap of Thursday and upside gap of Friday remains unfilled/partially filled. This could be a positive indication for the short term and one may expect Nifty to retest the recent swing high of 11,460 in the coming sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

Siddhartha Khemka, Head - Retail Research at Motilal Oswal Financial Services also feels going ahead, the market may continue its positive momentum in the near term driven by positive news flows around vaccine development and favourable policies.

However, the volatility may continue in between given tepid economic data and lofty valuations, he said, adding technically too, the major trend is positive, Nifty requires to surpass recent swing highs of 11,460 for an upmove towards 11,500-11,600 while the support exists at 11,200.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support level for the Nifty is placed at 11,349.7, followed by 11,327.8. If the index moves up, the key resistance levels to watch out for are 11,406 and 11,440.4.

Nifty Bank

The Bank Nifty outperformed Nifty50, rising 300.15 points or 1.36 percent to close at 22,299.60. The important pivot level, which will act as crucial support for the index, is placed at 22,195.1, followed by 22,090.6. On the upside, key resistance levels are placed at 22,374.1 and 22,448.6.

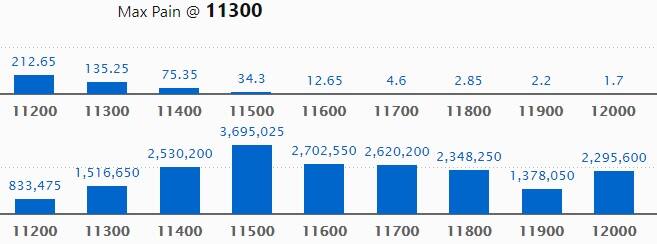

Call option data

Maximum Call open interest of 36.95 lakh contracts was seen at 11,500 strike, which will act as crucial resistance in the August series.

This is followed by 11,600 strike, which holds 27.02 lakh contracts, and 11,700 strike, which has accumulated 26.20 lakh contracts.

Call writing was seen at 11,600 strike, which added 6.91 lakh contracts, followed by 11,700 strike, which added 6.2 lakh contracts, and 11,500 strike, which added 5.05 lakh contracts.

Call unwinding was seen at 11,300, which shed 7.22 contracts, followed by 11,200 strike, which shed 35,025 contracts.

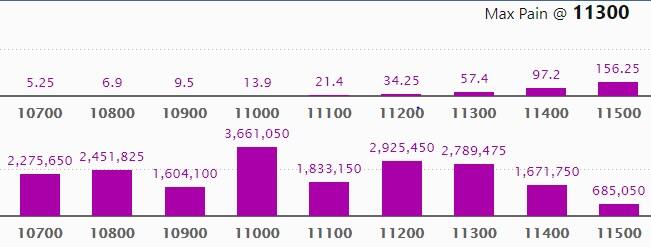

Put option data

Maximum Put open interest of 36.61 lakh contracts was seen at 11,000 strike, which will act as crucial support in the August series.

This is followed by 11,200 strike, which holds 29.25 lakh contracts, and 11,300 strike, which has accumulated 27.89 lakh contracts.

Put writing was seen at 11,300 strike, which added 9.93 lakh contracts, followed by 11,400 strike, which added 9.76 lakh contracts, 11,200 strike, which added 7.9 lakh contracts, and 10,700 strike, which added 4.86 lakh contracts.

Put unwinding was witnessed at 11,000, which shed 2.42 lakh contracts, followed by 12,000 strike, which shed 54,525 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

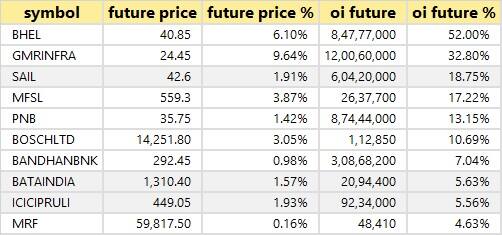

41 stocks saw long build-up

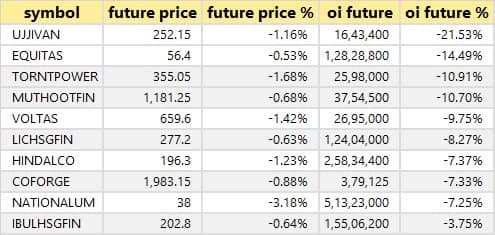

31 stocks saw long unwinding

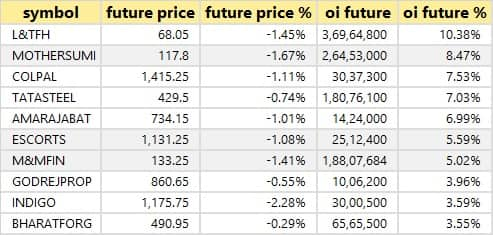

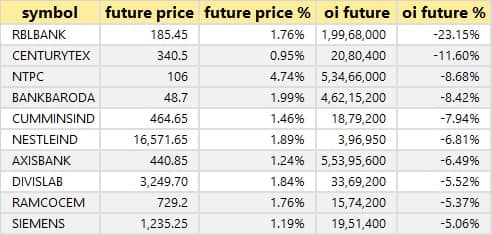

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

29 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering.

Bulk deals

Ceat: Jwalamukhi Investment Holdings sold 3,49,332 shares in company at Rs 871.28 per share on the BSE and 4,88,249 shares at Rs 871.24 per share on the NSE.

CG Power and Industrial Solutions: KKR India Debt Opportunities Fund II sold 34,64,021 shares in company at Rs 16.95 per share and KKR India Financial Services 50 lakh shares at same price on the BSE and 96,10,588 shares at Rs 16.85 per share on the NSE.

Sudarshan Chemical Industries: ICICI Prudential Mutual Fund acquired 9.5 lakh shares in the company at Rs 430.05 per share, whereas Rohit Kishor Rathi sold 10 lakh shares at Rs 430.16 per share on the BSE.

Vikas Multicorp: Aviator Global Investment Fund bought 33.5 lakh shares in the company at Rs 16.70 per share on the BSE.

Asian Hotels (North): Asian Agro Industries sold 1.48 lakh shares in the company at Rs 63.91 per share on the NSE.

BASF: Plutus Wealth Management LLP acquired 3.15 lakh shares in the company at Rs 1,584.46 per share on the NSE.

Future Consumer: Clix Capital Services sold another 1.64 crore shares in the company at Rs 10.74 per share on the NSE.

GSS Infotech: Thakar Ashish Bhupendra sold 1.8 lakh shares in the company at Rs 27.15 per share on the NSE.

Orient Bell: Porinju Veliyath-owned Equity Intelligence India acquired 80,000 shares in the company at Rs 91.87 per share on the NSE.

VA Tech Wabag: Environment Agency Active Pension Fund sold 4,02,933 shares in the company at Rs 207.59 per share on the NSE.

Flexituff Ventures International: New World Capital bought 1.3 lakh shares in the company at Rs 7.9 per share, whereas Clearwater Capital Partners Singapore Fund IV sold 3.77 lakh shares at same price.

(For more bulk deals, click here)

LIC Housing Finance, IRB Infrastructure Developers, Globus Spirits, Indraprastha Medical Corporation, Ingersoll-Rand India, NOCIL, Parabolic Drugs, Suzlon Energy etc will announce its quarterly earnings on August 24.

Stocks in the news

Indiabulls Housing Finance Q1: Profit at Rs 272.8 crore versus Rs 790 crore, revenue at Rs 2,574.6 crore versus Rs 3,885 crore YoY.

SMS Lifesciences Q1: Profit at Rs 2.48 crore versus Rs 4.7 crore, revenue at Rs 54.7 crore versus Rs 91.8 crore YoY.

Rossari Biotech Q1: Profit at Rs 15.5 crore versus Rs 14.16 crore, revenue at Rs 109.5 crore versus Rs 127.8 crore YoY.

Max Healthcare Institute: Ashish Dhawan held 1.78% stake in company and FPIs have 10.87% shareholding as of June 2020.

AGC Networks Q1: Profit at Rs 4.33 crore versus Rs 13.56 crore, revenue at Rs 993.86 crore versus Rs 1,228.47 crore YoY.

Genus Paper & Boards Q1: Loss at Rs 5.48 crore versus profit Rs 2.1 crore, revenue at Rs 31.35 crore versus Rs 70.12 crore YoY.

Union Bank of India Q1: Profit at Rs 332.74 crore versus Rs 224.43 crore, NII at Rs 6,403.2 crore versus Rs 2,518.19 crore YoY.

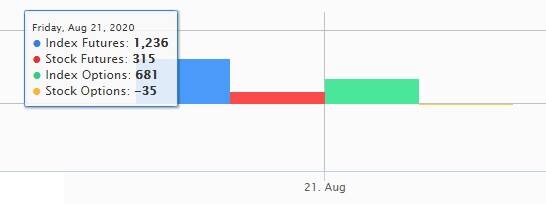

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 410.16 crore, whereas domestic institutional investors (DIIs) sold shares worth Rs 250.65 crore in the Indian equity market on August 21, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Nine stocks -- Adani Enterprises, Aurobindo Pharma, Bharat Heavy Electricals (BHEL), Canara Bank, Indiabulls Housing Finance, Muthoot Finance, NALCO, Punjab National Bank and RBL Bank -- are under the F&O ban for August 24.

Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!