With the formation of Bearish Engulfing kind of candlestick pattern on the monthly F&O expiry day, July 27, the bears got back in action mode and dragged the Nifty50 below 10-day EMA (exponential moving average) that had acted as a support for several sessions in the past, after the Federal Reserve hinted for one more rate hike in rest of calendar year.

As a result, the index may see further correction up to 19,500 or 20-day EMA and if the said levels get broken then there could be sharp correction in the beginning sessions of August series.

On July 27, the BSE Sensex dropped 440 points to 66,267, while the Nifty50 slipped 118 points to close at 19,660 despite uptrend in global peers, led by banking & financial services, auto, FMCG, oil & gas, and select IT stocks.

Going ahead, "the profit booking may extend a bit and the support level of 19,500 (20-EMA) is likely to get challenged in this scenario," said Rajesh Bhosale, Technical Analyst at Angel One.

He further said this average has proven to be a strong base during previous price corrections in May and June, resulting in significant positive momentum. Therefore, it holds pivotal importance for the upcoming sessions, as a break below it may lead to meaningful profit booking in days to come, he feels.

On the other hand, Thursday’s supply zone around 19,850 – 19,880 is expected to act as a stiff resistance, and only a breakthrough would trigger an upside momentum.

Hence, Rajesh advised traders to wait for some consolidation or a decent price dip before considering aggressive long positions.

The daily as well as hourly momentum indicator has a negative crossover which is a sell signal.

Thus, "both price and momentum indicators are suggesting that there could be some weakness in the short term," said Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas.

The daily Bollinger bands are also contracting, which points towards consolidation in the short term. And thus, Jatin changes short-term stance from positive to sideways and the range of consolidation is likely to be 19,900 - 19,500.

We have collated 15 data points to help you spot profitable trades:

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on Nifty

The pivot point calculator suggests that the Nifty may get support at 19,610, followed by 19,547 and 19,446. In case of an upside, 19,811 can be the key resistance area followed by 19,874 and 19,974.

Bank Nifty is also likely to see further correction if it fails to hold on to 45,300 (20-day EMA) in coming sessions, whereas 46,000 is expected to remain key hurdle on the higher side.

The index was under pressure on the day of expiry of July derivative contracts, as it failed to sustain above 46,000 mark, and dropped 383 points to end at 45,679 on July 27. The index has formed Bearish Engulfing kind of candlestick pattern on the daily charts, which is a bearish reversal pattern.

"Bank Nifty also witnessed a correction from the resistance zone 46,300 – 46,400 where the previous swing highs were placed. The daily momentum indicator has triggered a fresh negative crossover which is a sell signal," said Gedia.

Thus, he feels until the Bank Nifty does not manage to sustain above 46,300 – 46,400 zone, one can expect it to slip down to 45,330 – 45,300 levels where support in the form of the 20-day moving average is placed.

The pivot point calculator indicates that the Bank Nifty is likely to take support at 45,571, followed by 45,396 and 45,114. In case of upside, the initial resistance zone can be 46,136, followed by 46,310 and 46,593.

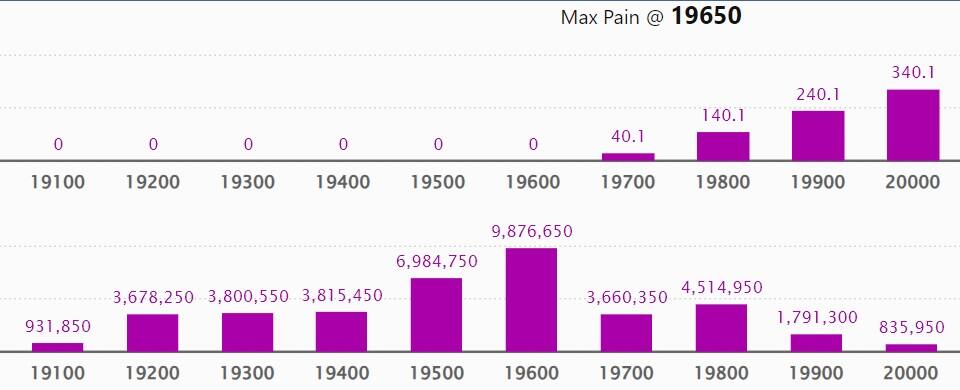

On the Options front, we have seen the maximum weekly Call open interest (OI) at 19,700 strike, with 97.84 lakh contracts, which can act as a key resistance for the Nifty. This is followed by 19,800 strike which has 92.57 lakh contacts, while 20,500 strike has 78.66 lakh contracts.

Meaningful Call writing was seen at 19,700 strike, which added 62.43 lakh contracts, followed by 19,600 and 20,400 strikes, which added 17.08 lakh and 7.78 lakh contracts, respectively.

The maximum Call unwinding was at 20,000 strike, which shed 66.16 lakh contracts, followed by 19,900 and 19,800 strikes, which shed 64.55 lakh and 37.68 lakh contracts, respectively.

On the Put side, the maximum open interest was at 19,600 strike, with 98.76 lakh contracts. This can be an important support level for the Nifty50 in the coming sessions.

This is followed by 19,500 strike, comprising 69.84 lakh contracts, and 19,000 strike, with 50.68 lakh contracts.

The maximum Put writing was visible at 19,600 strike, which added 10.89 lakh contracts, followed by 20,500 strike, which added 4,400 contracts.

Meaningful Put unwinding was at 19,700 strike, which shed 63.66 lakh contracts, followed by 19,000 and 19,800 strikes, which shed 18.56 lakh contracts and 14.73 lakh contracts, respectively.

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. We saw the highest delivery in Dabur India, SRF, Tata Consultancy Services, Hindustan Unilever, and Petronet LNG among others.

Here are the top 10 stocks which saw the highest rollovers on expiry day including Info Edge, Indus Towers, ICICI Lombard General Insurance Company, AU Small Finance Bank, and Grasim Industries with over 98 percent rollovers.

Syngene International, Birlasoft, Metropolis Healthcare, Exide Industries, and ACC were among the 11 stocks to see a long build-up based on the open interest (OI) percentage. An increase in open interest and price indicates a build-up of long positions.

Based on the OI percentage, 76 stocks, including ONGC, RBL Bank, Sun TV Network, National Aluminium Company, and Vodafone Idea saw a long unwinding. A decline in OI and price indicates a long unwinding.

We have seen a short build-up in 13 stocks, including Mahindra & Mahindra, Indraprastha Gas, Can Fin Homes, Bajaj Finance, and BPCL. An increase in OI along with a price fall indicates a build-up of short positions.

Based on the OI percentage, we have seen 88 stocks on the short-covering list. These included Delta Corp, GMR Airports Infrastructure, REC, Larsen & Toubro, and Glenmark Pharma. A decrease in OI along with a price increase is an indication of short-covering.

(For more bulk deals, click here)

Results on July 28 and July 29

Stocks in the news

Indus Towers: The telecom infrastructure provider recorded a massive a 182 percent year-on-year growth in profit at Rs 1,348 crore for quarter ended June FY24, driven by healthy operating performance. Revenue from operations for the quarter grew three percent to Rs 7,076 crore compared to year-ago period.

Bharat Electronics: The state-owned defence company reported a 23 percent year-on-year growth in standalone profit at Rs 530.84 crore for June FY24 quarter, driven by strong topline and operating performance with fall in input cost. Revenue from operations grew by 12.8 percent to Rs 3,510.8 crore compared to same period last year.

JK Lakshmi Cement: The flagship company of JK organisation registered a 30.65 percent on-year fall in consolidated profit at Rs 79.8 crore for the quarter ended June FY24, impacted by disappointing operating numbers. Revenue from operations grew by 4.6 percent to Rs 1,730.25 crore compared to year-ago period.

Indian Hotels: The country's largest hospitality company started off the year with profit at Rs 222 crore for June FY24 quarter, growing 31 percent over a year-ago period, with 17 percent on-year growth in revenue at Rs 1,516 crore.

Lupin: The pharma major received correspondence from the US FDA that it has now addressed the concerns raised in the warning letter for its facilities in Goa and Pithampur unit-2, Indore. This is after the satisfactory evaluation of the corrective actions taken by the company in response to the warning letter. The US FDA issued warning letter to the company in November 2017.

Trident: The textile company registered a 27.8 percent year-on-year decline in consolidated profit at Rs 93.4 crore for the quarter ended June FY24, impacted by lower topline and operating margin. Revenue from operations for the quarter at Rs 1,493.7 crore declined by 11 percent compared to corresponding period last fiscal, with fall in yarn, and paper & chemicals businesses.

Ajanta Pharma: The specialty pharmaceutical formulation company has registered a 19 percent year-on-year growth in profit at Rs 208 crore for the quarter ended June FY23, driven by healthy operating performance. Revenue from operations for the quarter increased by 7 percent on-year to Rs 1,021 crore, with US sales increasing by 19 percent, India sales growing 14 percent and Asia reporting 6 percent sales growth, but Africa sales fell 5 percent YoY.

Fund Flow

Foreign institutional investors (FII) sold shares worth Rs 3,979.44 crore, whereas domestic institutional investors (DII) purchased shares worth Rs 2,528.15 crore on July 27, provisional data from the National Stock Exchange (NSE) shows.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!