The market snapped a four-day winning streak and closed with more than a third of a percent loss on October 22, dented by weak global cues.

The BSE Sensex fell 148.82 points to close at 40,558.49, while the Nifty50 declined 41.20 points to 11,896.50 and formed a Doji (or Inside Bar) kind of pattern on the daily charts.

"A small positive candle was formed with upper and lower shadow, which indicates a formation of high wave-type candle pattern. Having formed this high wave pattern beside the long-range candle of Wednesday could indicate a sideways range movement in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol.

"There is a possibility of continuation of rangebound action around 11,850-11,950 levels by the next session. Immediate supports to be watched at 11,800 and crucial upside hurdle is placed at 12,025," he said.

Chandan Taparia of Motilal Oswal feels overall price and data setup suggests bounce may be seen but multiple hurdles and supply pressure at higher zones could restrict its upside momentum with higher volatility.

The broader markets outperformed frontline indices as the Nifty Midcap index was up 0.6 percent and smallcap index gained 1 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,833.5, followed by 11,770.5. If the index moves up, the key resistance levels to watch out for are 11,949.5 and 12,002.5.

Nifty Bank

The Bank Nifty fell 150.80 points to close at 24,484.20 on October 22. The important pivot level, which will act as crucial support for the index, is placed at 24,259.2, followed by 24,034.2. On the upside, key resistance levels are placed at 24,700.2 and 24,916.2.

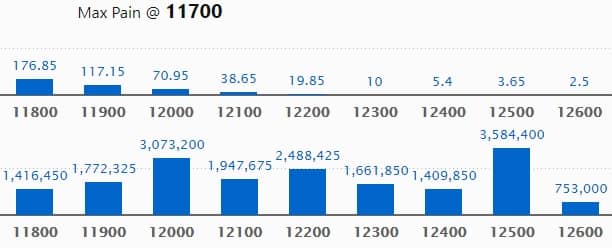

Call option data

Maximum Call open interest of 35.84 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 30.73 lakh contracts, and 12,200 strike, which has accumulated 24.88 lakh contracts.

Call writing was seen at 12,500 strike, which added 9.66 lakh contracts, followed by 12,000 strike which added 7.94 lakh contracts and 11,900 strike which added 6.17 lakh contracts.

Call unwinding was seen at 11,600 strike, which shed 5,475 contracts, followed by 11,100 strike, which shed 3,375 contracts.

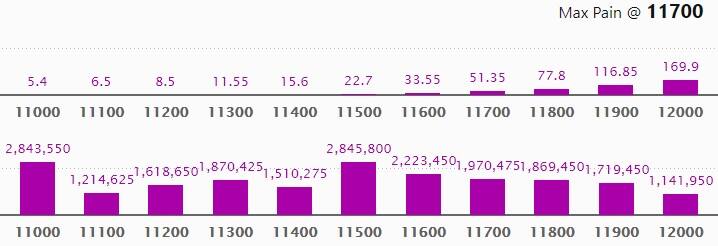

Put option data

Maximum Put open interest of 24.85 lakh contracts was seen at 11,500 strike, which will act as crucial support in the October series.

This is followed by 11,000 strike, which holds 24.83 lakh contracts, and 11,600 strike, which has accumulated 22.23 lakh contracts.

Put writing was seen at 11,800 strike, which added 5.89 lakh contracts, followed by 11,500 strike, which added 5.05 lakh contracts and 11,900 strike which added 4.7 lakh contracts.

Put unwinding was witnessed at 12,500 strike, which shed 9,675 contracts, followed by 12,300 strike which shed 9,600 contracts.

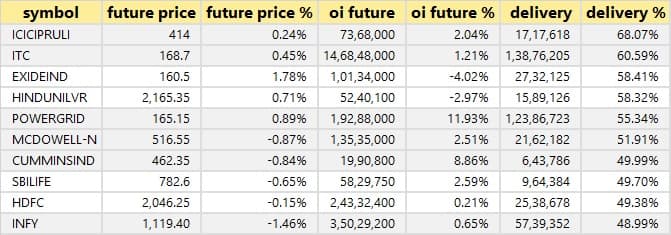

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

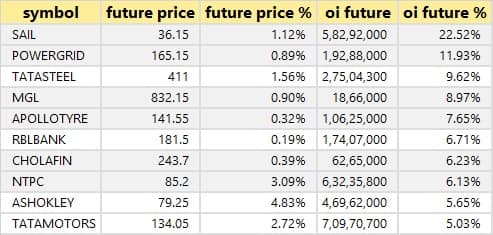

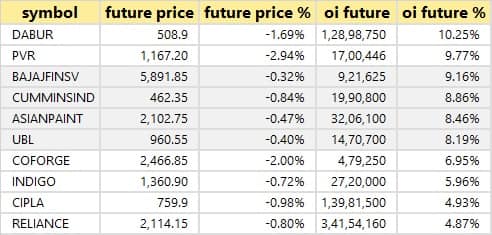

40 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

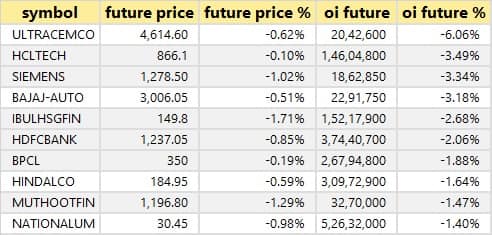

18 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

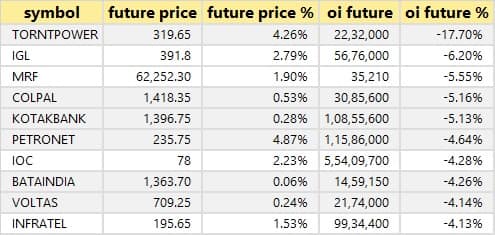

47 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

33 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

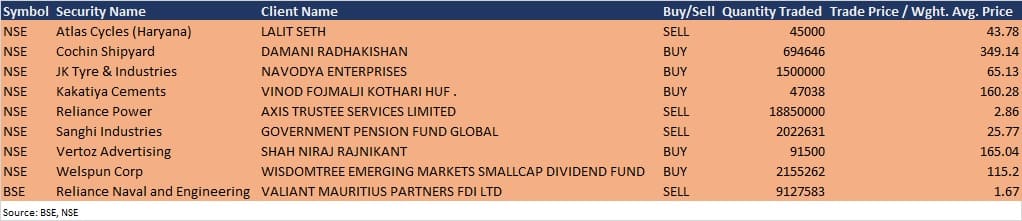

Bulk deals

(For more bulk deals, click here)

Results on October 23

Tech Mahindra, Nestle India, Yes Bank, ICICI Lombard General Insurance Company, IDBI Bank, JSW Steel, Aarti Drugs, Alphageo (India), Apollo Tricoat Tubes, Atul, Genus Power Infrastructures, Heidelbergcement India, Mahindra EPC Irrigation, Mold-Tek Technologies, Huhtamaki PPL, Persistent Systems, Premier Explosives, Rane Engine Valve, Sudarshan Chemical Industries, Supreme Petrochem, Vikas Multicorp and Wabco India are among 38 companies to announce quarterly earnings on October 23.

Stocks in the news

Pricol: The company reported consolidated profit at Rs 49.51 crore in Q2FY21 against a loss of Rs 59.67 crore, revenue rose to Rs 390 crore from Rs 330 crore YoY.

Crompton Greaves Consumer Electricals: The company reported profit at Rs 141.68 crore in Q2FY21 against Rs 110.88 crore, revenue rose to Rs 1,213.2 crore from Rs 1,075.79 crore YoY.

HDFC Asset Management Company: The company reported profit at Rs 338 crore in Q2FY21 against Rs 368 crore, revenue fell to Rs 456 crore from Rs 498 crore YoY.

Alembic Pharma: The company reported profit at Rs 333.4 crore in Q2FY21 against Rs 246.3 crore, revenue rose to Rs 1,457 crore from Rs 1,240.9 crore YoY.

Bharti Infratel: Company reported profit at Rs 732.6 crore in Q2FY21 against Rs 703.6 crore in Q1FY21, revenue rose to Rs 3,695.2 crore from Rs 3,504.7 crore QoQ.

Hexaware Technologies: The company reported profit at Rs 162.7 crore in Q3CY20 against Rs 152.4 crore QoQ, revenue jumped to Rs 1,585.9 crore from Rs 1,569 crore QoQ.

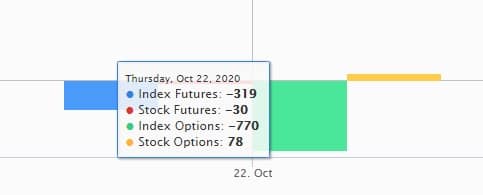

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,118.46 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 2,019.87 crore in the Indian equity market on October 22, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Five stocks - BHEL, Canara Bank, Mindtree, NALCO and Punjab National Bank - are under the F&O ban for October 23. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!