The market traded largely rangebound and settled the session on a flat note despite positive global cues on September 3. Banking and financials saw selling pressure, whereas auto, FMCG, IT and pharma stocks gained.

Benchmark indices snapped their two-day winning streak on September 3, with the Sensex closing down 95.09 points at 38,990.94. The Nifty declined 7.50 points to 11,527.50 after trading in a narrow high-low range of 77 points throughout the session, forming a bearish candle on the daily charts.

"A similar market action was seen during August 21-28. Nifty eventually witnessed sharp weakness from the highs (11,794) on August 31. According to this pattern, one may expect similar type of range movement in the next few sessions," Nagaraj Shetti, Technical Research Analyst at HDFC Securities, told Moneycontrol. He added that immediate resistance is seen at 11,600 and short term support is placed at 11,450.

The broader market continued to outperform front-liners as the Nifty Midcap and Smallcap indices was up 0.85 percent and 0.69 percent, respectively.

"We are seeing selective sectors and stocks doing well, so traders should spend more time on their stock selection process," Ajit Mishra, VP - Research at Religare Broking, said.

"The recent macroeconomic data suggests that economic revival would be gradual. There are no positive domestic triggers to boost sentiment. We suggest continuing with a cautious approach and keeping a close watch on the lingering broader tension between India and China for cues," he added.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty According to pivot charts, the key support levels for the Nifty is placed at 11,495.13, followed by 11,462.77. If the index moves up, the key resistance levels to watch out for are 11,572.43 and 11,617.37.

Nifty Bank The Bank Nifty sharply underperformed the Nifty, falling 343.75 points, or 1.44 percent, to 23,530.80 on September 3. The important pivot level, which will act as crucial support for the index, is placed at 23,304.46, followed by 23,078.13. On the upside, key resistance levels are placed at 23,904.36 and 24,277.93.

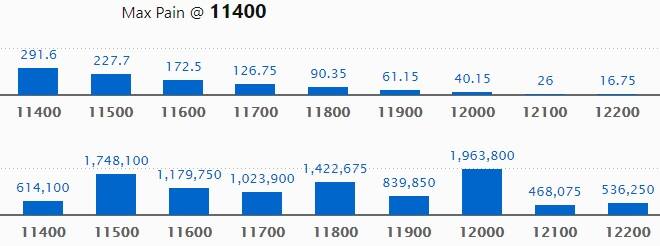

Call option data Maximum Call OI of 19.63 lakh contracts was seen at 12,000, which will act as crucial resistance in the September series.

This is followed by 11,500, which holds 17.48 lakh contracts, and 11,800 strikes, which has accumulated 14.22 lakh contracts.

Call writing was seen at 11,600, which added 1.04 lakh contracts, followed by 11,800, which added 75,075 contracts, and 11,700 strikes, which added 29,250 contracts.

Call unwinding was seen at 11,500, which shed 69,225 contracts, followed by 12,000 strikes, which shed 63,075 contracts.

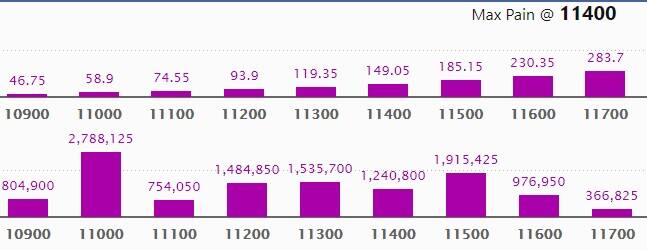

Put option data Maximum Put OI of 27.88 lakh contracts was seen at 11,000, which will act as crucial support in the September series.

This is followed by 11,500, which holds 19.15 lakh contracts, and 11,300 strikes, which has accumulated 15.35 lakh contracts.

Put writing was seen at 11,200, which added 97,800 contracts, followed by 11,500 strikes, which added 96,900 contracts.

Put unwinding was witnessed at 11,100, which shed 8,475 contracts, followed by 11,700 strikes, which shed 7,500 contracts.

Stocks with a high delivery percentage A high delivery percentage suggests that investors are showing interest in these stocks.

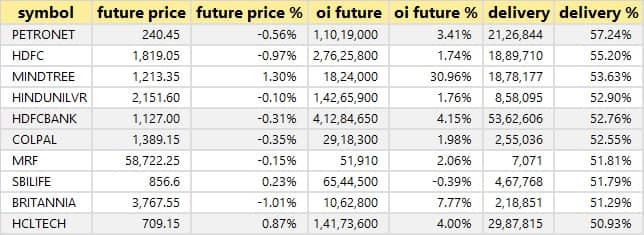

42 stocks saw long build-up Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

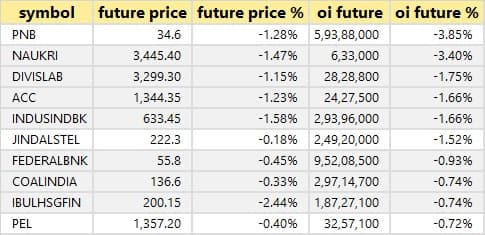

14 stocks saw long unwinding Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

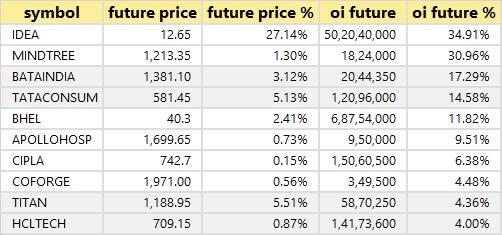

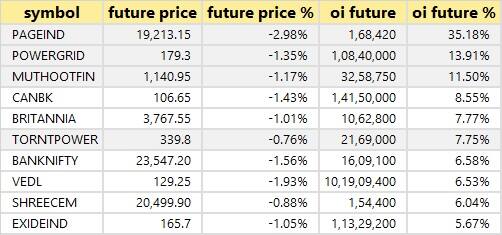

46 stocks saw short build-up An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which short build-up was seen.

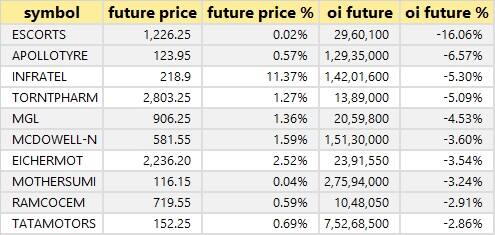

35 stock witnessed short-covering A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals Himatsingka Seide: Orient Silk bought 7,02,945 shares in company at Rs 79.29 per share. However, Bihar Mercantile Union sold 16,52,505 shares at Rs 79.29 per share on the BSE.

Gennex Laboratories: Premier Capital & Securities acquired 10 lakh shares in company at Rs 4.65 per share on the BSE.

Mangalam Drugs: Alpha Leon Enterprises net sold 39,656 shares in the company at Rs 132.45 per share on the NSE.

(For more bulk deals, click here)

Earnings on September 4 National Aluminium Company (NALCO), Future Retail, Goodyear India, Jubilant Life Sciences, NLC India, Repco Home Finance, RattanIndia Infrastructure, RattanIndia Power, Seamec, Simbhaoli Sugars, among 68 companies will announce their June quarter earnings on September 4.

Stocks in the news GSFC restarted Methanol plant with a daily installed capacity of 525 MT.

CreditAccess Grameen: Board approved raising of Rs 1,000 crore via equity.

Hindustan Aeronautics: Government to sell 5,02,462 equity shares to the company's eligible employees at Rs 950.95 per share via an offer for sale during September 4-9.

Jindal Steel & Power: Promoter entity Danta Enterprises released over 1 crore pledged shares during August 25-31. Another promoter entity Glebe Trading also released 1.4 lakh pledged shares.

Adani Gas: ICRA upgraded company's long-term rating to AA- and re-affirmed short-term rating at A1+ with a stable outlook.

Infosys will acquire product design and development firm, Kaleidoscope Innovation.

Usha Martin: Promoter entity Neutral Publishing House raised stake in company to 3.25% from 3.08% earlier on September 2.

Jubilant Industries: Q1 loss at Rs 3.1 crore versus a profit of Rs 9.6 crore, revenue at Rs 94.3 crore versus Rs 151.8 crore YoY.

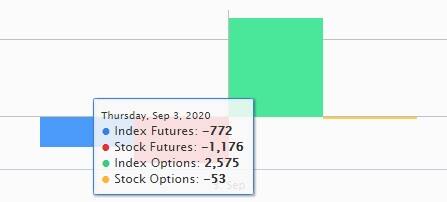

Fund flow

FII and DII data Foreign institutional investors (FIIs) net bought shares worth Rs 7.72 crore, while domestic institutional investors (DIIs) acquired shares worth Rs 120.08 crore in the Indian equity market on September 3, as per provisional data available on the NSE.

Stock under F&O ban on NSE Five stocks -- Canara Bank, Escorts, Indiabulls Housing Finance, Vodafone Idea and Punjab National Bank -- are under the F&O ban for September 4. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!