The market clocked 1.5 percent gains on April 21 as bulls retained charge over Dalal Street for a second consecutive session. Auto, banks, financial services, IT, FMCG and pharma stocks aided the rally.

The BSE Sensex jumped nearly 900 points to close above 57,900 levels, while the Nifty50 surged 256 points to 17,393 and formed bullish candle on the daily charts, indicating positive mood in the market.

"On the daily charts, the Nifty has formed Higher Top Higher Bottom and once again sustained above 200 days simple moving average (SMA - 17,185) indicating positive undertone of the market," said Vidnyan Sawant, AVP - Technical Research at GEPL Capital.

On the indicator front, the relative strength index (RSI) plotted on the daily charts is sustaining above 50 mark that shows positive momentum, he added.

He said the Nifty has immediate resistance placed at 17,468 and 17,842 followed by 18,000 levels. "The downside support for the index is placed at 17,185 (200 Day SMA) followed by 16,824 levels (weekly low)."

The broader markets also enjoyed bulls' party as the Nifty Midcap 100 and Smallcap 100 indices gained 1 percent and 1.5 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,267, followed by 17,142. If the index moves up, the key resistance levels to watch out for are 17,466 and 17,540.

Bank Nifty clocked 501 points or 1.4 percent gains at 36,816 on April 21. The important pivot level, which will act as crucial support for the index, is placed at 36,503, followed by 36,191. On the upside, key resistance levels are placed at 37,021 and 37,226 levels.

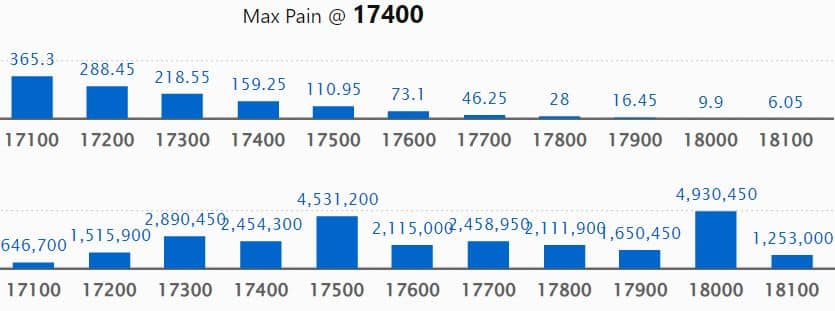

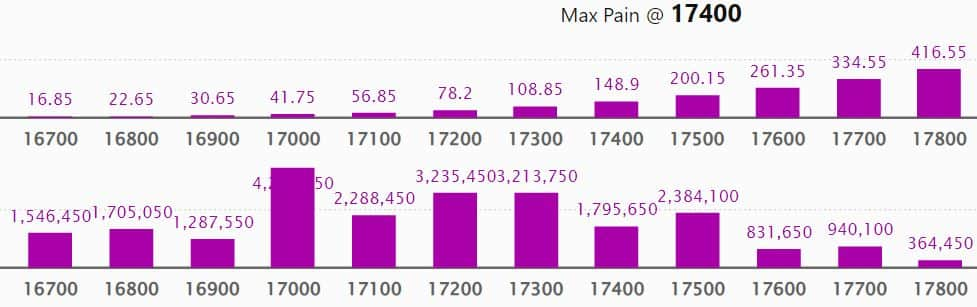

Maximum Call open interest of 49.3 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 17,500 strike, which holds 45.31 lakh contracts, and 18,500 strike, which has accumulated 38.8 lakh contracts.

Call writing was seen at 17,500 strike, which added 18.9 lakh contracts, followed by 18,500 strike which added 18.35 lakh contracts, and 18,000 strike which added 18.28 lakh contracts.

Call unwinding was seen at 17,200 strike, which shed 10.61 lakh contracts, followed by 17,100 strike which shed 3.18 lakh contracts and 17,000 strike which shed 66,700 contracts.

Maximum Put open interest of 42.37 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the April series.

This is followed by 17,200 strike, which holds 32.35 lakh contracts, and 17,300 strike, which has accumulated 32.13 lakh contracts.

Put writing was seen at 17,300 strike, which added 25.46 lakh contracts, followed by 17,200 strike, which added 12.87 lakh contracts and 17,400 strike which added 11.87 lakh contracts.

Put unwinding was seen at 18,200 strike, which shed 6,400 contracts, followed by 18,500 strike which shed 3,550 contracts, and 18,000 strike which shed 800 contracts.

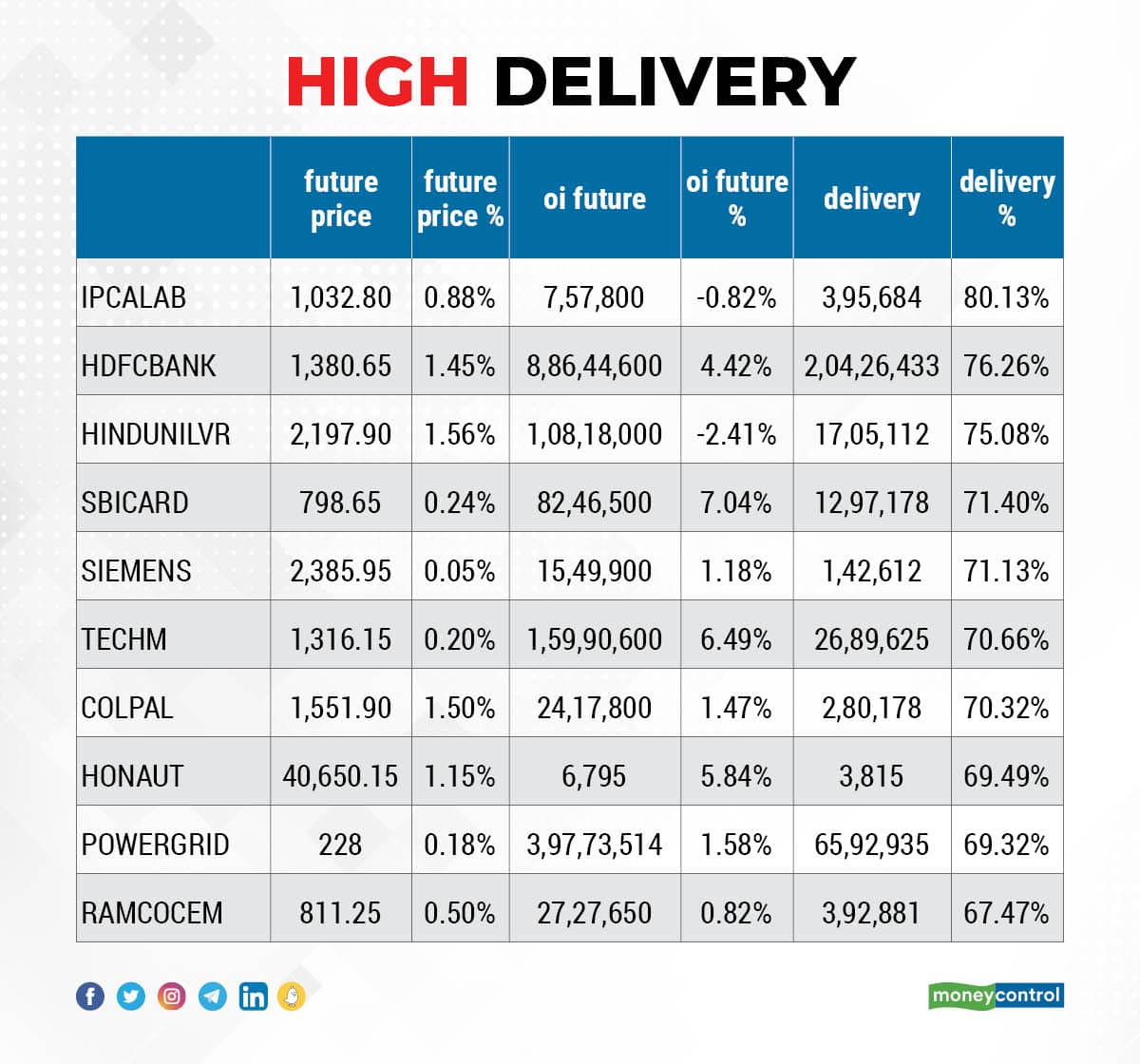

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Ipca Laboratories, HDFC Bank, Hindustan Unilever, SBI Card, and Siemens, among others.

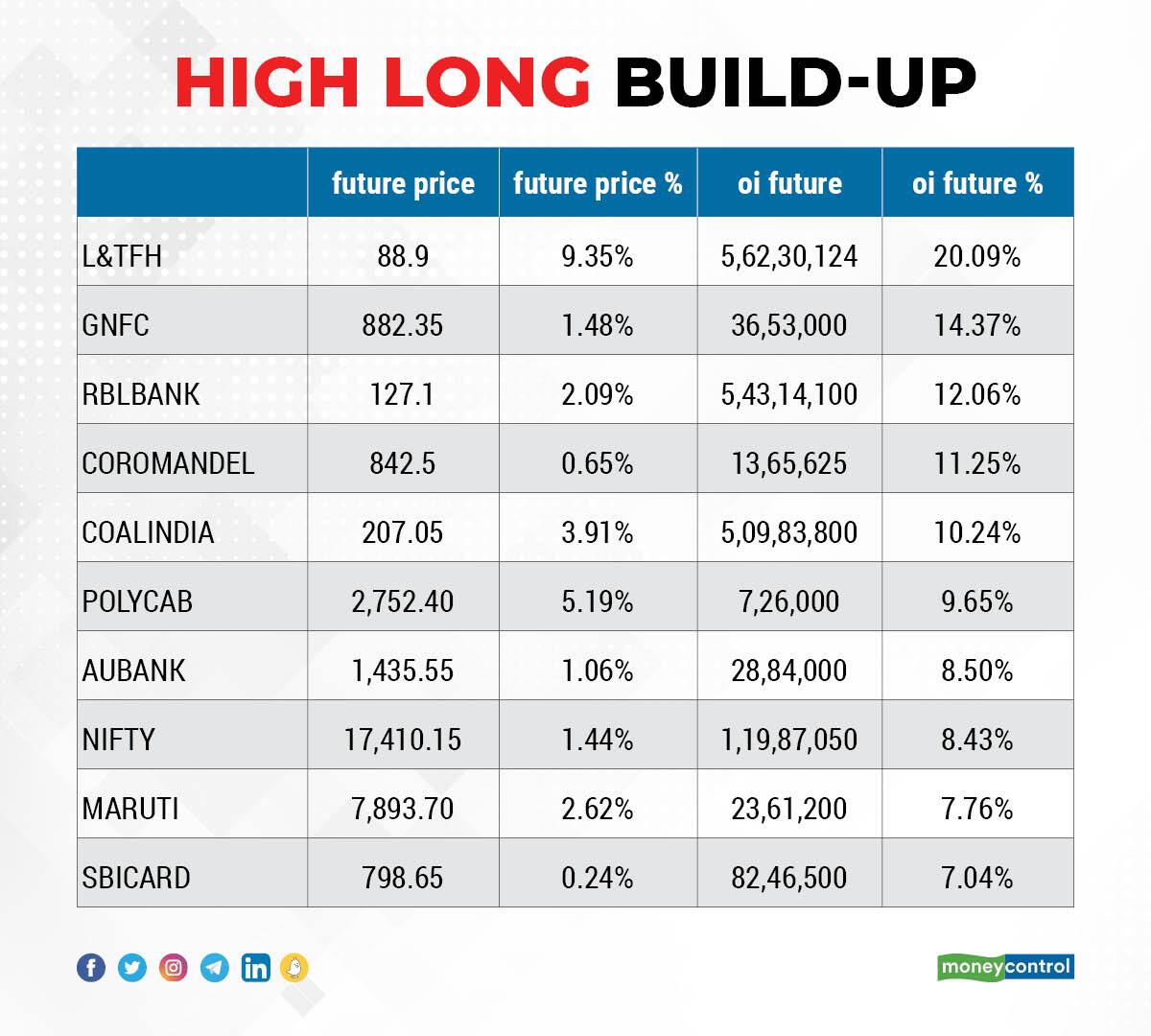

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including L&T Finance Holdings, GNFC, RBL Bank, Coromandel International, and Coal India, in which a long build-up was seen.

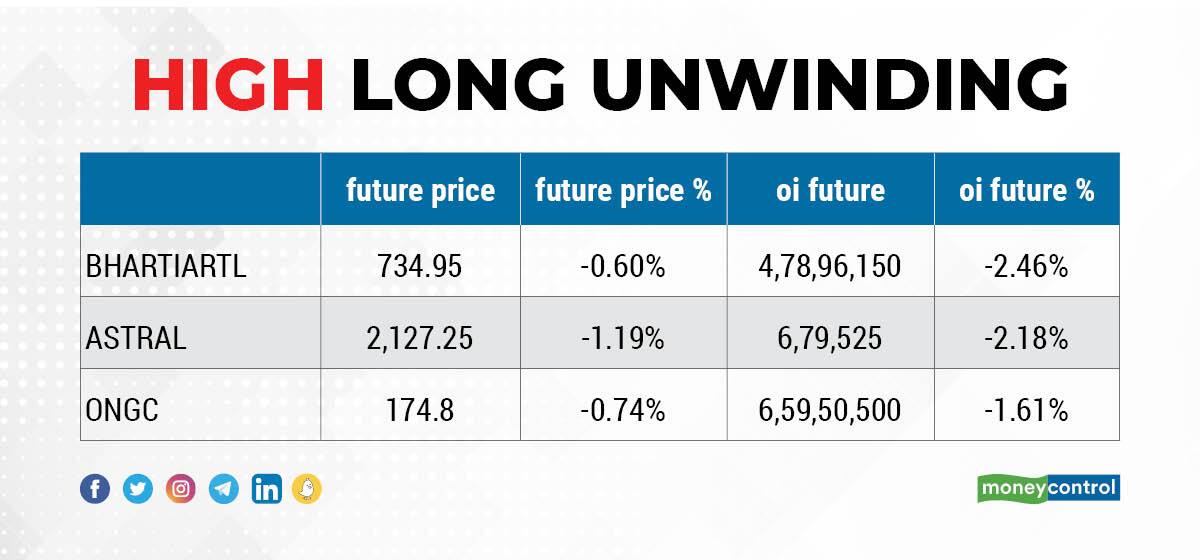

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the 3 stocks - Bharti Airtel, Astral, and ONGC - in which long unwinding was seen.

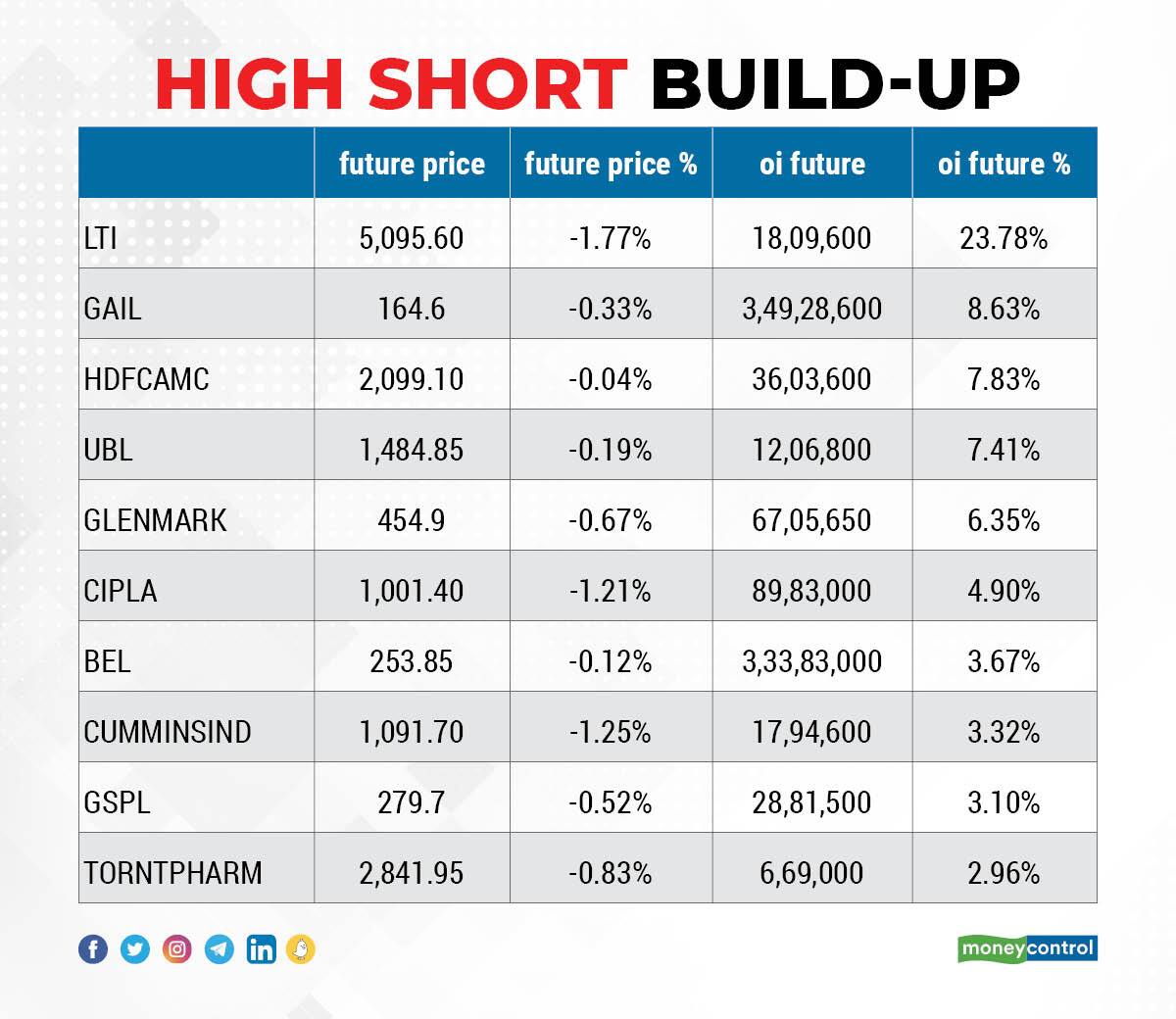

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including L&T Infotech, GAIL India, HDFC AMC, United Breweries, and Glenmark Pharma, in which a short build-up was seen.

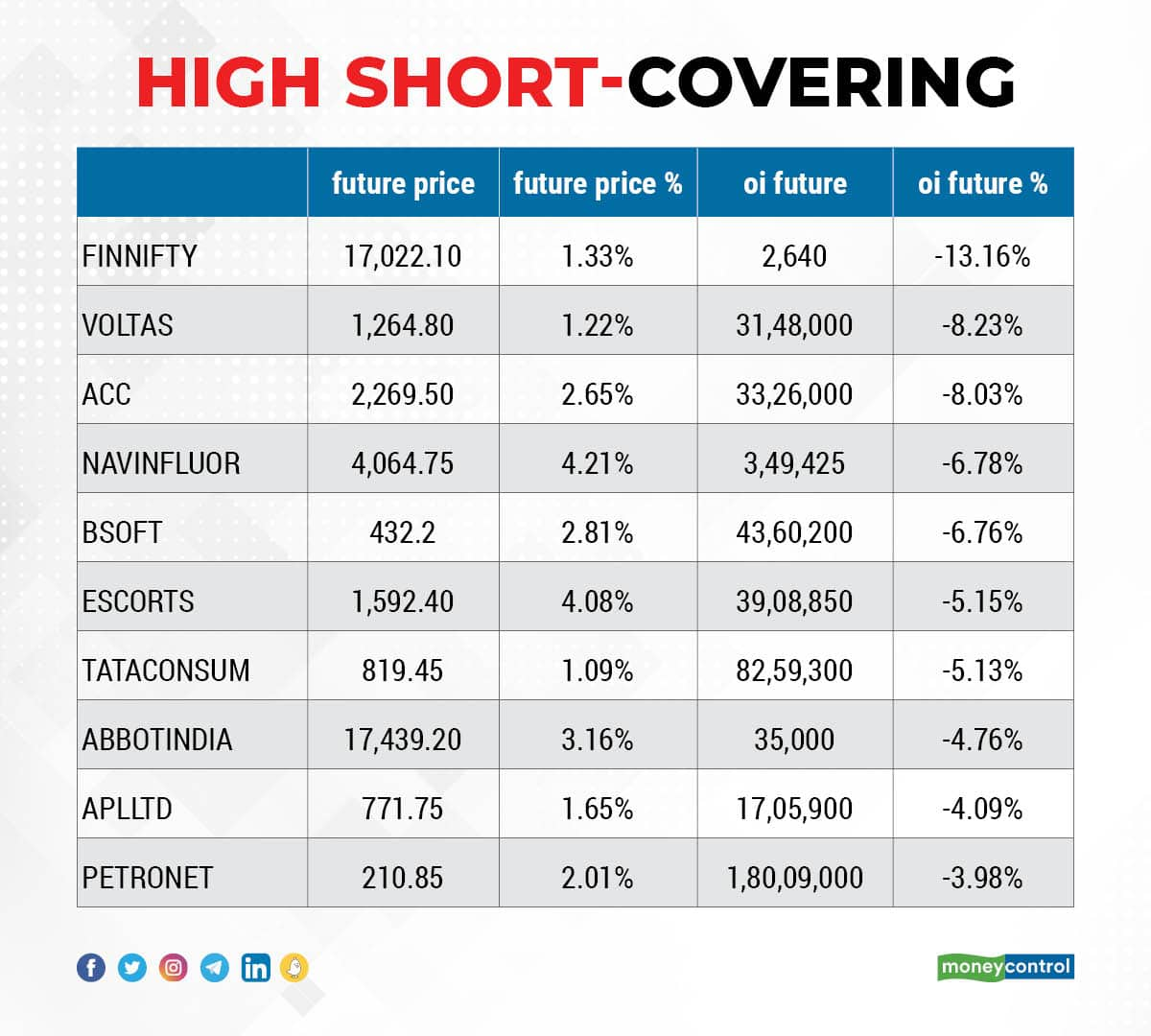

60 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Nifty Financial, Voltas, ACC, Navin Fluorine International, and Birlasoft, in which short-covering was seen.

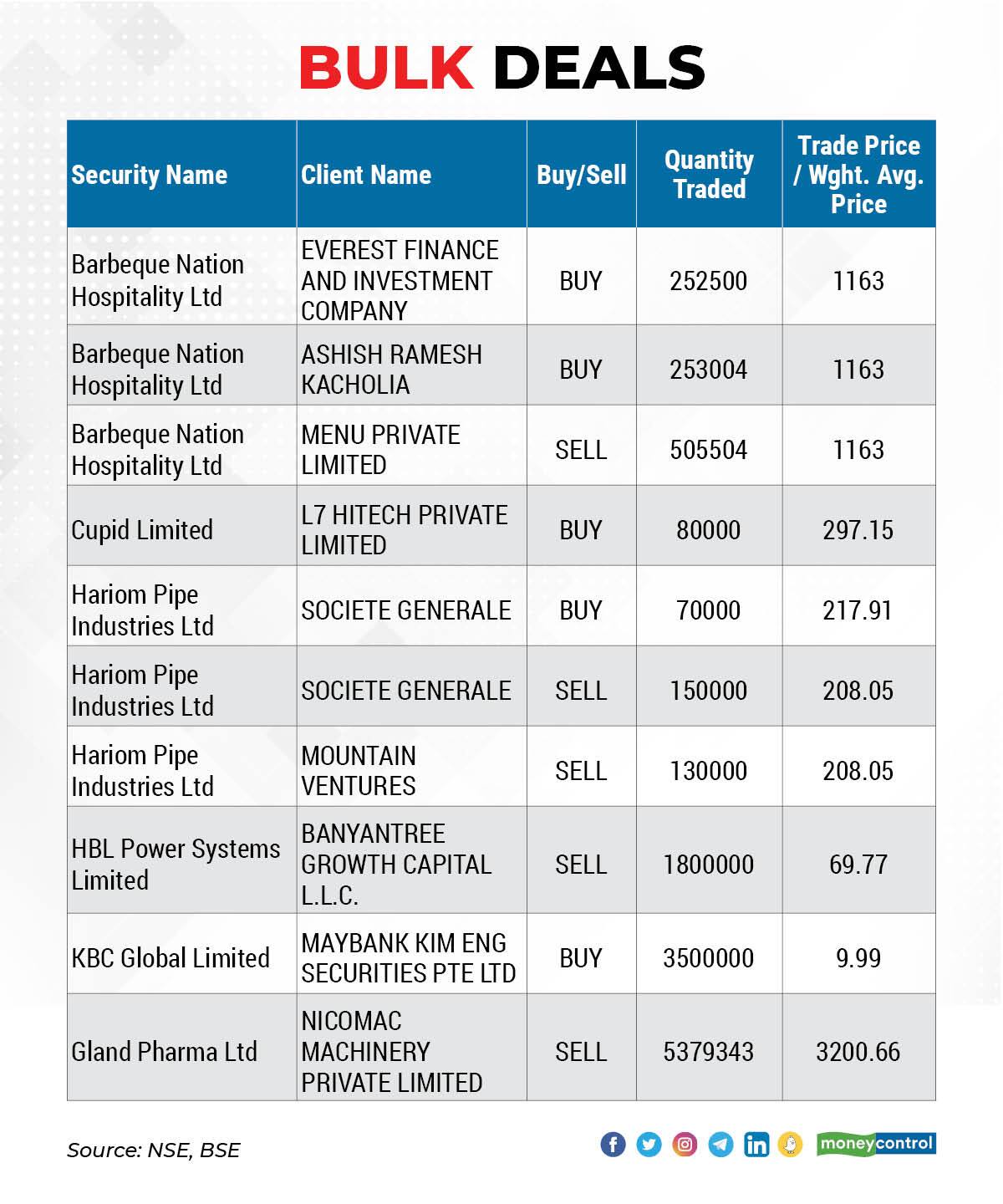

Barbeque Nation Hospitality: Everest Finance and Investment Company acquired 2,52,500 equity shares in the company at an average price of Rs 1,163 per share, and Ashish Ramesh Kacholia bought 2,53,004 shares at same price via open market transactions. However, Menu Private Limited exited the company by selling 5,05,504 equity shares at same price.

HBL Power Systems: Banyantree Growth Capital LLC sold 18 lakh equity shares in the company via open market transactions, at an average price of Rs 69.77 per share.

KBC Global: Maybank KIM ENG Securities Pte Ltd bought 35 lakh equity shares in the company via open market transactions at an average price of Rs 9.99 per share.

Gland Pharma: Investor Nicomac Machinery Private Limited sold 53,79,343 equity shares in the pharma company at an average price of Rs 3,200.66 per share.

(For more bulk deals, click here)

Results on April 22 and April 23

Aditya Birla Money, Hindustan Zinc, Sundram Fasteners, Tata Metaliks, Tejas Networks, MMTC, Wendt (India), Bhakti Gems and Jewellery, Eiko Lifesciences, Jhandewalas Foods, Khaitan Chemicals & Fertilizers, Quest Capital Markets, RS Software India, and Sharad Fibres & Yarn Processors will release quarterly earnings on April 22.

ICICI Bank, Bhansali Engineering Polymers, and Indag Rubber will release quarterly earnings on April 23.

Stocks In News

Tata Communications: Profit in Q4FY22 grew by 23.2 percent YoY to Rs 369 crore on higher other income. Revenue grew by 4.6 percent to Rs 4,263 crore in same period driven by data services segment, which contributed the maximum to revenue. The board has recommended a dividend of Rs 20.7 per share for the year, as a result of the company reporting strong profitability.

HCL Technologies: The IT services company recorded a 4.4 percent sequential growth in profit at Rs 3,593 crore and 1.2 percent QoQ growth in revenue at Rs 22,597 crore, but earnings before interest & tax fell 4.4 percent QoQ to Rs 4,069 crore. The dollar revenue growth was half a percent QoQ at $2,993 million and revenue in constant currency showed 1.1 percent increase QoQ. The company reported total contract value (TCV) of new deal wins at $2,260 million for Q4, registering 6 percent QoQ growth, and has declared a dividend of Rs 18 per share.

ICICI Lombard General Insurance Company: The company reported 9.6 percent year-on-year decline in profit at Rs 312.5 crore, but net premium earned during the quarter jumped 27 percent to Rs 3,318 crore and total income grew by 33 percent to Rs 4,636 crore compared to year-ago period. Even operating profit surged 29 percent YoY to Rs 1,009.6 crore during the quarter.

TVS Motor Company: The company announced an additional investment of 100 million pound in Norton Motorcycle, Britain's most iconic sporting motorcycle brand. Norton Motorcycle was acquired in April 2020.

RailTel Corporation of India: The company has received work order from National Informatics Centre Services. National Informatics Centre Services was incorporated in relation to assignment of work of immigration visa and foreigner registration & tracking. The work order was worth Rs 29.75 crore.

JSW Energy: Subsidiary JSW Neo Energy (JSWNEL) is going to set up 1,500 MW capacity of hydro pumped storage project (PSPs) - Komoram Bheem Pumped Storage Project, in Telangana. The company has entered into a Memorandum of Understanding with the state government, for the said project. With the said project, the company has tied-up resources for 5 GW hydro PSPs with the governments of various states (Maharashtra, Chhattisgarh, Telangana, and Rajasthan).

L&T Technology Services: The IT company clocked 5.3 percent sequential growth in profit at Rs 262 crore on better EBIT that grew by 4.1 percent with flat margin at 18.6 percent QoQ, while revenue increased 4.1 percent to Rs 1,756.1 crore compared to previous quarter. North America, Europe and India supported revenue growth, but Rest of World segment reported 1.6 percent sequential decline in Q4. It has bagged $100 million+ electric air mobility program from Jaunt Air Mobility. It will open an engineering and R&D centre in Québec Province for the next-gen electric aircraft manufacturer to provide engineering services for the Jaunt Journey eVTOL (electric Vertical Takeoff and Landing) air taxi.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 713.69 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 2,823.43 crore on April 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Not a single stock is under the F&O ban for April 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!