The market witnessed consolidation throughout the session and finally settled with moderate losses on March 24, but the broader markets outperformed frontline indices as the Nifty Midcap index gained 0.6 percent and Smallcap rose 0.4 percent.

Banking & financials and auto stocks dragged the market. The BSE Sensex was down 89 points at 57,596, while the Nifty50 fell 23 points to 17,223 but formed a bullish candle on the daily charts as the closing was higher than opening levels.

"A long positive candle was formed at the lows on the daily chart with minor upper shadow. Technically, this pattern indicates broader range movement for Nifty around 17,400-17,100 levels. Having placed at the lows, there is a possibility of an upside bounce in the coming sessions," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further says the broader uptrend status remains intact for Nifty. "We observe positive sequence like higher tops and bottoms on the daily chart. Any decline from here could find strong support at 17,000-16,900 levels and there is a possibility of market advancing towards the upper trajectory of 17,400-17,500 levels in the near term."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 17,112, followed by 17,001. If the index moves up, the key resistance levels to watch out for are 17,313 and 17,402.

Banking stocks caused the selling pressure in the benchmark indices as Bank Nifty fell 620 points or 1.7 percent to 35,527 on March 24. The important pivot level, which will act as crucial support for the index, is placed at 35,313, followed by 35,099. On the upside, key resistance levels are placed at 35,849 and 36,171 levels.

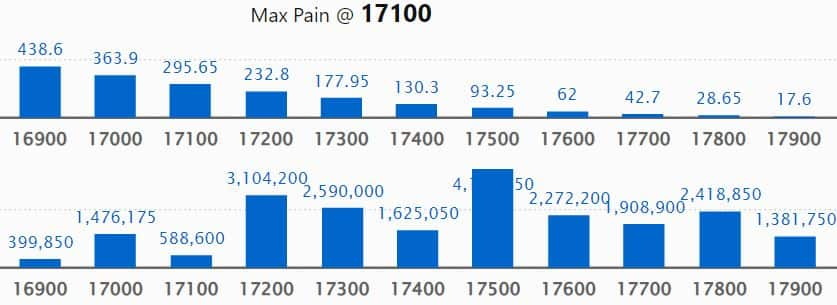

Maximum Call open interest of 56.28 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 17,500 strike, which holds 41.99 lakh contracts, and 17,200 strike, which has accumulated 31.04 lakh contracts.

Call writing was seen at 18,300 strike, which added 29.53 lakh contracts, followed by 17,200 strike which added 20.11 lakh contracts, and 17,500 strike which added 19.98 lakh contracts.

Call unwinding was seen at 16,300 strike, which shed 16,300 contracts, followed by 17,000 strike which shed 15,000 contracts and 16,400 strike which shed 6,600 contracts.

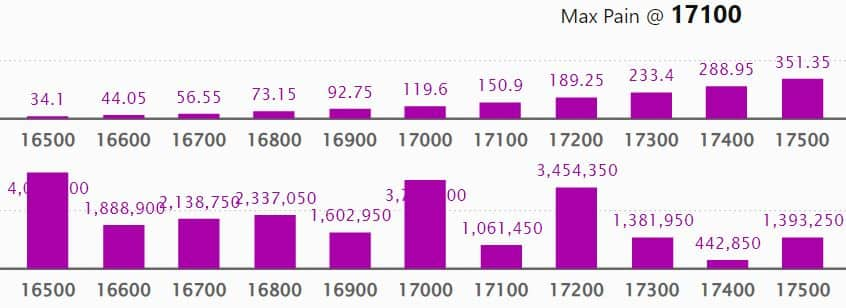

Maximum Put open interest of 54.98 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the March series.

This is followed by 16,500 strike, which holds 40.94 lakh contracts, and 17,000 strike, which has accumulated 37.83 lakh contracts.

Put writing was seen at 17,200 strike, which added 15.41 lakh contracts, followed by 16,800 strike, which added 8.41 lakh contracts, and 16,700 strike which added 5.71 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 92,950 contracts, followed by 17,400 strike which shed 39,650 contracts, and 18,000 strike which shed 16,250 contracts.

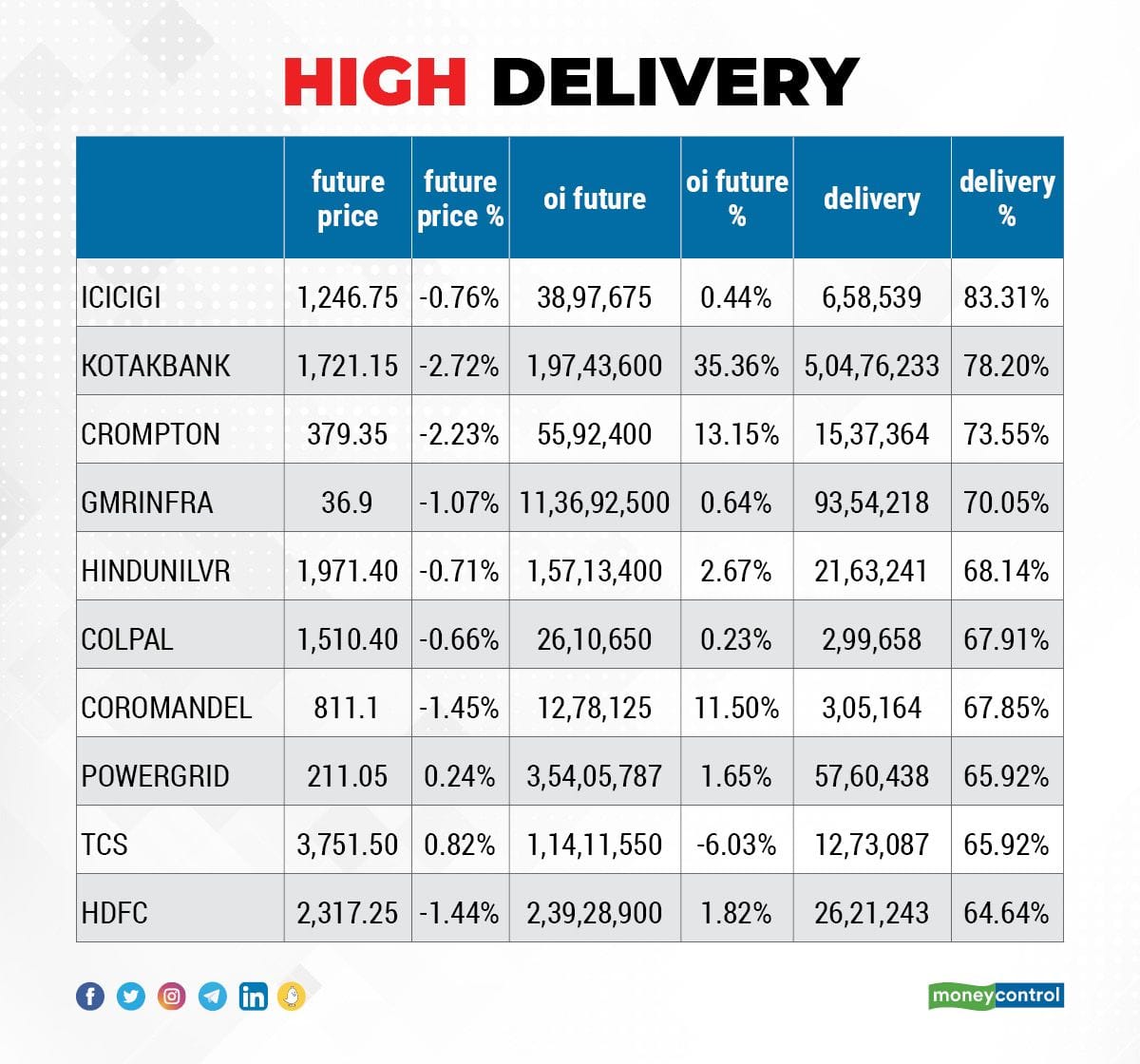

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in ICICI Lombard General Insurance, Kotak Mahindra Bank, Crompton Greaves Consumer Electricals, GMR Infrastructure, and Hindustan Unilever, among others on Thursday.

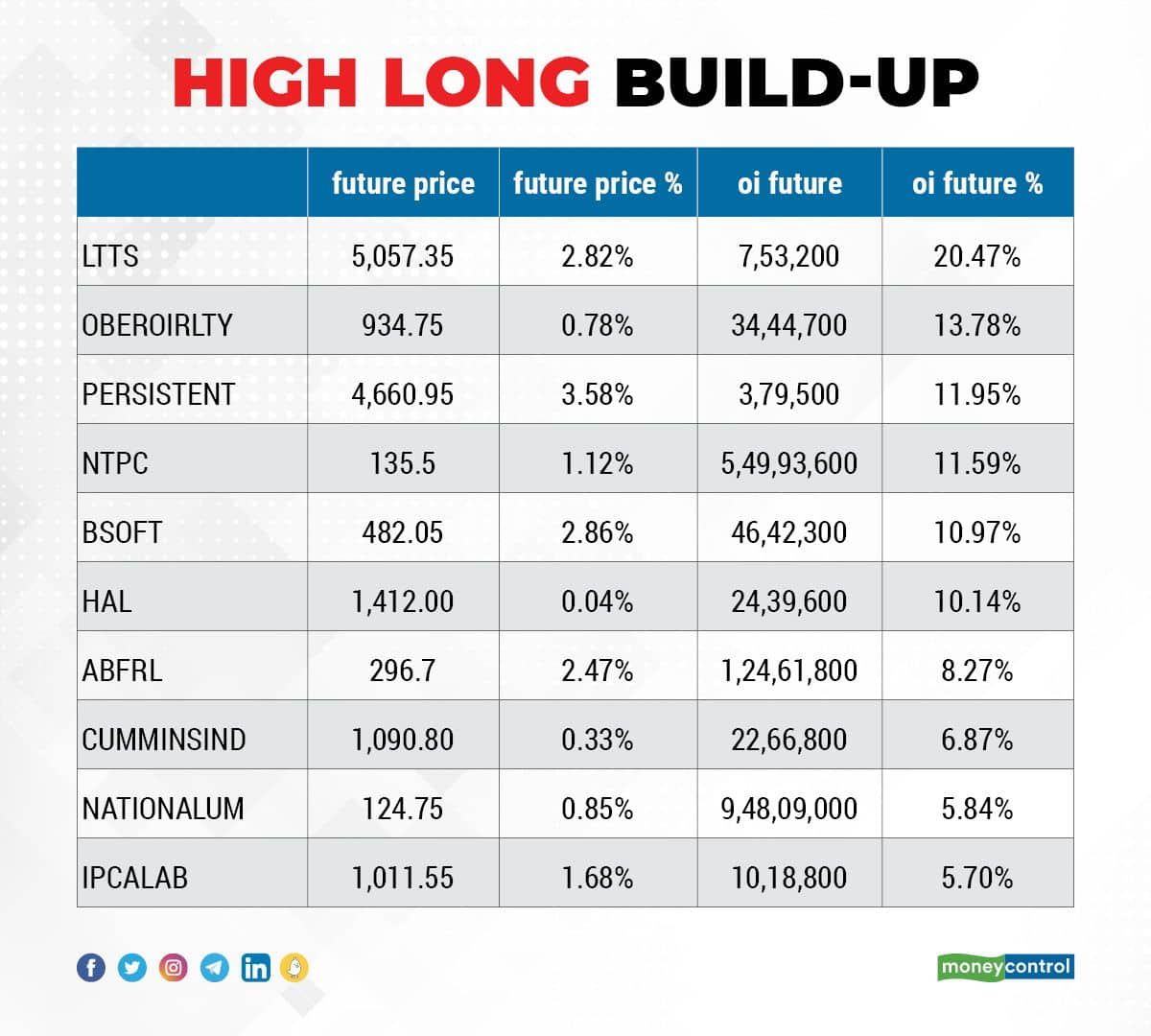

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen including L&T Technology Services, Oberoi Realty, Persistant Systems, NTPC, and Birlasoft.

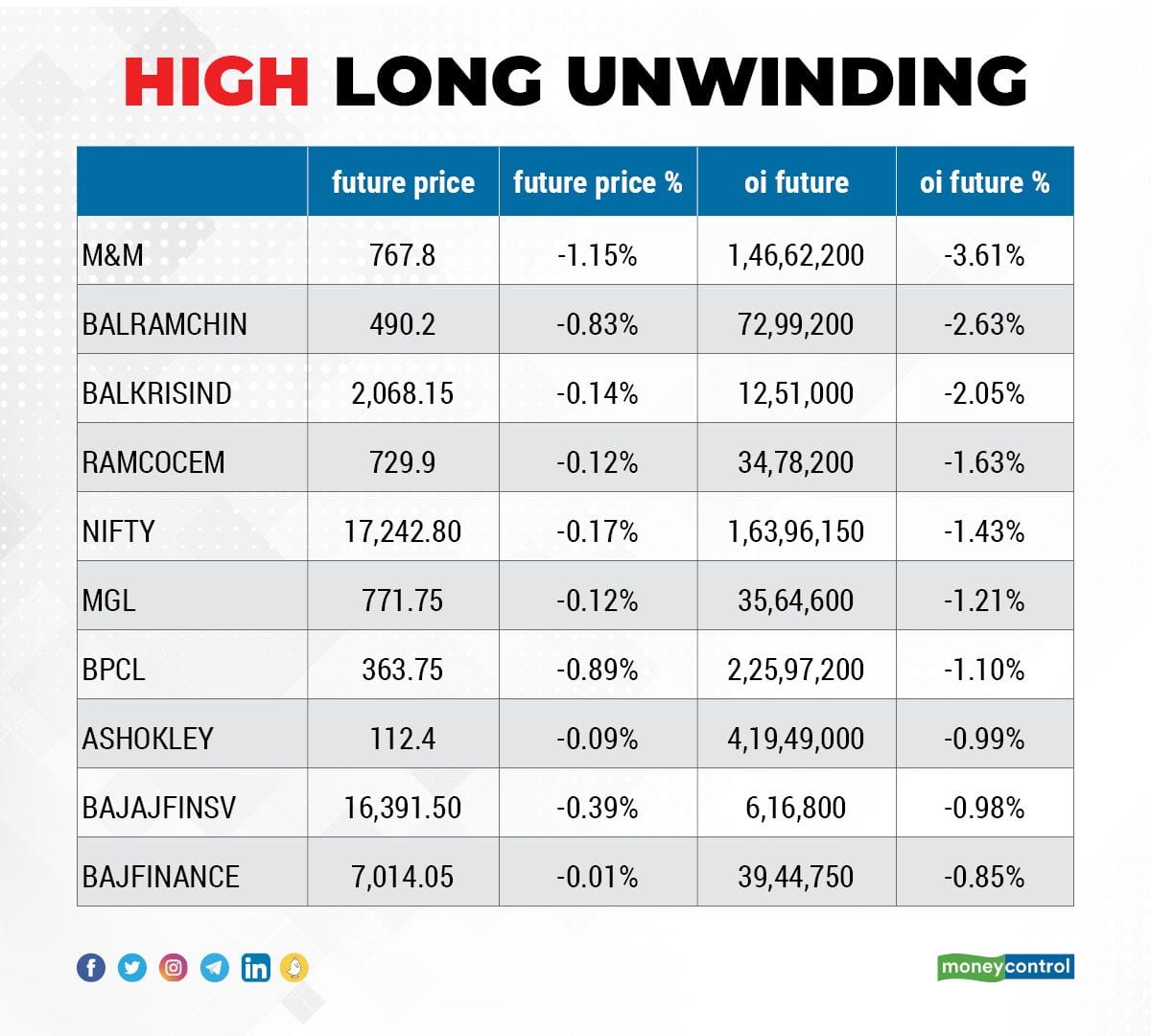

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen including M&M, Balrampur Chini Mills, Balkrishna Industries, Ramco Cements, and Nifty.

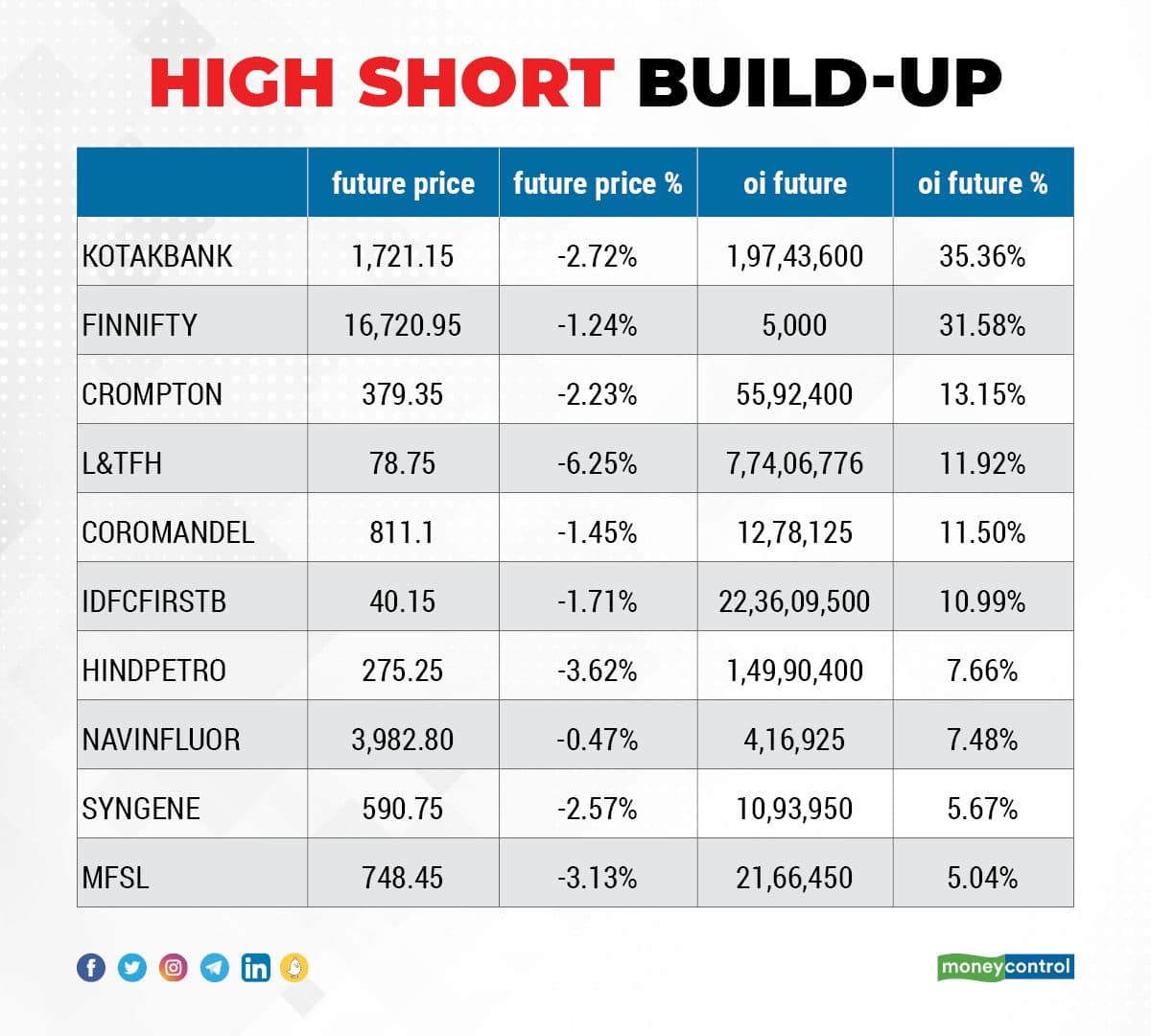

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen including Kotak Mahindra Bank, Nifty Financial, Crompton Greaves Consumer Electricals, L&T Finance Holdings, and Coromandel International.

51 stocks witnessed short-covering

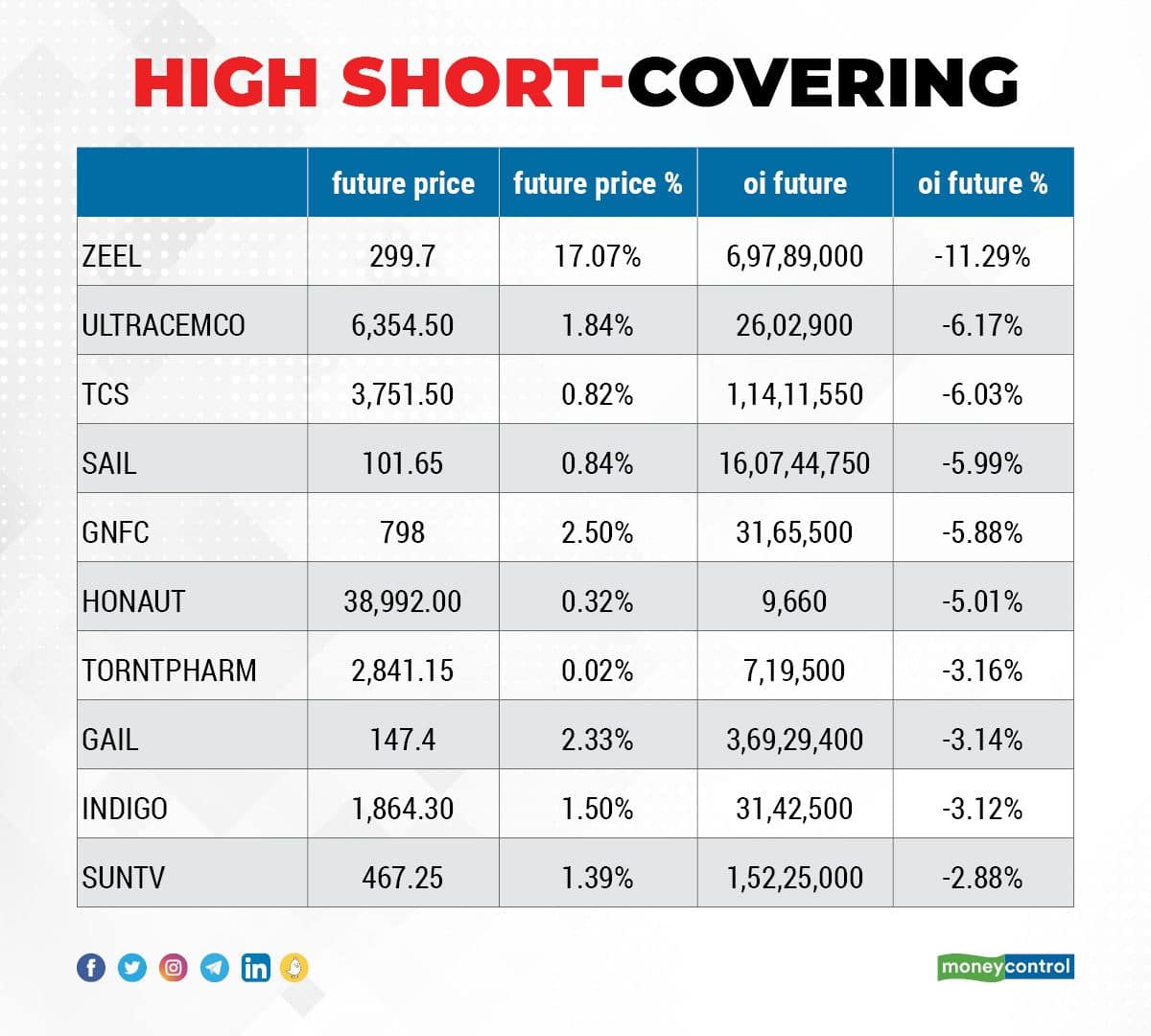

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen including Zee Entertainment Enterprises, UltraTech Cement, TCS, SAIL, and GNFC.

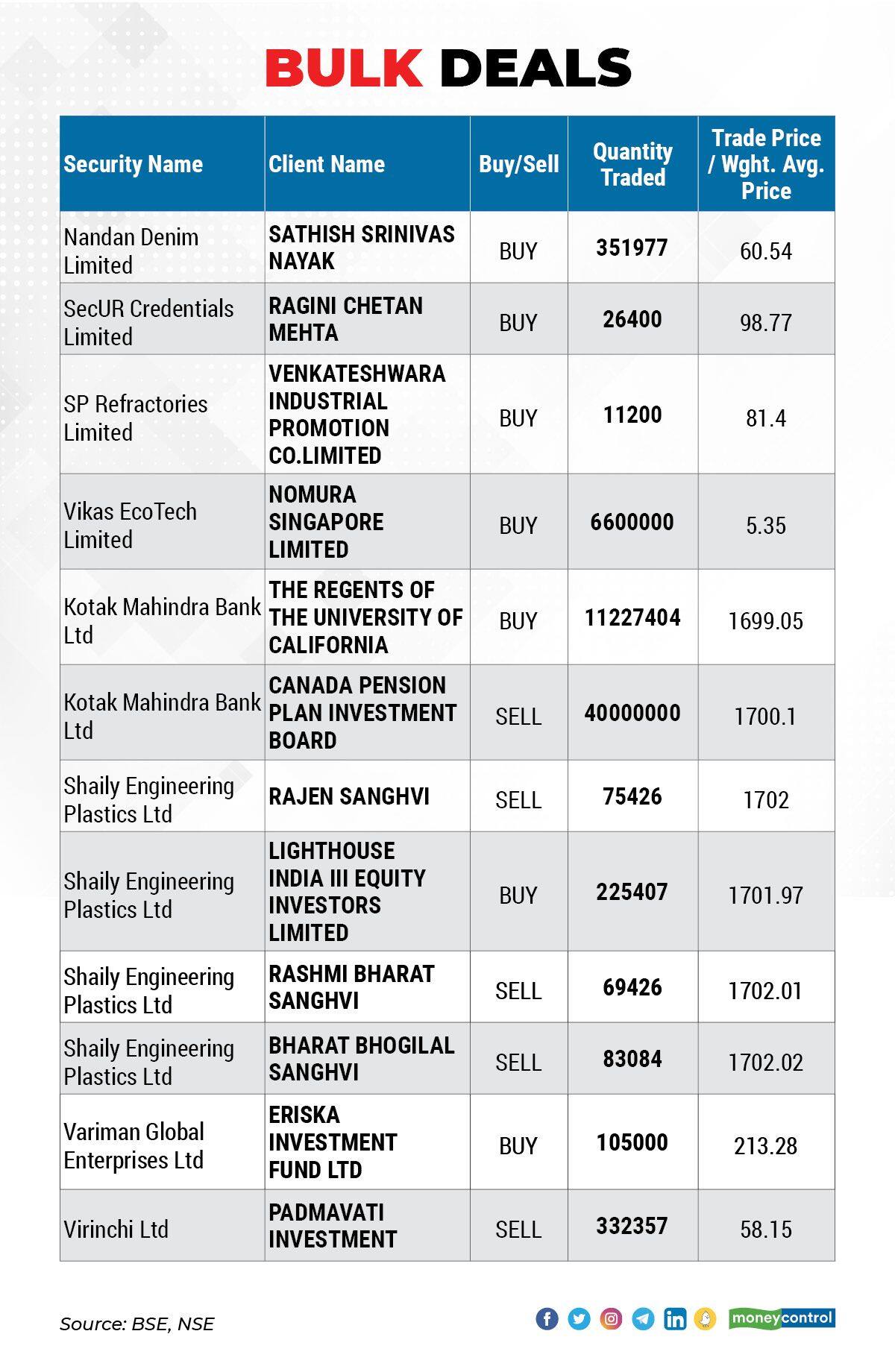

Kotak Mahindra Bank: The Regents of the University of California bought 1,12,27,404 equity shares in the private sector lender via open market transactions at an average price of Rs 1,699.05 per share, however, Canada Pension Plan Investment Board sold 4 crore shares in the bank at an average price of Rs 1,700.10 per share.

Vikas EcoTech: Nomura Singapore acquired 66 lakh equity shares in the company via open market transactions at an average price of Rs 5.35 per share.

(For more bulk deals, click here)

Analysts/Investors Meetings on March 25

Prism Johnson: The company's officials will attend Motilal Oswal Ideation Conference - 2022.

Hindustan Foods: The company's officials will attend Motilal Oswal Ideation Conference - 2022.

TCNS Clothing: The company's officials will attend Motilal Oswal Ideation Conference - 2022.

Sobha: The company's officials will meet Kotak Securities.

Granules India: The company's officials will meet Alchemy Capital, Helios Capital, Bharti Axa Life Insurance, Indvest Group, Centrum Wealth Management, Lucky Investment Managers, Dalal & Broacha, INT Asset Management, East Bridge Capital, and OHM Group.

Gland Pharma: The company's officials will meet Van Eck Associates, Neuberger Berman, Lord Abbett, Fred Alger Management, and Graticule Asset Management Asia.

GHCL: The company's officials will meet Lucky Securities, and Mahindra Manulife.

Stocks in News

Kalpataru Power Transmission: SBI Funds Management acquired 14.5 lakh equity shares in the EPC company via open market transactions on March 23. With this, its shareholding in the company stands at 7.25 percent, up from 6.27 percent earlier.

Shaily Engineering Plastics: Lighthouse India III Equity Investors Ltd & PACs bought 2.48 percent in the company via open market transactions on March 24. With this, their shareholding in the company stands at 9.1 percent, up from 6.62 percent earlier.

Kohinoor Foods: The board has approved the sale of factory unit of company at Sonepath (Haryana), by way of slump sale, and appointment of Chashu Arora, Chartered Accountant, as CFO of the company.

Exide Industries: Subsidiary Chloride Metals has started commercial production at its newly set-up green field manufacturing facility of battery recycling at Haldia, West Bengal. The said recycling plant is equipped with modern state-of-the-art technology with the help of global engineering firm, Engitec Technologies S.P.A. Italy. The total installed capacity of the plant is 108,000 MT per annum.

Zen Technologies: The company has received a project sanction order (PSO) from Indian Army, for design and development of prototype of Integrated Air Defence Combat Simulator (IADCS). The prototype is to be made ready for User Trial Readiness Review (UTRR) within a period of 30 weeks.

Anjani Foods: The company has executed a joint venture agreement with joint venture company Senta Foodwork wherein Anjani Foods holds 51 percent stake and the rest of shareholding is held by Quennelle 36 Foodworks. They formed joint venture to engage in the business of bakery products.

Fund Flow

Foreign institutional investors (FIIs) have net sold shares worth Rs 1,740.71 crore, while domestic institutional investors (DIIs) have net bought shares worth Rs 2,091.07 crore on March 24, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Seven stocks - Balrampur Chini Mills, Delta Corp, Indiabulls Housing Finance, Vodafone Idea, L&T Finance Holdings, SAIL, and Sun TV Network - are under the F&O ban for March 25. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!