After opening flat, the market remained in a consolidation mode throughout the session and finally settled with moderate losses on the expiry day of December derivative contracts, December 30. The broader markets closed mixed with the Nifty Midcap 100 falling 0.37 percent and Smallcap 100 index gaining 0.24 percent.

The BSE Sensex was down 12.17 points at 57,794.32, while the Nifty50 declined 9.60 points to 17,204 and formed Doji kind of pattern on the daily charts.

"Nifty50 opened on a flattish note and consolidated throughout the session in a narrow range. It managed to sustain above the 20-day simple moving average SMA (17,154), with a Doji candle formation," says Karan Pai, Technical Analyst at GEPL Capital.

He further says the candle pattern suggests that the index is still in an indecisive phase. "The price action suggests shrinking volatility and also points towards the possibility of the prices moving in a tight range of 17,000-17,300."

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,145.43, followed by 17,086.97. If the index moves up, the key resistance levels to watch out for are 17,263.23 and 17,322.56.

Nifty Bank

The Nifty Bank gained 18.20 points to close at 35,063.60 on December 30. The important pivot level, which will act as crucial support for the index, is placed at 34,816.83, followed by 34,570.06. On the upside, key resistance levels are placed at 35,244.73 and 35,425.87 levels.

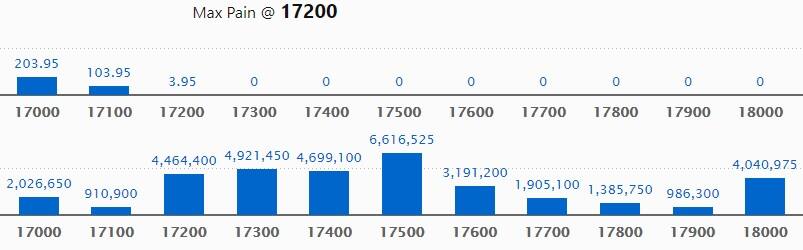

Call option data

Maximum Call open interest of 66.16 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the January series.

This is followed by 17,300 strike, which holds 49.21 lakh contracts, and 17,400 strike, which has accumulated 46.99 lakh contracts.

There was hardly any Call writing seen on expiry day.

Call unwinding was seen at 17,300 strike, which shed 29.83 lakh contracts, followed by 18,000 strike which shed 22.93 lakh contracts and 17,700 strike which shed 22.87 lakh contracts.

Put option data

Maximum Put open interest of 73.31 lakh contracts was seen at 17,200 strike, which will act as a crucial support level in the January series.

This is followed by 17,000 strike, which holds 58.09 lakh contracts, and 16,700 strike, which has accumulated 54.04 lakh contracts.

Put writing was seen at 17,200 strike, which added 12.96 lakh contracts.

Put unwinding was seen at 17,000 strike, which shed 37.72 lakh contracts, followed by 17,100 strike which shed 27.30 lakh contracts and 16,500 strike which shed 18.69 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

Rollovers

1 stock saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here is the one stock in which a long build-up was seen.

![]()

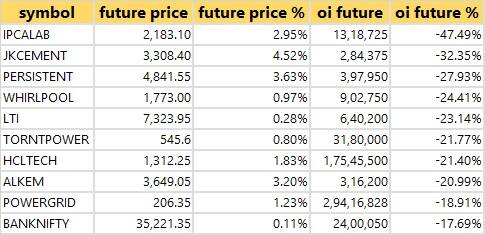

119 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

4 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 4 stocks in which a short build-up was seen.

67 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

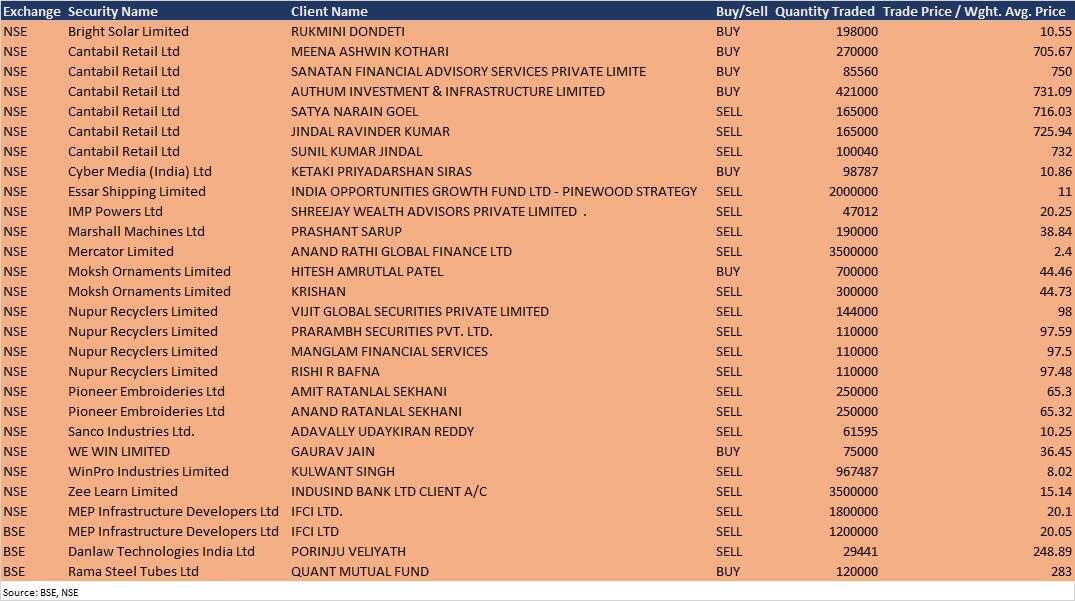

Bulk deals

Essar Shipping: India Opportunities Growth Fund Ltd - Pinewood Strategy sold 20 lakh equity shares in the company at Rs 11 per share on the NSE, the bulk deals data showed.

Pioneer Embroideries: Investors - Amit Ratanlal Sekhani sold 2.5 lakh equity shares in the company at Rs 65.3 per share, and Anand Ratanlal Sekhani sold 2.5 lakh shares at Rs 65.32 per share on the NSE, the bulk deals data showed.

WinPro Industries: Investor sold 9,67,487 equity shares in the company at Rs 8.02 per share on the NSE, the bulk deals data showed.

Zee Learn: IndusInd Bank - Client A/C sold 35 lakh equity shares in the company at Rs 15.14 per share on the NSE, the bulk deals data showed.

MEP Infrastructure Developers: IFCI sold 18 lakh shares in the company at Rs 20.1 per share on the NSE, and 12 lakh shares at Rs 20.05 per share on the BSE, the bulk deals data showed.

Danlaw Technologies India: Investor Porinju Veliyath offloaded 29,441 equity shares in the company at Rs 248.89 per share on the BSE, the bulk deals showed.

Rama Steel Tubes: Quant Mutual Fund acquired 1.2 lakh shares in the company at Rs 283 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

MTAR Technologies: The company's officials will interact with institutional investors on December 31.

Aegis Logistics: The company's officials will interact with investors and analysts on December 31.

Stocks in News

CMS Info Systems: The company will make a debut on the bourses on December 31. The final issue price is fixed at Rs 216 per share.

PB Fintech: The company approved investment of up to Rs 700 crore in one or more tranches in subsidiary Policybazaar Insurance Brokers Private Limited during FY22 and FY23, and up to Rs 299.99 crore in subsidiary Paisabazaar Marketing and Consulting Private Limited.

Power Grid Corporation of India: The company has approved investment proposal for 'expansion of POWERGRID telecom into data centre business and to establish a data centre at Manesar at an estimated cost of around Rs 322 crore.

Sterling and Wilson Renewable Energy: The company has approved the preferential allotment of 2.93 crore equity shares, to RNESL at a price of Rs 375 per share, aggregating to Rs 1,099,99 crore. Post the allotment, RNESL will hold 15.46% stake in the company.

JSW Energy: Life Insurance Corporation of India acquired 2.01% stake in the company via open market transactions, increasing shareholding to 9.01% from 7.00% earlier.

Biocon: Subsidiary Biocon Biologics' partner Viatris won US Court decisions on Sanofi appeals for Lantus device patents.

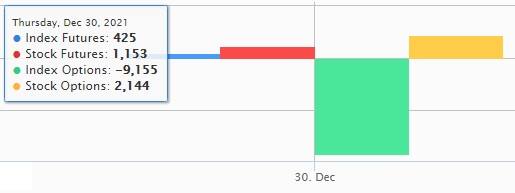

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 986.32 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 577.74 crore in the Indian equity market on December 30, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!