The mood of the market remained upbeat for the third straight session on December 23 as the Nifty50 topped the crucial 17,000-mark , backed by buying in all sectors, barring Metal.

The BSE Sensex jumped 384.72 points to 57,315.28, while the Nifty50 climbed 117.10 points to 17,072.60 and formed Doji kind of pattern on the daily charts as the closing was near its opening levels.

"The Nifty50 finally moved above the 17,000 mark after a lot of attempts. On the daily chart, we can see that the index ended with a Doji candle pattern," said Karan Pai, Technical Analyst at GEPL Capital.

From the broader point of view, Pai believes that the index might consolidate between the 17,600 and 16,400 levels.

Going ahead, he expects the 17,200-mark to act as a strong resistance level. "If the prices breach above the 17,200 mark, we can expect the prices to move higher toward the 17,600 level. The above analysis will not hold true if the prices breach below the 16,950 level," Pai said.

The broader markets continued to outperform benchmark indices. The Nifty Midcap 100 and Smallcap 100 indices have rallied 0.9 percent and 1.27 percent, respectively. The volatility also cooled down as the India VIX, which measures the expected volatility in the market, dropped by 4.5 percent to 15.83.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,019.23, followed by 16,965.87. If the index moves up, the key resistance levels to watch out for are 17,122.33 and 17,172.07.

Nifty Bank

The Nifty Bank gained further, rising 161.65 points to 35,191.15 on December 23. The important pivot level, which will act as crucial support for the index, is placed at 34,999.1, followed by 34,807.1. On the upside, key resistance levels are placed at 35,430.2 and 35,669.3 levels.

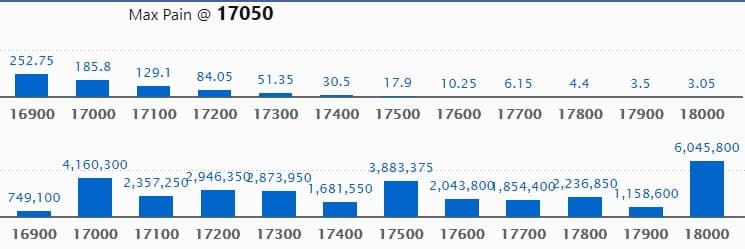

Call option data

Maximum Call open interest of 60.45 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17,000 strike, which holds 41.60 lakh contracts, and 17,500 strike, which has accumulated 38.83 lakh contracts.

Call writing was seen at 18,000 strike, which added 27.78 lakh contracts, followed by 17,000 strike which added 15.72 lakh contracts, and 17,500 strike which added 12.46 lakh contracts.

Call unwinding was seen at 16,900 strike, which shed 3.15 lakh contracts, followed by 16,800 strike which shed 2.79 lakh contracts and 16,700 strike which shed 1.73 lakh contracts.

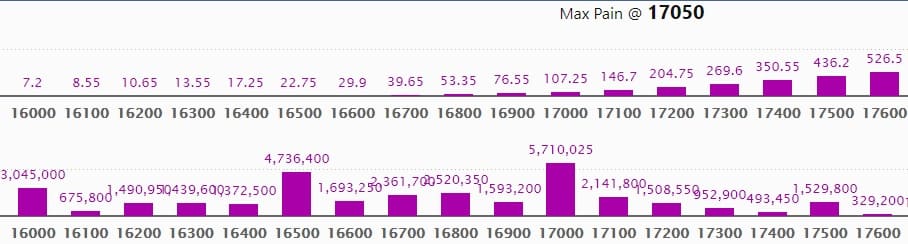

Put option data

Maximum Put open interest of 57.10 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the December series.

This is followed by 16,500 strike, which holds 47.36 lakh contracts, and 16,000 strike, which has accumulated 30.45 lakh contracts.

Put writing was seen at 17,000 strike, which added 24.82 lakh contracts, followed by 17,100 strike which added 10.02 lakh contracts and 16,500 strike which added 7.51 lakh contracts.

Put unwinding was seen at 17,600 strike, which shed 23,200 contracts, followed by 18,000 strike which shed 13,300 contracts and 18,100 strike which shed 500 contracts.

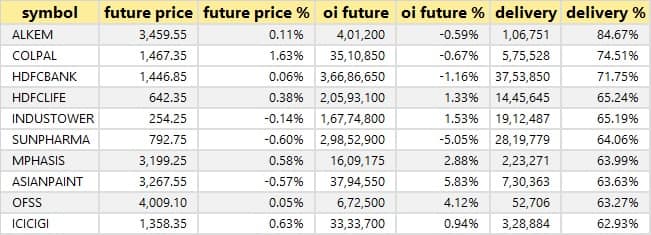

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

76 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

17 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

24 stocks saw short build-up

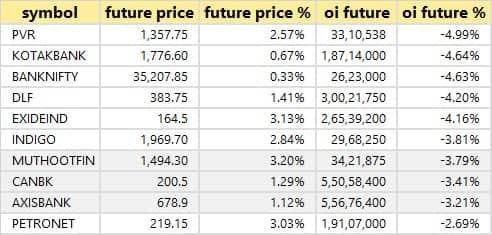

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

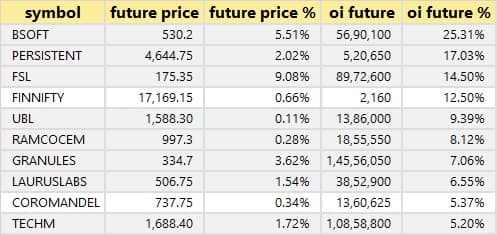

72 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

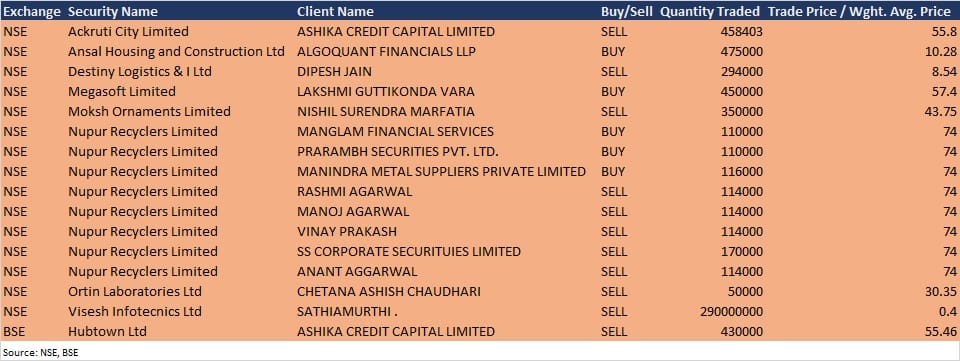

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Fermenta Biotech: The company's officials will interact with the analyst and institutional investors on December 24, to discuss the financial performance of the company.

Indoco Remedies: The company's officials will meet Tata Investments on December 24.

HSIL: The company's officials will meet Taurus Mutual Fund on December 24.

ION Exchange (India): The company's officials will meet institutional investors and analysts on December 27.

Arvind: The company's officials will attend investor meeting on December 27 for discussing the business strategy.

Indian Energy Exchange: The company's officials will meet Nippon India on December 27.

Orient Electric: The company's officials will meet Stockproadvisors, and PhillipCapital (India) on December 29.

Stocks in News

Data Patterns India: The company will make its debut on the bourses on December 24. The issue price is fixed at Rs 585 per share.

PSP Projects: The company has divested its 100% stake in PSP Projects INC, a wholly-owned subsidiary.

Allcargo Logistics: The company has approved to restructure the business by way of a scheme of arrangement and demerger. Container freight station/inland container depots and any other related logistics businesses of the company will be demerged into Allcargo Terminals, and engineering and equipment leasing and hiring solutions, logistics park, warehousing, real estate development and leasing activities and other related businesses of the company will be demerged into Translndia Realty & Logistics Parks.

Mphasis: Subsidiary Mphasis Consulting, UK, and Ardonagh has agreed to set up a shared services entity to service middle and back-office functions. To execute this, Mphasis and Ardonagh, signed a Business Venture Agreement wherein, Mphasis has acquired 51% stake in Mrald, a company incorporated in England and Wales.

TCS: La Mobilière, the oldest private non-life insurer in the Swiss market, selected TCS as strategic partner to accelerate its digital transformation agenda.

Ajanta Pharma: The company on December 28 will consider a proposal for buy-back of equity shares.

GPT Infraprojects: The company has bagged order valued at Rs 56 crore.

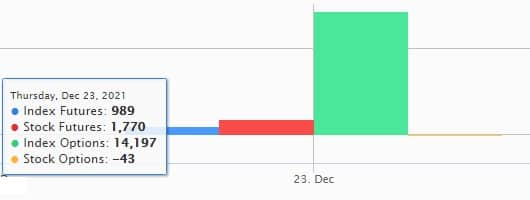

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 271.59 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,196.48 crore in the Indian equity market on December 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Escorts, Indiabulls Housing Finance, Vodafone Idea, and Zee Entertainment Enterprises - are under the F&O ban for December 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!