The market snapped four-day losing streak and closed with moderate gains on December 16, after the outcome of Federal Reserve meeting, driven by IT stocks, Bajaj Finance and Reliance Industries.

The BSE Sensex rose 113 points to 57,901, while the Nifty50 climbed 27 points to 17,248 and formed a bearish candle on the daily charts as the closing was lower than opening levels.

"Nifty started off on a very positive note by opening above the 20-day SMA (17,310). However, this positivity was very short lived, and the bears were quick to gain control over the index and pushed the prices lower. The index finally ended the session in the previous day's range with a strong bearish candle," says Karan Pai, Technical Analyst at GEPL Capital.

Looking at the prices action, Pai believes that the 17,200 mark in the coming sessions is going to be a key level to watch. "If the price manages to breach and sustains below the 17,200 mark, we might see the prices move lower towards the 17,000-16,800 level."

However, the broader markets underperformed benchmark indices, with the Nifty Midcap 100 and Smallcap 100 indices falling 0.69 percent and 0.83 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,162.43, followed by 17,076.47. If the index moves up, the key resistance levels to watch out for are 17,356.83 and 17,465.27.

Nifty Bank

The Nifty Bank extended losses further, down by 240.90 points to 36,548.65 on December 16. The important pivot level, which will act as crucial support for the index, is placed at 36,236.5, followed by 35,924.4. On the upside, key resistance levels are placed at 37,010 and 37,471.4 levels.

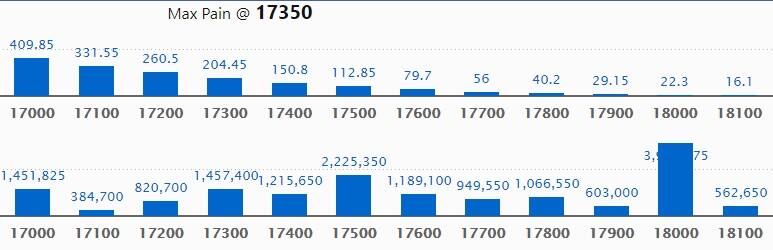

Call option data

Maximum Call open interest of 39.20 lakh contracts was seen at 18,000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17,500 strike, which holds 22.25 lakh contracts, and 17,300 strike, which has accumulated 14.57 lakh contracts.

Call writing was seen at 18,000 strike, which added 1.24 lakh contracts, followed by 17,300 strike which added 10,600 contracts, and 17,200 strike which added 3,850 contracts.

Call unwinding was seen at 17,400 strike, which shed 9.07 lakh contracts, followed by 17,500 strike which shed 1.71 lakh contracts and 17,700 strike which shed 95,300 contracts.

Put option data

Maximum Put open interest of 47.47 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the December series.

This is followed by 16,000 strike, which holds 30.19 lakh contracts, and 16,500 strike, which has accumulated 28.86 lakh contracts.

Put writing was seen at 17,200 strike, which added 2.27 lakh contracts, followed by 16,900 strike which added 38,200 contracts and 16,400 strike which added 28,250 contracts.

Put unwinding was seen at 17,400 strike, which shed 8.97 lakh contracts, followed by 17,300 strike which shed 1.92 lakh contracts and 17,500 strike which shed 1.74 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

27 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

50 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

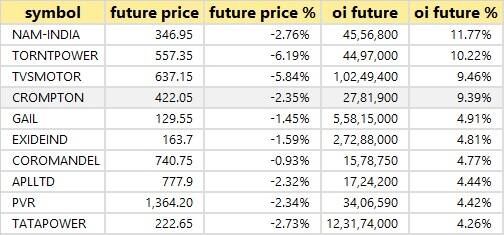

67 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

45 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

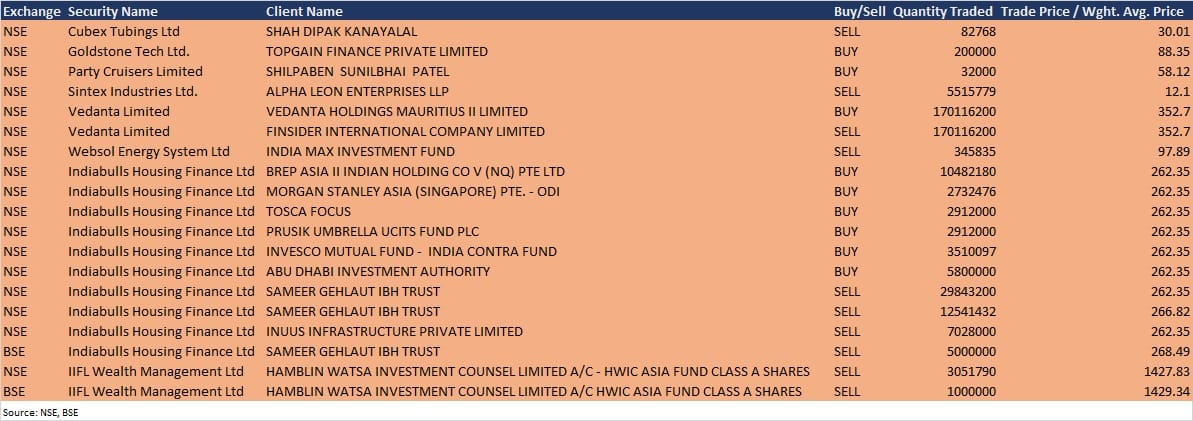

Bulk deals

Websol Energy System: India Max Investment Fund sold 3,45,835 equity shares in the company at Rs 97.89 per share on the NSE, the bulk deals data showed.

Indiabulls Housing Finance: BREP Asia II Indian Holding Co V (NQ) Pte Ltd acquired 1,04,82,180 equity shares in the company at Rs 262.35 per share, Morgan Stanley Asia (Singapore) Pte - ODI bought 27,32,476 equity shares at same price, Tosca Focus purchased 29.12 lakh equity shares at same price, Prusik Umbrella Ucits Fund Plc acquired 29.12 lakh shares at same price, Invesco Mutual Fund - India Contra Fund bought 35,10,097 equity shares at same price, and Abu Dhabi Investment Authority purchased 58 lakh shares in the company at same price on the NSE. However, promoter Sameer Gehlaut IBH Trust sold 2,98,43,200 equity shares in the company at Rs 262.35 per share, 1,25,41,432 equity shares at Rs 266.82 per share, 50 lakh shares at Rs 268.49 per share, and another promoter Inuus Infrastructure offloaded 70.28 lakh equity shares at Rs 262.35 per share.

IIFL Wealth Management: Hamblin Watsa Investment Counsel Limited A/C - HWIC Asia Fund Class A Shares exited the company by selling 30,51,790 equity shares in the company at Rs 1,427.83 per share on the NSE, and 10 lakh shares at Rs 1,429.34 per share on the BSE.

(For more bulk deals, click here)

Analysts/Investors Meeting

Allcargo Logistics: The company's officials will meet Prabhudas Lilladher on December 17.

Mrs. Bectors Foods Specialities: The company's officials will meet institutional investors on December 17.

Craftsman Automation: The company's officials will meet Jefferies India on December 17.

UltraTech Cement: The company's officials will meet Matthews Asia on December 17.

Xpro India: The company's officials will meet analysts and investors on December 17.

Stove Kraft: The company's officials will interact with institutional investors on December 20.

Stocks in News

Engineers India: The company inked Memorandum of Agreement (MoA) with Institute of Chemical Technology (ICT) for joint development of technology for large scale cultivation of algae and extraction of value-added products.

Persistent Systems: ATOSS, a Germany-based software provider for workforce management, has selected Persistent to transform its customer relationship management with the help of salesforce integrations.

Union Bank of India: Life Insurance Corporation of India acquired 2.01% stake in the bank via open market transactions, increasing shareholding to 5.16% from 3.15% earlier.

Redex Protech: The company has entered as partner in CVM Industrial Park LLP to undertake project of construct warehouses near Baroda with approximately project cost of Rs 100-125 crore.

Dhunseri Tea & Industries: The company entered into an Memorandum of Understanding for sale of 'SANTI TEA ESTATE', for Rs 6.01 crore, and entered into an Memorandum of Understanding with Warren Tea, for acquisition of Balijan North Tea Estate at Chabua, Assam.

Motherson Sumi Systems: Fitch Ratings has affirmed Long-Term Issuer Default Rating at ‘BB’ for Samvardhana Motherson Automotive Systems Group B.V, a material subsidiary of Motherson Sumi Systems (SMRP B.V.). The Outlook is Stable.

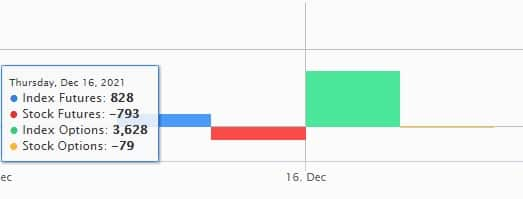

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,468.71 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,533.15 crore in the Indian equity market on December 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks--Escorts and Vodafone Idea--are under the F&O ban for December 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!