The market on December 9 closed higher amid volatility, continuing uptrend for the third consecutive session with the Nifty50 combing back above 17,500 mark, backed by major stocks ITC, L&T, Reliance Industries, Infosys and ICICI Bank.

The BSE Sensex jumped 157.45 points to 58,807.13, while the Nifty50 rose 47 points to 17,516.80 and formed a bearish candle on the daily charts.

"On the daily chart, the index has formed a bearish candle with a lower shadow, indicating buying at lower levels. The index continues to move in a Higher Top and Higher Bottom formation on the hourly chart, indicating a positive bias," says Rajesh Palviya, VP - Technical and Derivative Research at Axis Securities.

Palviya says the chart pattern suggests that if Nifty crosses and sustains above 17,550 levels, it would witness buying, which would lead the index towards 17,700-17,900 levels. However, if the index breaks below the 17,450 level, it would witness selling, which would take the index towards 17,300-17,100, he added.

The Nifty is trading above its 20-day SMA, which indicates a positive bias in the short term. It continues to remain in an uptrend in the medium and long term, so buying on dips continues to be our preferred strategy, he says.

The broader market outperformed frontliners, with the Nifty Midcap 100 and Smallcap 100 indices rising 0.6 percent and 1.24 percent respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,416.53, followed by 17,316.27. If the index moves up, the key resistance levels to watch out for are 17,580.13 and 17,643.46.

Nifty Bank

The Nifty Bank fell 202.30 points to 37,082.40 on December 9. The important pivot level, which will act as crucial support for the index, is placed at 36,845.33, followed by 36,608.26. On the upside, key resistance levels are placed at 37,358.53 and 37,634.67 levels.

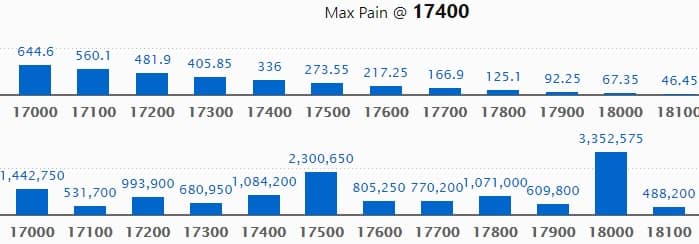

Call option data

Maximum Call open interest of 33.52 lakh contracts was seen at 18000 strike, which will act as a crucial resistance level in the December series.

This is followed by 17500 strike, which holds 23 lakh contracts, and 17000 strike, which has accumulated 14.42 lakh contracts.

Call writing was seen at 17500 strike, which added 2.35 lakh contracts, followed by 17800 strike which added 1.1 lakh contracts, and 18200 strike which added 44,150 contracts.

Call unwinding was seen at 17300 strike, which shed 78,050 contracts, followed by 17400 strike which shed 52,600 contracts and 17200 strike which shed 39,600 contracts.

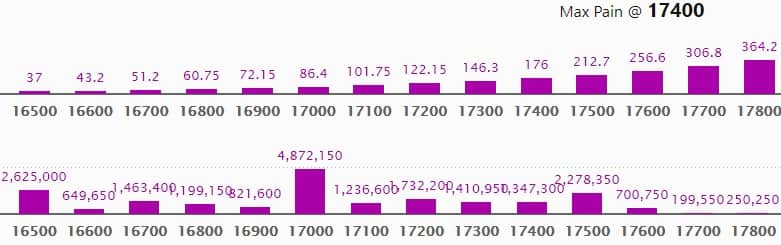

Put option data

Maximum Put open interest of 48.72 lakh contracts was seen at 17000 strike, which will act as a crucial support level in the December series.

This is followed by 16500 strike, which holds 26.25 lakh contracts, and 17500 strike, which has accumulated 22.78 lakh contracts.

Put writing was seen at 17600 strike, which added 2.26 lakh contracts, followed by 16500 strike which added 1.35 lakh contracts and 17400 strike which added 1.31 lakh contracts.

Put unwinding was seen at 16900 strike, which shed 80,600 contracts, followed by 16800 strike which shed 39,650 contracts and 18000 strike which shed 7,350 contracts.

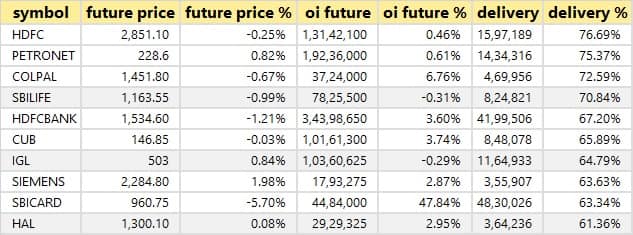

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

65 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

26 stock saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

43 stocks saw short build-up

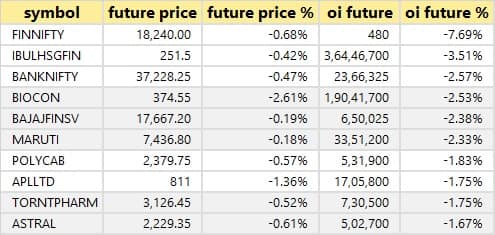

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

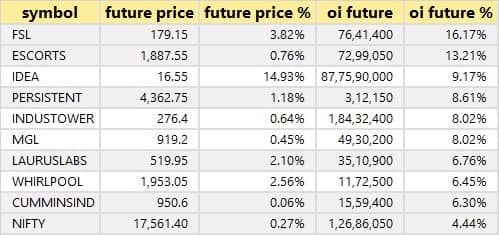

55 stocks witnessed short-covering

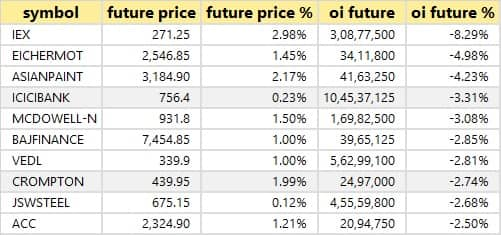

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

Bulk deals

Go Fashion India: SBI Mutual Fund acquired 15 lakh equity shares in the company at Rs 1,172 per share. However, India Advantage Fund S4 I sold 15 lakh shares at the same price on the NSE, the bulk deals data showed.

IIFL Finance: Smallcap World Fund Inc acquired 35,61,730 equity shares in the company at Rs 300 per share. However, Hamblin Watsa Investment Counsel Limited A/C - HWIC Asia Fund Class A Shares offloaded 1,04,20,631 equity shares in the company at Rs 300.17 per share on the NSE, the bulk deals data showed.

Lyka Labs: Algoquant Financials LLP sold 3 lakh equity shares in the company at Rs 173.24 per share on the NSE, the bulk deals data showed.

Kalpataru Power Transmission: ICICI Prudential Mutual Fund bought 44.5 lakh equity shares in the company at Rs 378 per share. However, Kalpataru Properties sold 44.5 lakh shares in the company at Rs 378 per share on the BSE, the bulk deals data showed.

Sequent Scientific: Infinity Holdings sold 1,46,85,986 equity shares in the company at Rs 157.02 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Mindtree: The company's officials will participate in BOB Capital Markets Digital Conference 2021 on December 10.

DCM Shriram: The company's officials will participate in Motilal Oswal 'Specialty Chemicals Day' Conference on December 10.

UltraTech Cement: The company's officials will meet Amundi Asset Management on December 10.

MTAR Technologies: The company's officials will interact with institutional investors on December 10.

CSB Bank: The company's officials will participate in Edelweiss Emerging Ideas Conference 2021 on December 10.

Praj Industries: The company's officials will participate in the conference call organised by Elara Capital on December 10.

Aegis Logistics: The company's officials will interact with analysts and investors on December 10.

CDSL: The company's officials will meet William Blair, USA on December 10, and Manulife Investment Management, Canada on December 13.

Balkrishna Industries: The company's officials will meet investors at JP Morgan Conference on December 13.

Stocks in News

Weizmann: The company approved the proposal to buy back up to 14,12,515 fully paid-up equity shares at a price of Rs 60 per share on a proportionate basis through the tender offer process.

Infosys: Infosys Equinox collaborated with Packable to help amplify its direct to consumer e-commerce offerings for its brand partners.

HFCL: The company closed the qualified institutional placement issue and raised Rs 600 crore by allocating 8,72,72,727 equity shares at issue price of Rs 68.75 per equity share.

Marksans Pharma: UK MHRA has granted market authorisation to the company's wholly owned subsidiary Relonchem for Loperamide 2mg hard capsules. Marksans will manufacture the products at its UK MHRA-approved state-of-the-art oral dosage facility located in Goa, India.

Karur Vysya Bank: The bank has appointed Ramshankar R as chief financial officer.

Bajaj Electricals: The company has authorised some of the directors and officials to review its corporate structure to unlock growth and value creation for all business segments.

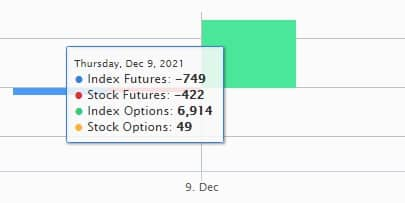

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,585.55 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 782.84 crore in the Indian equity market on December 9, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Escorts and Indiabulls Housing Finance - are under the F&O ban for December 10. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!