The buying in index heavyweight Reliance Industries and technology stocks helped the Nifty50 recover the previous day's losses and close above the 17,500 mark on November 25, the expiry day for November futures and options contracts. The broader markets also joined the rally with the Nifty Midcap 100 and Smallcap 100 indices rising 0.60 and 0.77 percent, respectively.

The BSE Sensex settled at 58,795.09 with 454.10 points gains, while the Nifty50 rose 121.30 points to 17,536.30 and formed a bullish candle on the daily charts.

"A reasonable positive candle was formed on the daily chart, which indicates the comeback of bulls from the lows. Presently, the Nifty is facing resistance around 17,550-17,600 levels and a sustainable upmove above this hurdle could only open further upside towards 17,800 levels in the near term," says Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further says the overall negative trend of the market remains intact and the present upside bounce could be considered as a pullback rally of a downtrend. Further upside from here to 17,800 levels is expected to be a pullback in the market.

"A decisive move only above 17,800 is expected to bring more strength to the upside momentum. On the other side, any weakness from here could find strong support around 17,200-17,300 levels in the short term and one may expect upside from the lows," he adds.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,403.83, followed by 17,271.46. If the index moves up, the key resistance levels to watch out for are 17,616.43 and 17,696.67.

Nifty Bank

The Nifty Bank fell 77.15 points to close at 37,364.75 on November 25. The important pivot level, which will act as crucial support for the index, is placed at 37,152.83, followed by 36,940.86. On the upside, key resistance levels are placed at 37,542.33 and 37,719.86 levels.

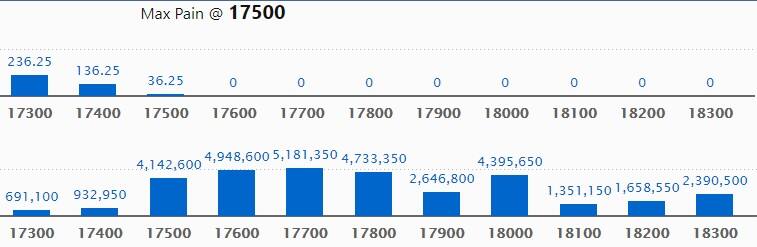

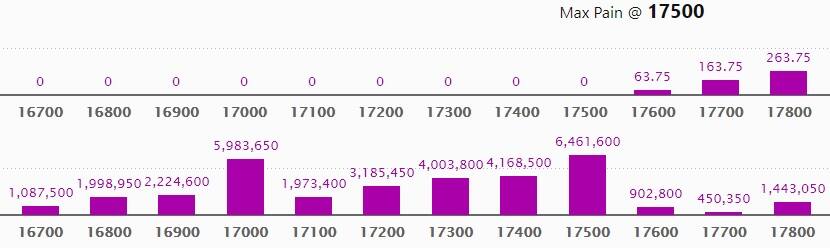

Call option data

Maximum Call open interest of 51.81 lakh contracts was seen at 17700 strike, which will act as a crucial resistance level in the December series.

This is followed by 17600 strike, which holds 49.48 lakh contracts, and 17800 strike, which has accumulated 47.33 lakh contracts.

There was hardly any Call writing on the expiry day.

Call unwinding was seen at 18000 strike, which shed 31.96 lakh contracts, followed by 17900 strike, which shed 31.39 lakh contracts, and 17500 strike which shed 25.75 lakh contracts.

Put option data

Maximum Put open interest of 64.61 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the December series.

This is followed by 17000 strike, which holds 59.83 lakh contracts, and 17400 strike, which has accumulated 41.68 lakh contracts.

Put writing was seen at 17500 strike, which added 32.37 lakh contracts, followed by 17400 strike which added 7.63 lakh contracts and 17000 strike which added 4.29 lakh contracts.

Put unwinding was seen at 17100 strike, which shed 5.98 lakh contracts, followed by 17600 strike which shed 3.97 lakh contracts, and 16800 strike which shed 3.77 lakh contracts.

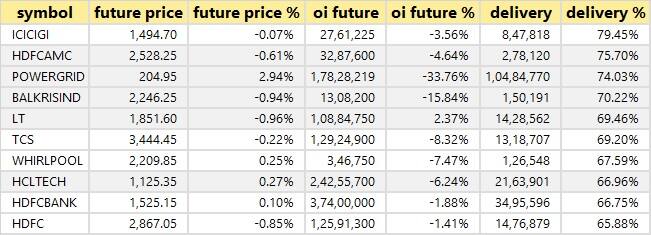

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

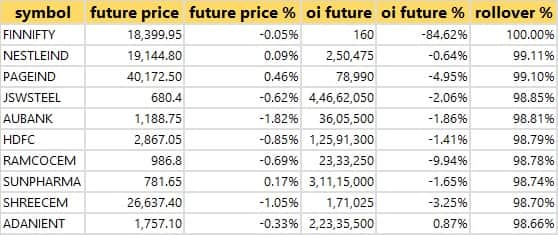

Rollovers

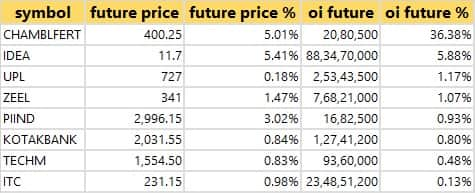

8 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 8 stocks in which a long build-up was seen.

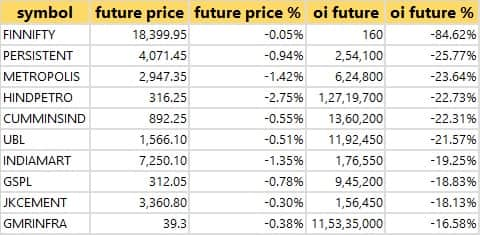

98 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

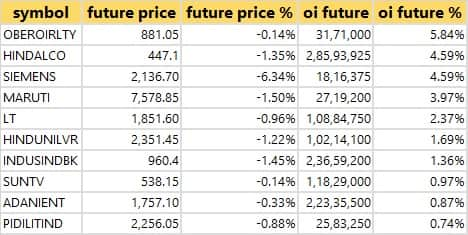

11 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

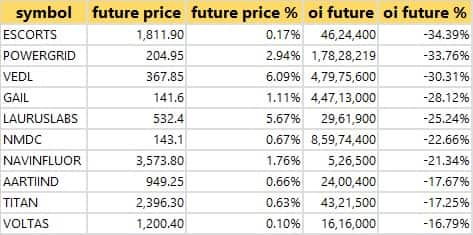

74 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

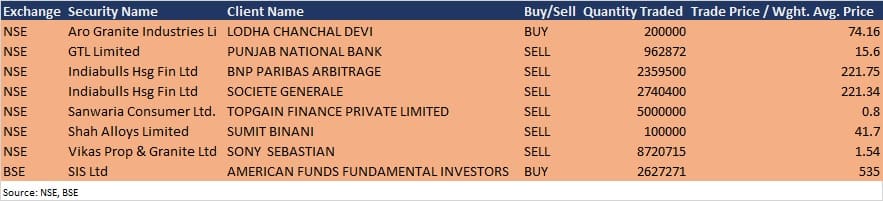

Bulk deals

Aro Granite Industries: Lodha Chanchal Devi acquired 2 lakh equity shares in the company at Rs 74.16 per share on the NSE, the bulk deals data showed.

GTL: Punjab National Bank sold 9,62,872 equity shares in the company at Rs 15.6 per share on the NSE, the bulk deals data showed.

Indiabulls Housing Finance: BNP Paribas Arbitrage sold 23,59,500 equity shares in the company at Rs 221.75 per share and Societe Generale offloaded 27,40,400 equity shares in the company at Rs 221.34 per share on the NSE, the bulk deals data showed.

SIS Ltd: American Funds Fundamental Investors acquired 26,27,271 equity shares in the company at Rs 535 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Gokaldas Exports: The company's officials will meet Dalal Broacha, Dolat Capital, Elara Capital, ICICI Securities, and Phillip Capital on November 26.

S P Apparels: The company's officials will participate in Ambit's Rising Phoenix Textile Industry Conference on November 26.

UPL: The company's officials will meet Enam Holdings, Deep Financials, BOI AXA, Old Bridge, PGIM India Asset, Tata AIA Life, and HDFC Life on November 26.

Mangalam Organics: The company's officials will meet analysts and investors on November 27.

Antony Waste Handling Cell: The company's officials will meet investors and analysts on November 27.

Shiva Texyarn: The company's officials will meet Sarath Capital on November 27.

Max Ventures and Industries: The company's officials will meet investors and analysts on November 29.

Gati: The company's officials will meet Wellington Asset Management & HDFC MF on November 29, and Franklin Templeton on November 30.

Stocks in News

Tarsons Products: The company will make its debut on the bourses on November 26. The issue price has been fixed at Rs 662 per share.

Aurobindo Pharma: Life Insurance Corporation of India bought 79,000 equity shares in the company via an open market transaction on November 24, increasing shareholding to 5.01 percent from 4.99 percent earlier.

Visagar Financial Services: The board has approved sub-division of face value of equity shares from Rs 2 to Re 1, and issue of bonus equity shares of Re 1 each in the ratio of 1 share of Re 1 each for every 2 shares of Re 1 each held by members.

Kirloskar Pneumatic: HDFC Asset Management Company sold 16.58 lakh equity shares in the company via an open market transaction on November 23, reducing shareholding to 3.62 percent from 6.19 percent earlier.

Kirloskar Ferrous Industries: The company has agreed to acquire a majority stake in ISMT by subscribing to equity shares of ISMT through preferential allotment and sole control over the ISMT.

Engineers India: The company and Chempolis OY, Finland have signed a strategic alliance for the conversion of biomass to green fuels.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,300.65 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,367.80 crore in the Indian equity market on November 25, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!