The market recorded biggest single day fall since April 2021, on October 28, the expiry day of October futures & options contracts. The benchmark indices corrected nearly 2 percent on account of selling across sectors, amid weak global cues and after Morgan Stanley downgraded Indian equities to equal-weight from overweight due to expensive valuations.

BSE Sensex closed below 60,000 mark, down 1,158.63 points at 59,984.70, while the Nifty50 has broken 18,000 levels, declining 353.70 points to 17,857.30 and formed large bearish candle on the daily charts.

"A long bear candle was formed (within a high low range of 390 points) on the daily timeframe chart, which signal a decisive downside breakout of the immediate supports. Such a sharp one day weakness was not happened in the last 35-40 sessions and this could indicate a shift in momentum from longs to short," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He feels the recent all-time high of 18,604 of October 19 could now be considered as an important top reversal for the Nifty.

"Thursday's decisive weakness after a range movement could indicate a sharp reversal of near term uptrend of the market and one may expect further weakness in the coming sessions. The next lower levels to be watched at 17,590-17,550 levels by next week," he said.

Any attempt of upside bounce from here could encounter resistance around 18,040 levels, he added.

The broader markets also corrected sharply with the Nifty Midcap 100 and Smallcap 100 indices falling 1.96 percent and 1.85 percent, respectively.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,707.5, followed by 17,557.8. If the index moves up, the key resistance levels to watch out for are 18,098.8 and 18,340.4.

Nifty Bank

The Nifty Bank also fell sharply on October 28, declining 1,365.35 points or 3.34 percent to close at 39,508.95. The important pivot level, which will act as crucial support for the index, is placed at 38,929.03, followed by 38,349.16. On the upside, key resistance levels are placed at 40,509.93 and 41,510.97 levels.

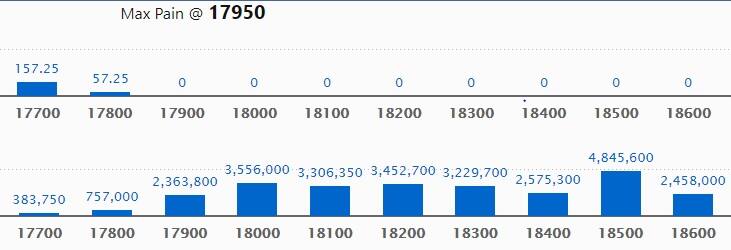

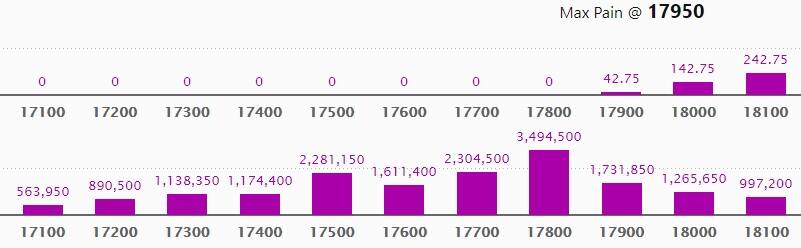

Call option data

Maximum Call open interest of 48.45 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the November series.

This is followed by 18000 strike, which holds 35.56 lakh contracts, and 18200 strike, which has accumulated 34.52 lakh contracts.

Call writing was seen at 18000 strike, which added 24.73 lakh contracts, followed by 18100 strike, which added 20.43 lakh contracts and 17900 strike which added 19.12 lakh contracts.

Call unwinding was seen at 18300 strike, which shed 37.63 lakh contracts, followed by 18400 strike, which shed 29.21 lakh contracts, and 18500 strike which shed 23.39 lakh contracts.

Put option data

Maximum Put open interest of 34.94 lakh contracts was seen at 17800 strike, which will act as a crucial support level in the November series.

This is followed by 17700 strike, which holds 23.04 lakh contracts, and 17500 strike, which has accumulated 22.81 lakh contracts.

Put writing was seen at 17700 strike, which added 5.56 lakh contracts, followed by 17800 strike which added 4.27 lakh contracts.

Put unwinding was seen at 18000 strike, which shed 29.28 lakh contracts, followed by 18200 strike which shed 27.55 lakh contracts, and 18100 strike which shed 18.28 lakh contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

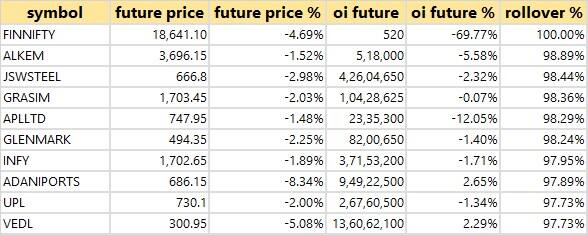

Rollovers

1 stock saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here is the 1 stock in which a long build-up was seen.

![]()

153 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 15 stocks in which long unwinding was seen.

11 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 11 stocks in which a short build-up was seen.

18 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 15 stocks in which short-covering was seen.

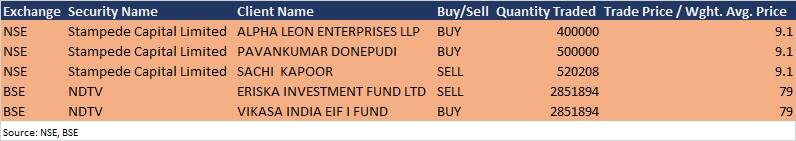

Bulk deals

NDTV: Eriska Investment Fund sold entire shareholding of 28,51,894 equity shares in the company at Rs 79 per share, whereas Vikasa India EIF I Fund was the buyer for same number of shares at same price.

(For more bulk deals, click here)

Analysts/Investors Meeting & Results Calendar

Results on October 29: BPCL, Adani Power, Dr Reddy's Labs, Shree Cement, UPL, Vedanta, Adani Transmission, Apollo Tyres, Bandhan Bank, Barbeque-Nation Hospitality, Bharat Electronics, Cadila Healthcare, CARE Ratings, Castrol India, Chemplast Sanmar, Cholamandalam Investment and Finance Company, LT Foods, Dalmia Bharat Sugar and Industries, Dixon Technologies (India), Elecon Engineering, Emami, Embassy Office Parks REIT, Equitas Small Finance Bank, Escorts, Exide Industries, GAIL (India), Glaxosmithkline Pharmaceuticals, Indigo Paints, JK Lakshmi Cement, JSW Energy, Kolte-Patil Developers, Neuland Laboratories, Oberoi Realty, REC, RPG Life Sciences, SAIL, Satin Creditcare Network, Sumitomo Chemical India, TTK Healthcare, Varun Beverages, VIP Industries, and Voltas will release September quarter earnings on October 29.

UltraTech Cement: The company's officials will meet ICICI Prudential Asset Management Company, and Putnam Investments on October 29.

Shree Pushkar Chemicals & Fertilisers: The company's officials will meet investors on October 29.

Kirloskar Oil Engines: The company's officials will meet SBI MF, PNB Metlife, Birla Sun Life Insurance, ITI MF, White Oak, and Quest on October 29.

Dixon Technologies (India): The company's officials will meet investors and analysts on October 29 after financial results.

JK Tyre & Industries: The company's officials will meet investors and analysts on October 30 after financial results.

Adani Green Energy: The company's officials will meet Capital World Investors on November 1.

Privi Speciality Chemicals: The company's officials will meet investors on November 1.

India Pesticides: The company's officials will meet analysts and investors on November 1 after financial results.

Stocks in News

KEC International: The company has bagged orders worth Rs 1,080 crore in the transmission and distribution business.

Adani Total Gas: The company approved to raise up to $750 million via Medium Term Note Programme. The company reported higher consolidated profit at Rs 158.12 crore in Q2FY22 against Rs 134.31 crore in Q2FY21, revenue increased to Rs 686.80 crore from Rs 441.16 crore YoY.

AU Small Finance Bank: The bank reported lower profit at Rs 278.5 crore in Q2FY22 against Rs 321.9 crore in Q2FY21, net interest income jumped to Rs 753.1 crore from Rs 560.6 crore YoY.

Infosys: The company and global energy firm Bp agreed to develop and pilot an energy as a service (EaaS) solution, which will aim to help businesses improve the energy efficiency of infrastructure, and help meet their decarbonization goals.

Wipro: The company and Oracle launched tollway transportation and billing solution.

NTPC: The company reported lower standalone profit at Rs 3,211.9 crore in Q2FY22 against Rs 3,504.8 crore in Q2FY21, revenue jumped to Rs 28,329 crore from Rs 24,677.1 crore YoY.

Fund Flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,818.51 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 836.60 crore in the Indian equity market on October 28, as per provisional data available on the NSE.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!