The selling pressure continued in the Indian equity benchmarks as well as broader markets on October 21, dragged by weak global cues. The correction in FMCG, IT, and Metals stocks pulled the market down, but banking and financials and auto stocks supported the market.

The BSE Sensex slipped 336.46 points to 60,923.50, and the Nifty50 declined 88.50 points at 18,178.10 and formed a bearish candle on the daily charts, continuing a downtrend for the third consecutive session.

"Weak global cues triggered selling pressure for the third day in a row, while for one more time bears took the aggressive stance near the 18,350 resistance level. Technically, after a short-term price correction, the Nifty took support near the 18,050 level and reversed sharply. The index has formed a bearish candle on daily charts but at the same time, it took support near the important retracement level of 18,030," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

He is of the view that the intraday texture of the market is weak and is likely to continue in the near future. "The immediate support level for the day traders would be 18,150. As long as the index is trading above the same, a pull-back rally could be seen up to 18,250-18,300 levels. On the flip side, dismissal of 18,150 may intensify further weakness up to 18,030-18,000," he said.

The broader markets also saw correction with the Nifty Midcap 100 index down 0.39 percent and Smallcap 100 index down 0.8 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 18,022.66, followed by 17,867.23. If the index moves up, the key resistance levels to watch out for are 18,358.86 and 18,539.63.

Nifty Bank

The Nifty Bank jumped 512 points or 1.3 percent to close above 40,000 mark for the first time at 40,030.20, outshining benchmark indices on October 21. The important pivot level, which will act as crucial support for the index, is placed at 39,572.07, followed by 39,113.94. On the upside, key resistance levels are placed at 40,344.37 and 40,658.53 levels.

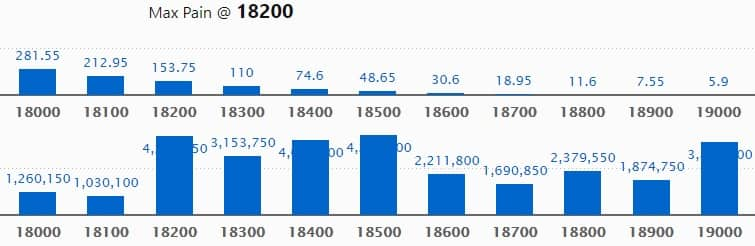

Call option data

Maximum Call open interest of 42.38 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the October series.

This is followed by 18200 strike, which holds 42.24 lakh contracts, and 18400 strike, which has accumulated 40.16 lakh contracts.

Call writing was seen at 18200 strike, which added 30.56 lakh contracts, followed by 18400 strike, which added 22.27 lakh contracts and 19000 strike which added 17.53 lakh contracts.

Call unwinding was seen at 17500 strike, which shed 49,800 contracts, followed by 17800 strike, which shed 45,250 contracts, and 17900 strike which shed 32,900 contracts.

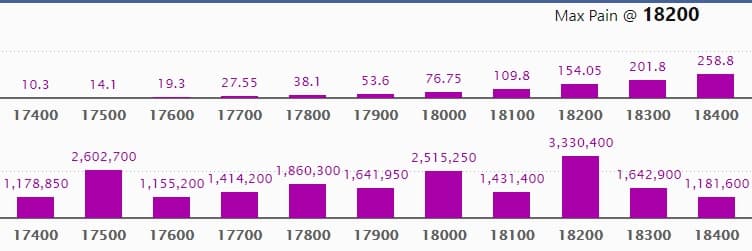

Put option data

Maximum Put open interest of 33.30 lakh contracts was seen at 18200 strike. This is followed by 17500 strike, which holds 26.02 lakh contracts, and 18000 strike, which has accumulated 25.15 lakh contracts.

Put writing was seen at 18200 strike, which added 14.09 lakh contracts, followed by 18100 strike which added 4.34 lakh contracts and 17900 strike which added 3.93 lakh contracts.

Put unwinding was seen at 18300 strike, which shed 1.18 lakh contracts, followed by 18500 strike which shed 1.01 lakh contracts, and 18400 strike which shed 86,750 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

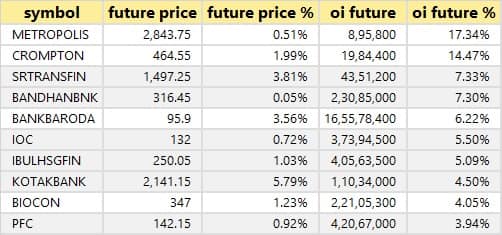

33 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

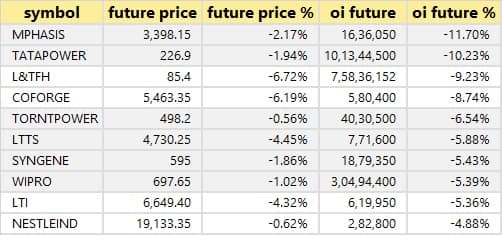

44 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

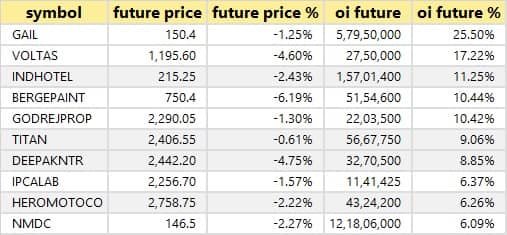

64 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 10 stocks in which a short build-up was seen.

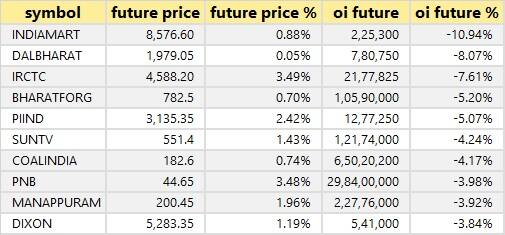

41 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

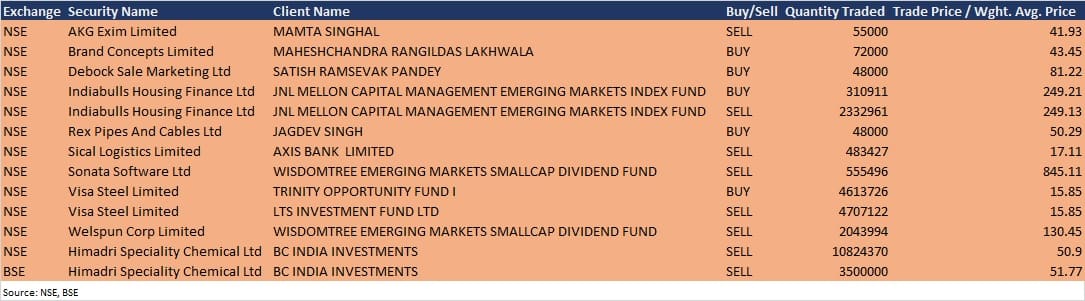

Bulk deals

Himadri Speciality Chemical: BC India Investments sold 35 lakh equity shares in the company at Rs 51.77 per share on the BSE and 1,08,24,370 equity shares at Rs 50.9 per share on the NSE, the bulk deals data showed.

Welspun Corp: Wisdomtree Emerging Markets Smallcap Dividend Fund sold 20,43,994 equity shares in the company at Rs 130.45 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/investors meeting and results calendar

Results on October 22: Reliance Industries, HDFC Life Insurance Company, Yes Bank, Apollo Pipes, Bharat Seats, Crompton Greaves Consumer Electricals, Dodla Dairy, Federal Bank, Gland Pharma, Hindustan Zinc, Inox Leisure, Jubilant Pharmova, Kajaria Ceramics, Kirloskar Ferrous Industries, Kwality Pharmaceuticals, Mahindra Holidays & Resorts India, Omkar Speciality Chemicals, Polycab India, ABB Power Products and Systems India, PVR, Steel Strips Wheels, Subros, Sundaram-Clayton, Supreme Industries, Tata Consumer Products, Tata Elxsi, and Zenotech Laboratories will release September quarter earnings on October 22.

Results on October 23: ICICI Bank, Seshasayee Paper & Boards, Vimta Labs, and ZF Steering Gear (India) will announce September quarter results on October 23.

Kirloskar Pneumatic Company: The company's officials will meet investors and analysts on October 22, post financial results.

Tatva Chintan Pharma Chem: The company's officials will meet analysts and investors on October 25 post announcement of financial results.

Westlife Development: The company's officials will meet investors and analysts on October 28 to discuss the financial performance.

Sudarshan Chemical Industries: The company's officials will meet analysts and investors on October 29 post financial results.

Stocks in News

South Indian Bank: The bank posted a loss of Rs 187.06 crore in Q2FY22 against a profit of Rs 65.09 crore in Q2FY21; net interest income fell to Rs 527.15 crore from Rs 663.11 crore YoY.

LIC Housing Finance: The company reported a lower profit at Rs 247.86 crore in Q2FY22 against Rs 790.90 crore in Q2FY21; revenue fell to Rs 4,708.01 crore from Rs 4,969.03 crore YoY.

ICICI Lombard General Insurance Company: The company reported a higher profit at Rs 446.67 crore in Q2FY22 against Rs 415.74 crore in Q2FY21. Total income jumped to Rs 3,808.16 crore from Rs 2,883.40 crore YoY.

Indian Energy Exchange: The company reported a higher consolidated profit at Rs 77.72 crore in Q2FY22 against Rs 44.33 crore in Q2FY21, and revenue jumped to Rs 110.37 crore from Rs 70.91 crore YoY. The company recommended a bonus issue of equity shares in the proportion of 2 equity shares of Re 1 each for every 1 existing equity share of Re 1 each held by the shareholders.

VST Industries: The company reported a lower profit at Rs 79.88 crore in Q2FY22 against Rs 88.54 crore in Q2FY21; revenue fell to Rs 360.86 crore from Rs 394.88 crore YoY.

Macrotech Developers: The company reported consolidated profit at Rs 223.36 crore in Q2FY22 against loss of Rs 362.58 crore in Q2FY21; revenue jumped to Rs 2,123.83 crore from Rs 900.76 crore YoY.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 2,818.90 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 428.45 crore in the Indian equity market on October 21, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Ten stocks - Amara Raja Batteries, Escorts, Vodafone Idea, IRCTC, L&T Finance Holdings, NALCO, Punjab National Bank, SAIL, Sun TV Network and Tata Power - are under the F&O ban for October 22. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!