The market hit yet another record high with the Nifty50 scaling 17,600 and BSE Sensex 59,000 levels for the first time on September 16, as the government announced further measures to support telecom, banks, and auto sectors that boosted the confidence of investors. The rally was led by banking & financials, FMCG, telecom, and select auto stocks.

The benchmark indices ended at fresh record closing high, outperforming broader markets. The BSE Sensex rallied 417.96 points to 59,141.16, while the Nifty50 jumped 110 points to 17,629.50 and formed a bullish candle on the daily charts.

"Another long bull candle was formed on the daily chart, which is back-to-back for the two consecutive sessions. This action signal a decisive upside breakout of the rangebound movement. This pattern also reflects the ongoing strength of uptrend in the market," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said, "Though Nifty placed at the new highs, still there is no indication of any tiredness or reversal pattern at the highs. This is a positive indication and signals more upside ahead."

"The overall positive chart pattern of Nifty from smaller to larger timeframe could hint next possible upside target of 18,000 in the next 1-2 weeks. Intraday corrections can't be ruled out in between. Immediate supports to be watched at 17,470 levels," he added.

The Nifty Midcap 100 index was up 0.36 percent and Smallcap 100 index gained 0.2 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,545.07, followed by 17,460.63. If the index moves up, the key resistance levels to watch out for are 17,679.27 and 17,729.03.

Nifty Bank

The Nifty Bank shot up 816.35 points or 2.22 percent to 37,668.60 and outperformed frontline indices on September 16. The important pivot level, which will act as crucial support for the index, is placed at 37,144.23, followed by 36,619.87. On the upside, key resistance levels are placed at 37,956.54 and 38,244.47 levels.

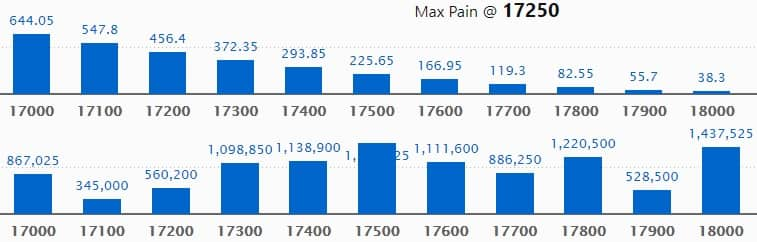

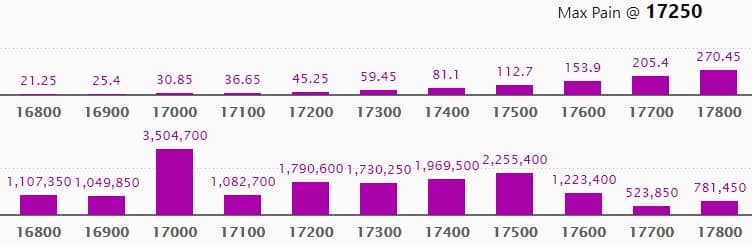

Call option data

Maximum Call open interest of 15.06 lakh contracts was seen at 17,500 strike. This is followed by 18,000 strike, which holds 14.37 lakh contracts, and 17,800 strike, which has accumulated 12.20 lakh contracts.

Call writing was seen at 17,800 strike, which added 3.35 lakh contracts, followed by 17,700 strike, which added 1.06 lakh contracts, and 17900 strike which added 87,650 contracts.

Call unwinding was seen at 17500 strike, which shed 1.85 lakh contracts, followed by 17400 strike, which shed 1.62 lakh contracts, and 17300 strike which shed 1.02 lakh contracts.

Put option data

Maximum Put open interest of 35.04 lakh contracts was seen at 17,000 strike, which will act as a crucial support level in the September series.

This is followed by 17,500 strike, which holds 22.55 lakh contracts, and 17,400 strike, which has accumulated 19.69 lakh contracts.

Put writing was seen at 17,800 strike, which added 4.45 lakh contracts, followed by 17,600 strike which added 3.91 lakh contracts, and 17,500 strike which added 3.9 lakh contracts.

Put unwinding was seen at 16,900 strike, which shed 2.6 lakh contracts, followed by 16,800 strike which shed 61,050 contracts, and 17,200 strike which shed 52,500 contracts.

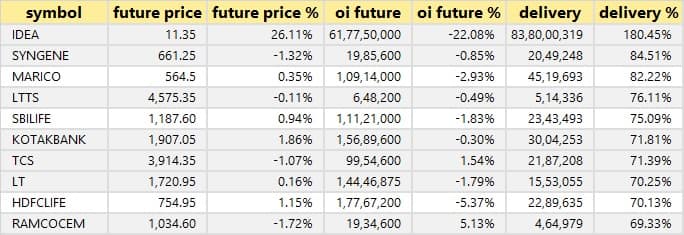

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

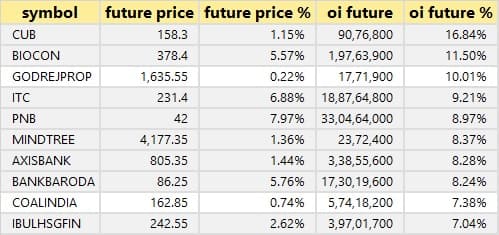

51 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

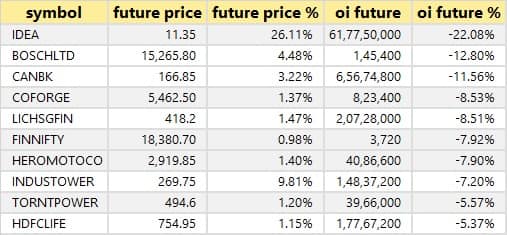

38 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

48 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

38 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

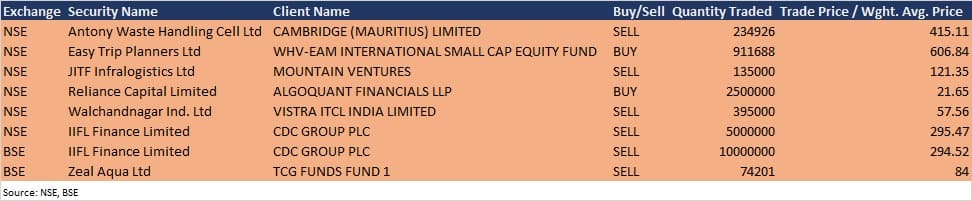

Bulk deals

Antony Waste Handling Cell: Cambridge (Mauritius) sold 2,34,926 equity shares in the company at Rs 415.11 per share on the NSE, the bulk deals data showed.

Easy Trip Planners: WHV-EAM International Small Cap Equity Fund acquired 9,11,688 equity shares in the company at Rs 606.84 per share on the NSE, the bulk deals data showed.

IIFL Finance: CDC Group Plc sold 50 lakh equity shares in the company at Rs 295.47 per share on the NSE and 1 crore shares at Rs 294.52 per share on the BSE, the bulk deals data showed.

Zeal Aqua: TCG Funds Fund 1 sold 74,201 equity shares in the company at Rs 84 per share on the BSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Gujarat Themis Biosyn: The company's officials will meet Rona Asset Managers on September 17.

Nuvoco Vistas Corporation: The company's officials will meet Millennium Partners on September 17.

HSIL: The company's officials will meet Baroda Asset Management on September 17.

Stocks in News

Gyscoal Alloys: Sampati Securities sold 18.9 lakh equity shares in the company via open market transaction on September 15, reducing shareholding to 10.679% from 11.873% earlier.

Indiabulls Housing Finance: The company approved the floor price for the issue of foreign currency convertible bonds (FCCB) at Rs 231.48 per FCCB and the opening of the issue on September 16.

Infosys: Frost Bank selected Infosys as strategic partner to launch new mortgage loan product offering.

Hero MotoCorp: The company will make an upward revision in the ex-showroom prices of its motorcycles and scooters, with effect from September 20, 2021, which will offset the impact of steadily increasing commodity prices.

Ambalal Sarabhai Enterprises: CDSCO Cosara Diagnostics (a joint venture company of Synbiotics, a wholly owned subsidiary of Ambalal Sarabhai Enterprises and Co-Diagnostics Inc, USA) received regulatory approval from (Central Drugs Standard Control Organisation) to manufacture and sell SARAGENE dengue test kit.

NCL Industries: CRISIL has upgraded the long term and short term ratings of the company's bank loan facilities (Rs 396 crore) to 'A'/Stable from 'A-' and 'A1' from 'A2+' respectively.

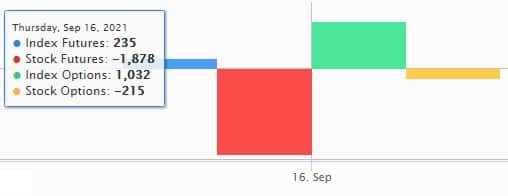

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,621.88 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 795.13 crore in the Indian equity market on September 16, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Escorts, Exide Industries, NALCO, SAIL, Sun TV Network and Zee Entertainment Network - are under the F&O ban for September 17. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!