After hitting a lifetime high in the previous session, the domestic equity market entered the consolidation phase on August 26, the last day of the futures & options contracts for the August series, and settled on a flat note.

The BSE Sensex rose 4.89 points to 55,949.10, while the Nifty50 rose 2.20 points to 16,636.90 and formed Doji kind of pattern on the daily charts as the closing was near its opening levels.

"A small positive candle was formed on the daily chart with upper shadow and the high low range for the day was also muted. Technically, this pattern indicates a rangebound action in the market with weak bias. The overall market breadth was slightly positive and the broad market indices have closed on a minor positive note," said Nagaraj Shetti, Technical Research Analyst at HDFC Securities.

He further said the emergence of weakness from the all-time high has failed to turn into a sharp negative reversal. "The ongoing consolidation/range-bound action could continue in the next 1-2 sessions, before showing upside breakout of the range movement. Immediate support of 10-period EMA is placed at 16,520 levels," he added.

The broader markets outweighed frontliners on the expiry day. The Nifty Midcap 100 and Smallcap 100 indices gained 0.2 percent each.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 16,598.97, followed by 16,561.04. If the index moves up, the key resistance levels to watch out for are 16,679.27 and 16,721.63.

Nifty Bank

The Nifty Bank also closed flat, rising 31.35 points to close at 35,617.60 on August 26. The important pivot level, which will act as crucial support for the index, is placed at 35,424.33, followed by 35,231.07. On the upside, key resistance levels are placed at 35,798.33 and 35,979.07 levels.

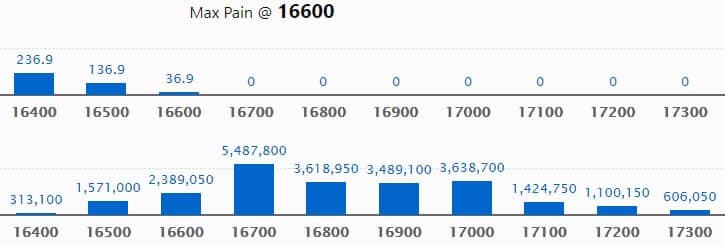

Call option data

Maximum Call open interest of 54.87 lakh contracts was seen at 16,700 strike, which will act as a crucial resistance level in the September series.

This is followed by 17,000 strike, which holds 36.38 lakh contracts, and 16,800 strike, which has accumulated 36.18 lakh contracts.

Call writing was seen at 16,800 strike, which added 19.41 lakh contracts, followed by 17,000 strike, which added 14.63 lakh contracts, and 16,700 strike which added 12.68 lakh contracts.

There was hardly any Call unwinding seen on expiry day.

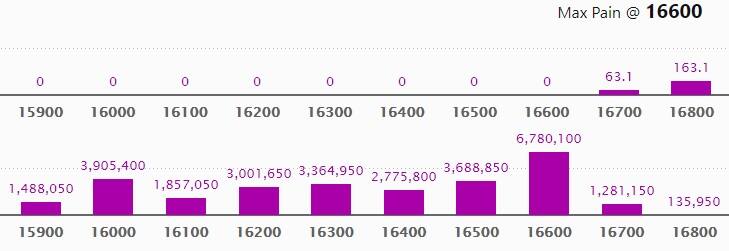

Put option data

Maximum Put open interest of 67.8 lakh contracts was seen at 16,600 strike, which will act as a crucial support level in the September series.

This is followed by 16,000 strike, which holds 39.05 lakh contracts, and 16,500 strike, which has accumulated 36.88 lakh contracts.

Put writing was seen at 16,600 strike, which added 17.39 lakh contracts.

Put unwinding was seen at 16,500 strike, which shed 31.91 lakh contracts, followed by 16,400 strike which shed 14.22 lakh contracts, and 16,000 strike which shed 6.7 lakh contracts.

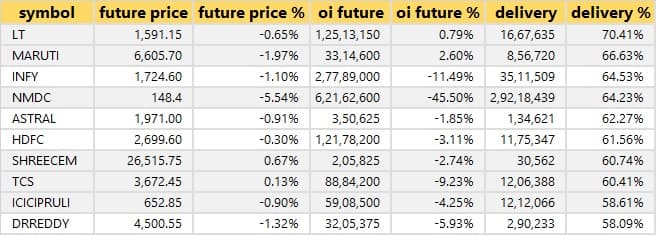

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

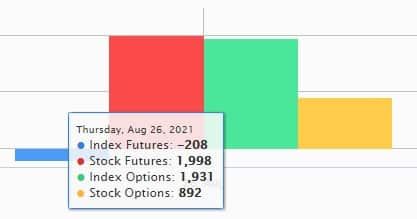

Rollovers

8 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the 8 stocks in which a long build-up was seen.

108 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

6 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 6 stocks in which a short build-up was seen.

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

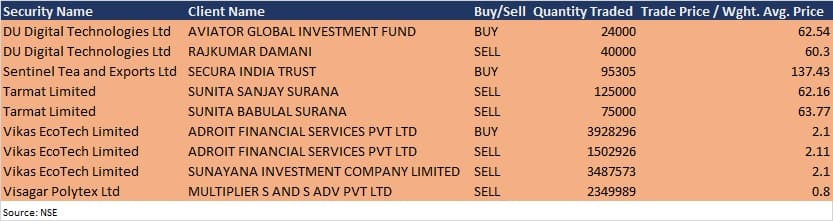

Bulk deals

DU Digital Technologies: Aviator Global Investment Fund acquired 24,000 equity shares in the company at Rs 62.54 per share, whereas Rajkumar Damani sold 40,000 equity shares at Rs 60.3 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Sterling and Wilson Solar: The company's officials will meet investors and analysts on August 27.

Tata Chemicals: The company's officials will meet Ishana Capital on August 27.

Hindustan Copper: The company's officials will meet several investors (including Enam, SBI General, Goldman Sachs AM, Alchemy, and Aegon) on August 27.

UltraTech Cement: The company's officials will meet Neuberger Berman Group LLC on August 27.

Meghmani Finechem: The company's officials will meet GIC (Government of Singapore Investment Corporation) on August 27.

Narayana Hrudayalaya: The company's officials will meet UTI Mutual Fund - Institutional Investor on August 30.

Garware Hi-Tech Films: The company's officials will meet Aditya Birla Money on August 31.

JSW Energy: The company's officials will meet analysts and institutional investors in Systematix - Virtual Power Sector Conference on August 31.

Stocks in News

Jindal Poly Films: The company has acquired 100% shares of Jindal India Solar Energy and consequent thereof Jindal India Solar became wholly-owned subsidiary.

GRM Overseas: Promoters acquired 23,802 equity shares in the company via open market transaction, increasing shareholding to 71.70% from 71.51% earlier.

BHEL: A Memorandum of Understanding (MOU) was signed between the company and JSC Rosoboronexport, to cooperate and implement possible joint projects and activities with BHEL for joint production of spare parts and components for Russian-origin equipment installed onboard the Indian Navy Aircraft Carrier "Vikramaditya" and maintenance of systems and equipment of Aircraft Carrier "Vikramaditya and on other issues of mutual interest.

IDFC First Bank: The RBI approved the appointment of Sanjeeb Chaudhuri, Independent Director, as the Part-Time Chairman of the bank, for a period of three years.

Onward Technologies: ICRA assigned long term rating for bank facilities of the company at BBB-/Positive and short term rating at A3.

Wipro: The company signed a strategic partnership with DataRobot to provide Augmented Intelligence at scale, to help customers become AI-driven enterprises, and accelerate their business impact.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,974.48 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 1,055.21 crore in the Indian equity market on August 26, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!