The market traded volatile with a negative bias for a major part of the session and closed in the red for the fifth straight session on July 1. Select banking and financials, IT and metal stocks pulled the market lower, while auto, FMCG and pharma stocks gained.

The BSE Sensex declined 164.11 points to 52,318.60, while the Nifty50 fell 41.50 points to 15,680 and formed a bearish candle on the daily charts.

"A reasonable negative candle was formed, that placed at the crucial support of 20-day EMA on the daily chart around 15,680 levels. We also observe a formation overlapping negative candles over the last three sessions, which indicate rangebound action and sell-on-rise opportunity in the market," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

He says the formation of such patterns could eventually result in an upside breakout. "As of now, there is no early sign of any upside bounce from the lows," he said.

He further said the Nifty continued to show choppy movement with negative bias and still there is no evidence of any upside bounce emerging from the lows. "The Nifty is currently placed at the important cluster support of 15,650 levels and a move below this area could result in slide down to 15,500 levels," he added.

The broader markets closed mixed as the Nifty Midcap 100 index declined 0.33 percent and Nifty Smallcap 100 index gained 0.66 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,646.17, followed by 15,612.33. If the index moves up, the key resistance levels to watch out for are 15,734.67 and 15,789.33.

Nifty Bank

The Nifty Bank declined 88.20 points to close at 34,684 on July 1. The important pivot level, which will act as crucial support for the index, is placed at 34,584.06, followed by 34,484.13. On the upside, key resistance levels are placed at 34,850.77 and 35,017.54 levels.

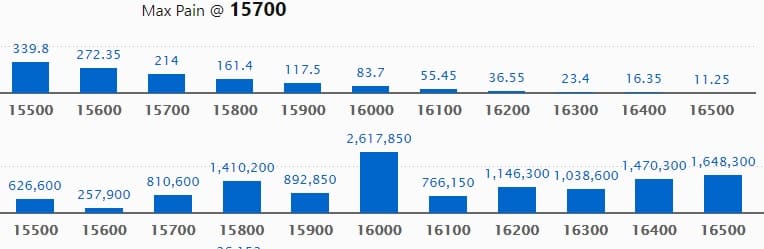

Call option data

Maximum Call open interest of 26.17 lakh contracts was seen at 16000 strike, which will act as a crucial resistance level in the July series.

This is followed by 16500 strike, which holds 16.48 lakh contracts, and 16400 strike, which has accumulated 14.70 lakh contracts.

Call writing was seen at 16000 strike, which added 2.13 lakh contracts, followed by 15700 strike which added 2.02 lakh contracts, and 16300 strike which added 1.44 lakh contracts.

Call unwinding was seen at 16500 strike, which shed 72,450 contracts, followed by 16200 strike which shed 62,800 contracts, and 16400 strike which shed 22,850 contracts.

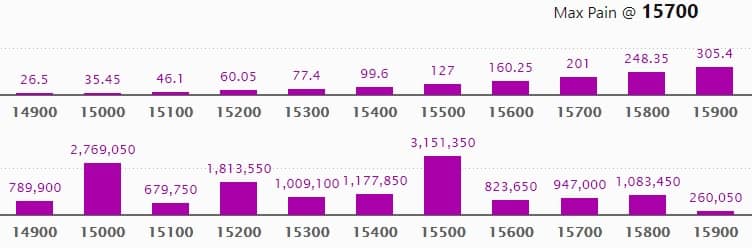

Put option data

Maximum Put open interest of 31.51 lakh contracts was seen at 15500 strike, which will act as a crucial support level in the July series.

This is followed by 15000 strike, which holds 27.69 lakh contracts, and 15200 strike, which has accumulated 18.13 lakh contracts.

Put writing was seen at 15000 strike, which added 1.35 lakh contracts, followed by 15700 strike which added 1 lakh contracts, and 14900 strike which added 83,400 contracts.

Put unwinding was seen at 15800 strike, which shed 49,300 contracts, followed by 16000 strike which shed 24,100 contracts and 15900 strike which shed 20,750 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

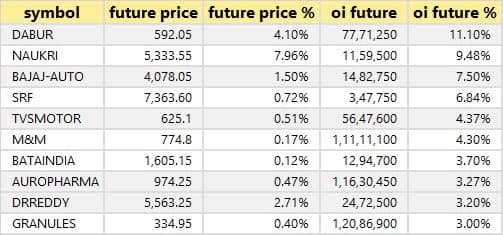

40 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

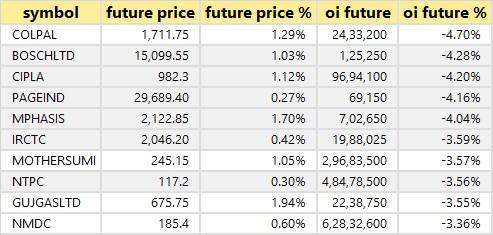

21 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

64 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

36 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

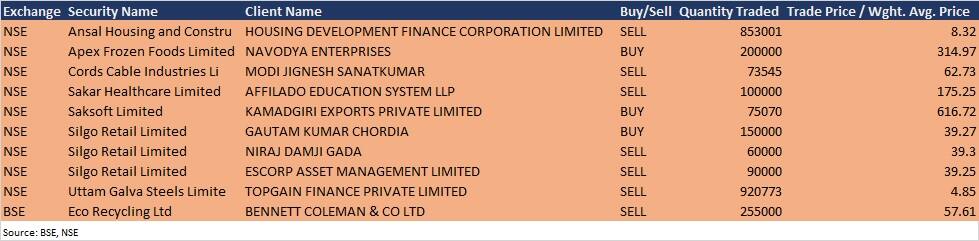

Bulk deals

(For more bulk deals, click here)

Analysts/Investors Meeting

Sadbhav Infrastructure Project: The company's officials will meet analysts/investors on July 2 to discuss financial results.

Sadbhav Engineering: The company's officials will meet analysts/investors on July 2 to discuss financial results.

Somany Home Innovation: The company's officials will meet Motilal Oswal Financial Services on July 2.

Brigade Enterprises: The company's officials will meet analysts/investors in an India Real Estate Access Day conference organised by CLSA on July 2.

Pricol: The company's officials will meet Philip Capital India, and Centrum Capital on July 2, Motilal Oswal Investment Advisors, and Ambit Capital on July 6.

Hinduja Global Solutions: The company's officials will meet Nirmal Bang Digital on July 2.

Stocks in News

Capacite Infraprojects: ICICI Prudential Asset Management Company sold 98,537 equity shares (or 0.15 percent of the total paid-up equity) via an open market transaction on June 29, reducing stake to 2.95 percent from 3.09 percent earlier.

Hero MotoCorp: With the gradual easing of the COVID-19 related restrictions and lockdowns across key markets in the country, the company witnessed a strong rebound in the month of June to sell 4,69,160 units of motorcycles and scooters, against 4,51,983 units sold in the corresponding month last year.

Tata Consultancy Services: The company partnered with John Wiley & Sons, an American multinational publishing company, to modernise its e-commerce platform with SAP Commerce, creating a unified, seamless customer experience.

NCC: The company received five new orders totalling Rs 2,149 crore in June. Out of the total orders, two orders valuing Rs 1,254 crore pertain to water and environment division and one order valuing Rs 729 crore pertains to buildings division and one order valuing Rs 166 crore pertains to mining division.

NMDC: The company sold 3.18 million tonnes of iron ore in June 2021, higher from 2.48 million tonnes of iron ore sold in June 2020. The production of iron ore stood at 2.98 million tonnes against 2.52 million tonnes in the same period.

Coal India: Coal production increased 2 percent to 40 million tonnes in June 2021 YoY, and offtake jumped 23 percent to 51.3 million tonnes in the same period.

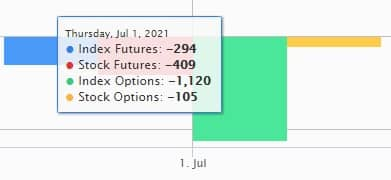

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 1,245.29 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 880.60 crore in the Indian equity market on July 1, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - NALCO - is under the F&O ban for July 2. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!