The market gained momentun in the afternoon session on May 6 with the Nifty50 climbing more than half a percent to close above 14,700 levels, driven by auto, IT, metals and select FMCG stocks.

The BSE Sensex rose 272.21 points to 48,949.76, while the Nifty50 jumped 106.90 points to 14,724.80 and witnessed a small bullish candle on the daily charts.

"A reasonable long candle was formed with minor lower shadow. Technically, this pattern signals a buy-on-dips in the market amidst a range movement. The long lower shadow of the last two rising candles shows emergence of buying on intraday dips," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Nifty is now placed at the crucial upper resistance of around 14,725 (swing high of May 4) and a sustainable move above this hurdle could open next upside resistance of around 14,900-15,000 levels in the short term, before showing a next round of weakness from the highs," he said.

Immediate support is placed at 14,610, Shetti added.

The broader markets also participated in the run with the Nifty Midcap 100 index rising 0.94 percent and Smallcap 100 index up 0.7 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,642.9, followed by 14,561. If the index moves up, the key resistance levels to watch out for will be 14,775.3 and 14,825.8.

Nifty Bank

The Nifty Bank index rose 44.10 points to close at 32,827.80 on May 6. The important pivot level, which will act as crucial support for the index, is placed at 32,609.07, followed by 32,390.34. On the upside, key resistance levels are placed at 33,001.47 and 33,175.13 levels.

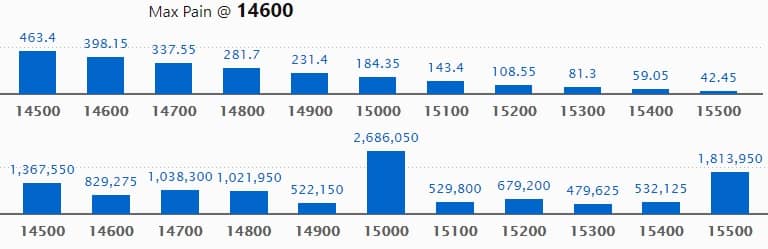

Call option data

Maximum Call open interest of 26.86 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the May series.

This is followed by 15,500 strike, which holds 18.13 lakh contracts, and 14,500 strike, which has accumulated 13.67 lakh contracts.

Call writing was seen at 14,700 strike, which added 2.39 lakh contracts, followed by 15,500 strike which added 2.05 lakh contracts and 14,800 strike which added 1.72 lakh contracts.

Call unwinding was seen at 14,200 strike, which shed 32,025 contracts, followed by 14,500 strike which shed 18,225 contracts and 14,300 strike which shed 6,750 contracts.

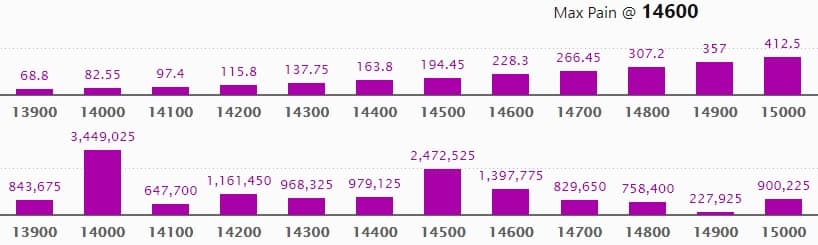

Put option data

Maximum Put open interest of 34.49 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the May series.

This is followed by 14,500 strike, which holds 24.72 lakh contracts, and 14,600 strike, which has accumulated 13.97 lakh contracts.

Put writing was seen at 14,200 strike, which added 2.2 lakh contracts, followed by 14,700 strike which added 1.54 lakh contracts and 14,800 strike which added 95,175 contracts.

Put unwinding was seen at 14,100 strike which shed 48,150 contracts, followed by 14,000 strike, which shed 45,600 contracts, and 13,900 strike which shed 4,500 contracts.

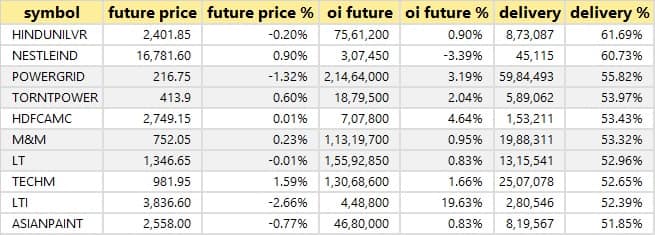

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

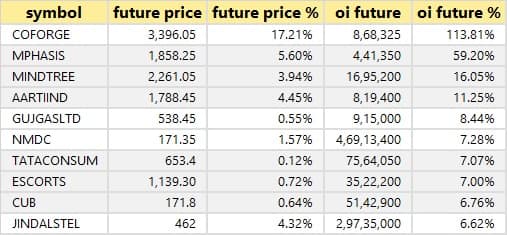

57 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

22 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

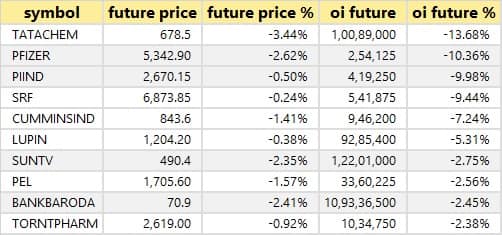

38 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

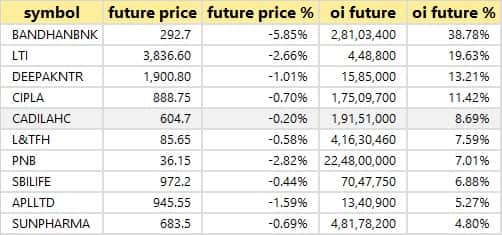

39 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

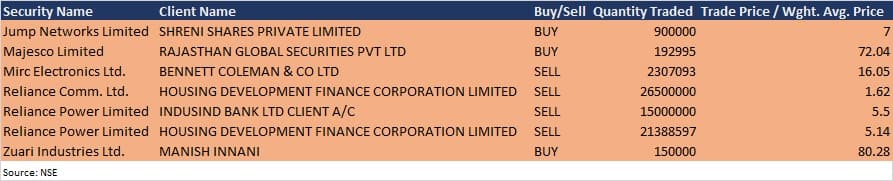

Bulk deals

(For more bulk deals, click here)

Results on May 7 and May 8

Results on May 7: Housing Development Finance Corporation, UltraTech Cement, Dabur India, Automobile Corporation of Goa, Cholamandalam Investment and Finance Company, Duncan Engineering, EIH, Great Eastern Shipping, Glance Finance, Godrej Agrovet, Grindwell Norton, Indo-City Infotech, Kansai Nerolac Paints, Navin Fluorine International, Nitta Gelatin India, Pioneer Distilleries, Ponni Sugars (Erode), Reliance Home Finance, Reliance Power, R Systems International, Sacheta Metals, Steel Strips Wheels, Sutlej Textiles & Industries, Tanfac Industries, and Yash Trading & Finance will release their quarterly earnings on May 7.

Results on May 8: Avenue Supermarts, Bandhan Bank, CSB Bank, DCB Bank, IDFC First Bank, Indag Rubber, Nitin Spinners, Reliance Capital, Seshasayee Paper & Boards, Shahi Shipping, SKP Securities, SORIL Infra Resources, Thyrocare Technologies, and Yaarii Digital Integrated Services will announce their quarterly earnings on May 8.

Stocks in News

Tata Consumer Products: The company reported consolidated profit at Rs 53.9 crore for Q4FY21 against loss of Rs 76.49 crore in Q4FY20. Revenue jumped to Rs 3,037.22 crore from Rs 2,405.03 crore in Q4FY20.

Aurionpro Solutions: Aurionpro exited from the cybersecurity business with the sale of its investment to Forcepoint LLC., USA. The deal, for the divestment of all stake held by Aurionpro in its cyber security business is valued at a consideration of $9.6 million.

IRB Infrastructure Developers: Life Insurance Corporation of India acquired over 71.29 lakh equity shares in the company (2.03% of paid up equity), raising stake in the company to 7.06% from 5.03% earlier.

Adani Transmission: The company reported higher consolidated profit of Rs 238.42 crore in Q4FY21 against Rs 94.30 crore in Q4FY20 while revenue fell to Rs 2,726.61 crore from Rs 3,186.96 crore in the year-ago period.

Zensar Technologies: UK-based FinTech Infinity Circle selected Zensar for end-to-end development of its next-gen wealth management platform.

Adani Power: The company reported consolidated profit at Rs 13.13 crore in Q4FY21 against loss of Rs 1,312.86 crore in Q4FY20, revenue rose to Rs 6,373.6 crore from Rs 6,172.43 crore in Q4FY20.

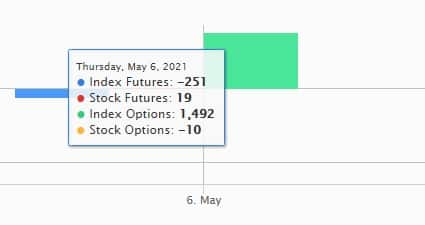

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,222.58 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 632.51 crore in the Indian equity market on May 6, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Three stocks - BHEL, Sun TV Network and Tata Chemicals - are under the F&O ban for May 7. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!