The late trade recovery after volatility helped the market close with half a percent gains on April 15, supported by banking and financials, metals, pharma and select IT stocks. Traders remained cautious about increasing restrictions by several state governments to control the spread of COVID-19.

The BSE Sensex rallied 259.62 points to 48,803.68, while the Nifty50 gained 76.70 points at 14,581.50 and formed a small bullish candle which resembles Hammer kind of pattern on the daily charts.

"The Nifty50 has formed a 'Bearish Gap' area in the range of 14,785-14,652 which remains a crucial resistance zone in the near term. In the past couple of sessions, Nifty bounced back from its 100-day SMA (14,282) which remains a crucial support zone to watch for," Rajesh Palviya, Head - Technical and Derivative Research at Axis Securities told Moneycontrol.

"Overall, since the past four weeks, Nifty continues to consolidate within 14,900-14,300 levels representing sideways trend. The next higher levels to be watched are around 14,650 levels," he said. Any sustainable move above 14,650 may cause pullback towards 14,800-14,900, and should be used as an exit opportunity for short term traders, he advised.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,423.97, followed by 14,266.43. If the index moves up, the key resistance levels to watch out for are 14,668.27 and 14,755.03.

Nifty Bank

The Nifty Bank index climbed 341.20 points or 1.07 percent to close at 32,112.80 on April 15. The important pivot level, which will act as crucial support for the index, is placed at 31,617.1, followed by 31,121.4. On the upside, key resistance levels are placed at 32,397.8 and 32,682.8 levels.

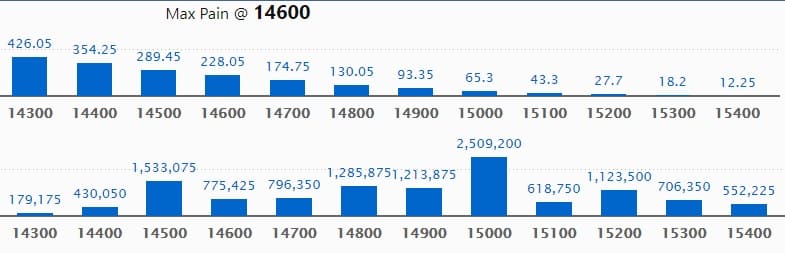

Call option data

Maximum Call open interest of 25.09 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,500 strike, which holds 15.33 lakh contracts, and 14,800 strike, which has accumulated 12.85 lakh contracts.

Call writing was seen at 15,200 strike, which added 4.37 lakh contracts, followed by 14,900 strike which added 2.01 lakh contracts and 14,500 strike which added 1.63 lakh contracts.

Call unwinding was seen at 14,700 strike, which shed 27,225 contracts, followed by 14,300 strike which shed 18,075 contracts.

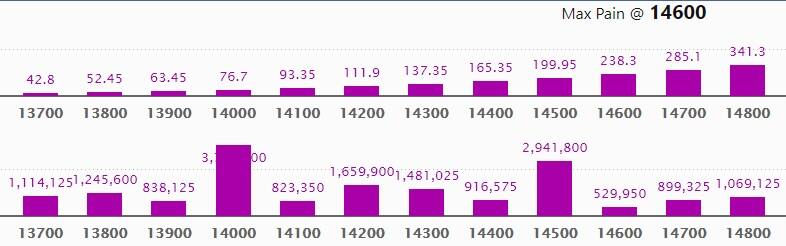

Put option data

Maximum Put open interest of 37.75 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,500 strike, which holds 29.41 lakh contracts, and 14,200 strike, which has accumulated 16.59 lakh contracts.

Put writing was seen at 14,500 strike, which added 3.06 lakh contracts, followed by 14,000 strike which added 2.39 lakh contracts and 14,300 strike which added 1.79 lakh contracts.

Put unwinding was seen at 13,900 strike, which shed 42,750 contracts, followed by 14,800 strike which shed 35,250 contracts.

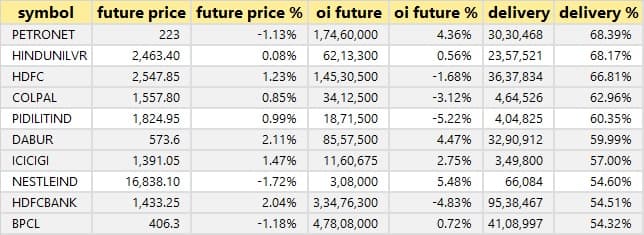

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

33 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

31 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

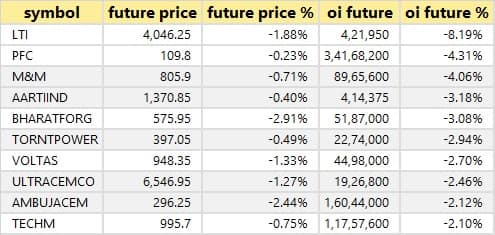

51 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

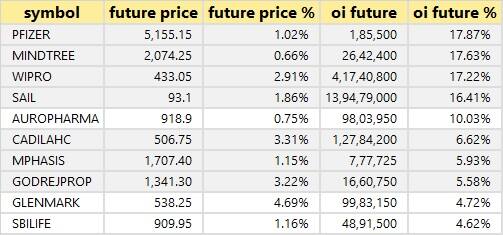

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

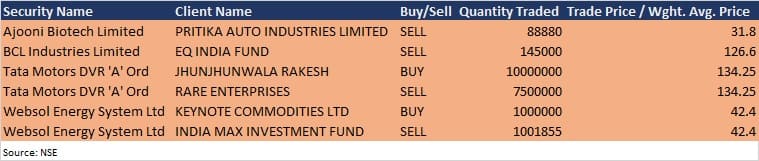

Bulk deals

(For more bulk deals, click here)

Results on April 16

Mindtree, Den Networks, GTPL Hathway, MMTC, and AAR Commercial Company will release quarterly numbers on April 16.

Stocks in News

Wipro: The company reported higher IT services revenue at Rs 16,334 crore in Q4FY21 against Rs 15,726.6 crore in the previous quarter, and expects dollar revenue in Q1FY22 in the range of $2,195-2,238 million.

National Fertilizers: The government intimated regarding an issue of request for proposals (RFP) for engagement of legal advisors, merchant bankers and selling brokers for the disinvestment of 20 percent stake in National Fertilizers out of its shareholding through the offer for sale route.

Ashoka Buildcon: The company has received a Letter of Award (LOA) from Gujarat Rail Infrastructure Development Corporation (G-RIDE) for the project - Gauge Conversion of Bechraji - Ranuj section, with 25 KV AC electrification in Ahmedabad division of Western Railway. The accepted project cost is Rs 333.625 crore.

Seshasayee Paper & Boards: CARE has re-affirmed the credit rating of 'A+' assigned to the long term bank facilities of the company, with outlook as 'stable'. The rating agency also re-affirmed the credit rating of 'A1+' assigned to the short term bank facilities of the company.

ISGEC Heavy Engineering: Goldman Sachs increased stake in the company to 1.88 percent (or 13,83,655 equity shares) at the end of March quarter 2021, from 1.33 percent (or 9,75,423 equity shares) in December quarter 2020.

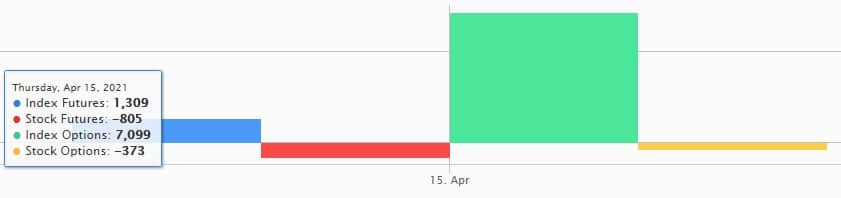

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 979.70 crore, while domestic institutional investors (DIIs) net sold shares worth Rs 526.63 crore in the Indian equity market on April 15, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - SAIL - is under the F&O ban for April 16. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!