The market witnessed a steep fall on March 25 with the benchmark indices declining 1.5 percent each as bears retained tight control over Dalal Street . The increasing COVID-19 infections and selling by FIIs selling weighed on the investor sentiment.

The BSE Sensex dropped 740.19 points to close at 48,440.12, while the Nifty50 fell 224.50 points to 14,324.90 and formed a bearish candle on the daily charts.

"A long bear candle was formed, that filled the opening upside gap of February 2 at 14,350 levels. A new swing low was formed on Thursday at 14,264 levels and the market is now placed at the edge of moving below this gap support," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

Shetti feels that the short term trend of Nifty continues to be weak and a decisive move below 14,300 levels could drag the index towards the next lows of 14,000 levels in the near term.

"This support is a mid part of long bull candle of February 1 (budget day move) and also 20-period weekly EMA. Any upside bounce from here is expected to find resistance at 14,500 levels," he said.

The broader markets - the Nifty Midcap 100 and Smallcap 100 indices - corrected 2 percent each again.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,201, followed by 14,077.1. If the index moves up, the key resistance levels to watch out for are 14,512.2 and 14,699.5.

Nifty Bank

The Nifty Bank index declined 286.90 points to 33,006.40 on March 25. The important pivot level, which will act as crucial support for the index, is placed at 32,431.03, followed by 31,855.66. On the upside, key resistance levels are placed at 33,565.93 and 34,125.47 levels.

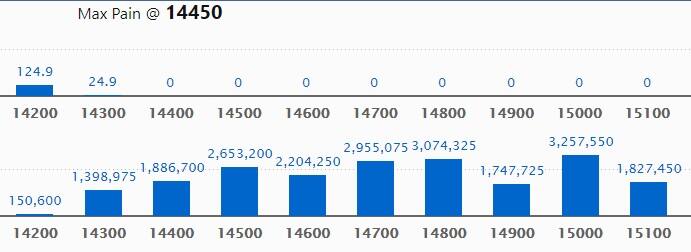

Call option data

Maximum Call open interest of 32.57 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the April series.

This is followed by 14,800 strike, which holds 30.74 lakh contracts, and 14,700 strike, which has accumulated 29.55 lakh contracts.

Call writing was seen at 14,400 strike, which added 15.75 lakh contracts, followed by 14,500 strike which added 14.16 lakh contracts and 14,300 strike which added 13.19 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 23.72 lakh contracts, followed by 14,900 strike which shed 14.96 lakh contracts and 14,800 strike which shed 10.31 lakh contracts.

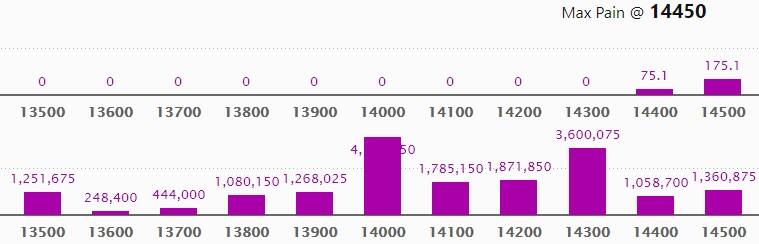

Put option data

Maximum Put open interest of 41.62 lakh contracts was seen at 14,000 strike, which will act as a crucial support level in the April series.

This is followed by 14,300 strike, which holds 36 lakh contracts, and 14,200 strike, which has accumulated 18.71 lakh contracts.

Put writing was seen at 14,300 strike, which added 8.06 lakh contracts, followed by 14,100 strike which added 2.29 lakh contracts.

Put unwinding was seen at 14,500 strike, which shed 21.28 lakh contracts, followed by 14,600 strike which shed 12.90 lakh contracts and 14,400 strike which shed 11.98 lakh contracts.

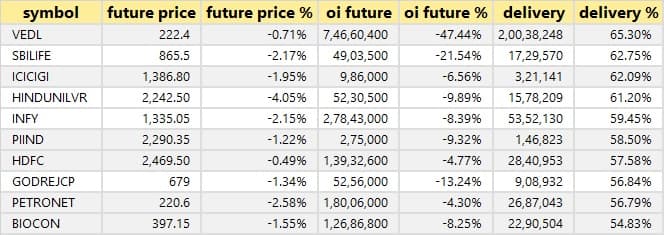

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

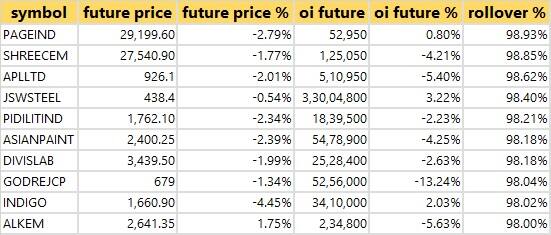

Rollovers

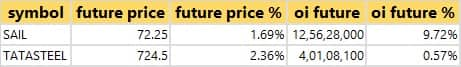

2 stocks saw long build-up

Based on the open interest future percentage, here are the 2 stocks in which a long build-up was seen.

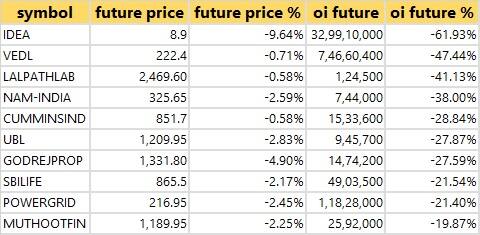

141 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

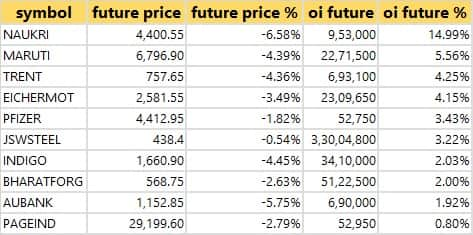

11 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

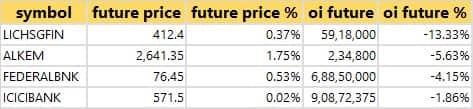

4 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the 4 stocks in which short-covering was seen.

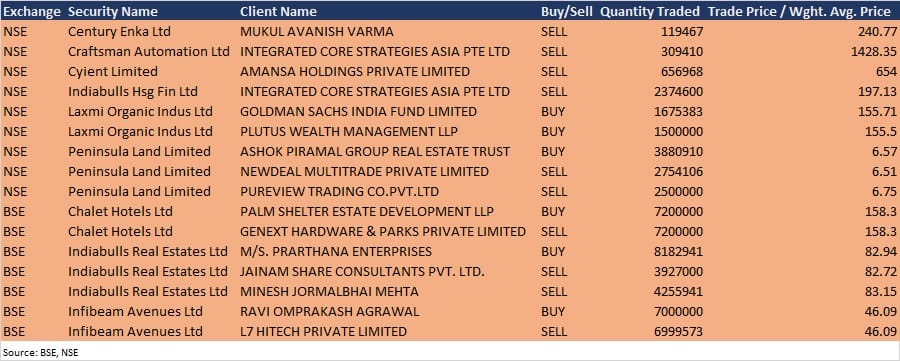

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Godawari Power and Ispat: The company's officials will interact with Investor-Analyst on March 26.

HEG: Senior management of the company is scheduled to meet the investors and analysts on March 26 through video conferencing, as organised by Motilal Oswal Financial Services.

Indian Energy Exchange: The company's officials will interact with Marshall Wace on March 26.

Stocks in the news

Somany Home Innovation: Group Atlantic, France, will invest Rs 68.3 crore for a 50% stake in the water heater business subsidiary of Somany Home Innovation. Subsidiary Hintastica is setting up a state-of-the-art manufacturing plant in Telangana and the plant will be completed by March 2022, with trial runs expected to commence from May 2022.

Sun Pharmaceutical Industries: Sun Pharma's wholly-owned Indian subsidiary has subscribed to partnership interest in ABCD Technologies LLP, at a cost of Rs 40 crore. ABCD Technologies LLP will be renamed as IndoHealth Services LLP. The objective of investment is to promote efficiency and good distribution practices including digitising healthcare infrastructure in India. The share of profit or loss in the target entity is up to 20 percent.

Lupin: Lupin has agreed to subscribe to a partnership interest in ABCD Technologies LLP, at a cost of Rs 40 crore. ABCD Technologies LLP will be renamed as IndoHealth Services LLP. The objective of investment is to digitise healthcare infrastructure in India towards facilitating good distribution Practices in support of the National Digital Health Mission of Government of India. The share of profit or loss in the target entity is up to 20 percent.

Den Networks: Jio Futuristic Digital Holdings, Jio Digital Distribution Holdings and Jio Television Distribution Holdings will sell 5,54,85,048 equity shares or 11.63 percent stake in the company through offer for sale on March 26 and March 30. The floor price for the sale has been fixed at Rs 48.50 per share. The news came in after market hours on March 25.

Hathway Cable & Datacom: Jio Content Distribution Holdings, Jio Internet Distribution Holdings, and Jio Cable and Broadband Holdings will sell 33,79,83,855 equity shares or 19.09% stake in Hathway Cable through offer for sale on March 26 and March 30. The floor price has been fixed at Rs 25.25 per share.

Rail Vikas Nigam: LIC has bought more than 18.18 crore equity shares or 8.72% equity stake in Rail Vikas Nigam via open market transaction on March 24. The government had sold over 15% stake in the company via offer for sale during March 24-25. This news came in after market hours on March 25.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 3,383.60 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 2,267.69 crore in the Indian equity market on March 25, as per provisional data available on the NSE.

Disclaimer: Reliance Industries Ltd, which owns Jio, is the sole beneficiary of Independent Media Trust that controls Network18 Media & Investments Ltd which publishes Moneycontrol.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!