The market witnessed a rangebound session on March 10 but remained in the positive territory and closed half a percent higher, supported by IT, metals, pharma, auto and select FMCG stocks. The fall in the volatility index (VIX) to 20.75 from 22.50 levels also supported the bullish bias.

The BSE Sensex climbed 254.03 points to 51,279.51, while the Nifty50 rose 76.40 points to 15,174.80 and formed a small bearish candle on the daily charts as the closing was lower than opening levels.

"Technically, the market closed above the level of 15,150, which could maintain the market's bullish continuation. We may see at least 15,280 or 15,350 levels in the near term," Shrikant Chouhan, Executive Vice President, Equity Technical Research at Kotak Securities said.

"However, if the Nifty fails to break the 15,280 level, it may send the market to consolidation between 15,000 and 15,280. If the index goes below 15,000, the bullish trend will break. Bond yields and the dollar index would once again determine the market trend in the coming days," he added.

The broader markets outperformed benchmark indices as the Nifty Midcap 100 index climbed 0.82 percent while the Smallcap 100 index was up 1.39 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 15,110.9, followed by 15,047. If the index moves up, the key resistance levels to watch out for are 15,228.6 and 15,282.4.

Nifty Bank

The Nifty Bank index rose 72.60 points to 35,938.30 on March 10. The important pivot level, which will act as crucial support for the index, is placed at 35,742.83, followed by 35,547.36. On the upside, key resistance levels are placed at 36,155.33 and 36,372.36 levels.

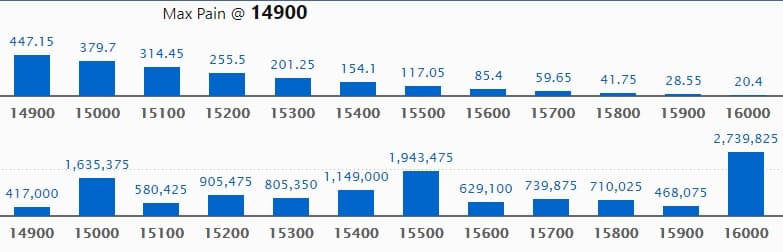

Call option data

Maximum Call open interest of 27.39 lakh contracts was seen at 16,000 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,500 strike, which holds 19.43 lakh contracts, and 15,000 strike, which has accumulated 16.35 lakh contracts.

Call writing was seen at 15,400 strike, which added 3.35 lakh contracts, followed by 16,000 strike which added 1.99 lakh contracts and 15,200 strike which added 1.82 lakh contracts.

Call unwinding was seen at 15,000 strike, which shed 1.79 lakh contracts, followed by 14,900 strike which shed 59,625 contracts and 15,100 strike which shed 48,975 contracts.

Put option data

Maximum Put open interest of 26.03 lakh contracts was seen at 14,500 strike, which will act as a crucial support level in the March series.

This is followed by 15,000 strike, which holds 21.50 lakh contracts, and 14,800 strike, which has accumulated 13.66 lakh contracts.

Put writing was seen at 15,200 strike, which added 1.9 lakh contracts, followed by 15,100 strike, which added 99,075 contracts and 14,400 strike which added 50,775 contracts.

Put unwinding was seen at 14,700 strike, which shed 8.25 lakh contracts, followed by 14,800 strike which shed 3.07 lakh contracts.

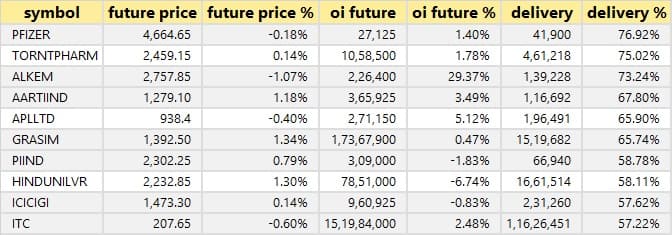

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

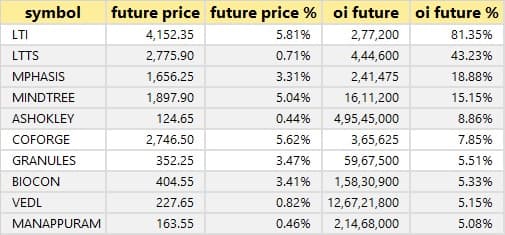

55 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

20 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

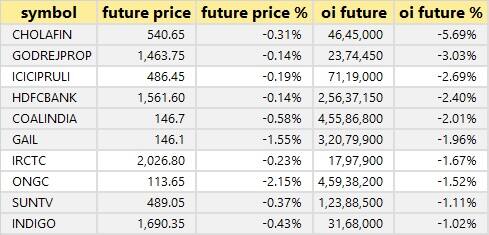

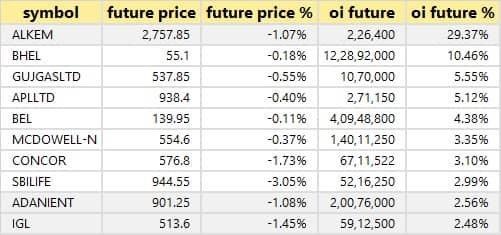

19 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

65 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

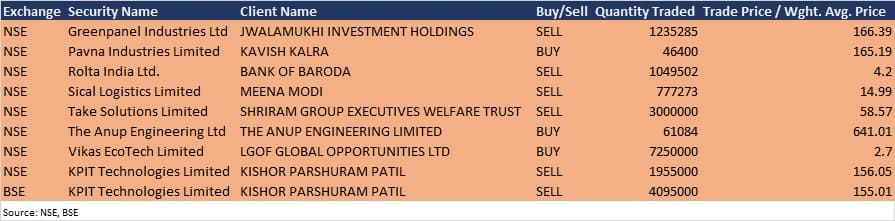

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Computer Age Management Services: The company's management will participate in a group investors call organised by Jefferies Financial Group on March 12.

Indostar Capital Finance: The conference calls are scheduled to be held on March 12 with analyst(s) / institutional investor(s) to discuss the performance of the company for quarter and nine months ended December 2020.

Polycab India: The company's officials will interact with Invesco on March 12, and will attend Jefferies India Mid-Cap Summit on March 16 and Citi Conference on March 17.

Rail Vikas Nigam: The management of the company will participate in a non-deal roadshow through video conferencing on March 12.

Genus Power Infrastructures: Top management of the company will have investors' update call with Fidelity International team on March 12.

Chemcon Speciality Chemicals: The officials of the company is slated to interact with few investors & analysts on March 12.

Bharat Petroleum Corporation: The Board of Directors of the company, on March 16, will consider proposal for declaration of 2nd interim dividend for the financial year 2020-21 and record date.

GAIL India: The company will consider payment of second interim dividend for FY 2020-21 on March 15.

Newgen Software Technologies: Official(s) of the company will participate and interact with several institutional investors/ funds/ analysts in the virtual investor conferences on March 16 and March 25.

Stocks in the news

Prestige Estates Projects: The company has completed phase 1 of proposed transaction with Blackstone Group. Phase 1 of the transaction included sale of twelve assets/undertakings comprising completed retail, office and hotel assets. The enterprise value forming part of phase 1 is approximately Rs 7,467 crore out of the total enterprise value of approximately Rs 9,160 crore. Phase 2 of the transaction is expected to get completed by the end of next quarter.

IDBI Bank: The bank has been taken out of Prompt Corrective Action (PCA) framework by the RBI. The bank has provided a written commitment that it would comply with the norms of minimum regulatory capital, net NPA and leverage ratio on an ongoing basis.

Pricol: ICRA revised rating on company's long term - fund based and term loan to BBB from BB+, with a Stable outlook.

NBCC India: The company received contracts for construction of cooling tower (NDCT) CT-1, 3 and 5 for Yadadri Thermal Power Station, (5x800 MW) owned by Telangana State Power Generation Corporation.

JSW Steel: The crude steel production in February 2021 declined to 13.06 lakh tonnes from 13.20 lakh tonnes in same month last year. The average capacity utilisation was 93 percent during February 2021.

AstraZeneca Pharma India: The company has received import and market permission in form CT-20 (subsequent new drug approval) from the Drugs Controller General of India for Osimertinib 40mg/80mg film coated tablets (TagrissoTM). The receipt of this permission paves way for the launch of Osimertinib 40mg/80mg film coated tablets into a new disease area in India.

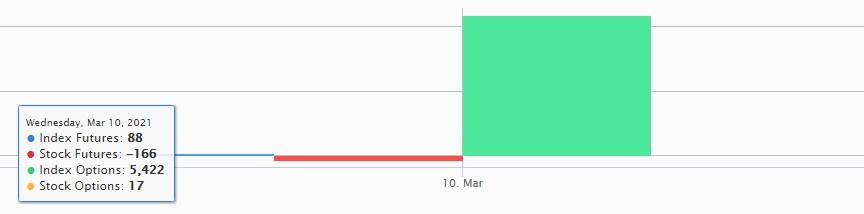

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net sold shares worth Rs 15.69 crore, while domestic institutional investors (DIIs) net acquired shares worth Rs 447.67 crore in the Indian equity market on March 10, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Four stocks - Bank of Baroda, Punjab National Bank, SAIL and Sun TV Network - are under the F&O ban for March 12. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!