The positive momentum, led by Budget and FII inflow continued in the equity market for the fourth consecutive session on February 4, with the Nifty50 hitting a record high of 14,914.

The S&P BSE Sensex climbed 358.54 points to 50,614.29, while the Nifty50 rose 105.70 points to 14,895.70 and formed a bullish candle on the daily charts.

"Technically, this pattern could signal uptrend continuation pattern, after the formation of a high wave-type candle on Wednesday. Hence, one may expect further upside in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The opening upside gap of February 2nd remains unfilled, three sessions after its formation. If this gap is unchallenged in the next couple of sessions, then that could be considered as a bullish breakaway gap, which is normally associated with crucial bottom reversals. Such happening could hint at more upside for the market in the near term," he said.

"The next upside target to be watched at 15,475, which is 1.618 percent Fibonacci extension (taken from the swing high of January 2020 and March 2020 low). Immediate support is placed at 14,750," he added.

The broader markets continued to see buying interest with the Nifty Midcap 100 index rising 1.06 percent and Smallcap 100 index up 1.55 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,769.1, followed by 14,642.5. If the index moves up, the key resistance levels to watch out for are 14,968 and 15,040.3.

Nifty Bank

The Nifty Bank settled at 35,344.80, rising 586.40 points or 1.69 percent on February 4. The important pivot level, which will act as crucial support for the index, is placed at 34,584.77, followed by 33,824.73. On the upside, key resistance levels are placed at 35,758.97 and 36,173.14.

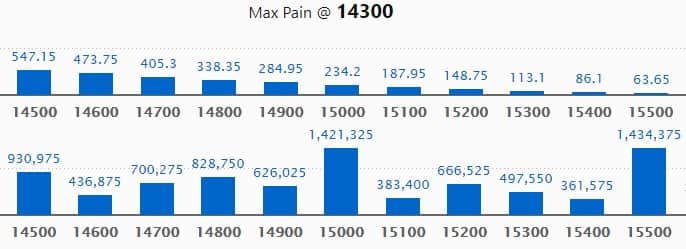

Call option data

Maximum Call open interest of 14.34 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the February series.

This is followed by 15,000 strike, which holds 14.21 lakh contracts, and 14,500 strike, which has accumulated 9.3 lakh contracts.

Call writing was seen at 15,500 strike, which added 2.43 lakh contracts, followed by 14,900 strike which added 2.33 lakh contracts and 15,300 strike which added 1.12 lakh contracts.

Call unwinding was seen at 14,000 strike, which shed 57,300 contracts, followed by 14,600 strike which shed 37,650 contracts and 14,200 strike which shed 21,675 contracts.

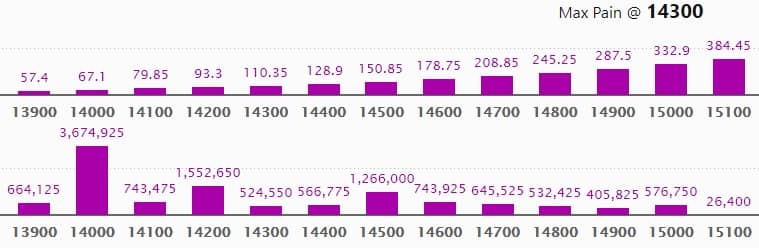

Put option data

Maximum Put open interest of 36.74 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the February series.

This is followed by 14,200 strike, which holds 15.52 lakh contracts, and 14,500 strike, which has accumulated 12.66 lakh contracts.

Put writing was seen at 14,000 strike, which added 3.6 lakh contracts, followed by 14,900 strike, which added 3.06 lakh contracts and 14,800 strike which added 1.65 lakh contracts.

There was hardly any Put unwinding seen on Thursday.

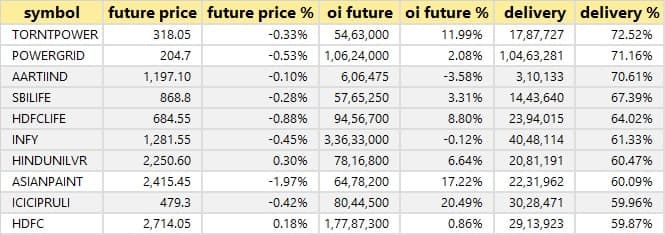

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

59 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

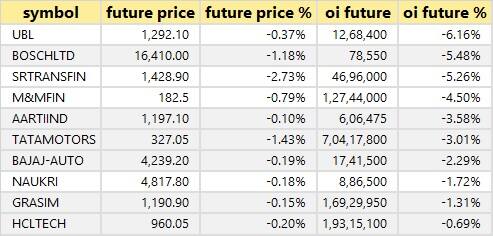

11 stocks saw long unwinding

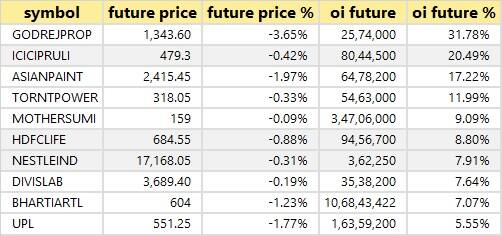

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

25 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

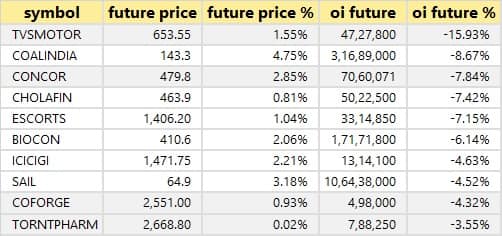

48 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

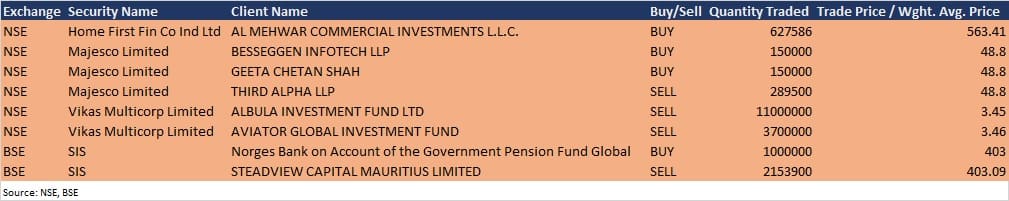

Bulk deals

(For more bulk deals, click here)

Britannia Industries, Mahindra & Mahindra, Punjab National Bank, Aditya Birla Capital, Alkem Laboratories, Ashoka Buildcon, Mrs Bectors Food Specialities, Cadila Healthcare, CG Power and Industrial Solutions, Equitas Holdings, Future Consumer, Fortis Healthcare, Gati, GSK Pharmaceuticals, Gujarat Gas, Jubilant Life Sciences, Narayana Hrudayalaya, Pfizer, RCF, Shipping Corporation of India etc are among 127 companies that are scheduled to release their quarterly earnings on February 5.

Stocks in the news

Bharat Electronics: The company entered into an offset contract with Russian company JSC Rosoboronexport.

PSP Projects: The company received additional work order worth Rs 236 crore for an institutional project at Gujarat, and is ranked L1 bidder for projects worth Rs 420.89 crore medical colleges construction in UP.

Container Corporation of India: The company reported a higher consolidated profit at Rs 234.3 crore for Q3FY21 against Rs 180.9 crore logged in Q3FY20. Revenue rose to Rs 1,766.9 crore from Rs 1,544.7 crore in the year-ago period.

Vedanta: The board approved an expansion of Lanjigarh alumina refinery from 2 MTPA to 5 MTPA at a cost of Rs 3,779 crore.

Godrej Agrovet: The company reported a higher consolidated profit of Rs 68 crore in Q3FY21 against Rs 51.2 crore in Q3FY20, revenue fell to Rs 1,526.2 crore from Rs 1,782.7 crore YoY.

Biocon: The company signed an agreement with the Clinton Health Access Initiative (CHAI), to expand access to lifesaving cancer biosimilars in over 30 countries in Africa & Asia.

Tata Power: The company reported higher consolidated profit at Rs 318.4 crore in Q3FY21 against Rs 260.1 crore in Q3FY20, while revenue increased to Rs 7,597.9 crore from Rs 7,071 crore YoY.

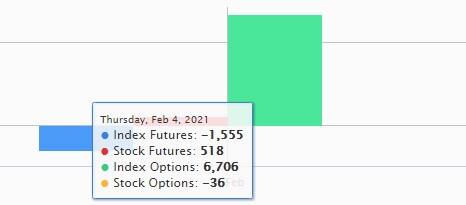

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,936.74 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 768.55 crore in the Indian equity market on February 4, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Two stocks - Punjab National Bank and SAIL - are under the F&O ban for February 5 as market is in the initial days of the February series. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!