The recovery in afternoon trade helped the market end at a record closing high on January 14, supported by index heavyweights. The overall market breadth has also recovered towards the close after showing a negative sign in the early part of the last session.

The BSE Sensex climbed 91.84 points to 49,584.16, while the Nifty50 rose 30.70 points to 14,595.60 and formed a bullish candle which resembles a Hanging Man kind of pattern formation on the daily charts.

"A small positive candle was formed on Thursday with minor lower shadow. This candle was placed beside the negative candle of the previous session. Technically, this pattern indicates a range movement in the market with buy on dips nature. This is a positive indication and further range movement in the market could open more space for upside in the short term," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"The underlying trend of Nifty remains range-bound with positive bias. There is a possibility of further upside and new high formation above 14,653 levels in the next couple of sessions, but one needs to be cautious about sharp profit booking from the new highs in the next 1-2 sessions. Immediate support is placed at 14,460 levels," he said.

The broad market indices like Nifty Midcap 100 index and Smallcap 100 index have closed 0.06 percent and 0.64 percent higher, respectively.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 14,505.47, followed by 14,415.33. If the index moves up, the key resistance levels to watch out for are 14,651.77 and 14,707.93.

Nifty Bank

The Nifty Bank fell 54.85 points to end at 32,519.80 on January 14. The important pivot level, which will act as crucial support for the index, is placed at 32,401.77, followed by 32,283.73. On the upside, key resistance levels are placed at 32,678.37 and 32,836.93.

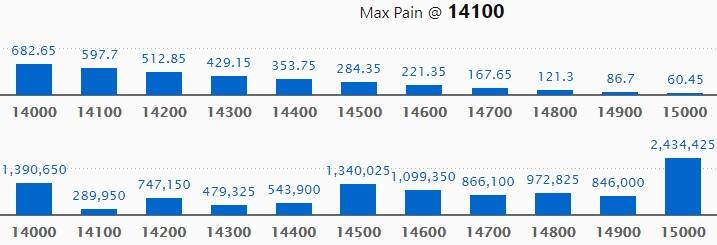

Call option data

Maximum Call open interest of 24.34 lakh contracts was seen at 15,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,000 strike, which holds 13.90 lakh contracts, and 14,500 strike, which has accumulated 13.40 lakh contracts.

Call writing was seen at 14,800 strike, which added 2.44 lakh contracts, followed by 14,600 strike which added 1.92 lakh contracts and 15,000 strike which added 1.2 lakh contracts.

Call unwinding was seen at 14,000 strike, which shed 1.26 lakh contracts, followed by 14,500 strike which shed 66,675 contracts and 14,200 strike which shed 62,400 contracts.

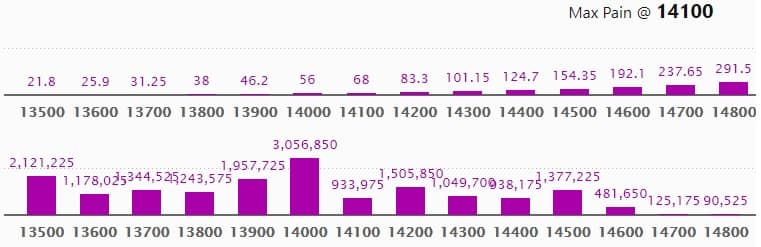

Put option data

Maximum Put open interest of 30.56 lakh contracts was seen at 14,000 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 21.21 lakh contracts, and 13,900 strike, which has accumulated 19.57 lakh contracts.

Put writing was seen at 13,700 strike, which added 1.98 lakh contracts, followed by 14,500 strike, which added 1.74 lakh contracts and 14,100 strike which added 1.3 lakh contracts.

Put unwinding was seen at 13,500 strike, which shed 78,000 contracts, followed by 13,900 strike, which shed 42,900 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

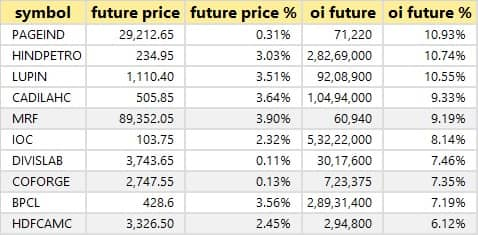

36 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

26 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

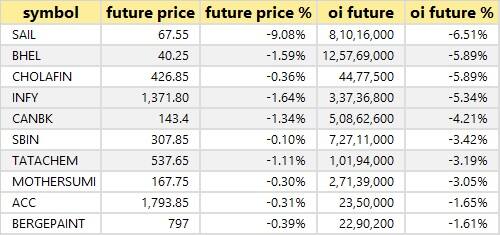

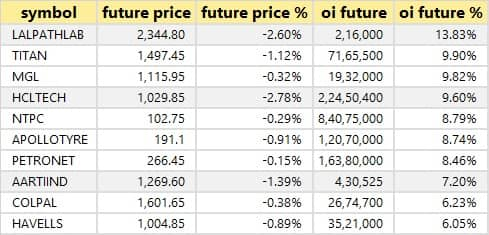

44 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

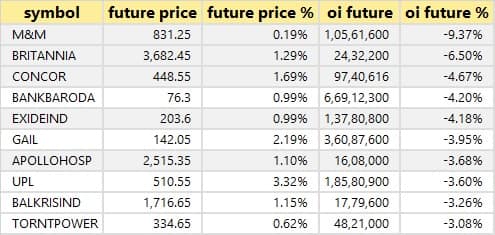

37 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

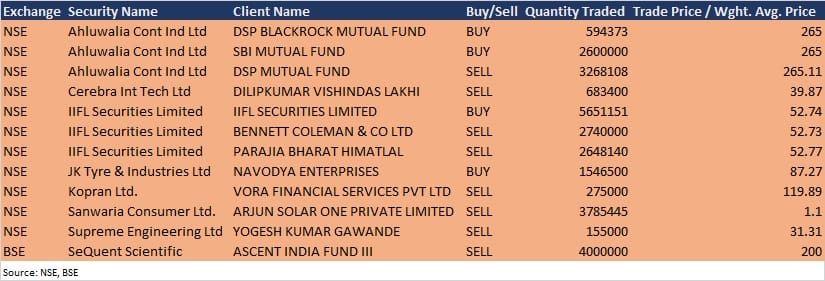

Bulk deals

(For more bulk deals, click here)

HCL Technologies, L&T Finance Holdings, PVR, Shoppers Stop, Bhakti Gems and Jewellery, Aditya Birla Money, Gautam Gems, Hathway Cable & Datacom, Indo Asian Finance, Mardia Samyoung Capillary Tubes, Next Mediaworks, Onward Technologies, Plastiblends India, Soril Infra Resources, Yaarii Digital Integrated Services and Ardi Investment will announce their quarterly earnings on January 15.

Stocks in the news

HFCL: The company reported sharply higher consolidated profit at Rs 82.2 crore in Q3FY21 against Rs 46.08 crore in Q3FY20; revenue jumped to Rs 1,277.5 crore from Rs 853.5 crore YoY.

Den Networks: The company reported a higher consolidated profit at Rs 65.5 crore in Q3FY21 against Rs 19.3 crore; revenue increased to Rs 342 crore from Rs 318 crore YoY.

L&T Infotech: The company to expand its multi-year, global alliance with IBM to help businesses transform their operations through open hybrid cloud adoption.

Bharti Airtel: MSCI said the company will be a part of the February 2021 Quarterly Review.

Hindusthan National Glass: Ironwood Investment Holdings lowered its stake in the company to 5.09% from 7.09% earlier via open market transaction.

Dishman Carbogen Amcis: Promoter Adimans Technologies LLP reduced stake in the company to 59.32% from 61.93% earlier, via offer for sale route.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,076.62 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 188.1 crore in the Indian equity market on January 14, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

One stock - BHEL - is under the F&O ban for January 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!