The market failed to hold on to the 14,000 mark and closed the volatile session on a flat note on December 31, the expiry day for December futures and options contracts, but gained 15 percent for the year 2020.

The BSE Sensex rose 5.11 points to 47,751.33, while the Nifty50 was down 0.20 point at 13,981.80 and formed Doji kind of pattern on the daily charts as closing was near opening levels.

"Technically, while the short term uptrend is intact, markets are showing signs of tiredness as selling pressure is emerging from the highs. The moving averages on the intraday charts too have flattened indicating the short term uptrend is matured. Markets could therefore consolidate in a range for the next few sessions. Short term supports to watch for a trend reversal are at 13,864," Subash Gangadharan, Technical and Derivative Analyst at HDFC Securities told Moneycontrol.

Shrikant Chouhan, Executive Vice President - Equity Technical Research at Kotak Securities also feels the texture of charts clearly suggested the short term trend is still up but strong possibility of intraday correction is not ruled out if the index trades below 13,935.

On the flip side, 14,025 would be the immediate hurdle for the day traders, above the same we could expect further uptrend till 14,075-14,125, he said.

The broader markets outperformed benchmarks as the Nifty Midcap index was up half a percent and Smallcap gained third of a percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 13,937.27, followed by 13,892.73. If the index moves up, the key resistance levels to watch out for are 14,025.57 and 14,069.33.

Nifty Bank

The Nifty Bank fell 39 points to 31,264 on December 31. The important pivot level, which will act as crucial support for the index, is placed at 31,098.3, followed by 30,932.5. On the upside, key resistance levels are placed at 31,419.7 and 31,575.3.

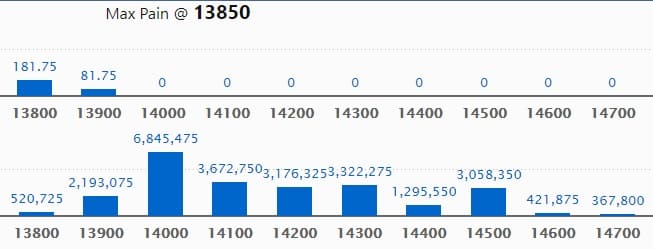

Call option data

Maximum Call open interest of 68.45 lakh contracts was seen at 14,000 strike, which will act as a crucial resistance level in the January series.

This is followed by 14,100 strike, which holds 36.72 lakh contracts, and 14,300 strike, which has accumulated 33.22 lakh contracts.

Call writing was seen at 14,000 strike, which added 16.31 lakh contracts, followed by 14,600 strike which added 22,125 contracts.

Call unwinding was seen at 13,900 strike, which shed 7.64 lakh contracts, followed by 13,800 strike which shed 6.7 lakh contracts and 14,300 strike which shed 4.74 lakh contracts.

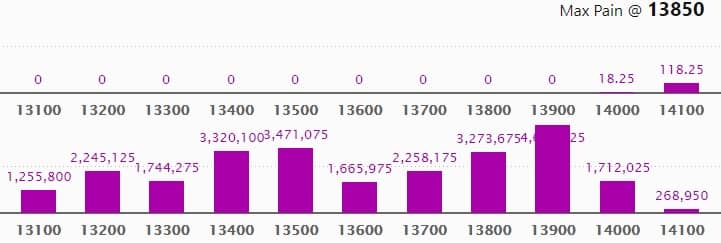

Put option data

Maximum Put open interest of 46.80 lakh contracts was seen at 13,900 strike, which will act as crucial support level in the January series.

This is followed by 13,500 strike, which holds 34.71 lakh contracts, and 13,400 strike, which has accumulated 33.20 lakh contracts.

Put writing was seen at 13,900 strike, which added 3.43 lakh contracts, followed by 14,400 strike, which added 4,875 contracts.

Put unwinding was seen at 13,400 strike, which shed 10.67 lakh contracts, followed by 13,700 strike, which shed 9.7 lakh contracts and 13,500 strike which shed 7.44 lakh contracts.

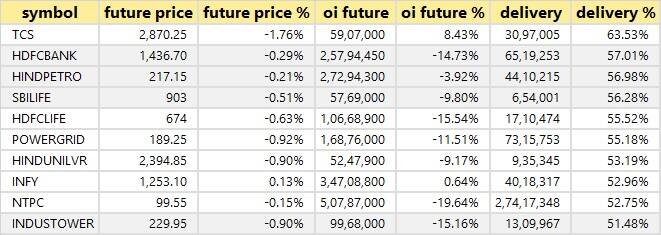

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

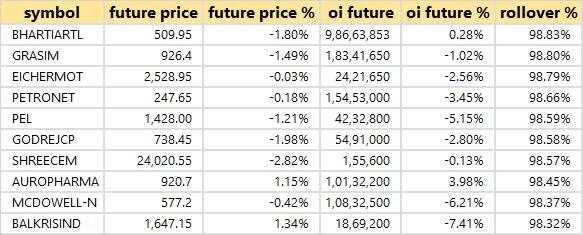

Rollovers

4 stocks saw long build-up

Based on the open interest future percentage, here are the 4 stocks in which a long build-up was seen.

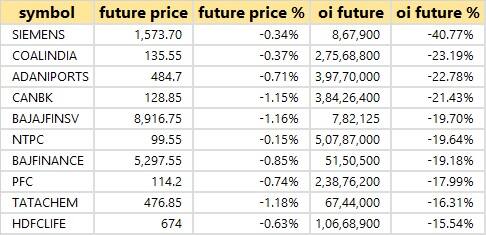

83 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

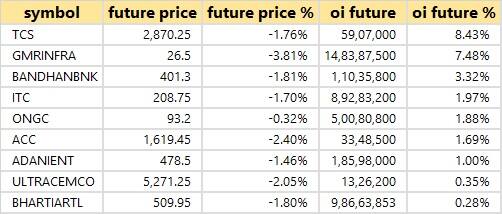

9 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the 9 stocks in which a short build-up was seen.

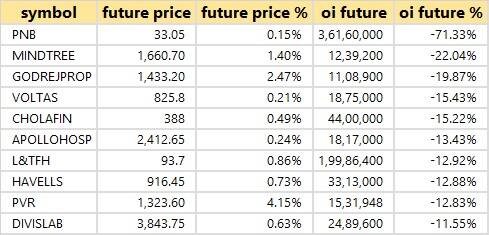

43 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

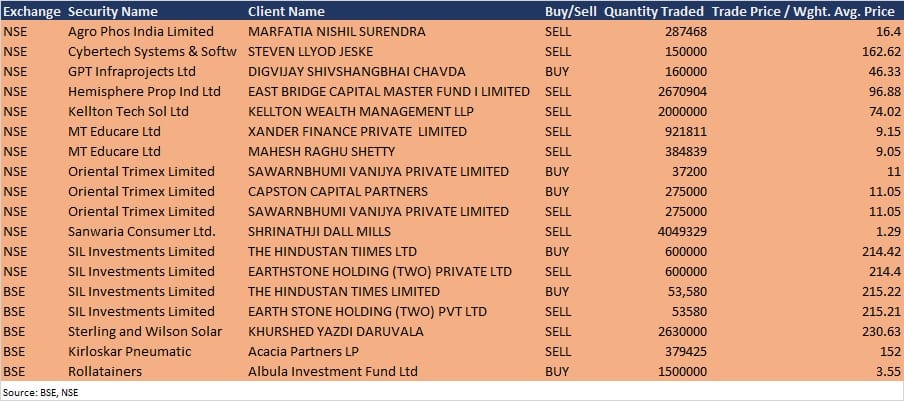

Bulk deals

(For more bulk deals, click here)

Analysts/Board Meetings

Dixon Technologies: Company's officials will interact with Emkay Global on January 1.

Sastasundar Ventures: Company's officials will interact with several investors/analysts on January 4.

Tips Industries: Board meeting is scheduled on January 5 to consider demerger of the film business.

HDFC Life Insurance Company: Board meeting is scheduled on January 22 to consider December quarter results.

L&T Technology Services: Board meeting is scheduled on January 20 to consider December quarter results.

HDFC AMC: Board meeting is scheduled on January 20 to consider December quarter results.

Mahindra EPC Irrigation: Board meeting is scheduled on January 27 to consider December quarter results.

Zensar Technologies: Board to consider Q3 results & interim dividend on January 21.

Novartis India: Board meeting is scheduled on February 11 to consider December quarter results.

Stocks in the news

Antony Waste Handling Cell: Company to list shares on bourses on January 1, issue price has been fixed at Rs 315 per share.

UPL: Promoter Jaidev Rajnikant Shroff bought 3,98,500 Global Depository Receipts equivalent to 7,97,000 equity shares of UPL, representing 0.10% of the total share capital of the company.

Infibeam Avenues: Company divested its 100% ownership with control in its wholly owned subsidiary Cardpay Technologies to its subsidiary Instant Global Paytech.

HSIL: Company closed its share buyback offer.

CRISIL Ratings: Company received the necessary approvals from SEBI and RBI to undertake the Ratings business transferred to it pursuant to the scheme.

IDBI Bank: Bank completed sale of its 23% stake in IDBI Federal Life Insurance, to Ageas for Rs 507.10 crore.

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 1,136 crore, whereas domestic institutional investors (DIIs) net sold shares worth Rs 258 crore in the Indian equity market on December 31, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!