The market had a stellar rally with the benchmark indices rising 1.6 percent after Federal Reserve policy meeting and easing of China's Evergrande issue, on September 23. Bulls turned out to be a big winner, having a upper hand at Dalal Street.

The benchmark indices ended at record closing high. The BSE Sensex surged 958.03 points to 59,885.36, while the Nifty50 climbed 276.30 points to 17,823 and formed bullish candle on the daily charts as the closing was higher than opening levels.

"Markets continued to scale new highs on the back of abundant liquidity and strong global cues, with Sensex almost on the verge of hitting the 60,000 peaks. The upsurge was mainly on the back of impressive gains in realty stocks," said Shrikant Chouhan, Head of Equity Research (Retail) at Kotak Securities.

In the short term, benchmark Nifty has formed a strong bullish breakout candle and has consistently maintained higher bottom series formation, which supports further uptrend from current levels, he added.

"For day traders, 17,800-17,750-17,720 would be key support levels. On the other hand, 17,900-17,950-17,990 could act as a major resistance level in the short run," said Chouhan who advised contra traders to take a long bet between 17,750-17,720 with a strict 16,910 support stop loss.

The broader markets also participated in the rally as the Nifty Midcap 100 index gained 1.49 percent and Smallcap 100 index rose 0.78 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty are placed at 17,698.37, followed by 17,573.83. If the index moves up, the key resistance levels to watch out for are 17,895.67 and 17,968.43.

Nifty Bank

The Nifty Bank also joined the bulls' party, rising 827 points or 2.24 percent to 37,771.70 on September 23. The important pivot level, which will act as crucial support for the index, is placed at 37,381.61, followed by 36,991.5. On the upside, key resistance levels are placed at 37,996.3 and 38,220.9 levels.

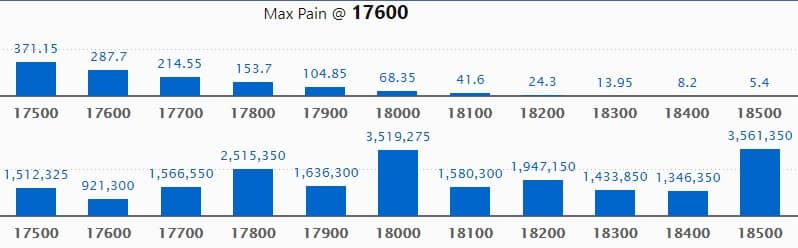

Call option data

Maximum Call open interest of 35.61 lakh contracts was seen at 18500 strike, which will act as a crucial resistance level in the September series.

This is followed by 18000 strike, which holds 35.19 lakh contracts, and 17800 strike, which has accumulated 25.15 lakh contracts.

Call writing was seen at 18500 strike, which added 25.93 lakh contracts, followed by 18000 strike, which added 15.4 lakh contracts and 18400 strike which added 11.20 lakh contracts.

Call unwinding was seen at 17600 strike, which shed 8.19 lakh contracts, followed by 17500 strike, which shed 7.49 lakh contracts, and 17400 strike which shed 3.64 lakh contracts.

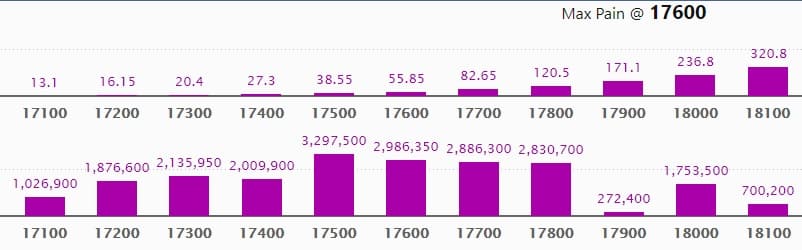

Put option data

Maximum Put open interest of 32.97 lakh contracts was seen at 17500 strike, which will act as a crucial support level in the September series.

This is followed by 17600 strike, which holds 29.86 lakh contracts, and 17700 strike, which has accumulated 28.86 lakh contracts.

Put writing was seen at 17800 strike, which added 19.83 lakh contracts, followed by 17700 strike which added 17.46 lakh contracts, and 17600 strike which added 13.30 lakh contracts.

Put unwinding was seen at 17200 strike, which shed 40,750 contracts, followed by 17100 strike which shed 23,600 contracts and 18500 strike which shed 2,350 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

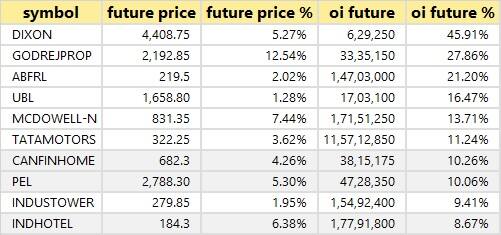

82 stocks saw long build-up

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks in which a long build-up was seen.

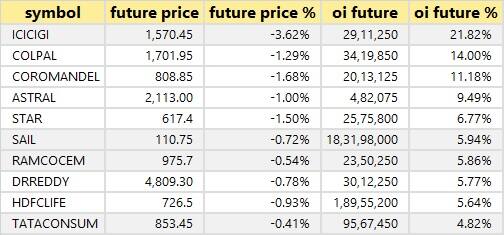

13 stocks saw long unwinding

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

27 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen.

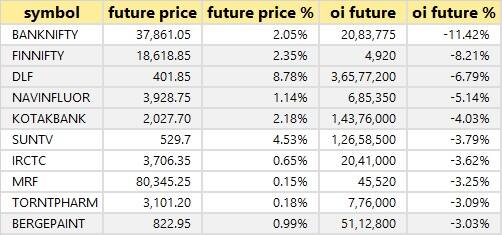

52 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

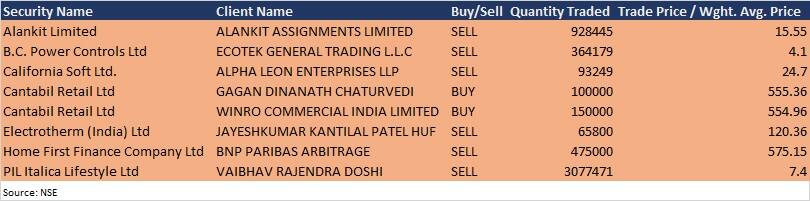

Bulk deals

Alankit: Promoter Alankit Assignments sold 9,28,445 equity shares in the company at Rs 15.55 per share on the NSE, the bulk deals data showed.

Home First Finance Company: BNP Paribas Arbitrage sold 4.75 lakh equity shares in the company at Rs 575.15 per share on the NSE, the bulk deals data showed.

(For more bulk deals, click here)

Analysts/Investors Meeting

Blue Star: The company's officials will meet analysts and institutional investors in Equirus Virtual Annual Conference on September 24.

Gokaldas Exports: The company's officials will meet GMO Investment and Asset Management on September 24.

Aptus Value Housing Finance India: The company's officials will meet Kotak Research on September 24.

Trident: The company's officials will meet HSBC Mutual Fund on September 24.

Hindalco Industries: The company's officials will meet ICICI Prudential Life Insurance on September 24, ICICI Prudential Asset Management on September 28, and Aditya Birla Sunlife Asset Management on September 30.

Mahindra Holidays & Resorts India: The company's officials will meet Ambit Capital on September 24, Dolat Capital on September 27, and RARE Enterprises on September 29.

Somany Home Innovation: The company's officials will meet investors and analysts in Dart India Virtual Conference Series 2021 on September 24.

Nuvoco Vistas Corporation: The company's officials will meet IDFC MF on September 27, and Torq Capital Management on September 30.

Jubilant Pharmova: The company's officials will meet investors and analysts in Equirus Virtual Annual Conference 2021 on September 27.

Indo Count Industries: The company's officials will meet analysts on September 27.

Stocks in News

Sansera Engineering: The company will list its equity shares on September 24. The final issue price has been fixed at Rs 744 per share.

Dilip Buildcon: Supreme Court confirmed appointment of Dilip Buildcon & VPR Mining Infrastructure, as the mine developer cum operator, by Punjab State Power Corporation at the Pachhwara Central Coal Block Mine. The total contract value of the tender is Rs 32,156.04 crore.

Globus Spirits: National Company Law Tribunal approved the scheme of arrangement between Unibev and Globus Spirits.

HealthCare Global Enterprises: ICRA has upgraded rating for the long term bank facilities of HealthCare Global Enterprises to A+/Stable from A-/Stable and short term facilities to A1 from A2+.

Ahluwalia Contracts (India): SBI Funds Management acquired 2.5 lakh equity shares in the company via open market transaction, increasing shareholding to 7.7669% from 7.3937% earlier.

PVR: CRISIL downgraded long term credit rating on company's bank loan facilities to A+/Negative from AA-/Negative, and short term rating to A1 from A1+.

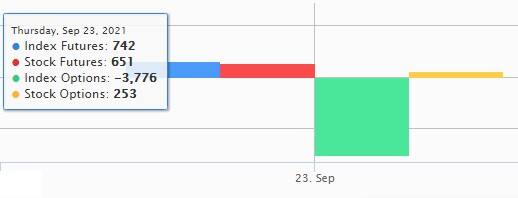

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net acquired shares worth Rs 357.93 crore, while domestic institutional investors (DIIs) net purchased shares worth Rs 1,173.09 crore in the Indian equity market on September 23, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

Six stocks - Canara Bank, Escorts, Indiabulls Housing Finance, Vodafone Idea, IRCTC, and Punjab National Bank - are under the F&O ban for September 24. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!