The market, after a strong start, witnessed some profit booking in the last couple of hours of trade but closed higher for the sixth consecutive session on October 8. Buying in IT stocks driven by TCS' earnings with a share buyback and banking stocks ahead of the Reserve Bank of India's monetary policy lifted sentiments.

The BSE Sensex rose 303.72 points to close at 40,182.67, while the Nifty50 was up 95.70 points at 11,834.60, the fresh seven-month high, and formed Doji kind of pattern on daily charts as closing was near its opening levels, which indicated that traders seem to be clueless about further direction.

"A formation of Doji type pattern at the swing high of 11,905 could be crucial for bulls to sustain the highs and could be considered as a reversal pattern (top reversal) post confirmation. Hence, any weakness in the next session is expected to open profit booking in the market from the highs," Nagaraj Shetti, Technical Research Analyst at HDFC Securities told Moneycontrol.

"Today's upmove and the formation of new swing high seem to have negated the previous reversal pattern of Bearish Engulfing (August 20) as per daily and weekly timeframe chart, as Nifty closed above 11,794 on Thursday. If Nifty closes above 11,850 by Friday, then one may consider such action as a bullish pattern and more upside could open," he said.

The broader markets ended mixed with negative breadth. About five shares declined for every four advancing shares on the NSE.

Among sectors, the Nifty IT index was a lead gainer with 3.2 percent rally and Pharma was up 2.5 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three- month data and not of the current month only.

Key support and resistance levels on the Nifty

According to pivot charts, the key support levels for the Nifty is placed at 11,781.97, followed by 11,729.33. If the index moves up, the key resistance levels to watch out for are 11,896.47 and 11,958.33.

Nifty Bank

The Bank Nifty jumped 226.50 points or 1 percent to end at 23191.30 on October 8. The important pivot level, which will act as crucial support for the index, is placed at 23,019.63, followed by 22,847.96. On the upside, key resistance levels are placed at 23,406.93 and 23,622.57.

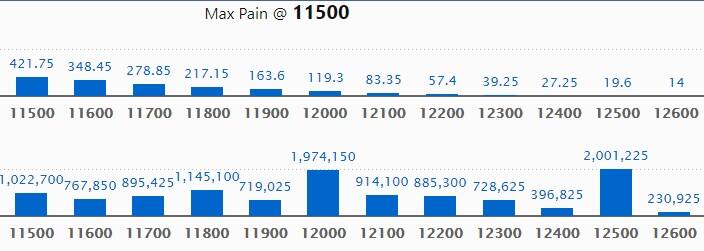

Call option data

Maximum Call open interest of 20.01 lakh contracts was seen at 12,500 strike, which will act as crucial resistance in the October series.

This is followed by 12,000 strike, which holds 19.74 lakh contracts, and 11,800 strike, which has accumulated 11.45 lakh contracts.

Call writing was seen at 12,500 strike, which added 1.94 lakh contracts, followed by 12,200 strike which added 1.84 lakh contracts and 12,100 strike which added 1.83 lakh contracts.

Call unwinding was seen at 11,700 strike, which shed 2.04 lakh contracts, followed by 11,600 strike, which shed 1.53 lakh contracts and 11,500 strike which shed 1.5 lakh contracts.

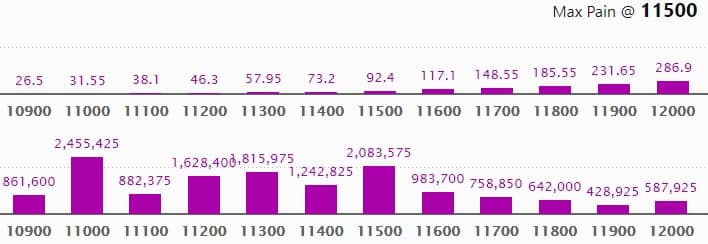

Put option data

Maximum Put open interest of 24.55 lakh contracts was seen at 11,000 strike, which will act as crucial support in the October series.

This is followed by 11,500 strike, which holds 20.83 lakh contracts, and 11,300 strike, which has accumulated 18.15 lakh contracts.

Put writing was seen at 11,800 strike, which added 3.72 lakh contracts, followed by 11,500 strike, which added 2.78 lakh contracts and 11,900 strike which added 2.43 lakh contracts.

Put unwinding was witnessed at 11,100 strike, which shed 1.24 lakh contracts, followed by 11,000 strike which shed 67,725 contracts.

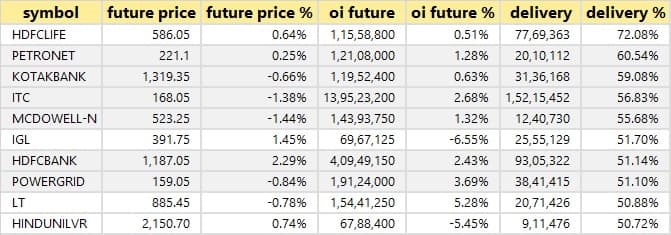

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

43 stocks saw long build-up

Based on the open interest future percentage, here are the top 10 stocks in which long build-up was seen.

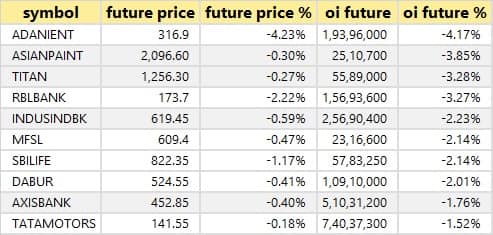

22 stocks saw long unwinding

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen.

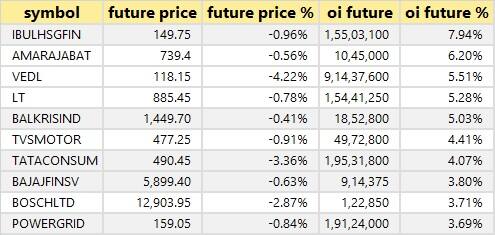

34 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are top 10 stocks in which short build-up was seen.

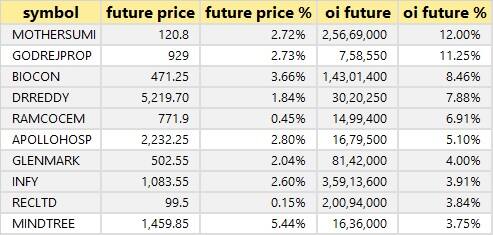

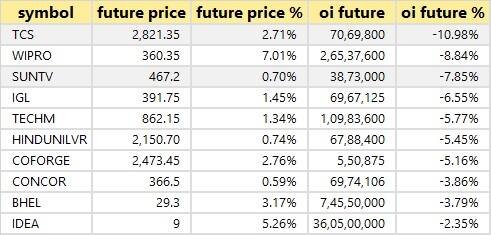

38 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

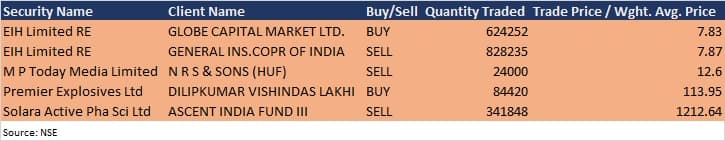

Bulk deals

(For more bulk deals, click here)

Results on October 9

Rashtriya Chemicals & Fertilizers, Steel Strips Wheels, Integrated Capital Services, Indian Acrylics and Terai Tea will announce their quarterly earnings on October 9.

Stocks in the news

Adani Green Energy: Fitch affirmed Adani Green Energy Restricted Group 2's notes at 'BBB-', and the outlook is Negative.

Solara Active Pharma: Ascent India Fund III sold 3,41,848 shares in the company at Rs 1,212.64 per share on the NSE.

Solar Industries India: The company and its subsidiary Economic Explosives have received orders from Singareni Collieries Company (SCCL) for the supply of explosives and initiating systems worth Rs 447 crore, to be delivered over a period of two years.

GOCL Corporation: Subsidiary IDL Explosives (IDLEL) has bagged an order of Rs 186.78 crore from Singareni Collieries Company for the supply of bulk explosives and accessories.

Surya Roshni: CARE reaffirmed credit ratings at A+ for the company's long term facilities, A1 for short term facilities and A1+ for commercial papers.

Srikalahasthi Pipes: Belgrave Investment Fund increased stake in the company to 5.80 percent from 4.95 percent earlier.

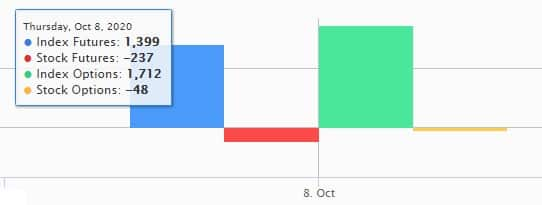

Fund flow

FII and DII data

Foreign institutional investors (FIIs) net bought shares worth Rs 978.37 crore, while domestic institutional investors (DIIs) net bought shares worth Rs 19.85 crore in the Indian equity market on October 8, as per provisional data available on the NSE.

Stock under F&O ban on NSE

Four stocks - Adani Enterprises, BHEL, Vodafone Idea and Vedanta - are under the F&O ban for October 9. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!