The market witnessed a pullback after opening the gap down and closed well off the day's low by taking support at the 19,500 area on October 19. Hence, if the said levels of 19,600-19,500 get hold in the coming days, then further pullback towards 19,700-19,800 is most likely, experts said, adding in case the index breaks the support zone, then the correction may be seen towards the 19,300 mark.

The BSE Sensex dropped 248 points to 65,629 while the Nifty50 declined 46 points to 19,625 and formed a bullish candlestick pattern with an upper shadow on the daily charts.

"On the daily charts, the Nifty has taken support at 19,530–19,500 zones where support in the form of the 61.82 percent Fibonacci retracement level of the previous rise form 19,333–19,850 is placed," Jatin Gedia, technical research analyst at Sharekhan by BNP Paribas said.

He believes that Thursday's low of 19,512 shall act as a crucial support and until that is not breached on the downside, one can expect the Nifty to witness a pullback towards 19,730-19,800 from a short-term perspective.

The broader markets have a mixed trend with the Nifty Midcap 100 index falling 0.1 percent and Smallcap 100 index rising 0.15 percent.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks are the aggregates of three-month data and not just the current month.Key support and resistance levels on Nifty

The pivot point calculator indicates that the Nifty may be taking support at 19,542 followed by 19,502 and 19,437. On the higher side, 19,671 can be an immediate resistance followed by 19,711 and 19,776.

On October 19, the Bank Nifty also narrowed its losses to end down by 134 points at 43,755 and formed a bullish candlestick pattern with a long upper shadow on the daily charts, which resembles an Inverted Hammer kind of pattern. This is a bullish reversal pattern formed at the downtrend, increasing the significance of likely bounce back in the coming session.

"The index currently faces immediate resistance at the 44,000 level, while the support is situated at 43,500. A decisive breakout in either direction from this range is expected to lead to significant trending moves," Kunal Shah, senior technical & derivative analyst at LKP Securities said.

He feels the prevailing sentiment for the Bank Nifty remains tilted toward a "sell on rise" approach, implying that traders are more inclined to sell the index during price rallies.

Strong resistance is observed at 44,500, and a closing price above this level would indicate a resumption of the uptrend, Kunal said.

As per the pivot point calculator, the banking index is expected to take support at 43,599 followed by 43,481 and 43,290. On the upside, the initial resistance is at 43,982 then at 44,100 and at 44,291.

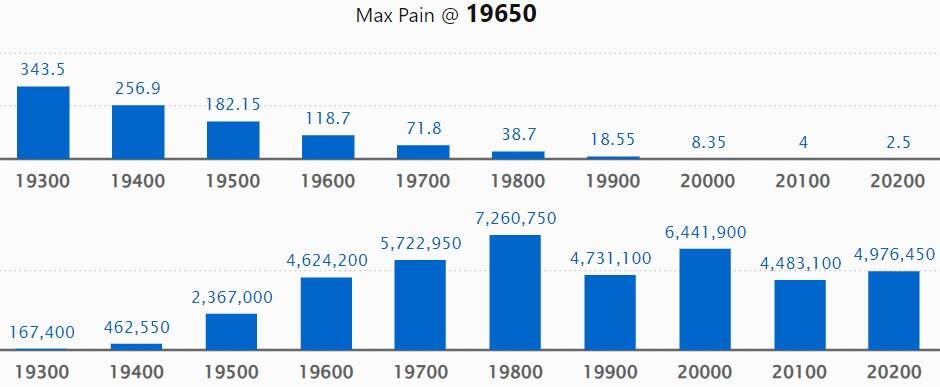

As per monthly options data, the maximum Call open interest (OI) remained at 19,800 strike with 72.6 lakh contracts, which can act as a key resistance for the Nifty. It was followed by the 20,000 strike, which had 64.41 lakh contracts, while the 19,700 strike had 57.22 lakh contracts.

Meaningful Call writing was seen at 19,600 strike, which added 31.1 lakh contracts followed by 20,200 and 20,100 strikes, which added 26.55 lakh and 23.11 lakh contracts.

Maximum Call unwinding was visible at 19,000 strike, which shed 46,450 contracts followed by 19,100 and 18,500 strikes, which shed 22,650 and 22,400 contracts.

On the Put side, the maximum open interest was seen at 19,500 strike with 73.22 lakh contracts, which can act as immediate support for the Nifty50 in coming sessions.

It was followed by 19,000 strike comprising 72.4 lakh contracts and 19,600 strike with 56.17 lakh contracts.

The meaningful Put writing was at 19,600 strike, which added 21.08 lakh contracts followed by 19,500 strike and 19,000 strike, which added 20.31 lakh and 18.89 lakh contracts.

Put unwinding was at 19,800 strike, which shed 5.39 lakh contracts followed by 19,700 strike and 19,900 strike, which shed 3.52 lakh and 1.52 lakh contracts.

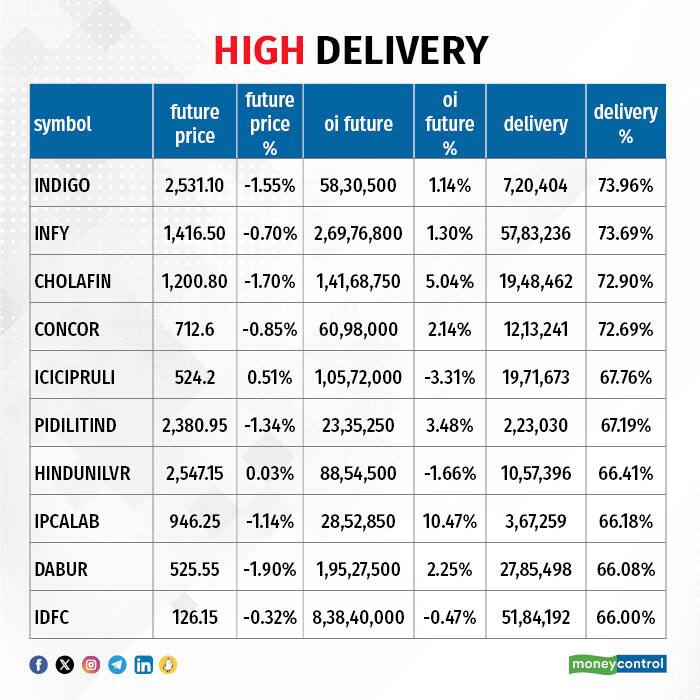

Stocks with high delivery percentage

A high delivery percentage suggests that investors are showing interest in the stock. InterGlobe Aviation, Infosys, Cholamandalam Investment & Finance, Container Corporation of India and ICICI Prudential Life Insurance Company saw the highest delivery among the F&O stocks.

A long build-up was seen in 41 stocks including Bajaj Auto, Nestle India, UltraTech Cement, M&M Financial Services and L&T Technology Services. An increase in open interest (OI) and price indicates a build-up of long positions.

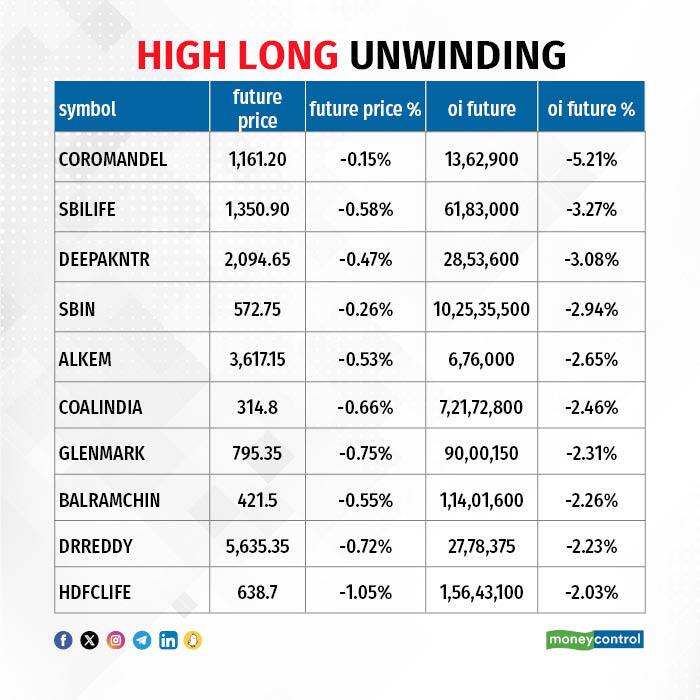

Based on the OI percentage, a total of 43 stocks, including Coromandel International, SBI Life Insurance Company, Deepak Nitrite, State Bank of India and Alkem Laboratories saw a long unwinding. A decline in OI and price indicates long unwinding.

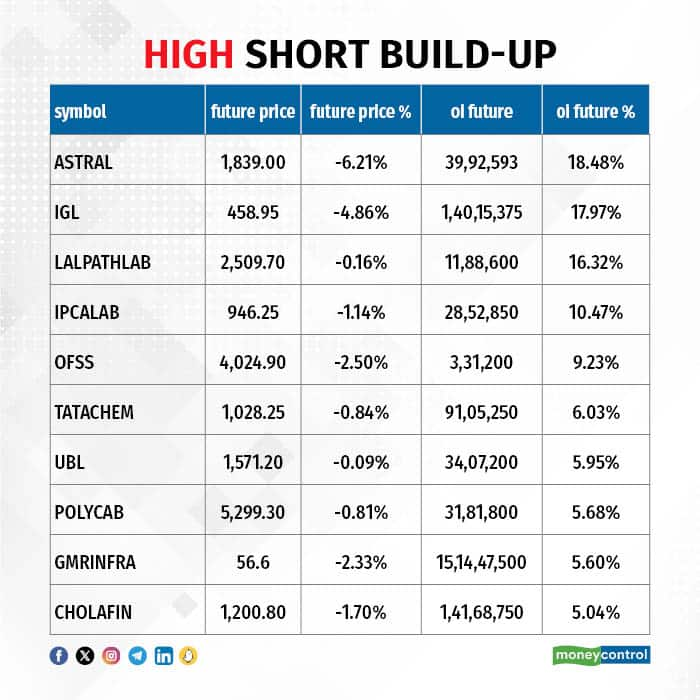

71 stocks see a short build-up

A short build-up was seen in 71 stocks, including Astral, Indraprastha Gas, Dr Lal PathLabs, Ipca Laboratories and Oracle Financial. An increase in OI along with a fall in price points to a build-up of short positions.

Based on the OI percentage, 32 stocks were on the short-covering list. These included Persistent Systems, Coforge, JK Cement, Indian Energy Exchange and Havells India. A decrease in OI along with a price increase is an indication of short-covering.

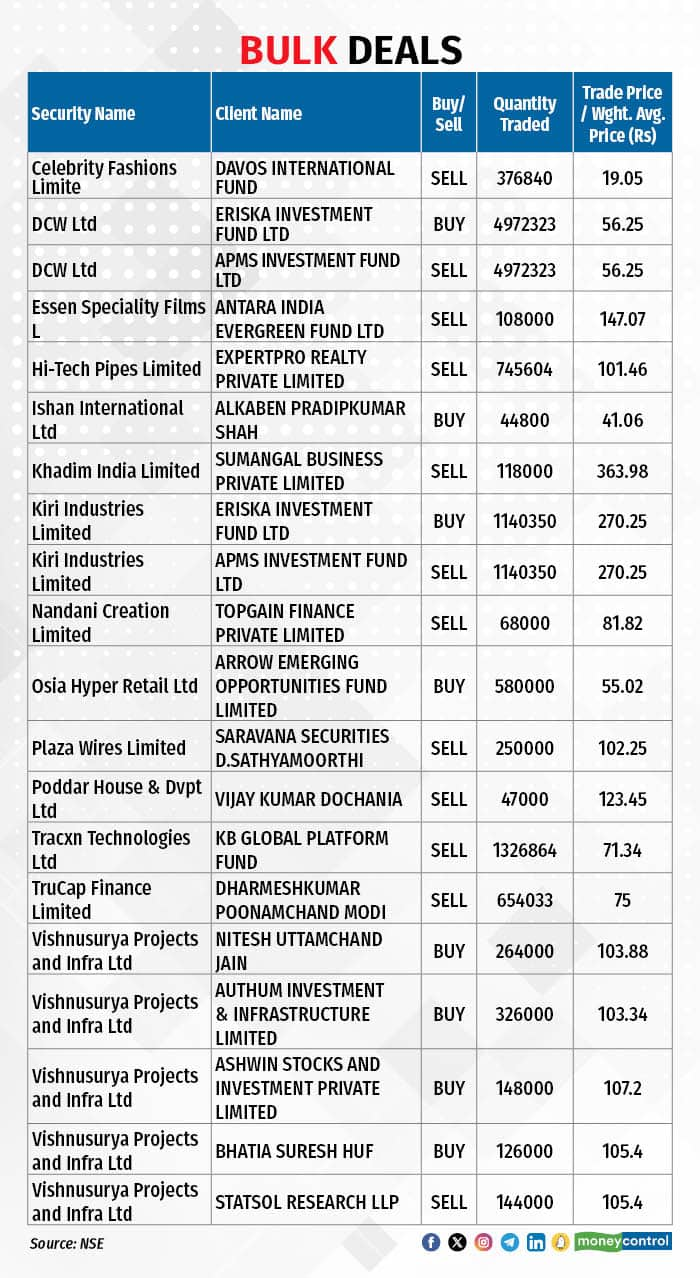

For more bulk deals, click here

Results on October 20 and October 21

Stocks in the news

Hindustan Unilever: The FMCG major recorded a 3.9 percent on-year growth in standalone profit at Rs 2,717 crore for the quarter ended September FY24, beating analysts' estimates with better-than-expected operating margin performance and lower input cost. Standalone revenue from operations grew by 3.6 percent YoY to Rs 15,276 crore for the quarter. The board has approved an interim dividend of Rs 18 per share for the year.

Zomato: SoftBank-owned Svf Growth (Singapore) Pte Ltd is likely to sell a stake worth around Rs 1,000 crore in Zomato, the food delivery giant, sources told Moneycontrol. SoftBank is planning to sell a 1.1 percent stake via block deals. Svf Growth holds a 2.22 percent stake in Zomato as of September 2023, which is valued at Rs 2,090 crore at the closing price of Rs 111.7 per share on October 19.

Natco Pharma: The United States Food and Drug Administration (USFDA) has conducted an inspection of the company's pharma division in Kothur, Hyderabad, during October 9-18. At the end of the inspection, the said facility received eight observations. The company is working with USFDA to close them at the earliest.

Indoco Remedies: The United States Food and Drug Administration (USFDA) has conducted a pre-approval inspection at the company's solid oral formulation facility in Goa during October 12-18. The pre-approval inspection was conducted for two drug product applications (ANDAs) filed from this facility. The USFDA has issued four observations in Form 483 at the end of the pre-approval inspection.

Tata Motors: The Tata Group company has entered into a share purchase agreement and other agreements to acquire a 26.79 percent stake in logistics solutions company Freight Commerce Solutions (Freight Tiger) for Rs 150 crore. The agreement also includes a provision enabling Tata Motors to further invest Rs 100 crore over the next two years.

Jindal Stainless: The stainless steel company has recorded a 74 percent on-year growth in standalone profit at Rs 609 crore for the quarter ended September FY24, with revenue growing 14 percent to Rs 9,720 crore and EBITDA increasing 54 percent to Rs 1,070 crore during the same period. The standalone sales volume for the second quarter of FY24 stood at 5,43,619 metric tonnes (MT), up by nearly 26 percent YoY due to robust domestic demand.

Havells India: The electrical equipment company has registered a 33 percent year-on-year growth in profit at Rs 249 crore for the quarter ended September FY24, driven by healthy operating numbers. Revenue from operations for the quarter increased by 6 percent to Rs 3,891 crore during the same period led by switchgears and cable segments.

Fund Flow (Rs Crore)

Foreign institutional investors (FII) sold shares worth Rs 1,093.47 crore, while domestic institutional investors (DII) purchased Rs 736.15 crore worth of stocks on October 19, provisional data from the National Stock Exchange (NSE) showed.

Stocks under F&O ban on NSE

The NSE has retained Balrampur Chini Mills, Delta Corp, GNFC, Indiabulls Housing Finance, India Cements, Manappuram Finance, and MCX India to its F&O ban list for October 20. Hindustan Copper and SAIL have been removed from the said list.

Securities banned under the F&O segment include companies where derivative contracts cross 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol are their own and not those of the website or its management. Moneycontrol advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!