Hindustan Unilever shares gained 4.12 percent to close at Rs 1,825.90 Monday after the company decided to merge Glaxosmithkline Consumer Healthcare with itself. GSK Consumer shares rallied 3.75 percent to Rs 7,542.85 on the BSE.

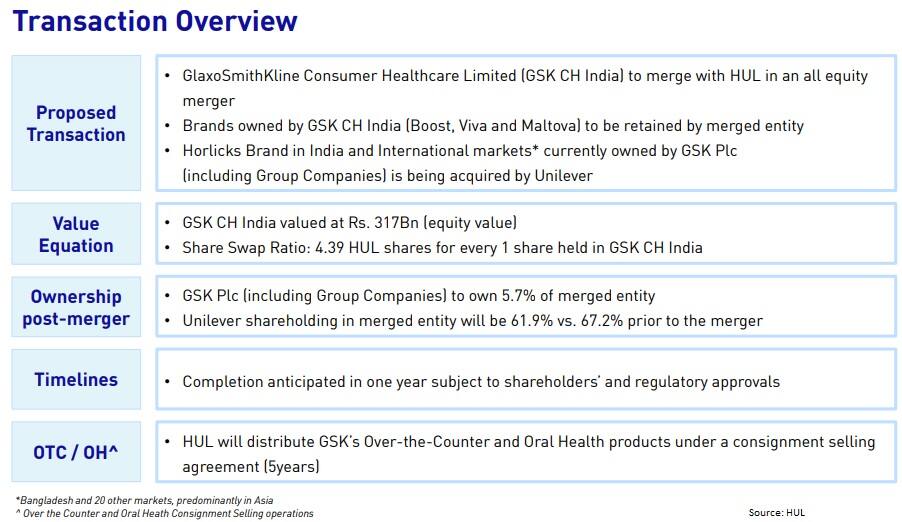

"Board of directors approved a scheme of amalgamation between the company and GlaxoSmithKline Consumer Healthcare (GSK CH India) subject to obtaining requisite approvals from statutory authorities and shareholders," the FMCG major said in its filing.

The transaction is an all equity merger with 4.39 shares of HUL being allotted for every share in GSK CH India, it added.

This transaction values the total business of GSK Consumer India at Rs 31,700 crore. Following the issue of new HUL shares, Unilever's holding in HUL will be diluted from 67.2 percent to 61.9 percent and GSK Plc including Group companies will own 5.7 percent of merged entity.

"The acquisition is in line with the Hindustan Unilever strategy to build a sustainable and profitable foods and refreshment (F&R) business in India by leveraging the mega trend of health and wellness," HUL said.

Also read: Why Horlicks is unlikely to boost Unilever

GSK Consumer Healthcare India is the market leader in the HFD category, with iconic brands such as Horlicks and Boost, and a product portfolio supported by strong nutritional claims.

HUL expects the business to grow in double-digits in the medium-term and margins to be accretive to company post realisation of synergy benefits.

"The turnover of our foods and refreshment business will exceed Rs 10,000 crore and we will become one of the largest foods and refreshment businesses in the country," Sanjiv Mehta, Chairman and Managing Director, HUL said.

Foods and refreshment segment contributed 19 percent to total revenue of the company in Q2FY19; and over 18 percent in year ended March 2018, which is Rs 6,487 crore out of total revenue of Rs 35,204 crore.

The GSK Consumer India business delivered total turnover of around Rs 4,200 crore in the year ended March 2018, primarily through its Horlicks and Boost brands.

The merger includes the totality of operations within GSK CH India, including a consignment selling contract to distribute GSK Consumer India’s over-the-counter and oral health products in India.

The transaction is expected to be completed in one year subject to regulatory and shareholder approvals, HUL said.

“GSK Consumer valuations are much cheaper than HUL. Also, HUL will be able to drive cost synergies plus HUL will be able to expand the distribution foot print,” said an analyst from a brokerage firm.

“RoE (Return on equity) of GSK is poor as it is sitting on cash. The merged entity will use cash much better,” he added.

FMCG analysts said that over the long term one will know as to what happens to HUL shares that are acquired by GSK.

“It (HUL shares) will be worth more than Rs 20,000 crore at today's prices. It can be a overhang. This is far in the future i.e post transactions and post lock in period if any,” said another FMCG analyst from a domestic brokerage house.

The merger of GSK Consumer India with HUL will be on a basis of an exchange ratio of 4.39 HUL shares for each GSK CH India Share, implying a total equity value of Rs 31,700 crore for 100 per cent of GSK CH India, it said.

The GSK Consumer Health India business delivered a total turnover of around Rs 4,200 crore in the year ended March 2018, primarily through its Horlicks and Boost brands, the statement on the exchange said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!