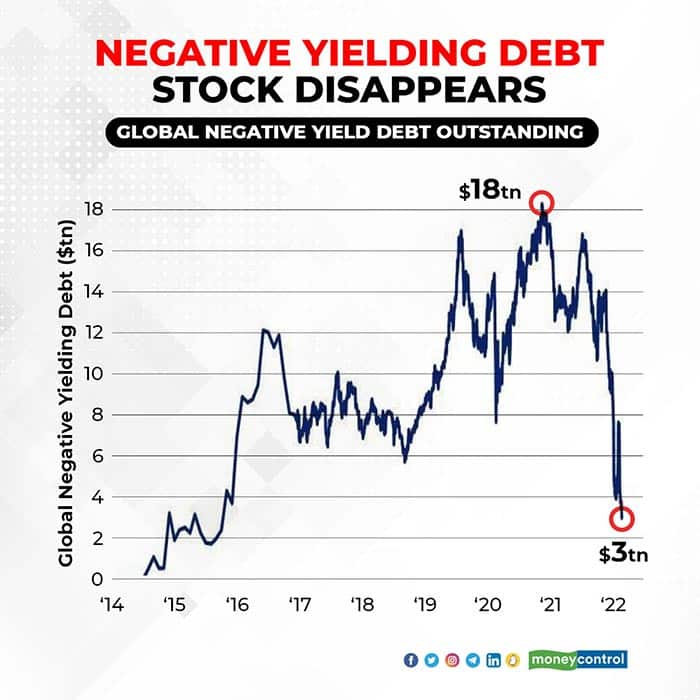

What does the bill of saving the world economy from crises look like? It looks like this chart from Bofa Securities.

The stock of bonds carrying negative yield globally is now a mere $3 trillion. That is a phenomenal fall from the peak of $18 trillion in 2021. Like two sides to a coin, this pivot back to positive yield entails both pain and reward. As governments begin to pay holders of their bonds, savers and long duration investors will be rewarded. They finally get money off their fixed income. But this comes at the cost of a massive capital loss to short term bond holders: a $2.6 trillion hit according to Bloomberg. Also, this reflects a raging inflation which will require central banks to hike policy rates. The bill for $20 trillion fiscal and monetary stimulus, undertaken by countries to blunt the pandemic’s impact on their economies, has now arrived. From the US Federal Reserve to the Reserve Bank of Australia, central banks will now gear up to hike rates steadily to pay up for the money printing they indulged so far.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.