TCS Q1 Results: India's biggest IT services company Tata Consultancy Services (TCS) announced its financial results for the first quarter ended June 30, 2023. The largest IT exporter in the country kickstarted the first quarter (Q1 FY24) earnings season by beating Street estimates.

Watch: TCS management commentary on Q1FY24 earnings report

The number of our clients are into efficiency cycles, they are reassessing and that's why the delay, he said.

"Don't see large scale rampdown or cancellations, that's not driving softness. It's reprioritisation mainly", says TCS CEO.

-Net Profit down 2.8% QoQ At Rs 11,074 Crore

-Rupee Revenue up 0.4% QoQ At Rs 59,381 Crore

-EBIT Margin At 23.2% Vs 24.5% (QoQ)

-Interim Dividend Of Rs 9/Share Announced

-Order Wins At $10.2 Billion Vs $10 Billion (QoQ) TCS Q1FY24 Segments QoQ

-BFSIUp 0.2%

-Mfg Up 1.5%

-Retail Up 1.1%

-Communication Down 1%

-Life Science Up 0.8%

Tata Consultancy Services (TCS) reported a strong order book of $10.2 billion for the first quarter of fiscal year 2024. Beating macroeconomic headwinds in the United Kingdom this quarter, the IT services major surpassed its quarterly deal win guidance of $7-9 billion. The total contract value (TCV) for Q1 was up by 24.39 percent on a year-on-year (YoY) basis as compared to $8.2 billion reported in Q1FY23. Last quarter, TCV stood at $10 billion.

With this, the company’s headcount stood at 6,15,318 as of June 30, 2023. The slowdown in hiring is expected as the industry faces mounting macroeconomic headwinds leading to a demand environment. The attrition levels of India’s largest IT services company dipped to 17.8 percent on the last-twelve-months basis, down from last quarter’s 20.1 percent. Read more here.

TCS reported a nearly 17 percent year-on-year (YoY) rise in consolidated net profit for the June quarter to Rs 11,074 crore. This beats Street estimates as the analysts predicted the net profit estimate at Rs 10,886 crore.

Moreover, consolidated revenue increased nearly 13 percent YoY to Rs 59,381 crore, which was slightly lower than the estimated Rs 59,500 crore.

K Krithivasan, Chief Executive Officer and Managing Director, said: “It is very satisfying to start the new fiscal year with a string of marquee deal wins. We remain confident in the longer-term demand for our services, driven by the emergence of newer technologies. We are investing early in building capabilities at scale on these new technologies, and in research and innovation, so we can maximize our participation in these opportunities.”

N Ganapathy Subramaniam, Chief Operating Officer and Executive Director, said: “Our products and platforms achieved major milestones during the quarter with several transformational engagements going live. In the UK Life and Pensions administration space, we signed three new deals on our digital insurance platform, making TCS the undisputed leader in this market on any metric. We are proactively building differentiating capabilities in generative AI and actively working on such projects with our clients, delivering impact on technology, operations and client experience dimensions.”

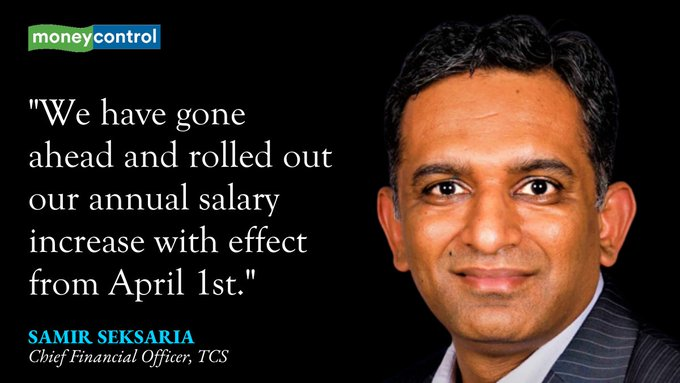

Amid salary buzz among employees, TCS chief financial officer (CFO) said, “We have gone ahead and rolled out our annual salary increase with effect from April 1st. Our operating margin of 23.2% reflects the 200 bps impact of this hike, offset through improved efficiencies. At the same time, we continue to make the investments needed to power our future growth, including expansion of our delivery and research infrastructure.”

Milind Lakkad, Chief HR Officer, said: “We remain focused on developing, retaining and rewarding the best talent in the industry, and enhancing their effectiveness by bringing them back to office to foster our culture. Our Return to Office initiative is picking pace, with 53% of the workforce already in office thrice a week. We have given a 12-15% raise for exceptional performers in our latest annual compensation review, and also commenced the promotions cycle. TCSers logged 12.7 million learning hours in upskilling themselves during the quarter in market relevant skills like generative AI, cloud, data and analytics. Our attrition continues to trend down and we expect it to be back in our industry-leading, long term range in the second half of the year. While we are committed to honor all the offers we have made, our focus will be on leveraging the capacity we built last year.”