BUSINESS

Ramesh Damani, Nilesh Shah, others weigh in on post-election market outlook as Mumbai goes to vote

Veteran investors including Ramesh Damani, Hiren Ved, Atul Suri, Nilesh Shah and Sridhar Sivaram, after casting their votes, shared their expectations and the sectors poised for continued growth

BUSINESS

Stock Radar: Vodafone Idea, Jindal Saw, Biocon, ZEEL in focus today

JSW Steel, Zee Entertainment Enterprises, Zydus Lifesciences, Amber Enterprises India, Astral, Balkrishna Industries and Balrampur Chini Mills will release March quarter earnings on May 17

BUSINESS

Trade Spotlight: How should you trade NHPC, CDSL, L&T, M&M, Hero Motocorp and others?

CDSL stock has formed a long-legged doji on the daily chart, indicating market indecision

BUSINESS

Trading Plan: Will Nifty, Bank Nifty continue to rise in near-term?

The Nifty 50 settled 113.80 points or 0.51 percent higher at 22,217.8 and Nifty Bank rose 105.35 points or 0.22 percent to 47,859.45 on May 14

BUSINESS

New SME IPO: Solar PV, Lithium-Ion battery maker RCRS may go public in mid-June to raise Rs 30 crore

RCRS IPO: Noida-headquartered RCRS manufactures and markets lithium-ion batteries and Solar PV (Photovoltaic) Modules under the EXEGI brand

BUSINESS

Archit Nuwood files DRHP to launch India’s 2nd-largest SME IPO; maybe priced at Rs 260-280 per share

On a standalone basis, in FY23, the company's revenue from operations grew 4 percent to Rs 151.16 crore, from Rs 145.47 crore in FY22, while EBITDA grew by around 76 percent to Rs 20.22 crore, from Rs 11.49 crore.

BUSINESS

Promoter stake sales surge 93% in FY24, experts expect trend to continue

Market experts say that promoters offloading a small stake should not raise alarm bells, but if they have been paring their stake continuously over the years, then it does warrant a closer look.

BUSINESS

Saurabh Rungta’s pre-election strategy: Book profits in mid and smallcaps, allocate funds to largecaps

The MD and CIO of Avendus Wealth Management says HNIs have not been entering the SME space meaningfully because of bad experiences earlier

BUSINESS

Mobilisation via corporate bonds hits all-time high in FY24

The highest mobilisation through debt private placements during the year was by NABARD (Rs 65,393 crore) followed by REC (Rs 52,140 crore), HDFC (Rs 46,062 crore), PFC (Rs 45,130) and SIDBI (Rs 38,600 crore)

BUSINESS

Strong PE activity, surge in M&As drive 469 deals valued at $24.5 bn in Q1 of 2024

The $8.5-billion mega-merger between Reliance and Disney was the highlight of the quarter, making a significant portion of the overall deal value in Q1

BUSINESS

IPO lock-in expiry: Shares worth Rs 1.47 lakh crore to enter market between April and July

The lock-in period of Global Surfaces, Sai Silks (Kalamandir), JSW Infrastructure, Platinum Industries and Exicom Telesystems opened on Monday with the stocks of all five companies ending the session in green

BUSINESS

Ixigo flies high in pre-IPO market while Oyo slumps, Mobikwik makes a comeback

Market sources suggest that the continuous decline in Oyo’s valuation is because of ambiguity over its listing because of poor appetite for the stock at prevailing valuations

BUSINESS

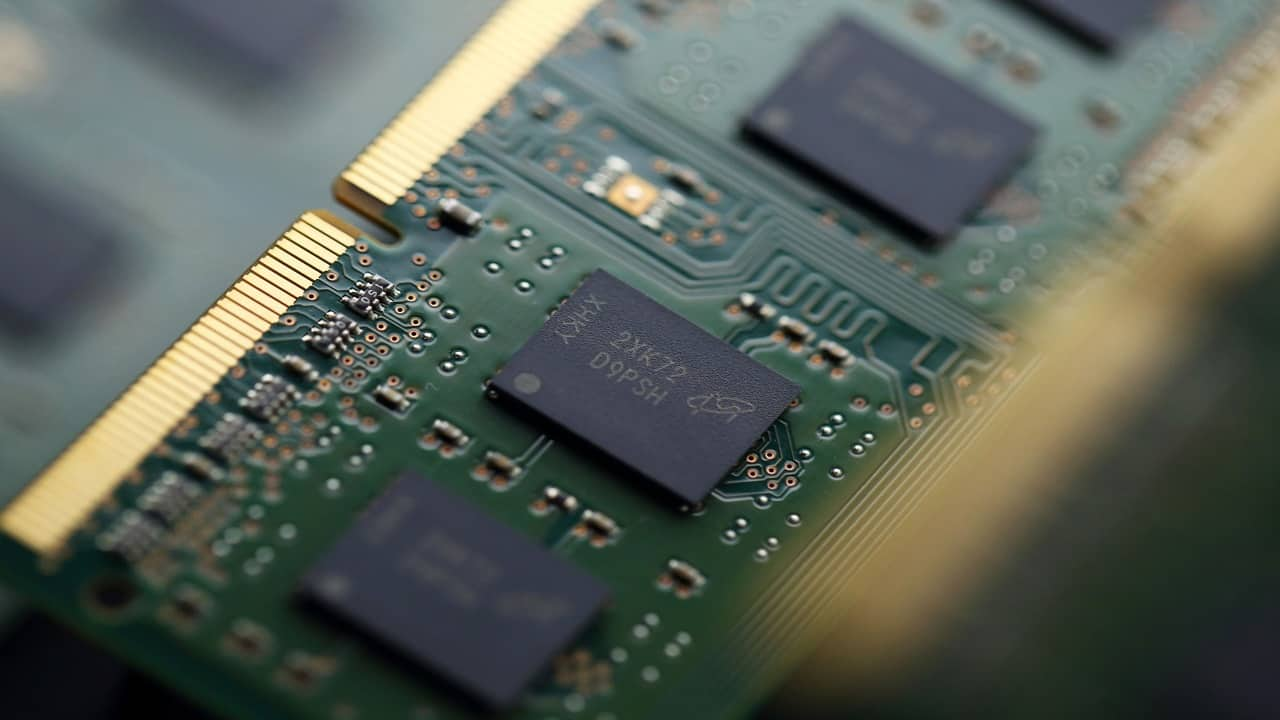

Semiconductor stocks on fire, defy bearish mood in mid and small caps

The government's ambitious semiconductor initiatives has got the Street excited, sending stocks such as SPEL Semiconductor, ASM Technology, CG Power, and Linde India soaring 70-200 percent over the past year

BUSINESS

Mutual Fund Stress Test: Quant MF says 'all is well', no signs of euphoria in Indian equities

The stress test result showed that it would take 22 days for 50 percent portfolio liquidation in Quant Small Cap Fund and 6 days in the Quant Mid Cap Fund

BUSINESS

Market veterans highlight threat crypto assets pose to capital markets

At the SEBI-NISM Research Conference, Uday Kotak, Nilesh Shah and Ashish Chauhan also spoke about the role the regulator can play

BUSINESS

Avoid sugar stocks, EVs may disappear like pagers if hydrogen fuel takes off: Cholamandalam Securities

Kant also explained how high interest rates are affecting rural consumption due to their high dependence on microfinance.

BUSINESS

Jaro Education weighs IPO route to raise Rs 600 crore

Jaro Education IPO: The offer will comprise a fresh issue of shares worth Rs 330 crore and an offer for sale worth Rs 270 crore by its founder Sanjay Salunkhe

BUSINESS

Exicom Tele-Systems IPO: Should you subscribe to Rs 429-crore public offer?

Exicom Tele-Systems IPO: The offer comprises a fresh issue of shares worth Rs 329 crore and an offer-for-sale (OFS) of 70.42 lakh shares, worth Rs 100 crore, at the upper price band

BUSINESS

Goldman downgrades ratings of SBI, ICICI Bank, Yes Bank, warns of stronger headwinds

Goldman Sachs downgraded State Bank of India, ICICI Bank and Yes Bank, saying that the ‘Goldilocks period’ is over for the financial sector

BUSINESS

Promoter selling no longer a red flag; these 10 stocks have doubled despite stake sale

Stocks of HDFC Asset Management Company, TD Power System, Jindal Stainless and many others have doubled in the last one year despite promoters offloading anywhere between 9 percent and 24 percent

BUSINESS

IPO rush: 66 issues targeting Rs 72,000-crore lined up for FY25

The biggest IPOs in the pipeline are OYO (about Rs 8,430 crore), Ebix Cash (Rs 6,000 crore), NSDL (Rs 4,500 crore), First Cry (Rs 4,000 crore) and Digit Insurance (Rs 3,500 crore)

BUSINESS

Ram Mandir may attract 50 mn tourists a year: Jefferies assesses the Ayodhya multiplier

The makeover of Ayodhya is now set to transform the ancient city into a global religious and spiritual tourist hotspot

BUSINESS

IPOs worth Rs 75,000 crore expected in 2024, NSDL may go public this year: Pranav Haldea

Pranav Haldea expects the most awaited National Securities Depository Limited’s (NSDL) IPO to hit the market in 2024

BUSINESS

Retail investors shouldn’t rush into IPOs, wait for prices to stabilise, says SEBI chief Buch

SEBI was working to resolve malpractices such as mule accounts and inflating of IPO application numbers, the SEBI chairperson has said