BUSINESS

Ahead of IPO, Hero FinCorp writes off bad loans worth around Rs 1,200 crore

Hero FinCorp recorded a 25 percent rise in AUM in the first nine months of FY24, which grew to Rs 49,127 crore, while disbursals rose 26 percent to Rs 24,979 crore

BUSINESS

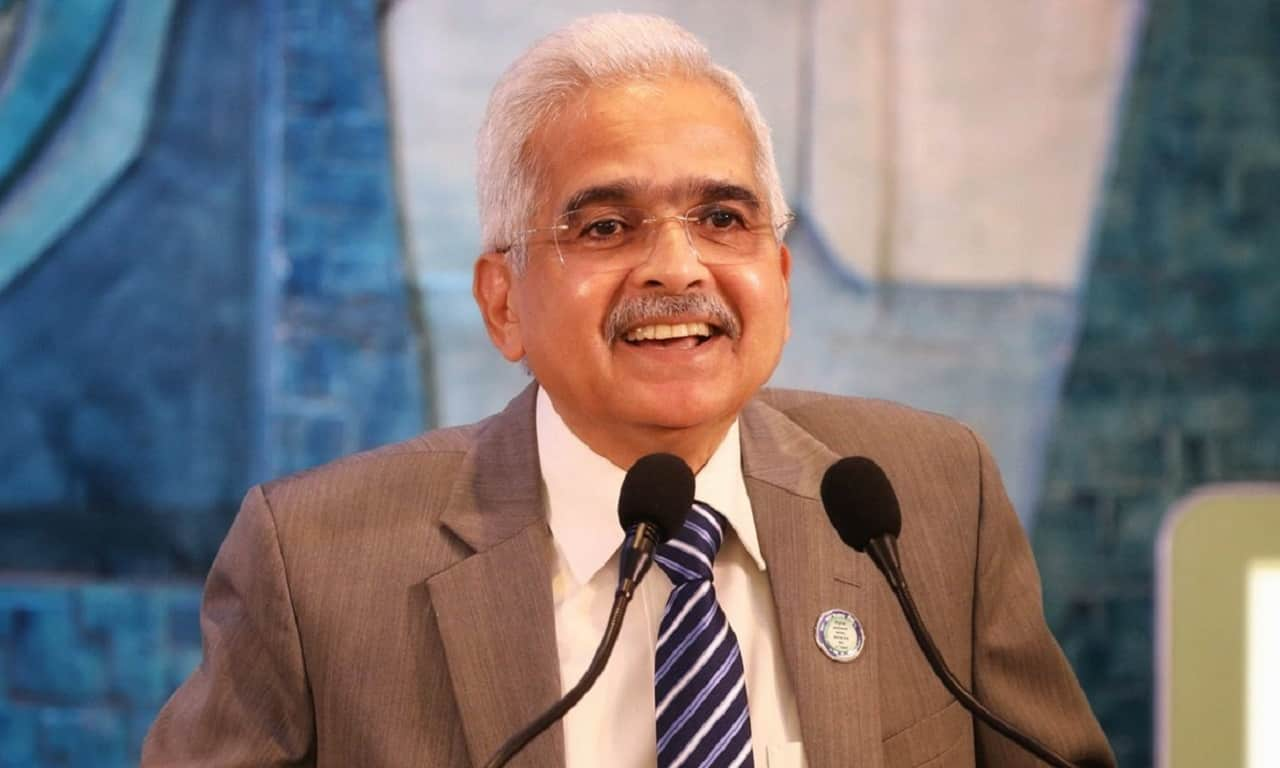

RBI policy meet: Upturn in private capex cycle becoming broad based, says governor Das

RBI Policy: Several sectors such as food processing, textiles, chemicals, cement, iron and steel, telecommunications and roads are seeing improvement in investment activities

BUSINESS

India’s green hydrogen value chain a $125-billion investment opportunity by 2030: Avendus Capital

Renewable energy production is expected to generate investment opportunities worth almost $80 billion by 2030

BUSINESS

Blackstone open to sale of controlling stake in PGP Glass

The private equity firm is looking at a valuation of over $2 billion for the stake sale.

BUSINESS

IL&FS to finally close its road InvIT; draft papers to be filed with Sebi this week

These assets have an approximate enterprise valuation of Rs 8,500-9,000 crore

BUSINESS

KKR taps Torrent Pharmaceuticals for JB Pharma stake sale

KKR's stake in JB Pharma is worth Rs 13,767 crore based on the stock's closing price of Rs 1,649.45 last week

BUSINESS

Kolkata-based Suraksha Diagnostic eyes $100 million IPO; PE investor OrbiMed to sell stake

The diagnostic chain’s private equity investor, OrbiMed, is likely to sell a large part of its stake through the IPO. Suraksha Diagnostic primarily operates in West Bengal, with over 40 centres in the State, and has one centre each in Patna and Guwahati.

BUSINESS

Hindustan Unilever weighs sale of Pureit water purifier business

The talks for the sale of the India Pureit business come amid parent Unilever Plc initiating the sale of its majority stake in Qinyuan Group Co., a Chinese maker of water purification equipment that it acquired in 2014.

BUSINESS

Executive startup founders holding more than 10% stake may be categorised as promoters

The move will affect new age tech companies that are planning to launch their IPOs, as individual founders in such companies tend to have low shareholdings, and were so far not classified as promoters.

BUSINESS

Sebi’s easing of minimum promoter contribution norms to help startup IPOs

Under the minimum promoter contribution norms of Sebi, promoters of IPO bound companies have to contribute 20% of their post offer shareholding to a mandatory three year lock-in, or a 18 month lock-in in certain cases.

BUSINESS

NHAI InvIT raises Rs 7,300 cr from Canadian pension funds CPP Investments, OTPP, others

The fundraise is aimed at funding the acquisition of a portfolio of road assets worth approximately Rs15,625 crore, spread across the states of Assam, Madhya Pradesh, West Bengal, Uttar Pradesh and Karnataka.

BUSINESS

Who is Keventer? The group that donated Rs 617 crore through electoral bonds

Keventer Food Park Infra donated Rs 195 crore through electoral bonds; Madanlal Ltd donated Rs 185.5 crore; MKJ Enterprises – Rs 192.4 crore and Sasmal Infrastructure – Rs 44 crore, as per the data released by the Election Commission

BUSINESS

AM Naik, Madhusudan Kela invest in medical devices company S3V Vascular Technologies

The company will use the funds to build a Rs 300-crore integrated manufacturing facility for neurovascular devices at Mysore.

BUSINESS

Spanish infra developer Ferrovial acquires $800 million stake from GIC in IRB Infrastructure Trust

This is the second investment by Ferrovial in the IRB group. In 2021, it acquired a 24.86 percent stake in the listed flagship of the group — IRB Infrastructure Developers

BUSINESS

IPO market shows no sign of pre-poll slowdown, raises record Rs 33,253 crore

Between October and March, leading up to the previous four elections - 2004, 2009, 2014 and 2019 - only 20 companies approached the IPO market, collectively raising just Rs 4,308 crore, data from primary market tracker Prime Database shows

BUSINESS

Hospital chain Paras Healthcare plans Rs 1,000 crore IPO; PE firm Creador to exit

Paras manages a portfolio of seven multi-super specialty hospitals across Haryana, Bihar, Rajasthan, J&K and Jharkhand with 1,700 beds.

BUSINESS

Indian solar panel makers plan to raise Rs 5,800 crore this year

Three solar panel makers are looking to raise as much as Rs5,800 crore this year, through IPOs and pre-IPO fundraising.

BUSINESS

A91 Partners in talks to invest in jewellery retailer ORRA at Rs 2,000 crore valuation

ORRA’s revenue jumped by 82% to Rs 950.9 crore in FY23, from a revenue of Rs 522.9 crore in the previous financial year, as per a report by ICRA. In the first nine months of FY24, the jewellery retailer reported a revenue of Rs 879 crore.

BUSINESS

No concrete plans yet for EV cell manufacturing: Anish Shah

M&M, which already sells the XUV400 EV, an electric version of its XUV300 model, aims to launch five to six electric vehicles in the coming quarters.

BUSINESS

No immediate plan for auto business demerger, says Mahindra CEO Shah

While M&M prioritizes maximising shareholder value through synergies, Shah says the group can consider a demerger if it promises greater value but such deliberations are not on the immediate agenda

BUSINESS

RBI, Sebi action will have a positive effect on financial services sector, says Mahindra's Anish Shah

Several financial institutions, including IIFL Finance, Paytm Payments Bank, and JM Financial, have come under intense regulatory scrutiny, sparking concerns across the financial sector.

BUSINESS

Kedaara hires IndiaRF's Maheshwari to help turn around Sunbeam

Maheshwari joined IndiaRF in 2020 after a four-year stint at auto component manufacturer Varroc Engineering. His experience includes stints with BK Birla group companies Birla Tyres and Century Pulp & Paper, ITC and Tata Steel.

BUSINESS

Tata Motors demerger aimed at unlocking better value for the two businesses

Analysts noted that the demerger will make it easier for the two companies to raise funds in the future, especially for the PV business with competition expected to intensify, and the EV unit.

BUSINESS

Flipkart-backed logistics startup BlackBuck plans IPO; to raise up to $300 million

BlackBuck is backed by investors including Tiger Global, Accel, Tribe Capital, IFC, Sands Capital and Sequoia, among others.