BUSINESS

SP Group may upsize Afcons Infrastructure IPO plan to Rs 8,500 crore

The group's move to boost Afcons IPO size comes as it negotiates with lenders to refinance debt. A bigger fundraise will help the group better manage its debt obligations

BUSINESS

Swiggy provides special indemnities to directors of SoftBank, Accel and Prosus, ahead of IPO

Prosus owns 30.95%, while SoftBank and Accel own 7.75% and 6.08%, respectively, of Swiggy. Prosus is eligible to nominate two board members, while SoftBank and Accel can name one each.

BUSINESS

Shapoorji Pallonji gets bondholders' approval to postpone Rs 1,800 cr interest payment to December end

In June last year, SP Group entity Goswami Infratech raised Rs 14,300 crore through rupee-denominated zero-coupon NCDs from a group of investors, including Cerberus Capital, Varde Partners, Canyon Capital, Davidson Kempner and others. SP Group had to make an interest payment of close to Rs 1,800 crore on these NCDs by September 30.

BUSINESS

SEBI objects to use of IPO proceeds for paying back promoter loans

IPOs of some companies are facing delays as SEBI expects them to change the use of proceeds or repay promoter loans using other financing routes, sources say

BUSINESS

AAI set to receive Rs 2,800 crore from Adani group towards payments linked to privatised airports

Payments because of under recovery of revenue in the period when AAI owned the airports

BUSINESS

Alkem promoter stake sale aimed at JB Chemicals bid

At current market prices, KKR’s 53.77 percent stake in JB Pharma is worth about Rs 15,500 crore

BUSINESS

Bound for IPO, Brookfield-run Leela plans hotels in spiritual, wildlife tourism segments

As of May 31, 2024, Leela’s portfolio comprised 3,382 hotel rooms across 12 properties under three formats - Leela Palaces, Leela Hotels and Leela Resorts.

BUSINESS

Anand Rathi eyes Rs 1,000 cr IPO; first brokerage firm to go public since 2020

The IPO proposal comes as Indian stocks rally to new records, buoyed by robust domestic institutional and retail investments, despite global economic challenges.

BUSINESS

US Fed rate cut to spur more Indian corporates to tap offshore bond markets

Fed chairman Jerome Powell delivered the large 50 bps rate cut, driven by the increased confidence that the US' long battle with inflation had come to an end.

BUSINESS

Shapoorji seeks Rs 2,000 crore from Davidson Kempner, Deutsche Bank to make interest payments

The talks for raising additional debt come as the group seeks more time for interest payment of Rs 1,800 crore on the debt facility raised by group entity Goswami Infratech

BUSINESS

Blackstone-TPG owned Care Hospitals in advanced talks for merger with Aster DM Healthcare

The merged entity will rank among the top three hospital chains in India, in terms of number of beds, along with Apollo Hospitals and Manipal Hospitals

BUSINESS

Carlyle's dividend haul from Hexaware touches Rs 1,380 crore in three years since its acquisition

Hexaware's Rs 530.8 crore dividend payout in 2023 beats Wipro, ICICI Lombard, and Godrej Consumer and would rank it 34th among BSE 100 index members if it were a publicly traded company.

BUSINESS

GSK Velu’s Neuberg Diagnostics in talks with 360One, M&G Investments for $100 mn pre-IPO fundraise

Neuberg had hired investment bank o3 Capital to help raise funds from private equity investors, Moneycontrol reported on 17 April.

BUSINESS

QIPs lead the show as real estate sector sees 17-year-high equity fundraising

Real estate developers raised Rs 11,746 crore through the QIP route tnis year, which is an all-time high. In fact, 2024 is the second-best year as far as overall equity issuances are concerned, after 2007.

BUSINESS

Alkem promoters may sell stake; tap PE firms KKR, Blackstone, EQT

Alkem's promoters, with a 56.38% stake worth about Rs 42,280 crore, have hired Nomura as the banker for the stake sale.

BUSINESS

Panchshil-Blackstone hotel JV Ventive Hospitality files DRHP for Rs 2,000 cr IPO

Moneycontrol first reported on September 9 that Ventive was looking to file its draft red herring prospectus with the markets regulator this week.

BUSINESS

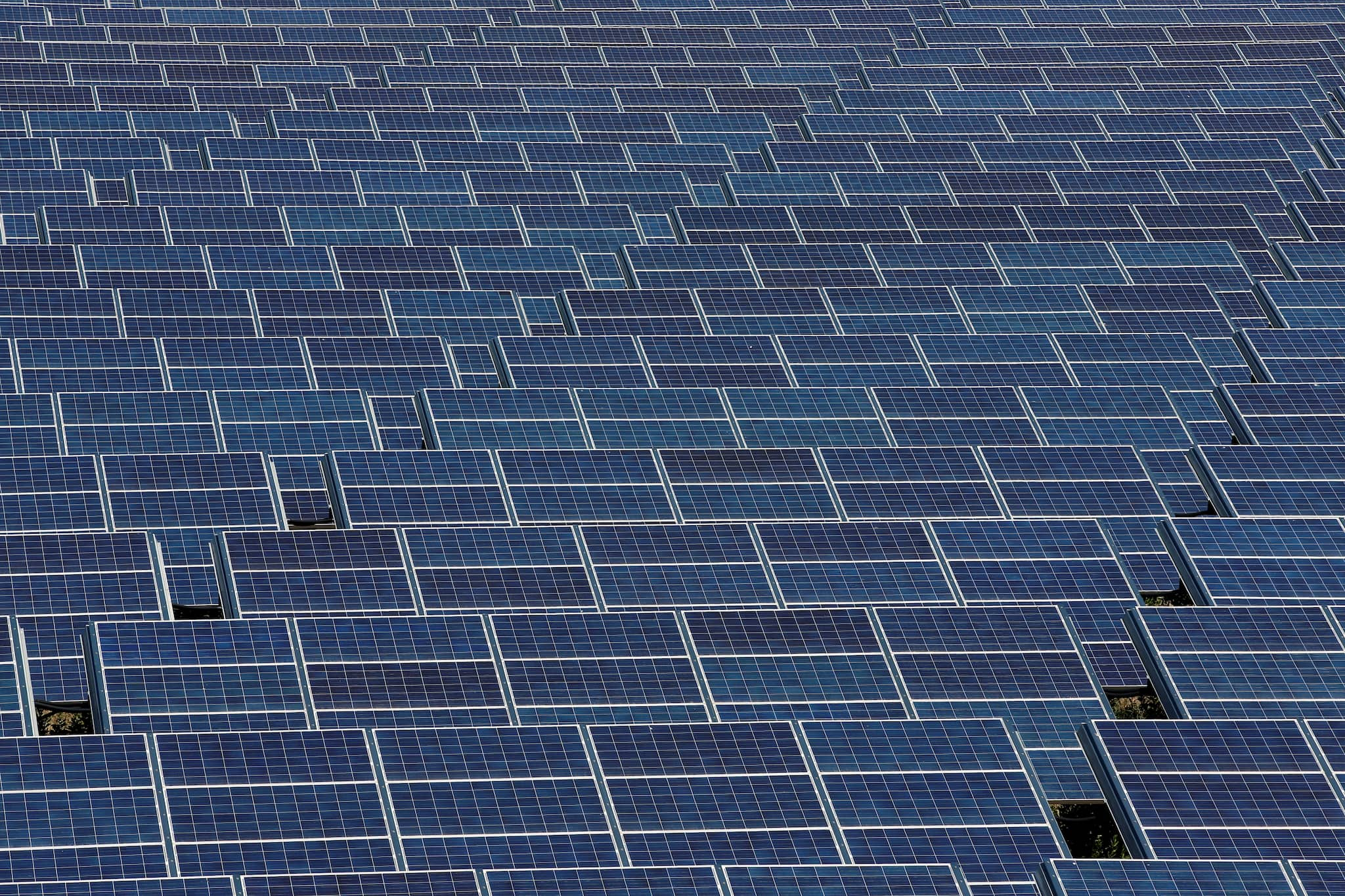

Solar panel maker Saatvik may go public next fiscal, plans Rs 1,500 cr capex

With the additional capacity, the company expects its revenue to increase to Rs 1,800-2,000 crore this financial year from Rs 1,100 crore last year. Saatvik is alsp planning a foray into newer areas like green hydrogen.

BUSINESS

Ather Energy’s venture debt backers set for big repayment from IPO

Ather plans to raise Rs 3,100 crore from fresh issue of shares, of which Rs 378.2 crore will go towards repayment of loans to Alteria Capital (Fund I and II), Innoven Capital India Fund, Stride Venture Debt (Fund II and III) and Nuvama Crossover Yield Opportunities Fund

BUSINESS

Panchshil-Blackstone’s Ventive Hospitality to file for Rs 2,000 crore IPO this week

India has seen three hotel operators go public in the past 12 months.

BUSINESS

Vedanta Resources in talks with lenders to raise $1 billion through foreign currency bonds: Sources

On July 25, global rating agency S&P upgraded Vedanta Resources credit rating to B- from CCC+ on the back of improving capital structure and liquidity.

BUSINESS

Post-Covid-19 capital markets boom sees IPO banker fee double for mid-sized deals

The Indian primary market has seen 196 IPOs from FY21 onwards, resulting in a total fundraise of Rs 2.56 lakh crore.

BUSINESS

JSW Steel taps Japan's MUFG for funding Australian coking coal mining company acquisition

The development assumes significance as most major global banks have limited their exposure to fossil fuel assets amidst growing global pressure over climate change, making it difficult for companies to access funds for financing the acquisition of such assets.

BUSINESS

JSW Cement’s IPO hits Sebi wall over show cause notice to promoter Jindal family

Sebi go-ahead for the offer document likely post-settlement of the case, say sources

BUSINESS

India's biggest solar panel maker Waaree Energies’ IPO delayed over deemed public offer non-compliance

The approval has been withheld due to apparent non-compliance with a Companies Act provision which states that an unlisted company cannot offer its shares to more than 200 people in a financial year, without making a public offering.