BUSINESS

Festive relief on fuel prices unlikely as oil simmers amid conflict

Reversing last week’s downward trend, oil prices jumped more than 4 percent on October 9 on fears that clashes between Israel and Hamas could spread beyond Gaza. But crude prices had already been hovering at over $90 per barrel for the last few months, with Saudi Arabia and Russia extending cuts and stoking concerns over tight supply.

BUSINESS

Govt likely to amend insolvency code to enable project-wise resolution in real estate sector: Officials

The proposed changes IBC will allow more targeted and efficient resolution of financially distressed real-estate companies. By allowing proceedings only against specific projects that have defaulted, the potential disruption to the company's operations could be minimised.

BUSINESS

GST Council Key Takeaways: Human consumption ENA out of GST, tax cuts on molasses, millets

The GST Council also reduced the tax rate on branded, pre-packaged and labelled millet-based flour to 5% from 18%

BUSINESS

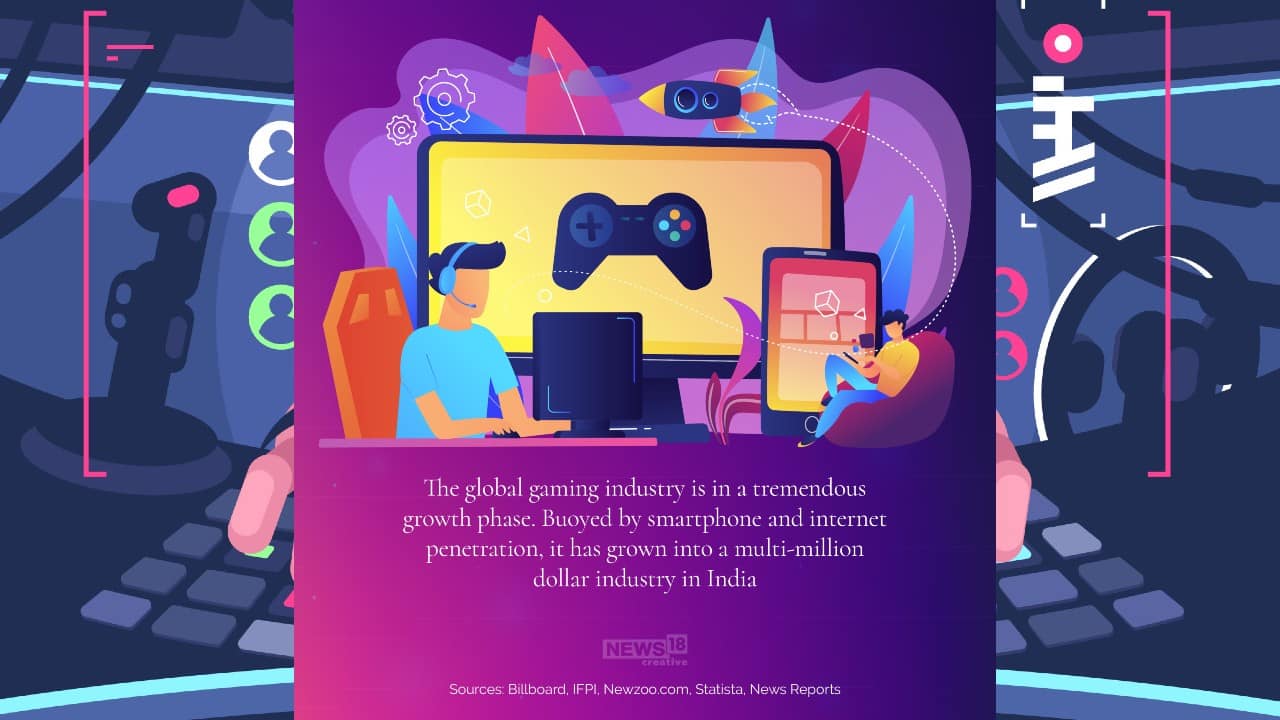

GST Council Meet: Govt says not taxing online gaming firms retrospectively as states flag concerns

Previously, online gaming companies paid 18 percent tax on the platform fees because the law was ambiguous, while betting and gambling always fell under the 28 percent slab.

BUSINESS

Gujarat 'Most Preferred Investment Destination' for semiconductors: CM Bhupendra Patel

The 10th edition of Vibrant Gujarat summit will be inaugurated by Prime Minister Narendra Modi on January 10, 2024.

BUSINESS

GST Council may clarify that exporters can claim input tax credit on INR credited in Special Vostro Accounts

Certain tax authorities have been citing Reserve Bank of India provisions to refuse input tax credit to exporters when they receive INR in Special Vostro accounts, in line with the rupee trade settlement mechanism.

TRENDS

Aviation lease agreements exempted from moratorium to rationalise future lease rates: Sr official

Prior to this notification, when an airline filed for insolvency, moratorium would apply and the lessor would not have been able to take back leased aircraft and helicopters from the company immediately, owing to ambiguity in law. The exemption from moratorium changes that.

BUSINESS

MC Exclusive: Council may clarify electricity supply to tenants by malls exempt from GST

A Calcutta High Court ruling in 2017, had declared that supply by any entity is not authorised to distribute electricity should be taxed, whereas the Delhi Electricity Regulation Commission had ruled that such supply is GST exempt. The Council is expected to uphold this rule.

INDIA

Govt extends tenure of SBI Chairman Dinesh Khara till August 2024

Dinesh Khara was appointed as SBI's chairman on October 7, 2020, for three years. As per norms, the SBI chairman can hold the position till the age of 63.

BUSINESS

MC Exclusive: Council likely to exempt extra neutral alcohol from GST for interim period

The taxability of ENA, which is used in the manufacture of liquor as well as for industrial and commercial purposes, has been under deliberation since 2017.

BUSINESS

GST fitment committee proposes no tax cut for EV batteries, tobacco products

The industry had sought uniform additional compensation cess on cigarettes, bidis, smokeless tobacco products and lower compensation cess on cigarette sticks up to 70 mm. The industry had also sought lowering of GST on electric vehicle (EV) batteries from 18 percent to 5 percent.

BUSINESS

Are gaming firms facing retrospective taxation? Maybe in essence, but not in law

The government says the tax notices follow a clarification of the law rather than a change and the demand for dues is not retrospective in nature.

BUSINESS

MC Exclusive: GST Council to discuss lower rate on motor vehicles purchased by visually impaired

The Madras High Court in a decision on June 26, 2023, said that the visually impaired petitioner is eligible for a concessional GST rate on the purchase of motor vehicles.

BUSINESS

MC Exclusive: No GST likely on millet flour preparations

GST on millet: The GST council is likely to remove 18 percent levy on millet flour preparations, which contain at least 70 percent of the traditional grains by weight, if sold in other than pre-packaged and labelled form.

BUSINESS

Govt likely to soon invite financial bids for Shipping Corp: Official

The govt may invite bids without waiting for the listing of Shipping Corporation of India Land and Assets Ltd, SCI’s demerged entity. Usually, financial bids are invited after the listing of demerged entities, and the valuation of the company follows.

BUSINESS

Maruti Suzuki receives Rs 2,160 crore draft income tax assessment order

Maruti Suzuki India will file its objections before the Dispute Resolution Panel.

BUSINESS

MC Exclusive: Govt considering Tesla's request for benefits to set up testing hub

Though setting up destructive testing for specific components and testing tracks for Tesla cars are cost- and skillset-intensive initiatives, they could benefit India and the automobile ecosystem in terms of technology and innovation.

BUSINESS

Indian Renewable Energy Development Agency IPO likely in October-November: Sources

This is the first IPO by a public sector enterprise after Life Insurance Corporation's public issue in May last year.

BUSINESS

Do not want tax notices to kill online gaming industry: Govt officials

Though the revenue department will go ahead with issuing demand and show cause notices to online gaming companies for additional tax liability from 2017 onwards, the Centre is concerned about a situation where these businesses are killed due to the huge tax demand, two senior government officials said. These notices pertain to the old GST rate of 18 percent on gaming and 28 percent on betting. The new GST rate of 28 percent is yet to come into effect.

BUSINESS

Top policy-makers, experts welcome move as bond inclusion opens door for greater foreign inflows

The move potentially gives global investors greater access to the world’s fastest-growing large economy that offers some of the highest returns in the region

BUSINESS

55% of retail credit has gone to housing, education, vehicles in last 2 years: SBI Ecowrap

The shift from financial savings to physical savings was triggered by a low interest rate regime in the pandemic and recovery in the real estate sector and the increase in property prices.

BUSINESS

Success of Chandrayaan 3 will have big positive impact on India’s satellite and technology ecosystem: FM Sitharaman

“To stand by the scientists is not muscular nationalism. ISRO corrected itself from the failure of Chandrayaan 2. Whoever would deny the scientists their contribution. The Prime Minister Narendra Modi stood by the scientists during Chandrayaan 2 failure," Sitharaman said.

BUSINESS

GST testing of biometric, geotagging authentication bogged down by data access issues: Official

Despite the delays, the government expects to roll out tighter registration norms in the next financial year.

BUSINESS

Advance tax growth after 2nd instalment signals good market sentiment ahead of festive season: Experts

The Advance Tax collections for Financial Year 2023-24 as on September 16 stand at Rs. 3.55 lakh crore as compared to Rs 2.94 lakh crore for the corresponding period of previous fiscal.