BUSINESS

Trent Q2 has multiple growth levers

Trent is among the fastest-growing consumption companies and the strong growth momentum is likely to continue. New initiatives like the Zudio Beauty store, international forays, and lab-grown diamonds will contribute to growth

BUSINESS

Titan Company: Second half of FY25 likely to be stronger

The cut in customs duty significantly boosted consumer sentiment, and Titan expects better growth in the second half of the fiscal

BUSINESS

Larsen & Toubro: Faster recovery in H2 likely, higher order inflows take focus

A general slowdown in the construction and engineering segment in H1 hit the company. However, higher capex and likely availability of workers and other resources are expected to make H2 stronger.

BUSINESS

Metro Brands: Eyeing strong growth in H2 FY25

The upcoming wedding and festive seasons as well as a low base in the corresponding period last year should aid performance

BUSINESS

Afcons Infrastructure IPO: Should investors bet on it?

The company has a strong parentage, rich experience, and follows the best risk management practices in the construction industry. Those investors wanting a long-term exposure in an EPC pure-play can consider the offering.

BUSINESS

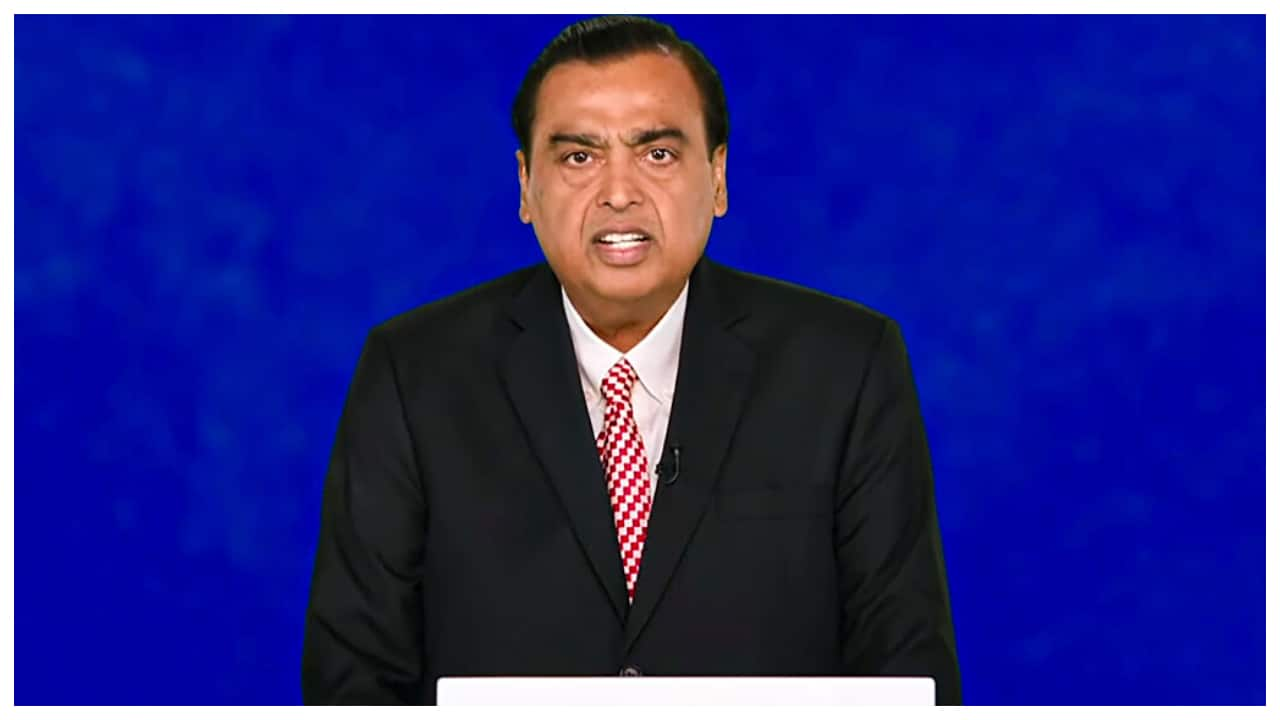

Reliance Industries Q2: Consumption-oriented segments telecom, retail drive growth

While a subdued global economic environment has affected its O2C business performance, improving prospects for consumption growth and progress in new energy business will drive the stock outlook

BUSINESS

Is it time to turn cautious on DMart?

DMart is facing increasing competition from quick-commerce online players and margin pressure is likely to sustain in the near term.

BUSINESS

Titan Company: Q2 in good shape; healthy long-term outlook

Titan, a big organised jewellery player, will be the prime beneficiary of the market shift from the unorganised to the organised segment. Moreover, ramping up the non-jewellery business remains an additional growth trigger.

BUSINESS

Discovery Series | Juniper Hotels: Why should you check into this hotel stock?

JHL has unveiled Juniper 2.0, a massive growth plan — both organic and inorganic. JHL’s stock price has corrected ~33 percent from the all-time high recorded in April 2024. and current levels offer a good entry point.

BUSINESS

Cantabil Retail India: Demand to pick up from H2; valuations attractive

With roughly 550 stores now, CRIL has huge potential to expand. Moreover, CRIL is not present in South India now and aims to enter that market after two years, which indicates huge growth potential.

BUSINESS

Mrs Bectors Food Specialities: Why we remain bullish on the company

Be it gaining market share, controlling costs, venturing into new geographies, or launching premium products, MBFSL scores on all fronts. Its ambition is to become a pan-India player in the long run.

BUSINESS

Cello World: Second half likely to be stronger

The company has immense growth potential on the back of the market’s shift towards the organised segment and the focus on premium products

BUSINESS

Will the IPO of PN Gadgil Jewellers shine on bourses?

The transition from a family-run business to a professionally-managed organisation will lead to a valuation re-rating

BUSINESS

Metro Brands: Looking forward to a strong second half

Metro Brands Limited is expected to significantly strengthen its presence in the S&A (sports and athleisure) category, with tie-ups/acquisitions. This will provide the next leg of growth.

BUSINESS

Baazar Style Retail IPO: Does this retailer offer value to investors?

Since its inception in FY2014, BSRL has scaled up operations to reach a revenue size of close to Rs 1,000 crore in FY2024 and is amongst the fastest growing retail companies.

BUSINESS

SAMHI Hotels: Growth levers in place to tap industry upcycle

With the balance sheet in shape and healthy cash-flow generation, SAMHI’s focus has now shifted to tapping growth by addition of new room inventory & improving profitability by renovating/refurbishing the existing inventory.

BUSINESS

Royal Orchid Hotels: Why is it the right time to enter the stock?

The hotelier is seeing demand traction at present and expects a double-digit growth in revenues for the current fiscal

BUSINESS

Apeejay Surrendra Park Hotels: Why you should buy this hotel stock

Apeejay Surrendra Park Hotels is among the quality hotel stocks with a strong brand, and industry-leading occupancy and return ratios. A pickup in growth would lead to a re-rating.

BUSINESS

Senco Gold: Glowing long-term prospects

Senco Gold has a glittering future as demand picks up on the back of customs duty cut and shift of consumers to the organised jewellery segment

BUSINESS

Goldiam International: Glittering growth prospects

With in-house manufacturing capability, innovative designs, and established relationships with key retail clients in the US, Goldiam is expected to sustain the outperformance in the fast-growing LGD space

BUSINESS

Sky Gold: Sparkling growth prospects

The company is emerging as a preferred manufacturer of lightweight jewellery, given the varied design offerings as well as the recent shift to a much larger plant.

BUSINESS

Trent: Industry-leading show continues

While the stock’s valuations are at a premium, the consistent industry-leading performance and robust earnings outlook would continue to drive it.

BUSINESS

Lemon Tree Hotels: Major renovations to boost long-term outlook

The company would largely complete renovations by FY26, and we expect a strong increase in ARRs after that. With a new and upgraded overall room portfolio, LMNT is likely to report much stronger results from H2FY26.

BUSINESS

EIH: Weak Q1, but strong growth outlook

EIHL has lined up healthy room addition plans and aims to add about 50 properties and about 4,500 keys by 2030, which is more than double the current room count