BUSINESS

ITC: How does the new GST rate structure unfold for the cigarette business?

A flat GST on retail sales price will enhance pricing stability, and lower tax evasion, resulting in a predictable tax environment

BUSINESS

GST reforms: Push for natural ingredients in the flavours and fragrance industry

Lower GST rates for natural menthol and its derivatives, but higher for non-natural ingredients

BUSINESS

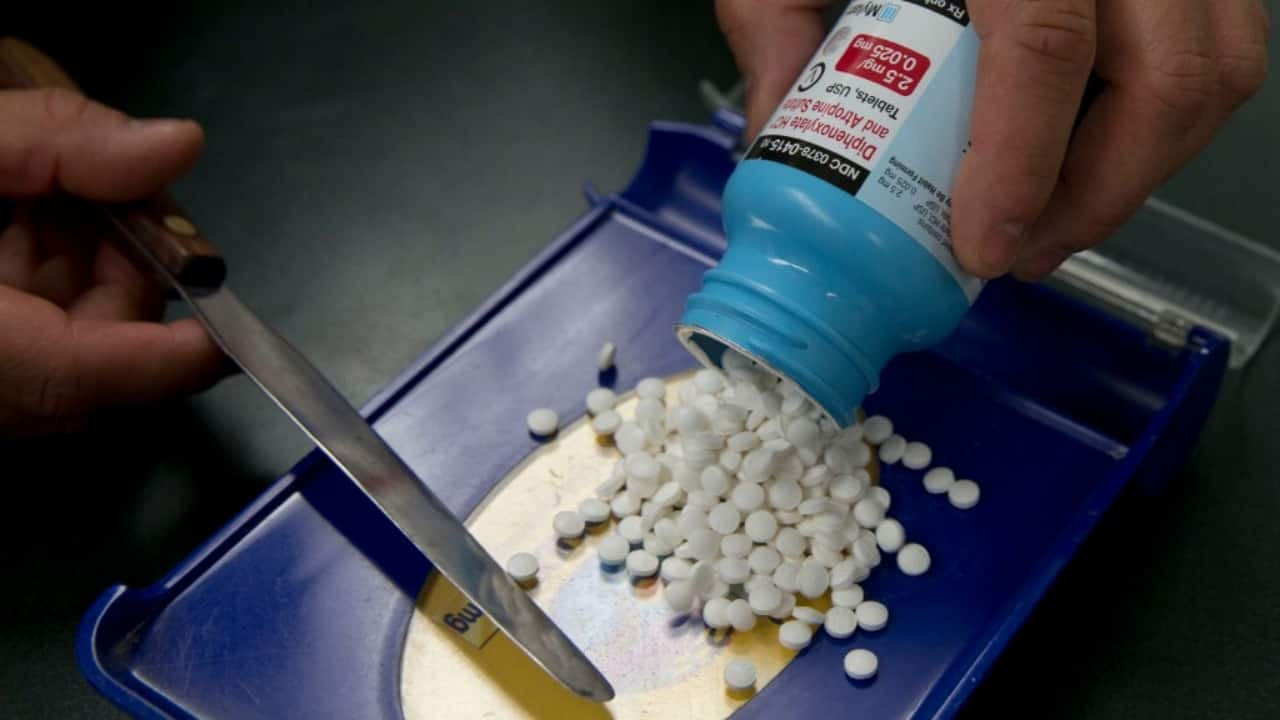

GST rate cuts to benefit players across the healthcare sector

Rates have been pruned for drugs used in chronic diseases as also medical devices and hospital chains

BUSINESS

Balaji Amines: Competitive intensity remains elevated

Favourable outcome of dumping probes appears to be the key growth catalyst in the near term

BUSINESS

Is the FMCG sector gearing up for another disruption?

Reliance Consumer Products Ltd (RCPL) is positioned to become a major disruptor in India's FMCG sector, with Reliance Industries announcing aggressive expansion plans

BUSINESS

Galaxy Surfactants: Valuation pricing in the pessimistic outlook

The company’s long-standing relations with MNC customers can help it navigate the US tariff headwinds

BUSINESS

Gem Aromatics IPO: A niche play on flavours and fragrances market

Key growth drivers will be the new set of product lines belonging to the aroma industry

BUSINESS

Zydus Lifesciences: Time to accumulate the stock?

Tariffs pose a near-term risk. However, Zydus’s focus on novel drugs and the foray into medical devices are key moves to watch

BUSINESS

Sai Life Sciences: Strong start keeps CDMO business in the lead

India’s limited share in the CRDMO market presents strong headroom for growth

BUSINESS

Why Indian exporters may not succeed in offsetting the potential US loss

Even as it faces a trade war with the US, China’s share in global exports has increased over the years. For India, replicating this story will not be easy

BUSINESS

Divi’s Lab: Better capex guidance to meet upcoming demand

R&D activities around peptides and contrast media remain the two medium-term growth drivers for the company. US tariffs are a near-term risk.

BUSINESS

SRF: Chemicals support the performance chemistry

The chemical business grew 24 percent YoY, helped by volume recovery in agrochemical intermediates and improved off-take for the recently launched products

BUSINESS

Acutaas Chemicals: CDMO business outlook improves

The CDMO business appears steady and additional approvals of indications for the oncology drug – Darolutamide – add to revenue visibility. Further, another key contract is expected to commence from Q4 FY26

BUSINESS

Navin Fluorine: After a strong run-up, is it time to book profit?

The company has multiple CDMO orders lined up for FY26, starting with two European majors, including US-based Fermion, for the second quarter.

BUSINESS

Sun Pharma: Innovative drugs are near-term growth drivers

Sun Pharma’s top line growth is steady. Innovative medicines to act as growth tonic, as the US generics business remains soft. The stock valuation is justified.

BUSINESS

Triple factors that are likely to guide the market course in the near term

How should investors position themselves amid Fed’s caution, IMF upgrades, and Trump’s punitive stance for India

BUSINESS

Laurus Labs: Is it time to book profit?

The company has a CDMO pipeline of 90+ human health projects, wherein 15 products are commercialised, targeting APIs and intermediates

BUSINESS

Syngene: How soon can it overcome near-term worries?

The CRDMO player is still to see the full impact of the client’s inventory rationalisation

BUSINESS

Cipla: Non-US markets to drive growth in the near term

Reduced contribution of Revlimid is likely to get offset by new products

BUSINESS

Dr Reddy’s: Near-term growth outlook is opaque

The medium-term triggers for the company include a launch pipeline for Semaglutide in non-US markets and the progress of biosimilars.

BUSINESS

Himadri Speciality: Strategically positioned to emerge as a battery chemicals giant

The company benefitted from lower raw material costs, productivity, and higher salience of high-margin products, leading to continued expansion in gross margins.

BUSINESS

Anthem Biosciences IPO: Promising, but pricey play on global CRDMO tailwind

The company offers integrated services across the drug discovery, development, and manufacturing lifecycle for both NCEs and NBEs, including specialised fermentation-based APIs

BUSINESS

Aarti Industries: Return ratios to light up with better sweating of assets

While a large number of end markets are showing an improving outlook, in the near term, pricing pressure is expected to continue.

BUSINESS

Balaji Amines: Is caution warranted after the run-up?

Among the end markets, the pharmaceutical sector has shown stable demand, but the agrochemical segment remains fragile