BUSINESS

Gaming firms may use grey area in GST law to challenge 'retrospective' taxation: Sources

Officials say the centre will leave it to the courts to decide whether the notices sent for the period prior to October 1 for 28 percent GST are valid or not.

BUSINESS

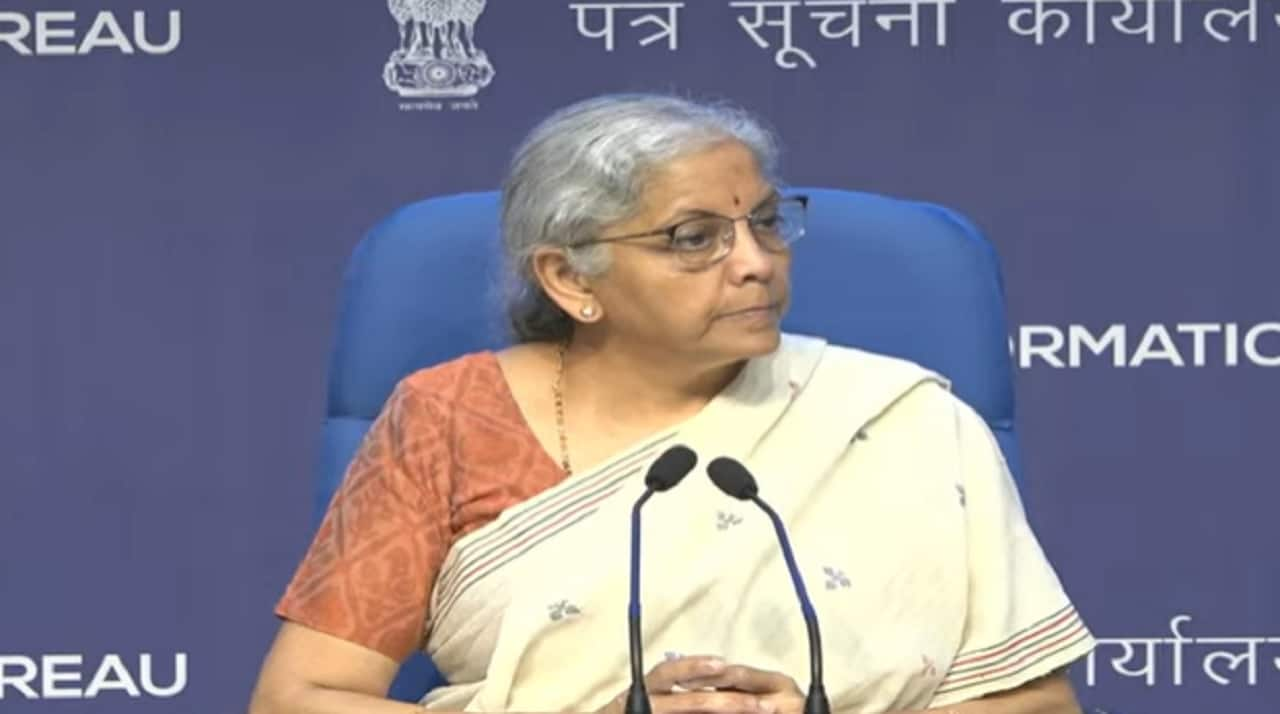

Inflation may stay elevated on global uncertainties, domestic disruptions: Finance minister

Sitharaman's comments on inflation staying firm comes at a time when the ongoing war between Israel and Hamas have sparked worries over its impact on the global economy.

BUSINESS

Cabinet approves royalty rates for mining of Lithium, 2 other minerals

The royalty rates were brought in since unless specifically provided these minerals would have been subject to a higher 12 percent rate of the average sale price

BUSINESS

India-Middle East-Europe Economic Corridor may get delayed over Gaza war

The success of the proposed economic corridor depends on the relationship between Israel and Saudi Arabia improving, but with the conflict escalating between Tel Aviv and Gaza, the future of this flagship project is looking grim.

BUSINESS

Expect oil at $100 if Israel-Hamas war spreads beyond Gaza

Being the world’s third-largest consumer of crude oil, India is particularly vulnerable to any price fluctuations in global oil prices. Experts tell Moneycontrol that India faces the risk of a further surge in oil prices if the ongoing conflict spreads beyond Gaza.

BUSINESS

Festive relief on fuel prices unlikely as oil simmers amid conflict

Reversing last week’s downward trend, oil prices jumped more than 4 percent on October 9 on fears that clashes between Israel and Hamas could spread beyond Gaza. But crude prices had already been hovering at over $90 per barrel for the last few months, with Saudi Arabia and Russia extending cuts and stoking concerns over tight supply.

BUSINESS

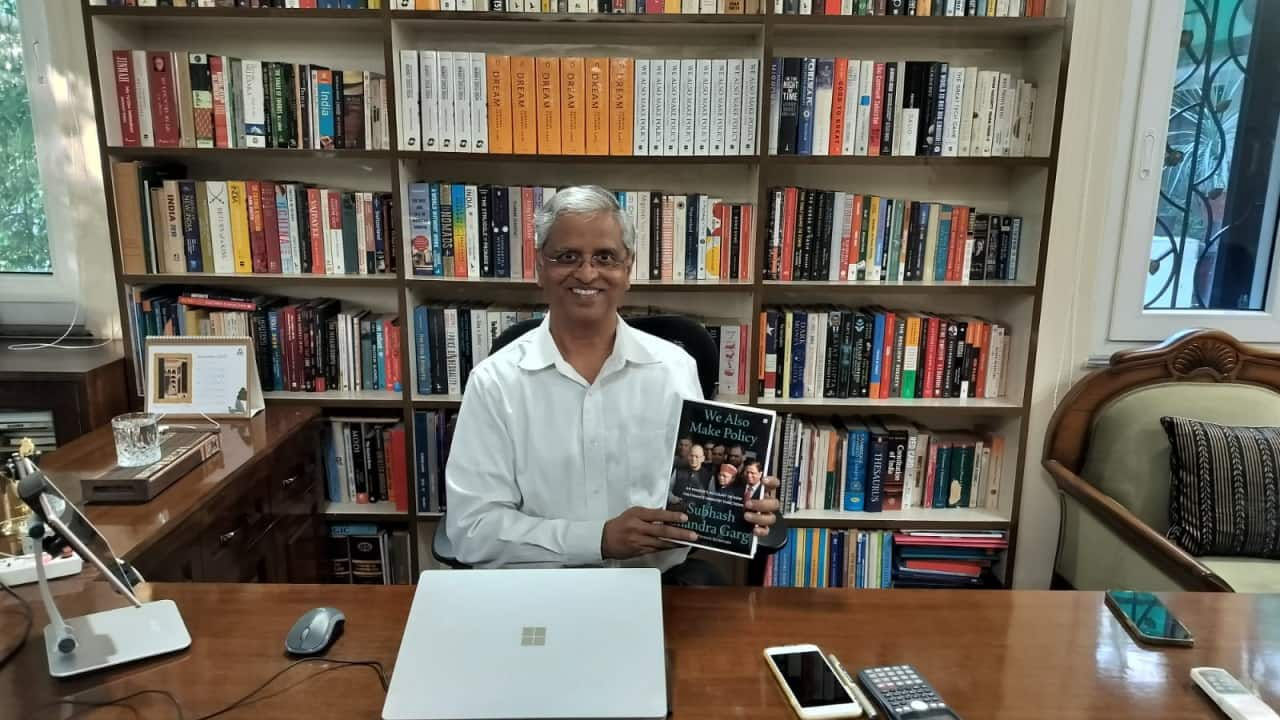

Interview: Shaktikanta Das good at short-term fixes, says ex-finance secy Subhash Garg

In a wide-ranging interview with Moneycontrol following the release of his new book 'We Also Make Policy', the former finance secretary also spoke about the influence – or its lack thereof – exerted by political parties' social and economic wings over the finance ministry's policies, and the turn North Block's relationship took with the media in his final weeks in the government

BUSINESS

GST Council Key Takeaways: Human consumption ENA out of GST, tax cuts on molasses, millets

The GST Council also reduced the tax rate on branded, pre-packaged and labelled millet-based flour to 5% from 18%

BUSINESS

GST Council may clarify that exporters can claim input tax credit on INR credited in Special Vostro Accounts

Certain tax authorities have been citing Reserve Bank of India provisions to refuse input tax credit to exporters when they receive INR in Special Vostro accounts, in line with the rupee trade settlement mechanism.

BUSINESS

Would have transferred full surplus to govt had I become RBI Governor: Subhash Chandra Garg

With the former Finance Secretary's new book kicking up a storm, Garg spoke to Moneycontrol on the battle between the government and the Reserve Bank of India over the latter’s surplus distribution policy, shedding light on a key factor that led to him being transferred from the Finance Ministry in July 2019

BUSINESS

Are gaming firms facing retrospective taxation? Maybe in essence, but not in law

The government says the tax notices follow a clarification of the law rather than a change and the demand for dues is not retrospective in nature.

BUSINESS

India must leverage domestic advantages to benefit from China Plus One strategy, write CEA, co-authors

In an article, CEA Nageswaran and his co-authors wrote that over the medium term, India’s value-chain integration with the West would target areas such as renewables and high-end technology, including artificial intelligence, semiconductors and next-generation telecommunication.

BUSINESS

FTSE exclusion confirms index inclusion hurdles remain, but India has little to fret about

Even while acknowledging the advantages of Indian bonds getting included in in global indices, top bureaucrats highlighted the risks associated with this development.

BUSINESS

Amid likely extra pre-poll spending, govt may take borrowing cut call only in Jan-Feb

Finance Ministry expects modest supply in October-March and the euphoria around index inclusion to drive down yields on Indian government bonds by another 6-7 basis points going ahead. But, the recent rise in crude oil prices could weigh in on bond prices

BUSINESS

Exclusive: India mulls steps to insulate bond markets from any abrupt outflows post index inclusion

The addition of Indian government bonds in JPMorgan's global indices in June is expected to bring in billions of dollars. The authorities are nevertheless concerned about the impact of possible large outflows

INDIA

At UNGA, Jaishankar says political convenience should not determine responses to terrorism

Though Jaishankar avoided directly mentioning Canada, a country with which India has seen tensions rising of late, the minister said that "respect for territorial integrity and non-interference in internal affairs cannot be exercises in cherry picking."

BUSINESS

Fuel exports rebound to a 5-month high but demand woes linger

With fears of a global slowdown impacting exports, India’s ability to continue as one of the top exporters of fuel, especially to newer markets like the US and Europe, would be a key factor in limiting the country’s widening trade gap.

BUSINESS

Top policy-makers, experts welcome move as bond inclusion opens door for greater foreign inflows

The move potentially gives global investors greater access to the world’s fastest-growing large economy that offers some of the highest returns in the region

BUSINESS

India's FY24 outlook bright but risk from oil spike, monsoon remains: Finance Ministry

The ministry also acknowledged that a potential stock market correction as well as geopolitical developments could hurt investment sentiment in the second half of the financial year, however, their impact on underlying economic activity should be relatively contained.

BUSINESS

Fin Min unlikely to change borrowing plan for second half of FY24

According to sources, the government sees no reason to lower its plan to borrow Rs 6.55 lakh in October 2023-March 2024. Any reduction in borrowing could be done at a later date once there is certainty about revenues.

BUSINESS

India’s CAD concerns make a comeback as crude climbs, trade gap worsens

A sharp sequential uptick in goods imports driven by a pick-up in inbound shipments of oil led to an increase of nearly 17 percent in India’s merchandise trade deficit in August compared to July.

BUSINESS

From clothes to PCs, falling Indian production points to weak demand

According to economists, the falling production of consumer durable goods is worrisome

BUSINESS

Expect FY24 revenue collections to meet budget targets, says Economic Affairs Secy

Responding to a question on whether the government expects key index provider JP Morgan to include Indian government bonds in global indices, Seth said, "it is for them to decide."

BUSINESS

Centre hopes to lower annual borrowing to Rs 12-13 lakh cr in next few years: Sources

The central government’s borrowing has hit new record highs over the last two years, rising to Rs 14.21 lakh crore in 2022-23. In fact, the budget presented on February 1 pegged it at Rs 15.43 lakh crore for 2023-24 and the government is keen on keeping a lid on it