In charts - Should you invest in Gold ETFs or Silver ETFs?

Silver not only acts as a precious metal, but also has many industrial uses. Its demand spans industry, investment and jewellery.

1/8

ICICI Mutual Fund launched India's first silver ETF on January 5, 2022, and plans to launch a FoF (fund of fund) on January 13, 2022. Nippon India MF and Aditya Birla Sun Life MF will roll out their silver ETFs on January 13. Gold ETFs have been in the Indian market for long time with a proven record. Both Gold and Silver are likely to provide a hedge against equity volatility in an economic/market downturn and also during sustained periods of rising inflation. Though both asset classes share common characteristics, which is the right investment option?

2/8

Silver ETFs are better than buying silver physically or buying and rolling over in the MCX’s derivative markets. Kishore Narne, head of commodity and currency at Motilal Oswal Commodity says, “For instance, the cost of holding in silver is higher than the gold in MCX. The approximate rollover cost for gold is around 3 percent annually in MCX, while it for silver is around 6 percent annually. Also, the cost of storage for silver is at least 40-50 bps higher than the gold. Since, the overall expenses including cost of holding is capped at 1 percent in silver ETF asper SEBI’s regulations, it is cost efficient for the investors”. However, given the higher storage cost, the expense ratio will be higher in silver ETF compared to gold ETF. Asper the latest data, the average expense ratio of the Gold ETF was 0.67 percent.

3/8

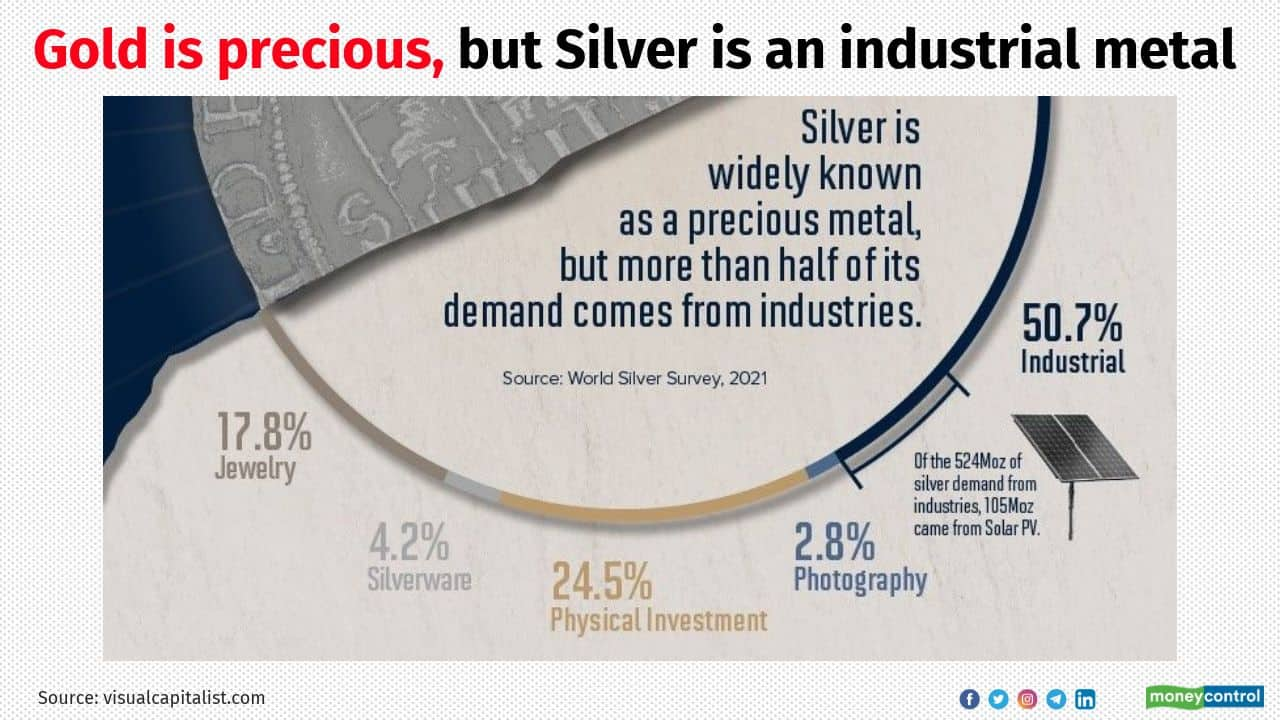

Silver not only acts as a precious metal, but also has many industrial uses. Its demand spans industry, investment and jewellery. Asper the world silver survey report, more than half of silver is used in heavy industry and high technology, including smartphones, tablets, automobile electrical systems, solar-panel cells and many other products and applications. On the other hand, up to 80 per cent of the gold that is newly mined or recycled is used in jewellery manufacture, as per a Mecmining report.

4/8

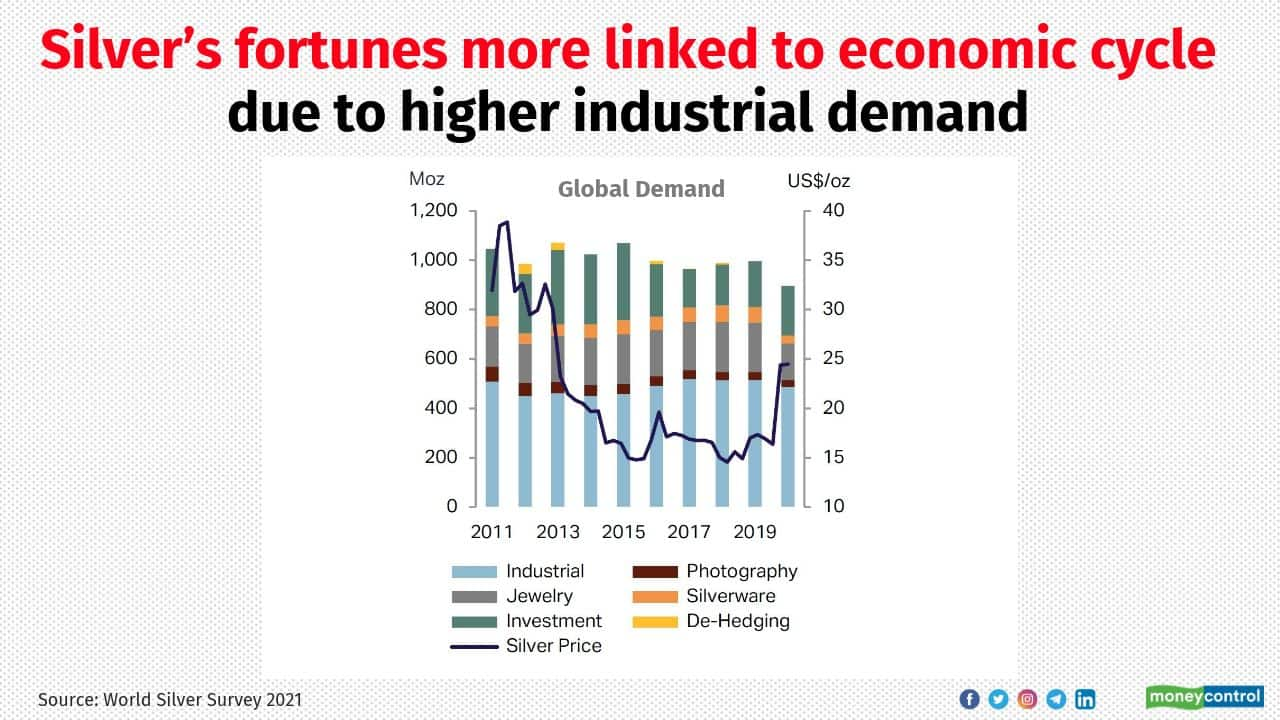

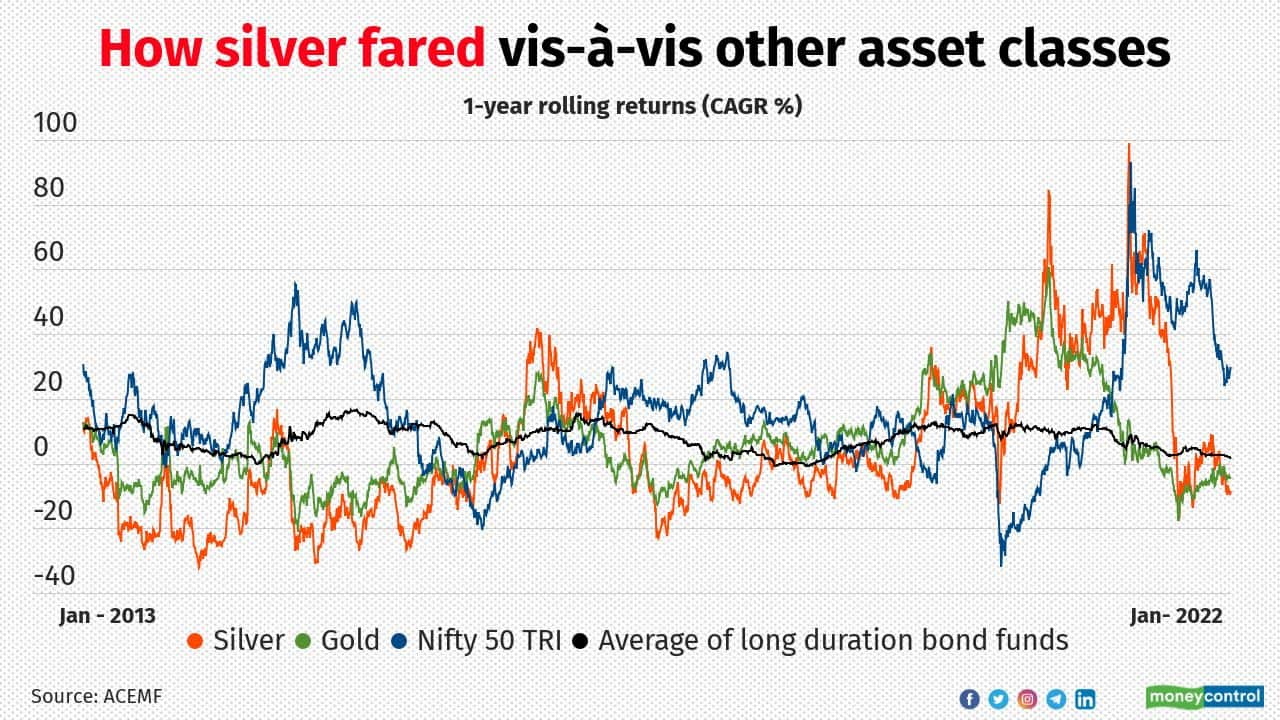

Considering the higher industrial usage, silver price is influenced by the changes in the economy. The recent Morgan Stanley’s report says, “As a result of higher industrial usage, silver is more sensitive to economic changes than gold, which has limited uses beyond jewellery and investment purposes. When economies take off, demand tends to grow for silver.” This also help silver to rise higher than gold when the inflation is on rise. Thus silver provides better hedge against inflation.

5/8

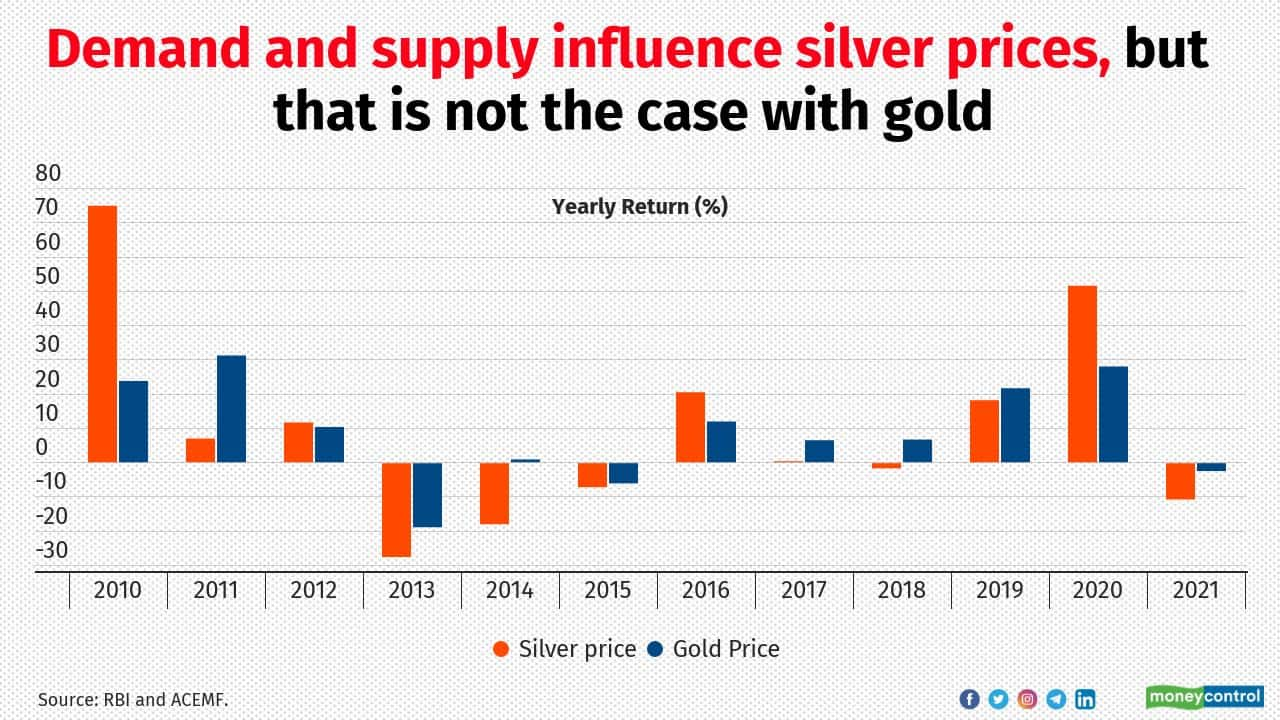

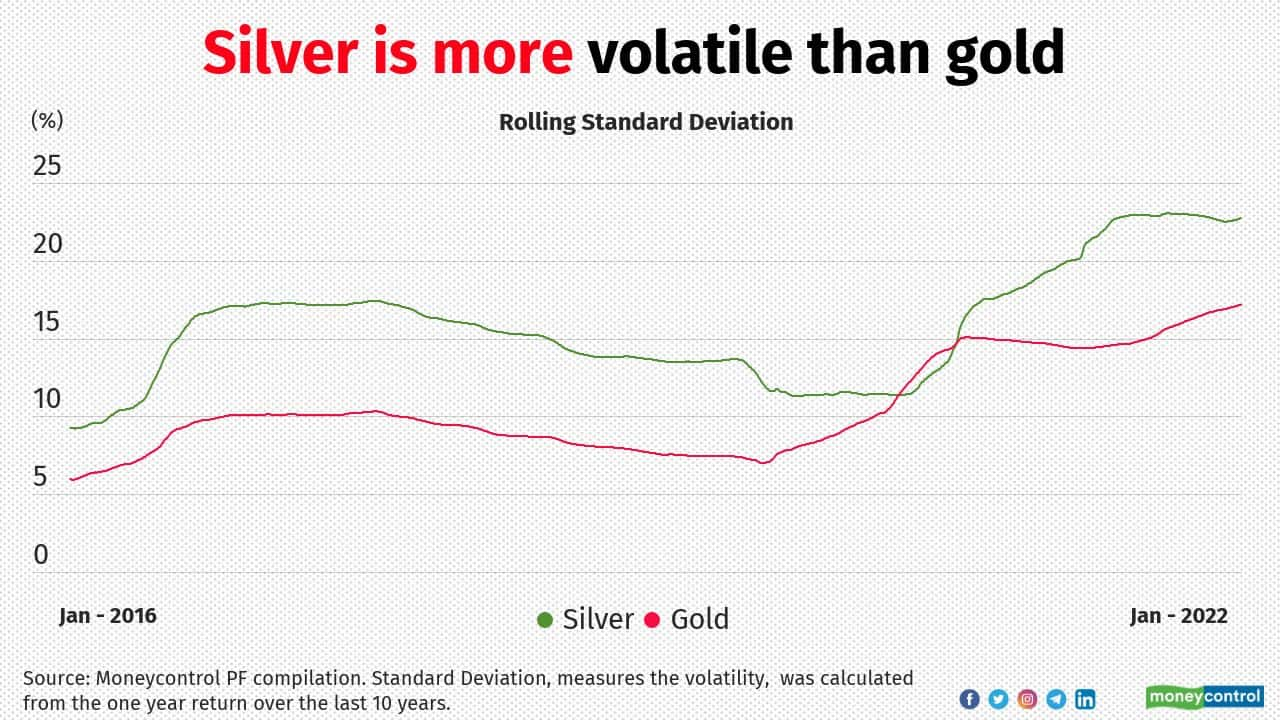

Narne of Motilal Oswal says, “For any purpose, gold is considered as a currency and move based the interest rates movement. The demand and supply do not impact the gold price absolutely. But in the case of silver, silver takes its cues from gold and also it has additional volatility coming from the industrial demand. For instance, there was a supply side issue during the pandemic wherein most of the mines got shut down that resulted in sudden shortage of metals including silver. Along that, refining cost in China shot up significantly. It resulted in silver price (52 percent) peaked ahead of gold (28 percent) in 2020”.

6/8

Though both commodities move in tandem, volatility in silver price was far higher compared to gold. One of the main reasons is that gold is held in large amounts by institutional investors all over the world such as central banks, governments, pension funds, etc. “As large amount of gold is held by these investors for long periods, it gives stability to gold prices,” Narne explains. Silver prices get influenced by gold prices, as the former is seen as an alternative to gold. Additional volatility coming from the industrial demand adds Narne. Low cost also other reason.

7/8

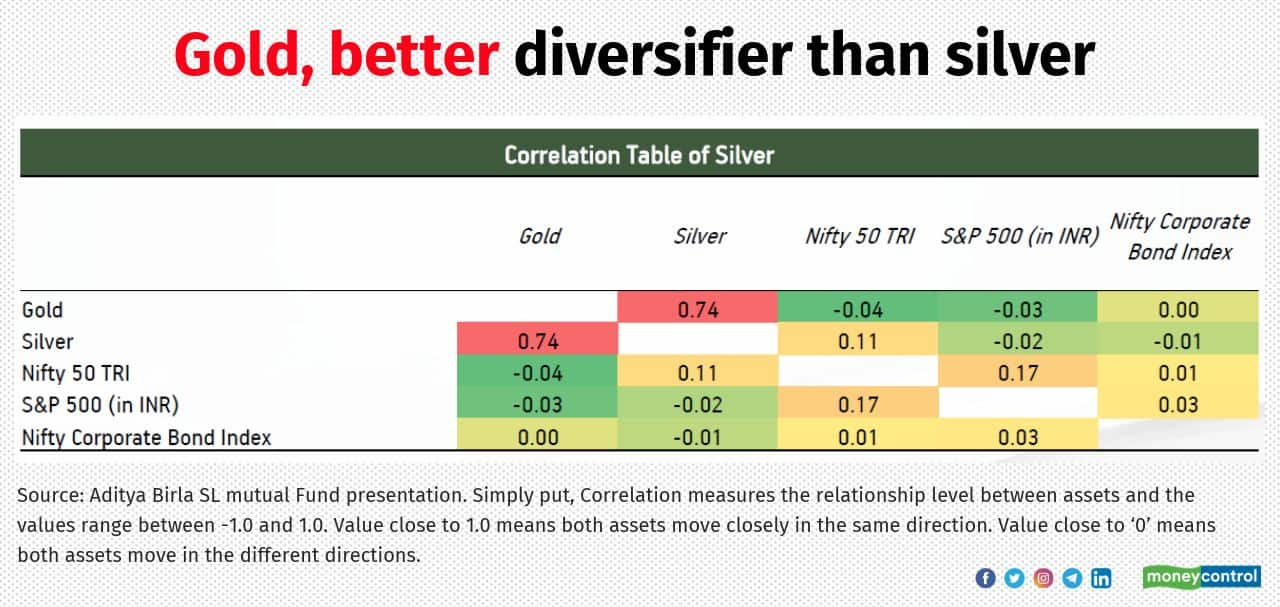

Morgan Stanley’s report says, “Silver can be considered a good portfolio diversifier with moderately weak positive correlation to stocks, bonds and commodities. However, gold is considered a more powerful diversifier. It has been consistently uncorrelated to stocks and has had very low correlations with other major asset classes—and with good reason: Unlike silver and industrial base metals, gold is less affected by economic declines because its industrial uses are fairly limited”.

8/8

The volatility in silver prices can be two to three times greater than that of gold on a given day. Traders may benefit such short term volatility in the silver. Though, gold and silver act as hedge during uncertainties, they have not outperformed equities over longer terms. Narne of Motilal Oswal advises, “Both silver and gold will service for different needs of the people. Gold is a better option for investors like retirees who want stability in return while the Silver is suited for investors with high risk profile”. It is better to have 5-10 percent of your portfolio in gold and silver together at any point of time.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!