This high-risk strategy midcap mutual fund has managed the downside well. Here's how

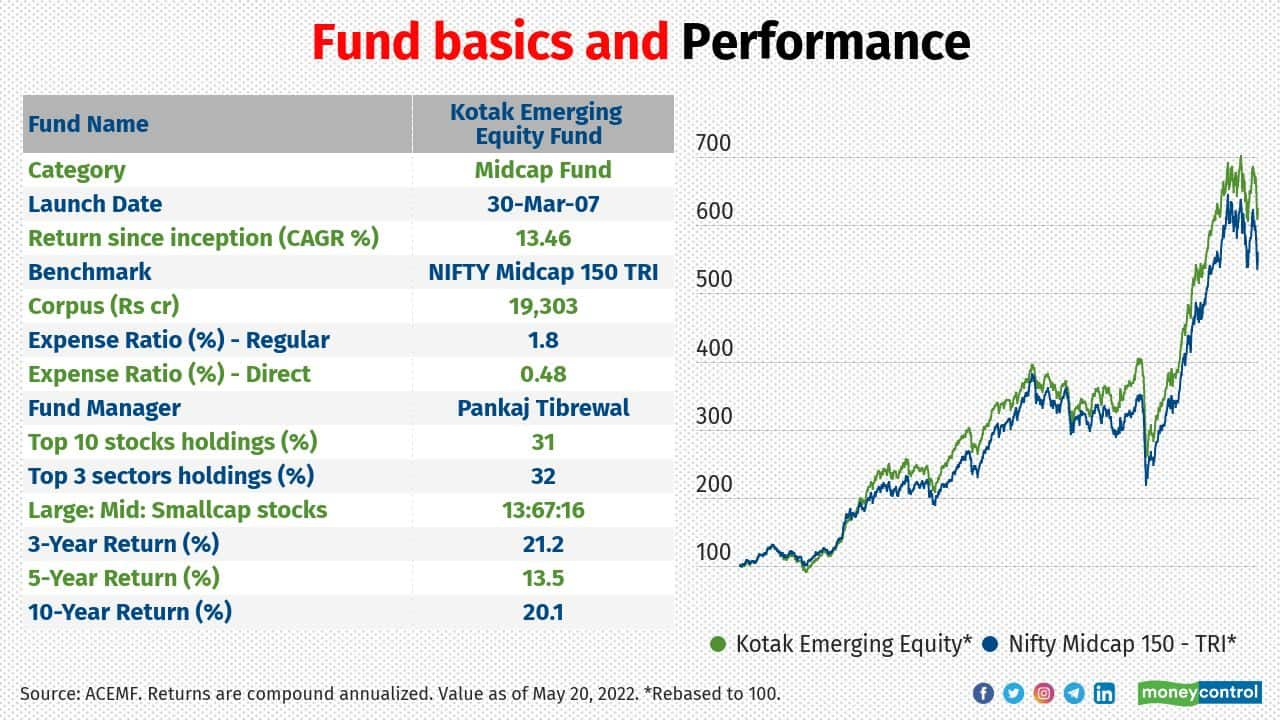

Kotak Emerging Equity Fund, a MC30 mutual fund scheme, has given consistent returns since its inception. Despite its large size, the fund has managed to manoeuvre its portfolio deftly so far

1/10

Falling equity markets often give investors a good opportunity to invest. The ongoing Russia-Ukraine conflict, rising inflation and interest rates have pushed major indices down since the start of the new year — the Nifty 50 index and Nifty midcap 150 index have fallen by as much as 13 percent from their peaks in October 2021. If you wish to invest now and are okay with taking slightly higher risks, Kotak Emerging Equity Fund (KEEF) is a good choice. This scheme is part of the MC30: Moneycontrol’s curated basket of 30 investment-worthy mutual fund (MF) schemes.

2/10

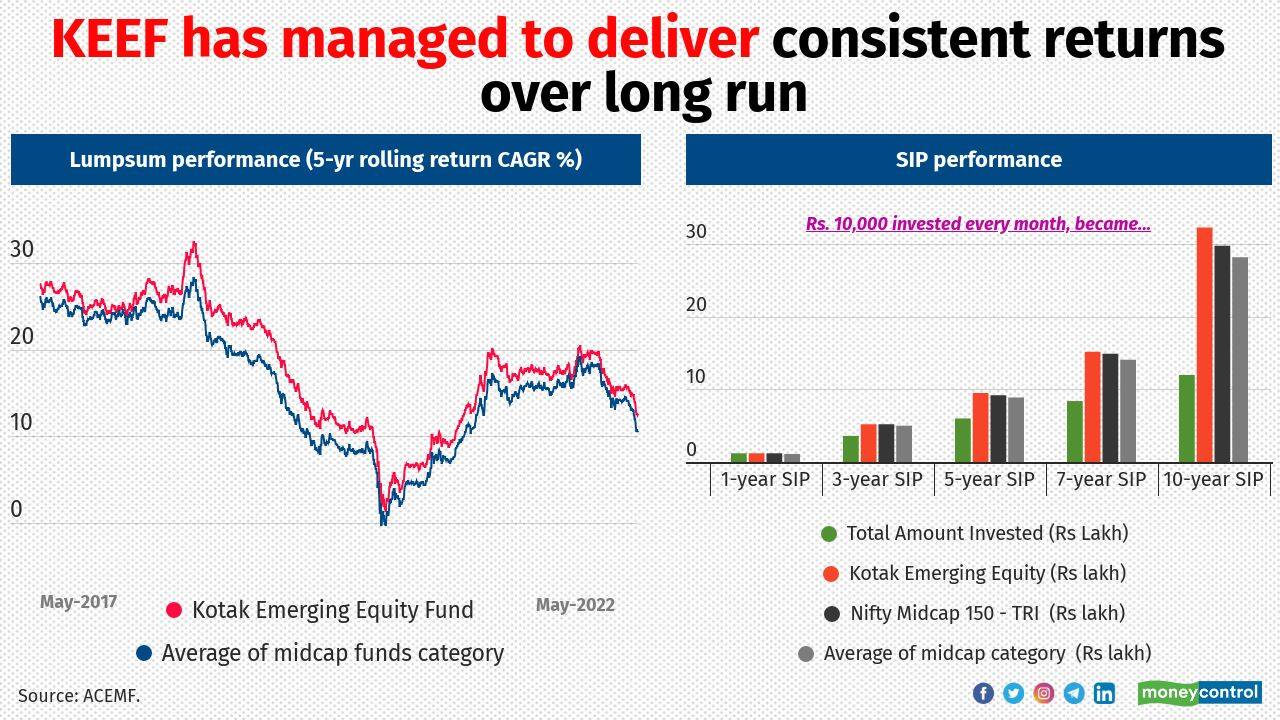

KEEF has managed to deliver better risk-adjusted returns of 13.5 percent since its inception. As mandated, KEEF holds at least 65 percent in midcap stocks and follows a high-risk and high-return investment strategy. With Rs 19,303 crore, it is the second-largest midcap scheme. Pankaj Tibrewal has managed the scheme over the last 12 years.

3/10

KEEF’s relatively better performance has come on the back of identifying good quality companies at reasonable valuations. Fund manager Pankaj Tibrewal typically holds them over the long term. “If you look at the last five years, on an aggregate basis, our portfolio (ex-financials) have a Return on equity (ROE) and Return on capital (ROC) of 18-20 percent and debt to equity ratio of just 0.2. The scheme follows a growth-oriented philosophy. Over a period of time in India, growth is rewarded disproportionately,” says Tibrewal.

4/10

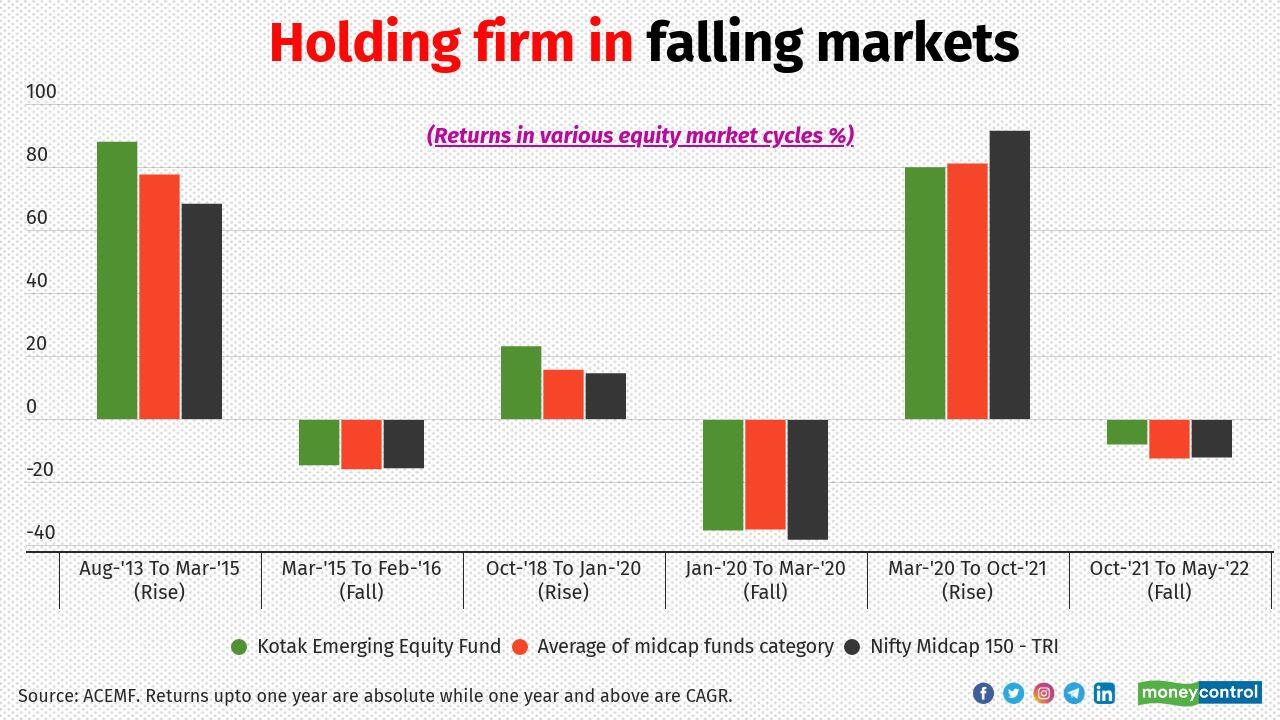

While KEEF has delivered better returns across market cycles, its performance in market corrections has been particularly noteworthy. Tibrewal prefers to focus on risk-adjusted returns instead of focusing on returns from just one particular point to another. “When you manage mid-cap funds, you can be a ‘hero’ for a very short period; if you take excessive risk, you can be ‘zero’ in no time,” he adds. His approach has helped the fund protect itself against the downside. Tibrewal says it’s more important to be consistent rather than being number 1. One hindrance for this fund is its large corpus of nearly Rs 19,500 crore, which has kept it from delivering outsized returns in market rallies. Midcap and smallcap funds with a large corpus find it relatively difficult to adapt to sudden market shifts compared to schemes with smaller corpuses. So far, KEEF has managed to deliver good returns over the long run. But a higher corpus might keep the fund from being agile when required.

5/10

The sectors that KEEF is overweight on that helped it generate higher returns include the specialty chemicals, industrials and consumer discretionary sectors. On the other hand, its relatively underweight position in the banking and finance sectors (around 11 percent altogether) compared to its peers (18-19 percent) has paid off well. While talking about recent additions, Tibrewal mentions three sectors in which he has added exposure: pharma, industries, and the home improvement space.

6/10

Some long-term holdings that have paid off well for KEEF include Persistent Systems, APL Apollo Tubes, Laurus Labs, Jindal Steel & Power, and Amber Enterprises India. In the wake of the recent correction, the fund has also added stocks such as Whirlpool of India, Bharat Forge, Metro Brands and PB Fintech.

7/10

In order to maintain liquidity and considering its large asset base, KEEF has been more diversified in selecting large and smallcap stocks apart from its mandated allocation towards midcap stocks. It has made a sizeable allocation to largecap stocks (an average of 13 percent over the last three years) and also to smallcaps (an average of 17 percent).

8/10

Though there is an internal cash limit of 7 percent, KEEF focuses more on portfolio construction rather than pursuing a cash call strategy. As of April 2022, its cash level was 4.3 percent.

9/10

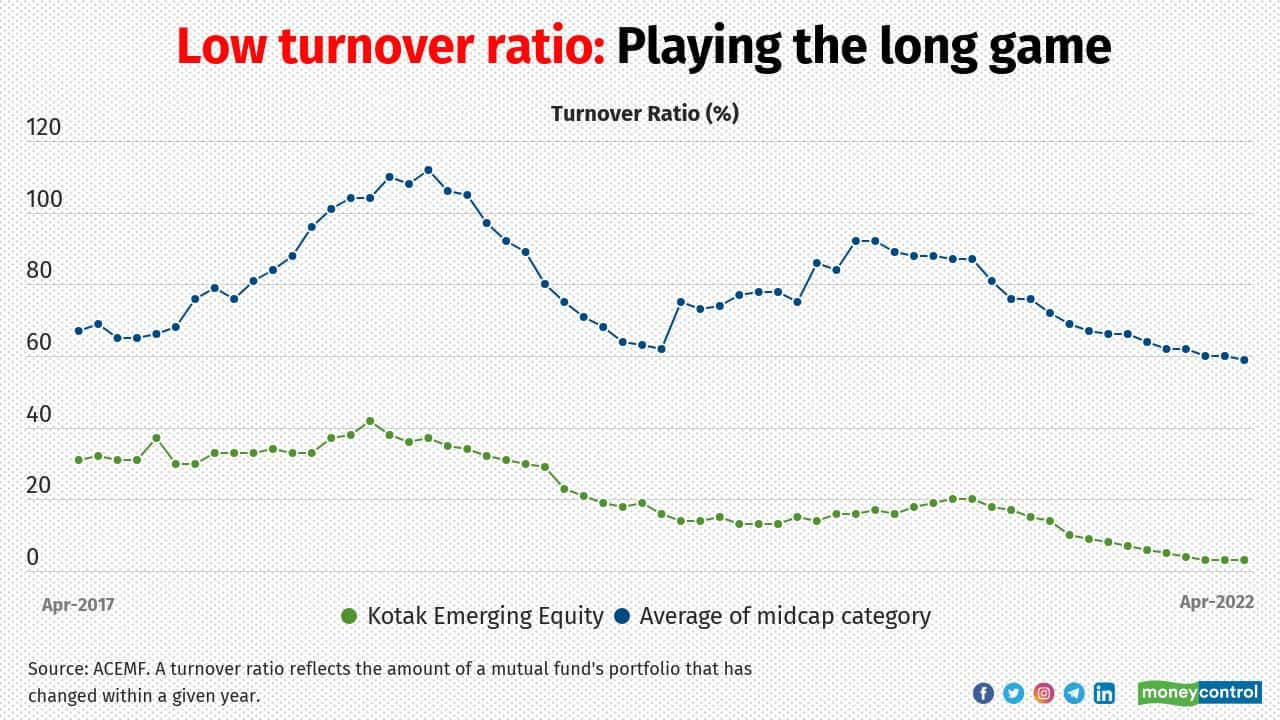

KEEF has not traded much and follows a Buy and Hold strategy. This is reflected in its turnover ratio, which was just 3 percent (as of April 2022), the lowest in the category. Many of its long-term holdings were multi-baggers and rewarded investors well. Identifying the right stocks early in their growth cycle implies prudent stock selection by the fund manager.

10/10

Experts believe that global growth will slow down over the next year due to high interest rates and inflationary woes. The systematic investment route may be a prudent way to invest in KEEF in this scenario considering the volatile movement of the market.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!