In Pics: Five Key Charts to Watch in Global Commodity Markets This Week

Biodiesel fans will be keenly awaiting an announcement this week by the US Environmental Protection Agency on how much of the renewable product must be blended into the nation’s fuel supply. Meanwhile, European natural gas traders will be watching to see if the biggest weekly surge since August can be sustained. Here are five charts to consider in global commodity markets.

1/5

Natural Gas | Gas prices in Europe had their first weekly gain since March as hotter weather forecasts signaled stronger demand than previously expected amid signs of budding competition from Asia for the heating and power-generation fuel. Benchmark Dutch front-month gas surged 35 percent last week, the most since August. That pushed the US dollar equivalent futures contract to a premium over the Japan-Korea Marker, the Asian benchmark, for the first time since mid-May. Both Europe and Asia compete for liquefied natural gas shipments from the US and the Middle East. (Source: Bloomberg)

2/5

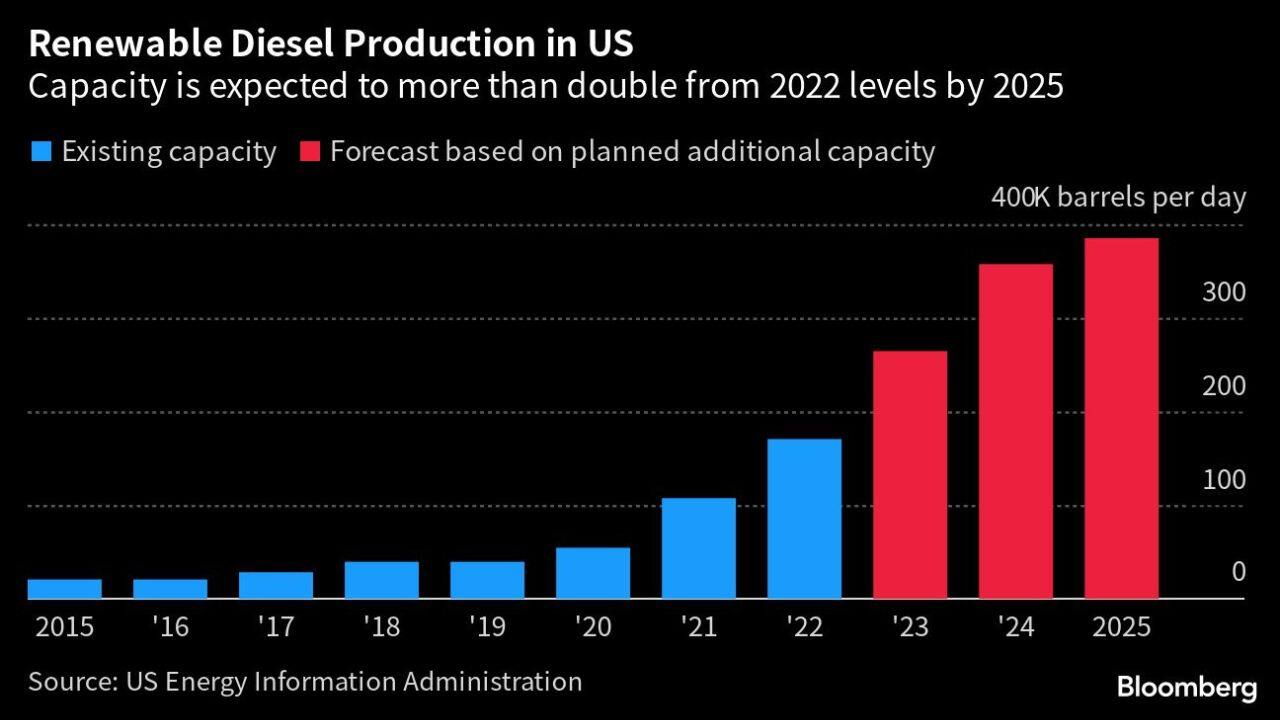

Renewables | Renewable diesel production is taking off in the US — with capacity on track to reach about 385,000 barrels per day by 2025 — more than double where things stood at the end of 2022, according to Energy Information Administration data. Generous federal incentives helped drive the surge in the production of green fuel made from crops and animal fat that can be substituted for petroleum-based diesel. The EPA is set to decide this week how much biomass-based diesel it should mandate be mixed into the country’s fuel supply in 2023, 2024 and 2025, amid concern that proposed targets lowballed potential production. (Source: Bloomberg)

3/5

Agriculture | The US corn belt will be a major focus for markets with the release of crop conditions on June 12 and the weekly drought report on June 15. Corn crops experiencing moderate to intense drought have been steadily increasing to 45 percent of the total. That compares with just 19 percent for the same time a year ago. The US Department of Agriculture last week refrained from changing its estimates for domestic corn yields, despite the dry weather. That will leave traders guessing about the state of the harvest until the next estimate is published in July. Corn for December delivery is down 13 percent this year in Chicago. (Source: Bloomberg)

4/5

Metals | Cobalt will surely be in focus this week as the Democratic Republic of Congo — the world’s largest producer of the key battery ingredient — hosts a mining conference. The price of the metal used in electric-car batteries and electronics has fallen almost 30 percent this year to $13.90 a pound, according to Fastmarkets data, amid a lacklustre global demand and rising supply from new No. 2 producer Indonesia. Goldman Sachs Group Inc. is forecasting softness for battery metals including cobalt, lithium and nickel in the second half of 2023 amid an oversupply. (Source: Bloomberg)

5/5

Oil | The flip-flop nature of oil trading continues, with futures coming off a second weekly decline after advancing for the same amount of time in a constant struggle for sustained momentum. Despite shocks from surprise production cuts by both OPEC+ and Saudi Arabia, futures have slumped about 13 percent this year amid ongoing concerns over economic growth and a slower-than-expected recovery in China. Oil traders will be closely watching monthly reports this week from the Organization of Petroleum Exporting Countries on June 13 and the International Energy Agency on June 14 for clues on the trajectory of supply and demand, which may weigh further on prices. (Source: Bloomberg)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!