ASK Automotive IPO: Financials, shareholding, comparison with peers in 5 charts

The price band of the issue, which will close on November 9, has been fixed at Rs 268-282 per share

1/6

ASK Automotive's Rs 834 crore IPO opened for subscription on November 7. The price band of the issue, which will close on November 9, has been fixed at Rs 268-282 per share. The offer is entirely an offer-for-sale of 2.95 crore shares. Ahead of the issue, the company mopped up Rs 250.2 crore via anchor investors.

2/6

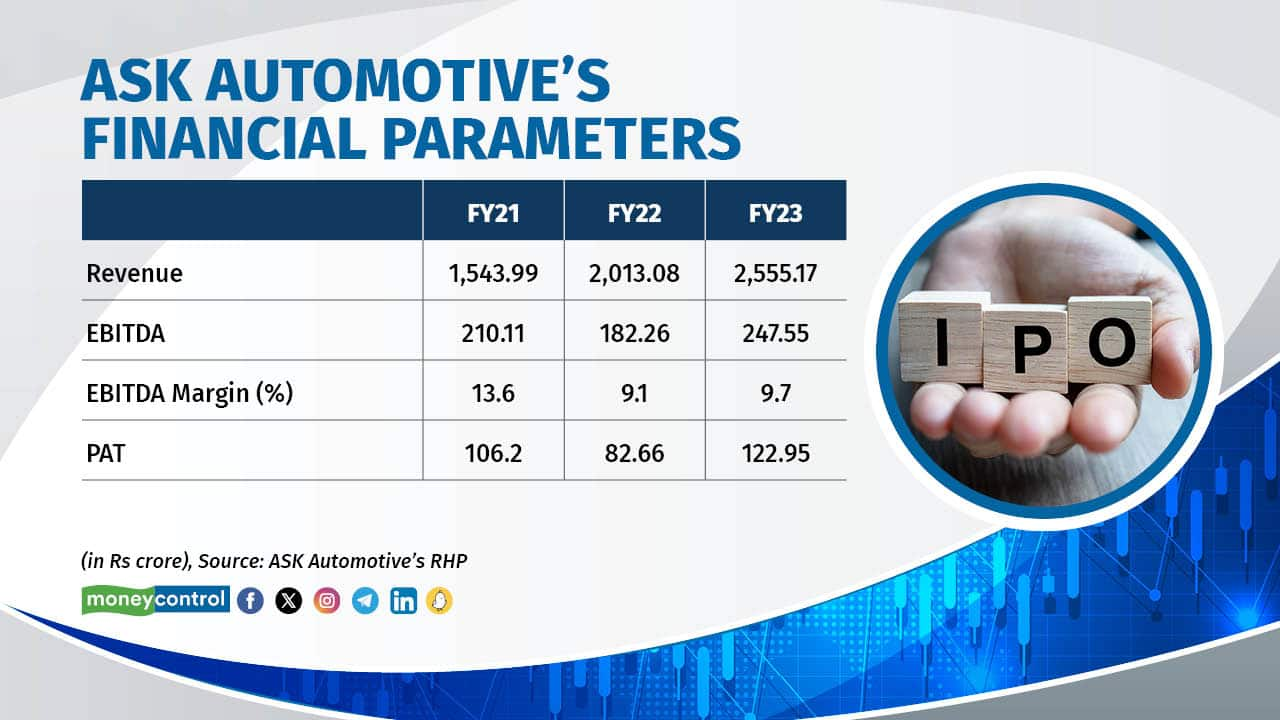

ASK Automotive's revenue rose from Rs 1,543.99 crore in FY21 to Rs 2,555.17 crore in FY23. However, EBITDA declined from Rs 210.11 crore in FY21 to Rs 182.26 crore in FY22 and then rebounded to Rs 247.55 crore in FY23. The EBITDA margin dropped from 13.6% in FY21 to 9.1% in FY22 and slightly improved to 9.7% in FY23. Profit after tax (PAT) decreased from Rs 106.2 crore in FY21 to Rs 82.66 crore in FY22 and increased to Rs 122.95 crore in FY23.

3/6

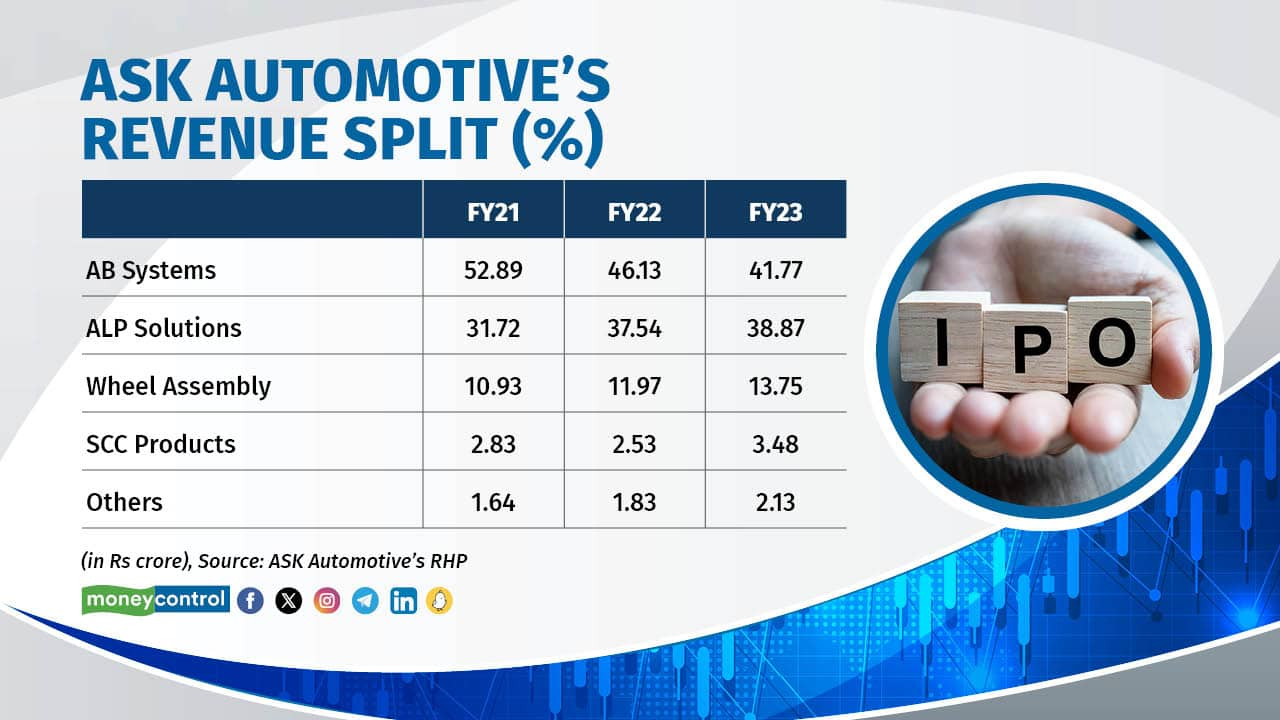

ASK Automotive's revenue split across its different business segments shows some notable changes over the past three fiscal years. In FY21, AB Systems accounted for 52.89%, followed by ALP Solutions at 31.72%, Wheel Assembly at 10.93% and SCC Products at 2.83%. However, by FY23, there was a shift in the distribution, with AB Systems' share decreasing to 41.77%, ALP Solutions increasing to 38.87%, Wheel Assembly growing to 13.75% and SCC Products going up to 3.48%.

4/6

In FY23, ASK Automotive recorded a revenue growth of 26.9%. EBITDA margin of 9.65% is lower than peers like Endurance Technologies and Suprajit Engineering. ASK Automotive's PAT margin was at 4.79% while Uno Minda and Suprajit Engineering’s margins stood at 6.2% and 5.45%, respectively.

5/6

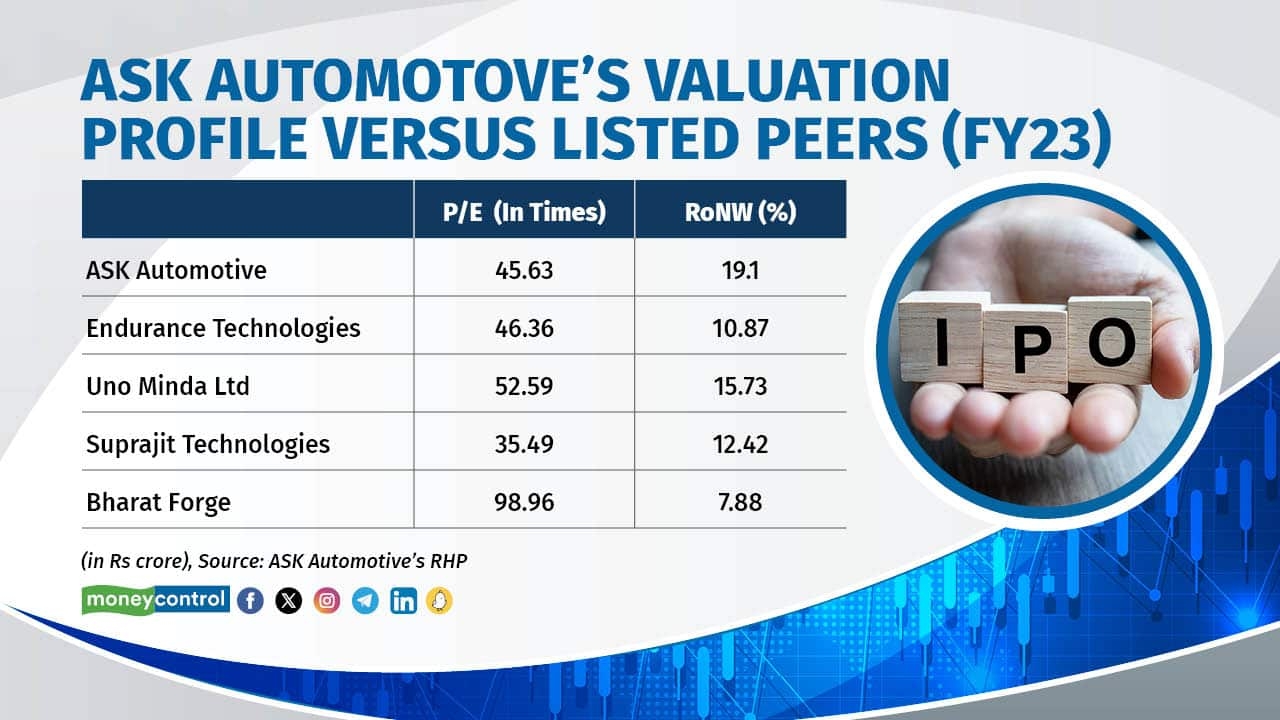

In FY23, ASK Automotive exhibited a price-to-earnings (P/E) ratio of 45.63. The company's return on net worth (RoNW) stood at 19.1%. Endurance Technologies has a slightly higher P/E ratio at 46.36 and a RoNW at 10.87%. Uno Minda's P/E ratio was at 52.59, with a RoNW of 15.73%. Suprajit Technologies P/E ratio came at 35.49 and a RoNW of 12.42%. Bharat Forge has a considerably higher P/E ratio of 98.96 but a lower RoNW of 7.88%.

6/6

Pre-IPO, promoter and promoter group held a 100% stake in the company. Post-IPO, public shareholding will increase to 15% while promoter and promoter Group's stake will come down to 85%.

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!