Corporate tax rate cut, the big bank merger and other policy decisions the government made in 2019

From corporate tax rate cut and bank recapitalisation, to ‘the big bank merger’, here’s a quick look at some of the key policy decisions taken by the government in 2019.

1/8

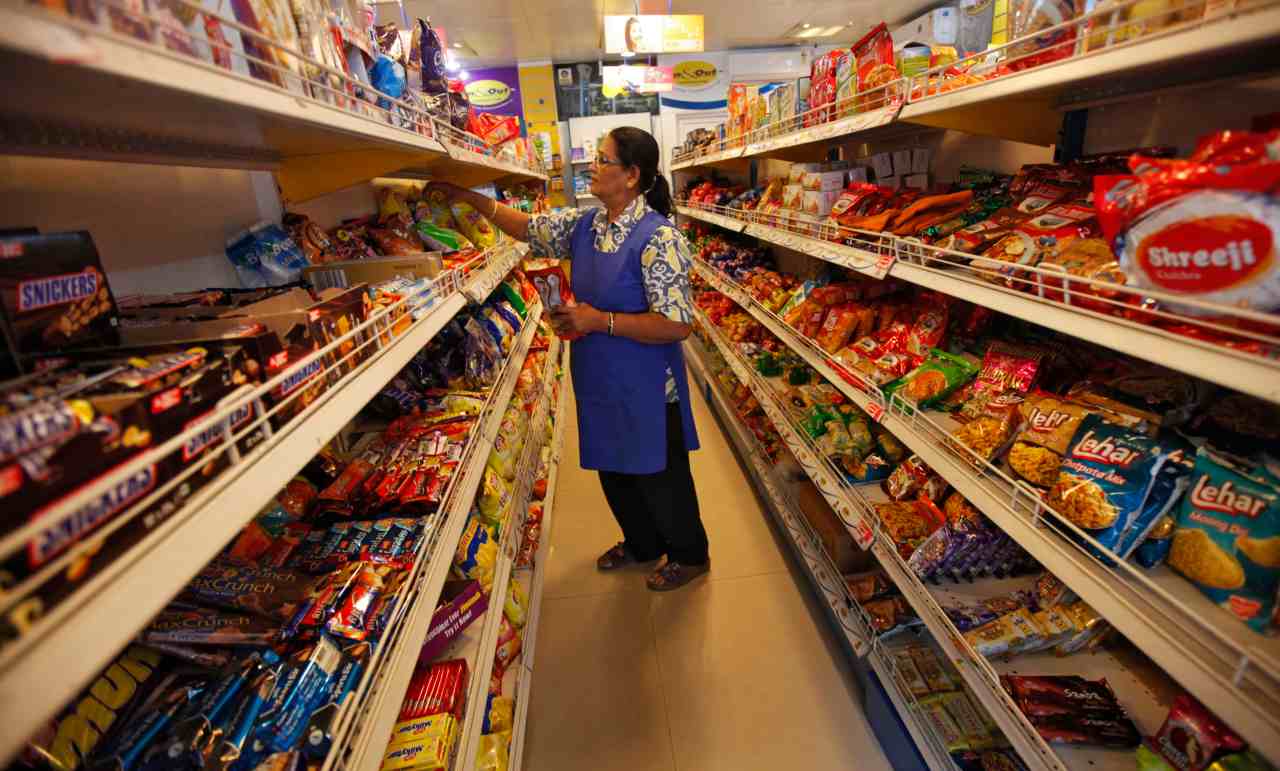

Year 2019 saw some major policy decisions in the banking, corporate and real estate sectors. Apart from the that, the Finance Ministry is trying hard to bring the economy back on track. Here’s a quick look at some of the major decisions taken by the government this year. (Image: PTI)

2/8

Corporate tax rate cut | In September, Union Finance Minister Nirmala Sitharaman announced that corporate Tax rate will be cut from 30 percent to 22 percent without exemptions. However, with surcharge and cess the new rate works out to around 25.17 percent. The rate, a long standing industry demand, was seen as one of the many reliefs for key sectors, including auto and FMCG. (Image: PTI)

3/8

Bank recapitalisation | The government decided to inject Rs 70,000 crore budgeted for the recapitalisation of PSBs in FY20 on immediate basis. The highest infusion at Rs 16,000 crore was for Punjab National Bank (PNB), followed by Union Bank of India at Rs 11,700 crore. (Image: PTI)

4/8

Changes in FDI norms | The Centre decided to change foreign direct investment (FDI) regulations for single brand retail, coal and lignite mining, digital media and contract manufacturing. The reforms are being seen as India pushes to become a part of the global supply chain at a time when the US-China trade war has caused disruption. (Image: Reuters)

5/8

Real estate fund | The government approved a plan to set up a Rs 25,000 crore alternative investment fund (AIF) to revive stalled housing projects to provide relief to distressed homebuyers. It aimed at revitalising the ailing realty sector. The Centre claims that incomplete housing projects worth under Rs 2 crore per unit in Mumbai, Rs 1.5 crore in other metros and Rs 1 crore in other parts of the country will benefit from the decision. (Image: PTI)

6/8

PM-KISAN scheme | Ahead of the 2019 Lok Sabha election, the Centre unveiled the Pradhan Mantri Kisan Samman Nidhi Yojana (PM-KISAN). Under this scheme, the government is providing Rs 6,000 per annum in three equal instalments to 14 crore farmers. The amount is directly transferred to the bank accounts of beneficiaries. The Centre had reportedly transferred these funds to 7.6 crore beneficiaries and distributed Rs 35,882.8 crore until November 30. (Representative image)

7/8

‘The big bank merger’ | In September, the Centre announced it would merge public sector banks and reduce their number from 27 to 12 over the next few years. FM Sitharaman unveiled a plan to merge 10 PSBs into four entities, with an aim to revitalise the banking sector. Three banks -- PNB, OBC and United Bank of India -- will combine to form India's second-largest lender. While Canara Bank and Syndicate Bank will merge to form the fourth largest PSB, Union Bank of India will merge with Andhra Bank and Corporation Bank to create India's fifth largest PSB. Additionally, Indian Bank would merge with Allahabad Bank, making it the seventh largest PSB. (Image: PTI)

8/8

Divestments | The Centre kick-started the divestment processes for select central public sector enterprises (CPSEs). This included the government's 53.2 percent stake in Bharat Petroleum Corporation Limited (BPCL), 63.7 percent in Shipping Corporation of India (SCI) and 30.8 percent of Container Corporation of India (CCI), to a strategic buyer. This excludes BPCL’s equity shareholding in Numalighar Refinery. The Centre also decided to sell 74.2 percent of THDC and 100 percent in North Eastern Electric Power Corporation Limited (NEEPCO) to NTPC. (Image: PTI)

Discover the latest Business News, Budget 2025 News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!